Feed Anti Caking Agent Market in South America Size and Trends

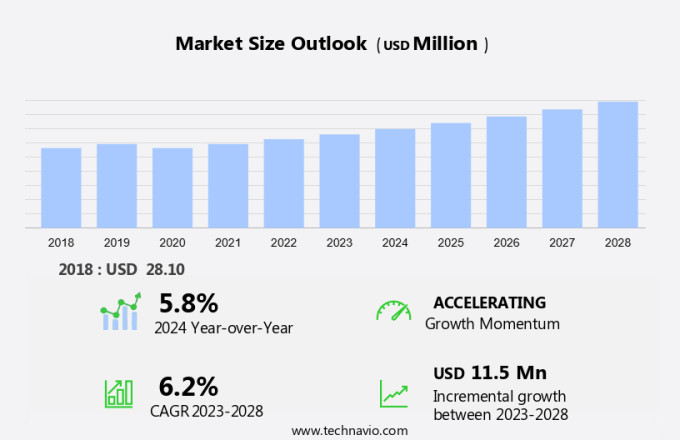

The feed anti caking agent market in South America size is forecast to increase by USD 11.5 million at a CAGR of 6.2% between 2023 and 2028. The feed anti-caking agent market is experiencing significant growth due to several key drivers. The increasing consumption of packaged food and ready-to-eat food in the US is a major factor fueling market expansion. Additionally, dietary preferences, particularly those leaning towards natural preservatives, are driving demand for natural feed anti-caking agents derived from natural compounds. The bakery industry also contributes to market growth, as calcium compounds are commonly used as anti-caking agents in baked goods. Government regulations mandating the use of safe and effective anti-caking agents in animal feed further support market growth. Synthetic compounds continue to dominate the market, but the demand for natural alternatives is on the rise due to consumer concerns about food additives and synthetic compounds. Overall, the feed anti-caking agent market is expected to continue growing due to these trends and challenges.

The anti-caking agent market in the feed additives sector plays a significant role in ensuring the smooth flow of animal feed and food ingredients. These agents prevent particle clumping and improve water repellency, thereby enhancing the overall production process. Anti-caking agents are essential in various industries, including compound feed, processed foods, and bakery products. They come in different forms, such as natural anti-caking agents, like magnesium carbonate and calcium carbonate, and synthetic agents, including sodium compounds. Natural anti-caking agents derived from organic sources are gaining popularity due to their organoleptic properties and biodegradability. They are widely used in the food industry to maintain the desired texture and taste of various food items. In the animal feed industry, anti-caking agents help improve the flowability of anhydrous compounds and dry foods, ensuring efficient mixing and reducing wastage. They also contribute to food preservation, ensuring the longevity of feed and food products. The convenience food and packaged food industries heavily rely on anti-caking agents to maintain the desired texture and prevent caking in their products.

Moreover, these agents ensure water repellency and water absorption, allowing for easy handling and processing. In the food and drug industry, anti-caking agents are used as release agents and in various food additives, such as baking powder, milk powder, cream powder, cake mixes, and instant soup powder. They help improve the flowability of these powders, ensuring consistent and efficient production. The increasing trend towards dietary preferences, such as gluten-free and organic, is driving the demand for natural anti-caking agents in the food industry. These agents offer a clean label solution, aligning with consumer preferences for natural and organic food products. In conclusion, the anti-caking agent market in the feed additives industry is a critical component in the production process of various industries, including animal feed, processed foods, and bakery products. These agents ensure the smooth flow of powders, prevent particle clumping, and contribute to food preservation. The demand for natural and biodegradable anti-caking agents is on the rise, driven by consumer preferences for clean label and organic food products.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Silicon

- Calcium

- Sodium

- Others

- Source

- Synthetic

- Natural

- Geography

- South America

- Brazil

- Argentina

- Colombia

- South America

By Type Insights

The silicon segment is estimated to witness significant growth during the forecast period. The feed anti-caking agent market in South America is witnessing a consistent expansion, primarily due to the indispensable function of sodium compounds in preserving feed quality and facilitating smooth flow. Sodium-based anti-caking agents, such as sodium silicoaluminate and sodium tripolyphosphate, are extensively employed in the animal feed sector to prevent caking during the storage and transport of dairy products, seasonings and condiments, milk powder, and baking powder. This crucial feature ensures even feed distribution and boosts handling efficiency, especially in areas with high humidity, common in certain regions of South America.

Get a glance at the market share of various segments Download the PDF Sample

The silicon segment was valued at USD 9.6 million in 2018. The burgeoning livestock and poultry industries across South America, fueled by increasing meat consumption and exports, significantly contribute to the market's growth. Sodium-based agents' inertness, non-toxicity, and effectiveness in preserving feed stability make them a preferred choice for feed manufacturers. These agents offer numerous health benefits, such as improving nutritional content and enhancing the overall quality of animal feed, further solidifying their position in the market.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Feed Anti Caking Agent Market in South America Driver

The rising consumption of food ingredients is notably driving market growth. In the United States, the food industry continues to evolve with an expanding range of processed foods and beverages. The Food and Drug Administration (FDA) manages a comprehensive inventory of over 3,000 food ingredients. Consumer preferences for healthier, high-quality food products have fueled innovation and demand for various food ingredients, such as food premixes, milk and cream powder, instant soup powder, baking powder, yeast, seasoning, and spices.

To ensure these ingredients maintain their optimal quality and flow during storage and transportation, feed anti-caking agents are increasingly utilized. These agents, often derived from natural sources like sodium compounds or biodegradable plant-derived ingredients, prevent the ingredients from clumping and extending their shelf life. As the market for clean-label products and organic food continues to grow, the demand for natural and health-conscious feed anti-caking agents is also on the rise. In the realm of fertilizers, feed anti-caking agents serve a similar purpose, preventing the active ingredients from caking and improving their flow properties. Thus, such factors are driving the growth of the market during the forecast period.

Feed Anti Caking Agent Market in South America Trends

Rising awareness about food safety in developed regions is the key trend in the market. In developed regions of South America, such as Brazil, Argentina, and Chile, there is a growing emphasis on food safety and quality in the production of packaged food and ready-to-eat items. This trend is particularly notable in the animal feed industry, where the use of feed anti-caking agents is essential for maintaining the consistency and flowability of the feed. These agents prevent clumping and moisture absorption, ensuring consistent nutrient delivery and preserving the integrity of the feed. The demand for feed anti-caking agents is being driven by stricter regulatory frameworks and increasing consumer preferences for high-quality meat and dairy products.

Moreover, natural and synthetic compounds, including calcium compounds, are commonly used as feed anti-caking agents. In the US market, both natural preservatives and synthetic compounds are utilized to meet the varying needs of the industry. The use of these agents not only enhances the overall quality of the feed but also extends its shelf life, making it a valuable investment for feed manufacturers. The feed anti-caking agent market in the US is expected to grow steadily, driven by the increasing demand for safe and high-quality animal feed. Thus, such trends will shape the growth of the market during the forecast period.

Feed Anti Caking Agent Market in South America Challenge

Government regulations related to usage of feed anti caking agent is the major challenge that affects the growth of the market. The feed anti-caking agent market in South America faces regulatory hurdles due to stringent guidelines regarding the usage of additives in animal feed. These regulations prioritize the safety, quality, and environmental implications of anti-caking agents. Complying with these regulations can be intricate and costly for manufacturers, potentially impeding market expansion.

For example, regulatory bodies in significant South American countries, including Brazil and Argentina, mandate extensive testing and certification to authorize the utilization of anti-caking agents. These tests verify that the additives are non-toxic, safe for animal consumption, and do not impair the nutritional value of the feed. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anmol Chemicals Group - The company offers feed anti caking agent such as precipitated silica and hydrated calcium silicate.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agropur Dairy Cooperative

- Anmol Chemicals Group

- BASF SE

- Bogdany Petrol Ltd.

- Brookside Agra LLC

- Cargill Inc.

- Great Plains Processing

- Halliburton Co.

- J.M. Huber Corp.

- Kao Corp.

- Kemin Industries Inc.

- Mitsui and Co. Ltd.

- Norkem Ltd.

- PPG Industries Inc.

- PQ Group Holdings Inc.

- RAG Stiftung

- Roquette Freres SA

- Sasol Ltd.

- Sweetener Supply Corp.

- ZEOCEM AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Feed additives play a crucial role in the production of animal feed, particularly in ensuring the free-flowing properties of compound feed. Anti-caking agents, specifically, are essential in preventing particle clumping and enhancing water repellency. Both natural and synthetic anti-caking agents are used in the feed industry. Natural anti-caking agents, such as magnesium carbonate and calcium carbonate, are derived from natural sources and are widely used due to their organoleptic properties. On the other hand, synthetic anti-caking agents, like sodium compounds, offer superior water repellency and water absorption capabilities. In the food industry, anti-caking agents are used in various processed foods, including packaged and ready-to-eat foods, bakery products, and dairy products. They help improve food preservation, convenience, and nutritional content by preventing caking and improving the flow properties of food ingredients. Biodegradable anti-caking agents derived from plant-derived ingredients are gaining popularity due to the growing demand for clean-label products.

Additionally, these agents offer the same functionality as synthetic anti-caking agents but are preferred by consumers due to their natural origin. Anti-caking agents are also used in fertilizers and various food additives, including seasonings and condiments, baking powder, milk powder, cream powder, cake mixes, and instant soup powder. They help maintain food quality, hygiene, and food safety during storage, transportation, and processing. The use of anti-caking agents is not limited to the food industry alone. They are also used in various industries, including pharmaceuticals and cosmetics, as release agents and in the production of anhydrous compounds for dry foods. In conclusion, anti-caking agents are essential additives that play a significant role in various industries, including animal feed and food production. They offer numerous benefits, including water repellency, water absorption, food preservation, and improved flow properties. Both natural and synthetic anti-caking agents are used, with natural sources gaining popularity due to consumer preferences for clean-label products.

|

Industry Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2024-2028 |

USD 11.5 million |

|

Market structure |

USD Fragmented |

|

YoY growth 2023-2024(%) |

5.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Agropur Dairy Cooperative, Anmol Chemicals Group, BASF SE, Bogdany Petrol Ltd., Brookside Agra LLC, Cargill Inc., Great Plains Processing, Halliburton Co., J.M. Huber Corp., Kao Corp., Kemin Industries Inc., Mitsui and Co. Ltd., Norkem Ltd., PPG Industries Inc., PQ Group Holdings Inc., RAG Stiftung, Roquette Freres SA, Sasol Ltd., Sweetener Supply Corp., and ZEOCEM AS |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch