Vitamin Ingredients Market Size 2024-2028

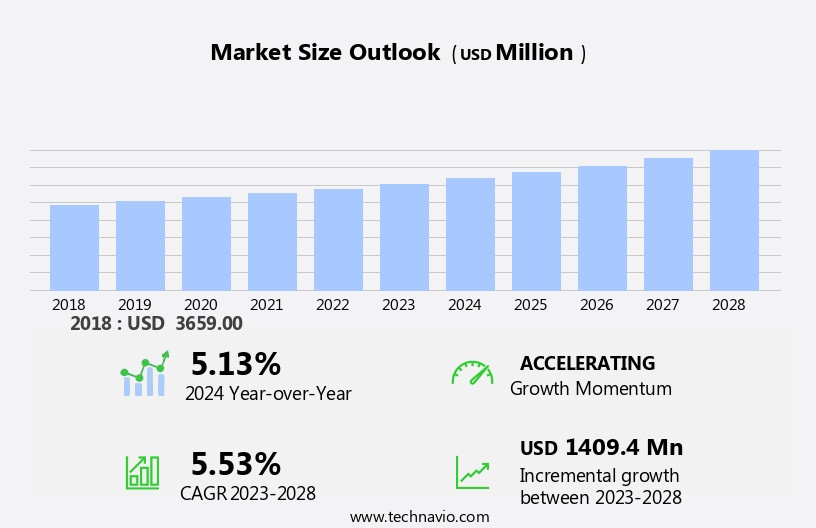

The vitamin ingredients market size is forecast to increase by USD 1.41 billion at a CAGR of 5.53% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing awareness of health and wellness, leading to the demand for vitamins in various applications such as feed additives, nutraceuticals, and dietary supplements. In the animal feed industry, the trend toward improving animal nutrition and productivity is driving the use of vitamins, particularly Vitamin D, B3, and E, as essential nutrients. Regulatory control on supplement usage limits and packaging requirements also contribute to market growth. In addition, the expanding applications of vitamins in functional food, cosmetics, and aquaculture further boost market demand. Enzymes, antioxidants, and other nutritional additives are also gaining popularity to enhance the effectiveness of vitamins. The increasing research and development expenditure In the animal feed sector is expected to provide opportunities for market growth. Overall, the market is poised for robust growth In the coming years.

What will be the Size of the Vitamin Ingredients Market During the Forecast Period?

- The market encompasses the production and supply of organic compounds derived from various natural sources, including fruits, vegetables, animals, and plants. These vitamins, or individual vitamins, play essential roles in maintaining human health and addressing nutritional deficiencies. The market includes water-soluble vitamins, such as B complex vitamins and vitamin C, and fat-soluble vitamins, including vitamins A, D, E, and K. The pharmaceuticals industry, animal feed industry, and nutritional supplements sector are significant consumers of vitamin ingredients. Vitamins have applications in treating disorders related to the eyes, heart, and other bodily functions. Vitamin A, for instance, is crucial for vision and skin health, while B complex vitamins contribute to energy production and nerve function.

- Vitamin C is known for its antioxidant properties, and Vitamin D is essential for bone health. The market is experiencing robust growth due to increasing health consciousness and preventive healthcare trends. Consumers are increasingly seeking natural sources of vitamins from fruits, vegetables, and animals to supplement their diets. The market's size and direction reflect the growing demand for these essential nutrients in various industries and applications.

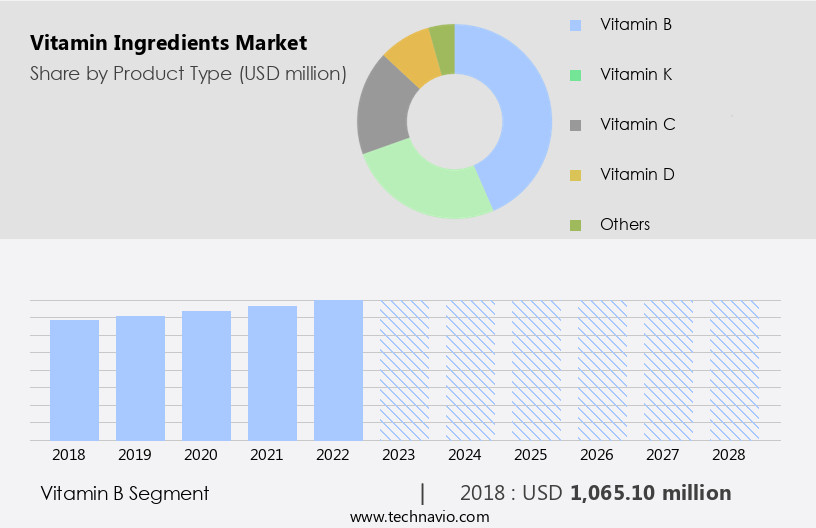

How is this Vitamin Ingredients Industry segmented and which is the largest segment?

The vitamin ingredients industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Vitamin B

- Vitamin K

- Vitamin C

- Vitamin D

- Others

- Application

- Animal feed

- Food and beverages

- Pharmaceutical industry

- Cosmetics

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Product Type Insights

- The vitamin b segment is estimated to witness significant growth during the forecast period.

Vitamin B, also known as niacin and nicotinic acid, is an essential organic compound that plays a crucial role in various metabolic functions in both human and animal bodies. This water-soluble vitamin is vital for the efficient working of enzymes, which includes releasing energy from carbohydrates and fat, breaking down amino acids, and transporting oxygen and nutrients. Naturally occurring in fruits, vegetables, animal-based sources, and synthesized from the amino acid tryptophan, it is essential for converting nutrients into energy, producing cholesterol and fats, and exerting antioxidant effects. Deficiencies in vitamin B can lead to disorders such as Beriberi and heart-related problems.

Its therapeutic purposes extend to preventing cholesterol levels from rising, supporting neurological functions, and aiding in DNA repair. Foods and beverages, nutritional supplements, animal feed, and functional food products are common sources of vitamin B. The growing awareness of health consciousness and preventive healthcare, along with the increasing prevalence of chronic medical ailments, geriatric population, and malnutrition, is driving the demand for vitamin B ingredients.

Get a glance at the Vitamin Ingredients Industry report of share of various segments Request Free Sample

The Vitamin B segment was valued at USD 1.07 billion in 2018 and showed a gradual increase during the forecast period.

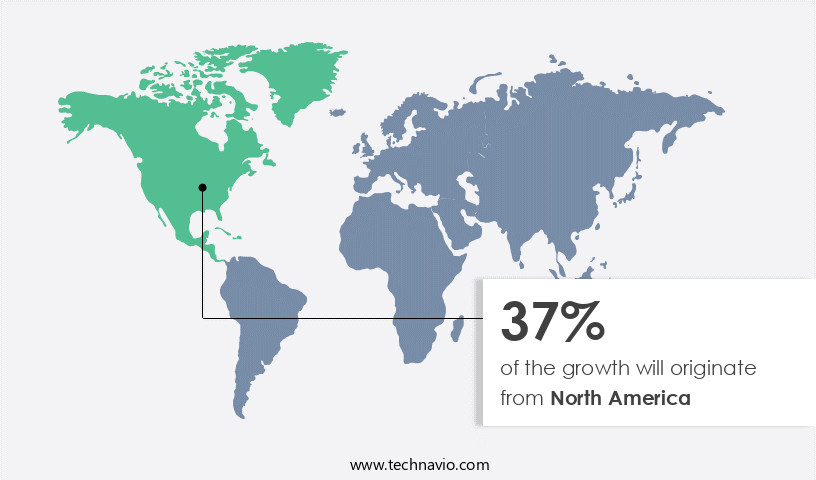

Regional Analysis

- North America is estimated to contribute 37% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the US and Canada is experiencing growth due to increasing consumer awareness of the importance of vitamins for overall health and wellness. Key players In the region are expanding their product offerings and collaborating with online retailers like Walmart and Amazon to boost sales. The US, with its large population of Internet users and well-established distribution networks for supplements, presents significant opportunities for market expansion. Vitamins, including Vitamin A, B complex, C, D, E, and K, are essential for various bodily functions such as vision, skin health, immune function, energy metabolism, nervous system function, bone health, and mood regulation.

Deficiencies In these vitamins can lead to disorders like cardiovascular diseases, diabetes, eye disorders, signs of aging, and heat strokes. To cater to diverse consumer needs, manufacturers are producing vitamin ingredients in various forms, such as tablets and capsules, powders, and liquid formulations, including gummies and chewable tablets. The market also includes fortified foods and beverages, animal feed, and nutraceuticals. The market is expected to continue growing due to the increasing prevalence of chronic medical ailments, an aging population, and a focus on preventive healthcare and natural sources of vitamins from fruits, vegetables, animals, and plants. The pharmaceuticals and animal feed industries are major consumers of vitamin ingredients, while the cosmetics, haircare, and skincare industries are also significant markets for natural sources of Vitamin E.

The market is subject to regulations by public health agencies and health regulators to ensure the safety and efficacy of vitamin ingredients.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Vitamin Ingredients Industry?

Increasing prevalence of vitamin deficiency is the key driver of the market.

- Vitamin ingredients play a crucial role in nourishing the body and addressing nutritional deficiencies. These organic compounds are derived from naturally occurring vitamins in fruits, vegetables, and animal-based sources. The market for vitamin ingredients is driven by the increasing prevalence of chronic medical ailments, such as cardiovascular diseases, diabetes, and eye disorders, as well as age-related issues. Consumers are increasingly turning to vitamin supplements to prevent these conditions and improve overall health. Water-soluble vitamins, including Vitamin C and B complex vitamins, and fat-soluble vitamins, such as Vitamin A, D, E, and K, are essential for various bodily functions, including energy metabolism, nervous system function, bone health, and mood regulation.

- Vitamin deficiencies can lead to disorders such as pellagra, dermatitis, dementia, and diarrhea. The market for vitamin ingredients is diverse, catering to various industries, including food and beverages, animal feed, pharmaceuticals, and nutraceuticals. Functional food products, such as tablets and capsules, powder formulations, and liquid formulations, offer convenience and ease of consumption for consumers. Vitamin supplements are used for therapeutic purposes, as well as in livestock and poultry feed, haircare, beauty products, and food fortification. The growing health consciousness and preventive healthcare trends have fueled the demand for vitamin ingredients. Their antioxidant properties contribute to immune health, vision, skin health, and anti-aging benefits.

- Vitamin E, in its natural form, is a popular ingredient in organic haircare, skincare, and cosmetics. Vitamin K is essential for blood clotting, while Vitamin A is crucial for vision and bone health. Vitamin ingredients manufacturers cater to various industries, including healthcare systems, public health agencies, and health regulators, to address the needs of high-risk patients and the geriatric population. The market is expected to continue its overall growth, driven by product innovations and the increasing demand for natural sources of vitamins from plants and animals.

What are the market trends shaping the Vitamin Ingredients Industry?

Increase in R and D expenditure on animal feed is the upcoming market trend.

- The market is experiencing significant growth due to increasing investments in research and development (R&D) and the adoption of innovative technologies by companies. These trends are driving the production of both plant- and animal-based vitamins, addressing nutritional deficiencies in various populations. Vitamins, which are organic compounds derived from naturally occurring vitamins in fruits, vegetables, animals, and other sources, play essential roles in nourishing the body, preventing chronic medical ailments, and supporting various body functions. Vitamin C and B complex vitamins, and fat-soluble vitamins, including Vitamin A, D, E, and K, are integral to maintaining immune health, vision, skin health, energy metabolism, nervous system function, bone health, and mood regulation.

- Vitamin deficiencies can lead to disorders like cardiovascular diseases, diabetes, eye disorders, signs of aging, heat strokes, and malnutrition. companies In the market are focusing on developing sustainable technologies to produce animal feed vitamins and launching new product innovations, such as natural Vitamin E, to cater to the growing demand for functional food products, nutraceuticals, and natural sources of vitamins. The pharmaceuticals industry, animal feed industry, and nutritional supplements are major consumers of vitamin ingredients. As health consciousness and preventive healthcare become increasingly important, there is a growing demand for vitamin ingredients in various applications, including tablets and capsules, powder formulations, liquid formulations, gummies, chewable tablets, and food and beverages.

- This trend is expected to continue during the forecast period, with a focus on convenience and ease of consumption. Additionally, the geriatric population and high-risk patients require specialized vitamin ingredients to address age-related issues and specific health conditions. Overall, the market is expected to grow significantly, driven by the increasing demand for vitamins and dietary supplements, fortified foods and beverages, and the development of new product innovations.

What challenges does the Vitamin Ingredients Industry face during its growth?

Regulatory control on supplement usage limit and packaging is a key challenge affecting the industry growth.

- Vitamin ingredients are organic compounds derived from naturally occurring vitamins in fruits, vegetables, animal-based sources, and other natural sources. These vitamins play essential roles in nourishing the body, addressing nutritional deficiencies, and preventing various disorders. The market for vitamin ingredients includes Vitamin C and B complex vitamins, as well as fat-soluble vitamins such as Vitamin A, D, E, and K. Absorption and utilization of these vitamins vary, with some requiring specific conditions for optimal absorption. For instance, Vitamin B supplements, particularly Vitamin B3, can cause side effects like flushing if consumed in excess of Recommended Dietary Allowances (RDAs).

- In contrast, Vitamin D requires sunlight for synthesis In the body, while Vitamin E has antioxidant properties that contribute to immune health, vision, skin health, and energy metabolism. The market caters to various industries, including food and beverages, animal feed, pharmaceuticals, and nutritional supplements. This market growth is driven by factors such as increasing health consciousness, preventive healthcare, and the development of product innovations like natural Vitamin E, organic haircare, skincare, cosmetics, and nutraceuticals. Chronic medical ailments, age-related issues, and malnutrition are significant markets for vitamin ingredients, targeting high-risk patients, such as the geriatric population, and addressing deficiency-related disorders.

- The pharmaceutical and animal feed industries also rely on vitamin ingredients to treat and prevent disorders related to eyes, heart, and blood clotting. Functional food products, tablets and capsules, powder formulations, liquid formulations, gummies, chewable tablets, and various food and beverage applications contribute to the market's overall growth. Vitamin ingredients manufacturers cater to the healthcare systems and public health agencies, ensuring the production and distribution of high-quality, safe, and effective vitamin ingredients.

Exclusive Customer Landscape

The vitamin ingredients market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vitamin ingredients market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, vitamin ingredients market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AIE Pharmaceuticals Inc.

- Atlantic Essential Products Inc.

- Bactolac Pharmaceutical Inc.

- BASF SE

- Bluebonnet Nutrition Corp.

- CSPC Pharmaceutical Group Ltd.

- Foodchem International Corp.

- Glanbia plc

- Hangzhou Focus Corp.

- Kirkman Group

- Koninklijke DSM NV

- LOHMANN and Co. AKTIENGESELLSCHAFT

- Lonza Group Ltd.

- Microbelcaps S.A.

- Northeast Pharmaceutical Group Co. Ltd.

- Nulab Inc.

- ParkAcre Ltd.

- Private Label Nutra

- TNN Development Ltd.

- Triveni Interchem Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Vitamin ingredients are essential organic compounds that play a vital role in nourishing the human body. These naturally occurring substances are found in various sources, including fruits, vegetables, and animal-based products. They are easily absorbed by the body but are excreted through urine, making it necessary to consume them regularly. On the other hand, fat-soluble vitamins, including vitamins A, D, E, and K, are absorbed with the help of dietary fats.

They are stored In the liver and fat tissues, allowing the body to use them as needed. However, excessive intake of fat-soluble vitamins can lead to toxicity. Vitamin deficiencies can result in various health issues, including cardiovascular diseases, diabetes, eye disorders, signs of aging, and heat strokes. Malnutrition and deficiency-related disorders are prevalent in chronic medical ailments and the geriatric population. The demand for vitamin ingredients is increasing due to the growing awareness of preventive healthcare and the antioxidant properties of vitamins. Vitamins are used in various industries, including food and beverages, animal feed, and pharmaceuticals. Functional food products, nutraceuticals, and natural vitamin E are popular In the market.

The healthcare systems and public health agencies are emphasizing the importance of vitamins in maintaining overall health and wellness. High-risk patients, such as the elderly and individuals with chronic medical conditions, require adequate vitamin intake to prevent complications. Natural sources of vitamins, such as plants and animals, are gaining popularity due to consumer preferences for organic and natural products. Natural sources of vitamins are used in various industries, including organic haircare, skincare, cosmetics, and nutritional supplements. Product innovations, such as tablets and capsules, powders, and liquid formulations, offer convenience and ease of consumption. Gummies and chewable tablets are popular among children and adults who dislike the taste of traditional vitamin supplements.

Vitamins play a crucial role in various bodily functions, including digestion, vision, skin health, immune function, energy metabolism, nervous system function, bone health, and mood regulation. They are essential for maintaining overall health and preventing various disorders, making them an essential component of a healthy diet.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

166 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.53% |

|

Market growth 2024-2028 |

USD 1.40 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.13 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Vitamin Ingredients Market Research and Growth Report?

- CAGR of the Vitamin Ingredients industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the vitamin ingredients market growth of industry companies

We can help! Our analysts can customize this vitamin ingredients market research report to meet your requirements.