Fat Rich Dairy Products Market Size 2024-2028

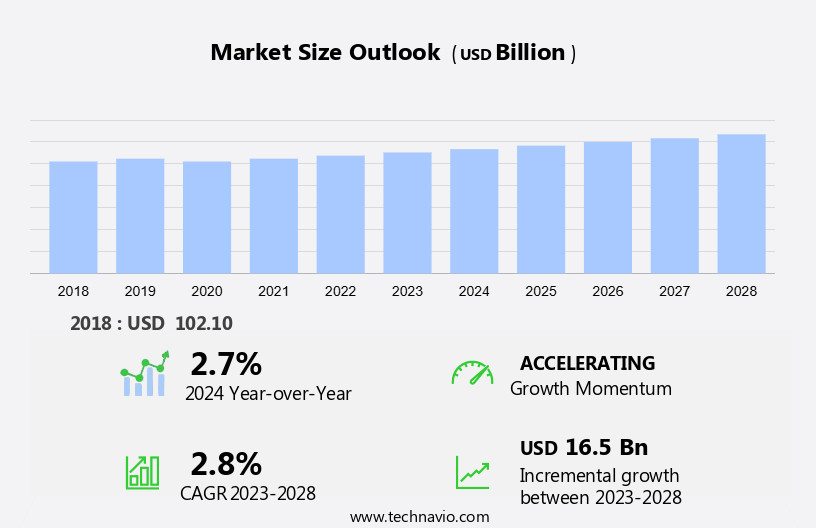

The fat rich dairy products market size is forecast to increase by USD 16.5 billion at a CAGR of 2.8% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. One of the primary factors driving market growth is the rising adoption of healthy food habits among consumers, leading to an increased demand for full-fat dairy products. Flavoring agents, such as chocolate, cakes, muffins, and sweet dishes, contribute to the food and beverage sector. Another trend influencing market growth is the increasing demand for dairy products in online retail channels. Additionally, the spread of various diseases in dairy animals is also contributing to market growth as farmers turn to high-fat dairy products to improve animal health and productivity. These trends, coupled with the growing consumer preference for natural and organic food products, are expected to boost market growth In the coming years. However, challenges such as increasing competition and fluctuating prices of raw materials may hinder market growth. Despite these challenges, the market is expected to continue its upward trajectory due to the growing demand for high-nutrient and high-value dairy products.

What will be the Size of the Fat Rich Dairy Products Market During the Forecast Period?

- The fat-rich dairy products market encompasses a range of nutrient-dense offerings, including ghee, butter, and cream, which cater to consumers seeking health benefits beyond traditional low-fat dairy alternatives. These products, often classified as functional, specialty, or premium dairy items, contain health-benefiting compounds such as conjugated linoleic acid. The market's growth is driven by the increasing awareness of obesity and cholesterol-based diseases, leading consumers to prioritize full-fat dairy options. Fresh, artisanal, and eco-friendly packaging further enhances the appeal of these products In the health and wellness-conscious market. Dietary requirements and nutritional preferences continue to influence the market, with reduced-fat and alternative fat products also gaining traction.

- Moreover, digital marketing efforts prioritize the unique selling points of these products, including their nutritional benefits and rich flavors. Overall, the fat-rich dairy products market is poised for growth as consumers seek out high-quality, health-promoting options.

How is this Fat Rich Dairy Products Industry segmented and which is the largest segment?

The fat rich dairy products industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Butter

- Ghee

- Cream

- Geography

- APAC

- China

- India

- Europe

- Germany

- France

- North America

- US

- South America

- Middle East and Africa

- APAC

By Application Insights

- The butter segment is estimated to witness significant growth during the forecast period.

Butter, derived from the milk fat and proteins of cattle, goats, sheep, buffalo, and yaks, is a versatile dairy product widely used in culinary applications. It offers antioxidants that shield against free radicals and contains saturated fats with potential anti-cancer properties. A single tablespoon of unsalted butter contains approximately 7.2 grams of saturated fat and 31 milligrams of cholesterol. Despite these nutrients, individuals with high cholesterol levels should limit their consumption to prevent cholesterol-based diseases. In recent dietary trends, butter is recommended for those following a ketogenic diet to aid in weight loss. This full-fat dairy product is available in various forms, including ghee, cream, and reduced-fat alternatives.

Get a glance at the Fat Rich Dairy Products Industry report of share of various segments Request Free Sample

The butter segment was valued at USD 42.10 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 48% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The Asia Pacific market for fat-rich dairy products is experiencing growth due to several factors, including the rise in obesity and cholesterol-based diseases, increasing awareness of health benefits, urbanization, and the expansion of organized retail. Key players, such as Gujarat Co-operative Milk Marketing Federation Ltd. (Amul), Fonterra Co-operative Group Ltd. (Fonterra), China Mengniu Dairy Co. Ltd. (China Mengniu Dairy), Danone, and Nestlé, dominate the market in APAC. The expanding urban population significantly drives the demand for these products. Fat-rich dairy items, including ghee, butter, cream, and cheese, offer nutrients like conjugated linoleic acid (CLA) and short-chain fatty acids (SCFAs), which contribute to health benefits.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fat Rich Dairy Products Industry?

Rising adoption of healthy food habits is the key driver of the market.

- The market is witnessing significant growth due to the increasing health consciousness among consumers and the rising prevalence of obesity and cholesterol-based diseases. Consumers are increasingly seeking dairy products rich in essential nutrients such as conjugated linoleic acid (CLA), SCFAs, and other health-benefiting compounds. Ghee, butter, cream, and other full-fat products are gaining popularity as they offer nutritional benefits and add rich flavors to food, especially in baking, cooking, and confectionery products. Functional products, including those fortified with CLA and other functional ingredients, are witnessing a increase in demand. Premium dairy products, such as artisanal cheeses and fresh dairy, are also gaining traction among health-conscious consumers.

- In addition, reduced-fat and alternative fat products are also available for consumers who prefer lower-fat options. Retail consumption of Fat-Rich Dairy Products is on the rise, with supermarkets and hypermarkets, convenience stores, and non-store-based retailers being the primary channels. Digital marketing and ecommerce infrastructure have made it easier for consumers to purchase these products online. The demand for ecofriendly packaging is also increasing as consumers become more environmentally conscious. Dairy products are an essential source of calcium and other essential nutrients, making them an essential part of a healthy diet. They offer numerous health benefits, including reducing the risk of obesity, improving bone health, and aiding in weight management.

What are the market trends shaping the Fat Rich Dairy Products Industry?

Rising demand in online retail is the upcoming market trend.

- The market is experiencing significant growth due to various factors. Consumers' increasing focus on health and wellness has led to a higher demand for dairy products rich in essential nutrients, such as Conjugated Linoleic Acid (CLA), found in Ghee and Butter. Cream, another popular fat-rich dairy product, is used extensively in Health benefits-focused foods, including baking, cooking, and flavoring. Manufacturers are responding to this trend by producing functional and specialty products, such as reduced-fat and alternative fat options, which cater to the dietary needs of consumers. Premium products, including fresh and artisanal offerings, are also gaining popularity due to their Nutritional benefits.

- Furthermore, ecofriendly packaging and digital marketing strategies are essential for companies in this market. Online retail channels, such as supermarkets and hypermarkets, convenience stores, and non-store-based retailers, offer convenience and competitive pricing, making it easier for consumers to access a wide range of fat-rich dairy products. E-commerce platforms like Amazon, IndiaMart, bigbasket, and Natures Basket are significant players In the online retail of fat-rich products. These channels provide consumers with easy access to a variety of products at competitive prices, contributing to the market's growth. Despite the health benefits associated with full-fat dairy products, concerns regarding Obesity and Cholesterol-based diseases remain.

What challenges does the Fat Rich Dairy Products Industry face during its growth?

Spread of various diseases in dairy animals is a key challenge affecting the industry growth.

- The market encompasses a range of dairy items that are high in nutrients, including conjugated linoleic acid (CLA), ghee, butter, cream, and other products. These items offer various health benefits, such as aiding in weight management, reducing cholesterol-based diseases, and contributing to functional and premium dairy categories. Convenience food products, including cheese, yogurt, and milk, dominate retail consumption, with supermarkets and hypermarkets, convenience stores, and non-store-based sales channels being the primary distribution channels. Health and wellness trends have led to the growth of specialty products, such as reduced-fat and alternative fat options, as well as eco-friendly packaging.

- Furthermore, the market is driven by the nutritional benefits of full-fat dairy, which includes SCFAs, essential vitamins, and minerals. Additionally, dairy products find applications in infant formulations, dietary supplements, and animal feed. Digital marketing and ecommerce infrastructure have significantly impacted the market, enabling easy access to consumers. Healthbenefiting compounds, including CLA and other functional ingredients, are increasingly being incorporated into dairy products to cater to evolving consumer preferences. The market is expected to grow as consumers seek out healthy fats and functional products.

Exclusive Customer Landscape

The fat rich dairy products market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Arla Foods amba

- Dairy Farmers of America Inc.

- DANA Dairy Group Ltd.

- Danone SA

- Fonterra Cooperative Group Ltd.

- General Mills Inc.

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Horizon Organic Dairy LLC

- LACTALIS Group

- Land O Lakes Inc.

- Meiji Holdings Co. Ltd.

- MVM Pack Holding AG

- Nestle SA

- Royal FrieslandCampina NV

- Saputo Inc.

- Savencia SA

- Schreiber Foods Inc.

- Sodiaal

- The Kraft Heinz Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market has experienced significant growth in recent years due to increasing consumer awareness and interest In the health benefits associated with these foods. These products, which include items like ghee, butter, and cream, are rich in essential nutrients and health-promoting compounds. One of the key drivers of this market is the growing recognition of the importance of healthy fats in a balanced diet. Conjugated linoleic acid (CLA), a type of fatty acid found in high concentrations in certain products, has been linked to a range of health benefits, including weight loss, improved metabolic function, and reduced risk of cholesterol-based diseases.

In addition, another factor contributing to the growth of the market is the convenience offered by these products. With busy lifestyles and the increasing popularity of convenience food products, consumers are turning to fat-rich dairy items as a quick and easy way to add healthy fats to their diets. This trend is particularly evident In the retail sector, with supermarkets and hypermarkets reporting strong sales of these products. However, the market is not limited to traditional retail channels. Convenience stores and non-store-based outlets are also seeing increased demand for these items, driven in part by the growing popularity of ecommerce and digital marketing.

Furthermore, as consumers become more health-conscious, there is also a growing demand for functional and specialty products. Premium dairy items, such as fresh dairy and artisanal products, are gaining popularity due to their perceived health benefits and unique flavors. Reduced-fat and alternative fat products are also seeing increased demand as consumers look for ways to incorporate healthy fats into their diets without consuming excess calories. Eco-friendly packaging is another trend that is gaining traction In the market. Consumers are increasingly concerned about the environmental impact of their food choices, and dairy companies are responding by offering products in sustainable and recyclable packaging.

Moreover, the market is expected to continue growing In the coming years, driven by increasing consumer awareness and demand for healthy, convenient, and eco-friendly food options. The market is also expected to see continued innovation, with new product launches and marketing strategies aimed at capitalizing on these trends. Therefore, the market is experiencing strong growth due to increasing consumer awareness of the health benefits associated with these foods and the convenience they offer. The market is diverse, with a range of products catering to different consumer preferences and dietary needs. As consumers continue to prioritize health and sustainability In their food choices, the market is poised for continued growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.8% |

|

Market growth 2024-2028 |

USD 16.5 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.7 |

|

Key countries |

US, India, China, Germany, and France |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fat Rich Dairy Products Market Research and Growth Report?

- CAGR of the Fat Rich Dairy Products industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fat rich dairy products market growth of industry companies

We can help! Our analysts can customize this fat rich dairy products market research report to meet your requirements.