Female Contraceptive Market Size 2024-2028

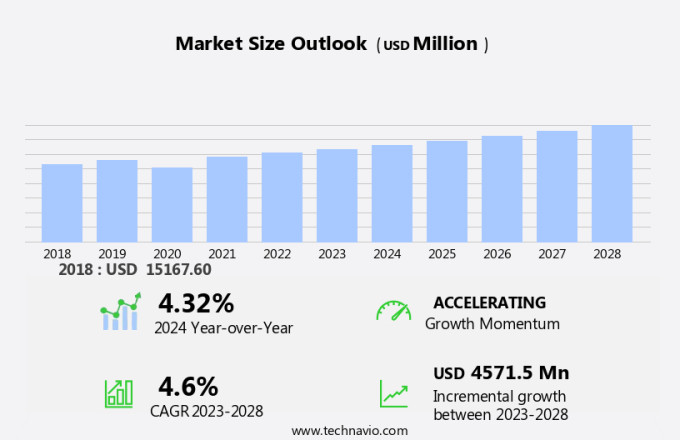

The female contraceptive market size is forecast to increase by USD 4.57 billion at a CAGR of 4.6% between 2023 and 2028. The market is experiencing significant growth due to several key factors. One trend is the increasing preference for contemporary contraceptive methods among teenagers and young populations, aiming to reduce unplanned pregnancies. Married women also continue to seek reliable and effective birth control options, leading to the popularity of various methods such as birth control pill, intrauterine devices (IUDs), and condoms. IUDs, in particular, have gained traction due to their long-term effectiveness and convenience. Hormonal IUDs and nonhormonal IUDs offer different advantages, with hormonal IUDs providing continuous hormonal release and nonhormonal IUDs offering a hormone-free alternative. However, there are challenges to address, such as irregularities in sex education in developed countries, which may result in misconceptions and incorrect usage of contraceptives. Additionally, surgery-related procedures for IUD insertion may deter some individuals from adopting this method. Overall, the market is driven by the need for effective and convenient contraceptive solutions for women.

The market is a significant sector within the healthcare industry, catering to the reproductive health needs of a substantial portion of the global female population. The market encompasses a diverse range of products, including intrauterine devices (IUDs), oral contraceptives, transdermal patches, vaginal gels, contraceptive injections, spermicides, female condoms, diaphragms and caps, and various other medications. The demand for contemporary contraceptives continues to grow as more women seek reliable and effective methods to prevent unplanned pregnancies. According to recent studies, the young population and teenagers represent a substantial portion of this demand.

Furthermore, the contraceptive pipeline is rich with new developments. For instance, dienogest + ethinylestradiol and Estelle (drospirenone + estetrol) are two promising oral contraceptives undergoing clinical trials. Dienogest, a progestogen, is known for its unique mechanism of action, while Estelle's novel estetrol component sets it apart from traditional oral contraceptives. Female population segments with specific health concerns, such as vitiligo patients and those at risk for osteoporosis, also contribute to the market's growth. These women require contraceptive solutions that cater to their unique health needs. The success of oral contraceptives has led to the exploration of alternative delivery methods.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Female contraceptive devices

- Female contraceptive drugs

- Geography

- North America

- Canada

- US

- Europe

- France

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

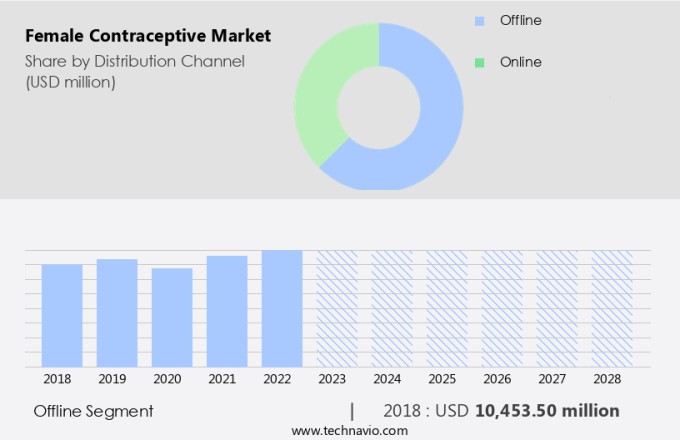

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses various products such as Male Condoms, Vaginal Rings, Subdermal Implants, Tablets (Oral Contraceptive Pills), Injectables, and more. These offerings are available through multiple channels, including Households, Clinics, and Hospitals. The market for female contraceptives is experiencing steady growth due to the increasing unmet needs and gender-based barriers to accessing contraceptives. Unintended pregnancies continue to be a concern, making the demand for effective and reliable contraceptive methods high. Major merchandisers, including specialty stores, supermarkets, and department stores, play a significant role in the distribution of these products. These merchandisers offer a wide range of brands and types of female contraceptives, contributing to the market's growth.

Additionally, they are expanding their reach to local and regional markets to cater to the increasing demand. Furthermore, there is a growing trend towards the development of male contraceptive methods. However, the market for male contraceptives is currently in its nascent stages, presenting significant opportunities for growth. As awareness about sexual and reproductive health continues to increase, the demand for effective and accessible contraceptive options is expected to rise.

Get a glance at the market share of various segments Request Free Sample

The Offline segment was valued at USD 10.45 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is experiencing significant expansion due to the widespread use and availability of various contraceptive options. One of the key contributors to this growth is the adoption of intrauterine devices (IUDS), which have gained popularity for their effectiveness in preventing pregnancies and cost-effectiveness for extended periods. Additionally, the increasing number of unplanned pregnancies and growing awareness about the convenience and availability of reimbursements have fueled the demand for oral contraceptives in the region. Moreover, the pipeline for new contraceptive products is strong, with innovative offerings such as Estelle (drospirenone + estetrol) and drospirenone-based contraceptives gaining attention.

Furthermore, these advancements cater to specific patient needs, including those with conditions like female vitiligo and osteoporosis. Transdermal patches and vaginal gels are also emerging as alternative contraceptive methods. The increasing incidence of unplanned pregnancies and the availability of various contraceptive options have contributed to the market's success. The professional and knowledgeable virtual assistant is committed to providing accurate and up-to-date information on this topic.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Increasing adoption of innovative marketing strategies is the key driver of the market. The contraceptive market in the United States is witnessing notable advancements, with key players increasing their promotional efforts to expand their market share. Notable brands, such as Abbvie's Lo Loestrin Fe, are investing significantly in advertising to retain their dominant positions. Public relations activities are being employed to pique women's interest in various female contraceptive solutions, including topical applications, injections, and others. Strategic digital marketing on social media and search engines enables companies to effectively engage specific demographics.

Further, engaging content, such as instructional videos, infographics, and blog articles, informs and empowers women about their contraceptive options. Collaborations with women's health and lifestyle influencers foster open conversations around contraception and broaden market reach. In the realm of family planning, pipeline valuation analysis and pipeline drug development remain crucial for companies to maintain a competitive edge.

Market Trends

The increasing popularity of female condoms is the upcoming trend in the market. The market in the US has seen a significant increase in the utilization of contemporary methods, such as intrauterine devices (IUDs) and birth control pill, among teenagers and young populations. Married women also continue to be a substantial consumer base. The decreasing cost of these methods, making them more affordable and accessible, has contributed to their popularity.

Moreover, the US government's initiatives, such as distributing female condoms through various channels under its DC program, have increased their availability and acceptance. The second-generation female condoms, like those manufactured by FH2, have also reduced their cost, making them competitively priced with male condoms. This pricing equivalence has led to a rise in demand for female condoms, providing an alternative to traditional methods for women seeking effective birth control options.

Market Challenge

Irregularities in sex education in developed countries is a key challenge affecting the market growth. In developed countries like the United States, the normalization of premarital sex does not guarantee adequate sex education for teenagers, leading to a decrease in demand for female contraceptives. Sex education plays a crucial role in promoting sexual awareness and encouraging the use of contraceptives. However, in certain US states, abstinence-only sex education is prevalent, which excludes the teaching of birth control measures and safe sex practices. Consequently, teenage pregnancy rates in these areas have risen. Drug developers continue to innovate in the contraceptive market, focusing on various classes such as intrauterine devices (IUDs) and subcutaneous implants. Late-stage pipeline therapies include hormonal intrauterine devices and non-hormonal contraceptives.

However, despite these advancements, adverse reactions to contraceptives remain a concern for some users, affecting compliance and adherence. Access to contraceptives is essential for effective birth control. The US Food and Drug Administration (FDA) regulates the availability and distribution of contraceptives, ensuring their safety and efficacy. However, there are disparities in access to contraceptives, particularly in underserved communities, which can result in unintended pregnancies. In summary, the demand for female contraceptives in the US is influenced by factors such as sex education, access, and adverse reactions. Developments in contraceptive classes, including hormonal intrauterine devices and subcutaneous implants, aim to address these challenges and improve sexual and reproductive health.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Abbvie Inc.- The company offers female contraceptives such as Liletta Intrauterine Contraceptive.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Afaxys Pharma LLC

- Agile Therapeutics Inc.

- Amgen Inc.

- Ansell Ltd.

- Bayer AG

- The Cooper Companies Inc.

- Cupid Ltd.

- Exeltis USA Inc.

- Johnson and Johnson Services Inc.

- Mayer Laboratories Inc.

- Medisafe Distribution Inc.

- Merck and Co. Inc.

- Pfizer Inc.

- Piramal Enterprises Ltd.

- Reckitt Benckiser Group Plc

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Veru Inc.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of products designed to prevent pregnancy. The market caters to the needs of a vast female population, with various contraceptive classes available, including hormonal intrauterine devices (IUDs), oral contraceptives, transdermal patches, vaginal gels, contraceptive injections, spermicides, female condoms, diaphragms and caps, vaginal rings, contraceptive sponges, sub-dermal implants, and topical contraceptives. Drug developers continue to innovate in this space, with late-stage pipeline therapies such as Estelle (drospirenone + estetrol) and hormonal IUDs gaining attention. However, compliance and adherence remain critical challenges, with unmet needs persisting due to gender-based barriers and unintended pregnancies. Oral contraceptives, including pills and extended-cycle COCs, remain popular choices, despite adverse reactions like spotting, bleeding between periods, sore breasts, nausea, and headaches.

Furthermore, hormonal IUDs and subdermal implants offer long-term reversible contraception, while non-hormonal IUDs cater to those with specific health conditions like osteoporosis or female vitiligo. Access to contraceptives remains a concern, with household, clinics, and hospitals playing essential roles in their distribution. Unplanned births among teenagers and young population segments continue to be a significant issue, emphasizing the importance of sex education and access to contraception. Male contraception is an emerging area of focus, with unmet needs and potential for novel progestins and extended-cycle COCs. The market also offers various emergency contraceptive options and sterilization procedures for those seeking permanent solutions. Ultimately, the goal is to address the prevalence of disorders and ensure public awareness, accessibility, and affordability of contemporary contraceptives.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market Growth 2024-2028 |

USD 4.57 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.32 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 37% |

|

Key countries |

US, China, France, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AbbVie Inc., Afaxys Pharma LLC, Agile Therapeutics Inc., Amgen Inc., Ansell Ltd., Bayer AG, The Cooper Companies Inc., Cupid Ltd., Exeltis USA Inc., Johnson and Johnson Services Inc., Mayer Laboratories Inc., Medisafe Distribution Inc., Merck and Co. Inc., Pfizer Inc., Piramal Enterprises Ltd., Reckitt Benckiser Group Plc, Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries Ltd., Veru Inc., and Viatris Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch