Africa Feed Vitamins Market Size and Trends

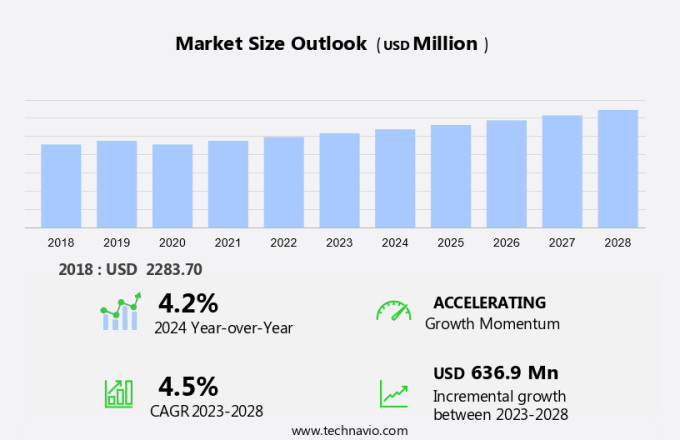

The Africa feed vitamins market size is forecast to increase by USD 636.9 million, at a CAGR of 4.5% between 2023 and 2028. The market demand is driven by several factors. The increasing consumption of meat and poultry products is a significant growth factor. Compound aquaculture feed, which contains vitamins and other essential nutrients, is gaining popularity due to its effectiveness in enhancing fish growth. Moreover, the evolution of advanced feed equipment is enabling the production of high-quality feed, thereby fueling market growth. Another trend in the market is the growing consumer preference for vegan food, leading to an increase in demand for plant-based feed ingredients. Furthermore, fraud detection and real-time analytics are becoming crucial in the finance industry to ensure the authenticity and quality of feed ingredients. Big data analysis is being extensively used to optimize feed formulations and improve overall efficiency.

The market is witnessing significant growth as businesses increasingly recognize the importance of data-driven decision-making. In this context, graph databases have emerged as a powerful tool for managing complex relationships and connections within data. This technology is particularly relevant to industries such as social networks, finance, and logistics, where recommendation engines, data modeling, and real-time analytics are essential. Graph databases utilize a property graph model, which consists of vertices (nodes) and edges (relationships) between them. Each vertex and edge can be assigned labels and properties, enabling efficient indexing and querying. This model is particularly effective in handling long tasks, such as route optimization and warehouse management, which require the analysis of intricate relationships between various data points. Social networks, for instance, can benefit from graph databases by providing more accurate and personalized recommendations based on users' connections and interests.

These databases can also facilitate real-time analytics, enabling businesses to respond quickly to user behavior and trends. In the finance industry, graph databases can be used for fraud detection and risk management by identifying complex relationships and patterns within financial transactions. Similarly, in logistics, these databases can optimize supply chain management by analyzing relationships between various stakeholders, including suppliers, manufacturers, distributors, and customers. However, the adoption of graph databases in the vitamins market is not without challenges. The lack of standardization in data modeling and programming ease can pose obstacles to widespread implementation. Moreover, the management of large datasets in data centers and cloud regions requires infrastructure and expertise. Despite these challenges, the benefits of graph databases in managing complex relationships and connections within data make them an attractive solution for businesses in various industries. As the demand for real-time analytics and personalized recommendations continues to grow, the role of graph databases in the vitamins market is set to expand.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Animal Type

- Poultry

- Ruminants

- Swine

- Others

- Type

- Vitamin A

- Vitamin B

- Vitamin C

- Others

- Geography

- Africa

- South Africa

- Nigeria

- Egypt

- Kenya

- Africa

By Animal Type Insights

The poultry segment is estimated to witness significant growth during the forecast period. The feed vitamins market in the logistics industry holds significance due to the increasing focus on animal health and consumer preferences for high-quality animal products. In Africa, the poultry segment led the market in 2023, with growing concerns over animal welfare and specific yolk and meat color driving demand. This trend is anticipated to continue during the forecast period, fueled by factors such as changing lifestyles, rising disposable income, and population growth.

Get a glance at the market share of various segments Download the PDF Sample

The poultry segment was valued at USD 927.60 million in 2018. Moreover, the increasing preference for poultry over red meat in countries like the US, the UK, and Argentina due to price fluctuations will further boost the poultry segment's growth. Effective data management and medical information are crucial for disease surveillance and ensuring the production of safe and healthy animal feed.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Africa Feed Vitamins Market Driver

Increasing demand for meat and poultry is notably driving market growth. The market is experiencing significant growth due to the increasing demand for meat and poultry products. Consumers in Africa are shifting their preferences towards protein-rich food sources, leading to a rise in the production of meat and poultry. To enhance the nutritional value and improve the quality of these products, animals are being fed proper food supplements and nutrients. Think tanks and industry experts believe that this trend is driven by the growing population and urbanization, which is leading to an increased demand for animal protein.

Market companies are responding to this trend by increasing their production capacity and investing in research and development to produce more efficient and effective feed vitamins. The market is poised for growth due to the increasing demand for meat and poultry products. This trend is expected to continue as consumers in Africa seek out protein-rich food sources to meet their nutritional needs. Market companies are responding to this trend by increasing production capacity and investing in research and development to produce more efficient and effective feed vitamins. Thus, such factors are driving the growth of the market during the forecast period.

Africa Feed Vitamins Market Trends

The rising influence of compound aquaculture feed and evolution of feed equipment is the key trend in the market. The usage of compound aquaculture feed in the global market has witnessed significant growth due to its numerous benefits in intensive aquaculture operations. Compound aquaculture feed offers an optimal nutrient balance, ensuring maximum growth for aquatic species. Additionally, it is economical compared to other feed options and can be efficiently utilized. Uniformity in quality is another key advantage, ensuring consistency in production. Manufacturing techniques for compound aquaculture feed include dry pelleted, moist pelleted feeds, and binary-type diets. A cutting-edge method, steam conditioning, is increasingly being employed to produce pelleted compound aquaculture feed, enhancing feed quality significantly. In the finance industry, fraud detection is a critical concern.

Big data and real-time analytics play a pivotal role in identifying and mitigating fraudulent activities. By analyzing vast amounts of data in real-time, financial institutions can detect anomalous patterns and potential fraudulent transactions. This not only helps in minimizing losses but also maintains the integrity of financial systems. Thus, such trends will shape the growth of the market during the forecast period.

Africa Feed Vitamins Market Challenge

Growing consumer inclination toward vegan food is the major challenge that affects the growth of the market. There is a growing preference for food products and ingredients that promote wellbeing and do not pose health risks. Among these, plant-based food items are gaining traction, particularly in Africa, where consumers are increasingly concerned about the health and food safety issues linked to animal-based food products. This trend is driven by the vegan community, who actively avoid animal-derived products in their diet.

The plant-based diet offers numerous benefits, including a higher intake of antioxidants, and is considered more advantageous than animal-based diets. It is also rich in essential nutrients like folate, magnesium, potassium, vitamin A, vitamin C, and vitamin E, which help reduce the risk of cardiovascular diseases and metabolic disorders. As a result, the demand for plant-based food products is on the rise among health-conscious consumers. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adisseo Co. - The company offers feed vitamins such as Microvit that are generally added to feed in the form of a premix.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- BASF

- Koninklijke DSM NV

- Lallemand Inc.

- Nestle SA

- Pfizer Inc.

- Virbac Group

- Vitafor NV

- Zinpro Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

The market is a dynamic and growing industry, fueled by the increasing demand for database products that enable real-time analytics and fraud detection in various sectors. Think tanks and organizations across the finance and logistics industries are investing heavily in advanced data modeling and analytics tools to optimize their operations and improve efficiency. People and places, things and events, are all being tracked and analyzed in real-time to identify bottlenecks and optimize delivery routes. In the finance industry, data management is crucial for fraud detection and risk assessment. Big data analytics is used to identify patterns and trends, helping to prevent financial losses and ensure regulatory compliance. In the logistics industry, real-time analytics is used for warehouse management, shipment tracking, and route optimization.

Logistics professionals rely on these tools to streamline their operations, reduce costs, and improve customer satisfaction. Medical information and disease surveillance are also benefiting from the feed vitamins market. By analyzing large datasets, public health organizations can identify outbreaks and respond quickly to contain them. Data analytics is also being used to improve patient care and optimize hospital operations. Overall, the feed vitamins market is transforming the way we manage and analyze data, providing valuable insights and improving efficiency across various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market Growth 2024-2028 |

USD 636.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

4.2 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Adisseo Co., Archer Daniels Midland Co., BASF, Koninklijke DSM NV, Lallemand Inc., Nestle SA, Pfizer Inc., Virbac Group, Vitafor NV, and Zinpro Corp. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.