What is the Size of FeSi15 Market?

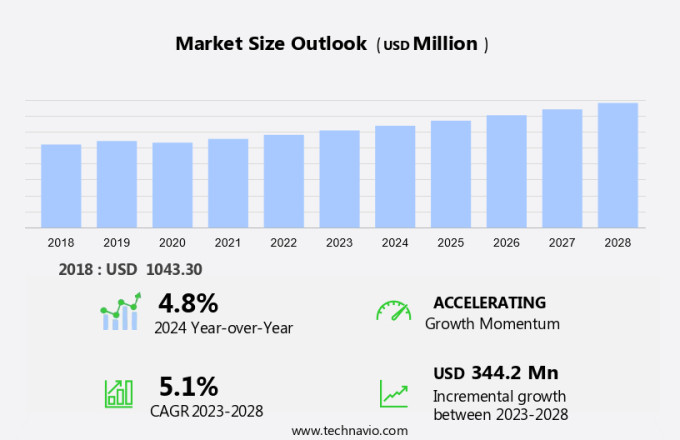

The FeSi15 market size is forecast to increase by USD 344.2 million, at a CAGR of 5.1% between 2023 and 2028. The market is experiencing significant growth due to several key trends and drivers. One major factor is the increasing demand for greener alternatives in various industries, leading to a rise in the adoption of Fesi15 as a sustainable option. Another trend is the expansion of the electric vehicle (EV) market, which relies heavily on Fesi15 for battery production. Market competition is intensifying as alternative materials gain popularity, necessitating greater operational efficiency and investment in sustainable practices. The regulatory environment is also becoming more stringent, pushing companies to adopt recycling methods and reduce their carbon footprint. These factors collectively contribute to the growth of the market, making it an attractive investment opportunity for businesses focused on sustainability and efficiency.

Request Free FeSi15 Market Sample

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Mining sector

- Metal recycling

- Others

- Type

- Atomized powder FeSi15

- Milled powder FeSi15

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- US

- South America

- Brazil

- Middle East and Africa

- APAC

Which is the Largest Segment Driving Market Growth?

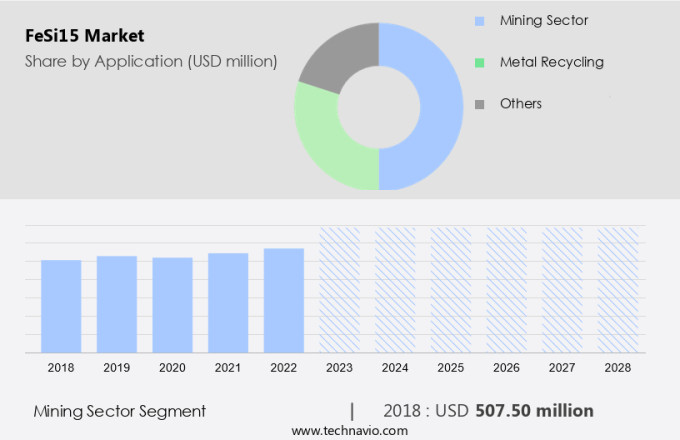

The mining sector segment is estimated to witness significant growth during the forecast period. The market holds significant importance in various industries, particularly in the mining sector, due to its application in supply chain processes such as ore separation. FeSi15's unique magnetic properties make it an essential component in ore flotation, enhancing the efficiency of mineral extraction. In this process, FeSi15 isolates valuable minerals like aluminum, gold, diamonds, and copper from the ore, improving overall production processes.

Get a glance at the market share of various regions Download the PDF Sample

The mining sector segment was valued at USD 507.50 million in 2018. Furthermore, in heavy media separation, FeSi15's high density and magnetic capabilities boost mineral extraction quality and efficiency. Infrastructure projects in the mining industry also benefit from the use of FeSi15, as it ensures safety protocols during production processes. Adhering to sustainable practices, FeSi15 contributes to the production of high-quality electronics, ensuring economic stability for businesses in the sector. In summary, the FeSi15 market plays a pivotal role in the mining industry, enhancing mineral extraction processes and contributing to the production of high-quality electronics.

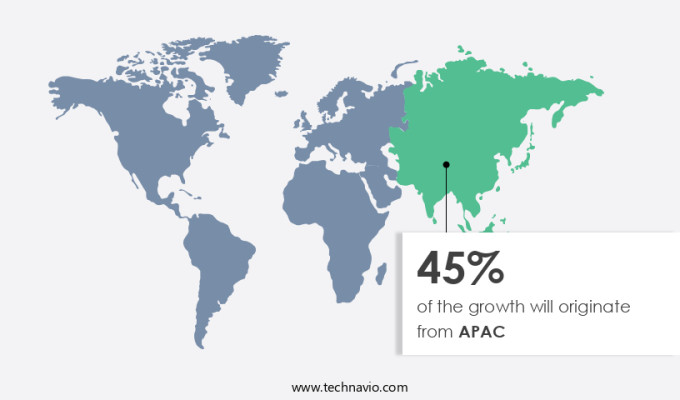

Which Region is Leading the Market?

For more insights on the market share of various regions Request Free Sample

APAC is estimated to contribute 45% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The Asia-Pacific (APAC) region plays a pivotal role in the global ferro-silicon (FeSi15) market due to its extensive steel production capabilities and ongoing urbanization. China, the world's leading steel producer, accounted for approximately 53% of the global steel output in 2023, with a production capacity of around 1.170 billion tons, marking a 2% year-over-year increase. FeSi15 is an essential component in steel manufacturing, improving the steel's quality and properties. Urbanization, particularly in countries like India and Australia, is driving substantial infrastructure development in APAC. This growth trend highlights the importance of FeSi15 in the region's steel industry. As global pandemics continue to impact production efficiency, there is a growing emphasis on implementing sustainable production methods in the ferroalloys sector. Solar PV capacity expansion and cost reduction strategies are key focus areas to ensure long-term profitability and competitiveness. The market is expected to grow steadily, driven by these factors and the region's industrial development.

How do Technavio's company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Anyang Wanhua Metal Material Co. Ltd. - The company offers FeSi15 that is produced using high-quality raw materials like coke, steel scrap, and quartz.

Technavio provides the ranking index for the top 13 companies along with insights on the market positioning of:

- DMS Powders

- Elkem ASA

- Feng Erda Group

- Hafsil AS

- Henan Star Metallurgy Material Co. Ltd.

- Inner Mongolia Pusheng Iron and Steel Co Ltd.

- KOVOHUTY Dolny Kubin s.r.o.

- Mechel PAO

- Pioneer Carbide Pvt. Ltd.

- Tongfa Abrasive Trading Co Ltd.

- Westbrook Resources Ltd.

- Zhenxin Metallurgical Materials Co Ltd.

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Market?

|

Market structure |

Concentrated |

|

YoY growth 2023-2024 |

4.8 |

Market Dynamic

The market is witnessing significant advancements in manufacturing technologies, driving the ferroalloy industry towards greater supply chain resilience and sustainable production. This shift is being fueled by renewed investments in renewable energy sources and materials, as well as a growing focus on environmental sustainability and circular economy principles. High-purity silicon applications are gaining traction in the renewable energy sector, necessitating the production of advanced ferroalloy materials. Manufacturers are turning to industrial robotics and smart manufacturing solutions to optimize their supply chains and improve energy efficiency. These innovations not only contribute to cost reduction but also align with eco-conscious consumer preferences and corporate social responsibility initiatives. Renewable energy policy and sustainable finance are key catalysts for this transformation. Governments and financial institutions are increasingly incentivizing the adoption of green infrastructure, green building practices, and renewable energy solutions. As a result, the demand for reliable components and high-performance alloys is on the rise.

Material science advancements are playing a crucial role in the development of sustainable ferroalloy production processes. Engineers are exploring new ways to minimize the environmental impact of manufacturing through energy efficiency improvements, green technology adoption, and carbon footprint reduction. Local regulations are also driving the industry to address climate change mitigation and circular economy principles. The circular economy is gaining momentum in the ferroalloy industry, with a focus on recycling and repurposing waste materials. This approach not only reduces the need for virgin resources but also contributes to the overall sustainability of the industry. Additionally, the adoption of biodegradable materials in manufacturing processes and green marketing initiatives is becoming increasingly important for companies seeking to differentiate themselves in the market. In conclusion, the market is undergoing a significant transformation, driven by advanced manufacturing technologies, renewable energy investment, and a growing focus on sustainability. Manufacturers are embracing industrial robotics, smart manufacturing, and material science advancements to optimize their supply chains, reduce costs, and minimize their environmental impact. The industry is also adapting to changing regulations and consumer preferences, with a focus on circular economy principles and eco-friendly practices. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

The rise in steel manufacturing is notably driving market growth. The market experiences significant growth due to the increasing demand for renewable energy and high-performance materials in various industries. In 2023, global crude steel production reached an impressive 1,892 million tonnes (MT), with China leading the way at 1,019 MT, India at 140 MT, Japan at 87.0 MT, and the USA contributing 81 MT. This substantial production underscores the importance of FeSi15 in steel manufacturing, as it functions as a deoxidizer and alloying agent, enhancing steel quality and properties. The renewable energy sector's expansion, particularly in solar energy, fuels the demand for FeSi15.

However, supply chain disruptions, price wars, and environmental regulations pose challenges to market growth. Strategic planning and construction projects require careful consideration of these factors, as well as geopolitical tensions and the availability of raw materials, such as silica, which are crucial to FeSi15 production. To stay competitive, market players must adapt to these market dynamics and maintain a strong focus on innovation and sustainability. Thus, such factors are driving the growth of the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

Expansion of Electric Vehicle (EV) adoption is the key trend in the market. The market experiences significant growth due to the increasing trend towards greener alternatives in transportation. In 2023, electric vehicle (EV) sales reached approximately 14 million units, with major markets being China, Europe, and the United States. The escalating demand for EVs necessitates the production of high-performing steel, which is where FeSi15 comes in. As an alloying agent and deoxidizer, FeSi15 enhances the efficiency and sustainability of steel production by increasing its strength and durability. This makes it an ideal choice for the automotive industry, where advanced materials are required to meet the demanding specifications of EV components.

The regulatory environment continues to encourage sustainable practices, driving investments in recycling methods to reduce operational costs and promote a circular economy. The FeSi15 market is expected to benefit from these trends, as the demand for high-quality steel continues to rise. Thus, such trends will shape the growth of the market during the forecast period.

What are the Major Market Challenges?

Competition from alternative materials is the major challenge that affects the growth of the market. The market experiences intense competition from alternative materials, such as aluminum and calcium silicon alloys, in the automotive and infrastructural development sectors. Aluminum, an efficient deoxidizer in steel production, is a significant competitor due to its widespread availability and relatively low cost in specific markets. Its use in steelmaking could potentially decrease the demand for FeSi15. Calcium silicon alloys, composed of silicon, calcium, and iron, are another formidable competitor. Recognized for their essential roles as deoxidizers and desulfurizers in steelmaking, these alloys are indispensable in various manufacturing processes.

They contribute significantly to the production of high-quality steels, including low-carbon steels, stainless steels, and special alloys like nickel-based and titanium-based alloys. Advanced high-strength steels and renewable technologies also utilize calcium silicon alloys in energy storage applications for sustainable solutions. Hence, the above factors will impede the growth of the market during the forecast period.

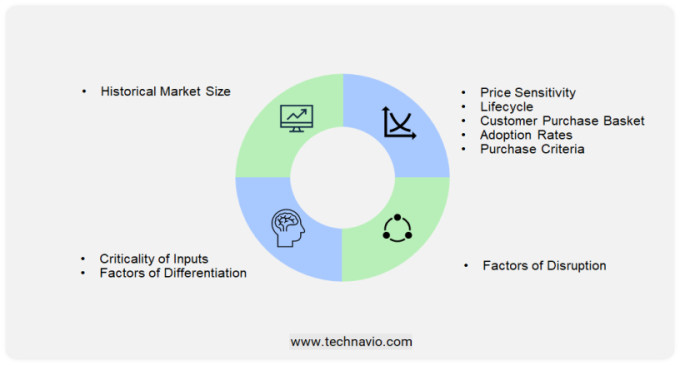

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market research and growth, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The market encompasses the production and application of ferro-silicon and other ferroalloys in various industries. With the ongoing global pandemics, the focus on sustainable production methods has gained significant importance. Urbanization and the expansion of steel production have led to increased emissions, making it crucial for the industry to adopt renewable energy and high-performance silicon alloys. The solar PV capacity expansion and the rise of renewable technologies have influenced the market dynamics, leading to cost pressures and price wars. Environmental regulations and geopolitical tensions have added complexity to the strategic planning of market players. Innovation and advanced manufacturing processes are essential for producing high-purity silicon and specialized steel, meeting the demands of the automotive, construction, and electronics industries. Sustainability and recycling methods are key areas of focus to reduce operational costs and improve product quality.

Infrastructural developments and economic stability are critical factors for the growth of the Fesi15 market. The regulatory environment and supply chains play a significant role in ensuring safety protocols and maintaining product quality. The welding sector benefits from stronger welds and durability, enabling fuel efficiency and structural integrity in various industrial sectors. Electric vehicles and evolving manufacturing processes, such as robot-assisted manufacturing, are driving the demand for high-strength materials and advanced high-strength steels. The market competition intensifies as consumption rates increase, and companies invest in research and development to stay competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market Growth 2024-2028 |

USD 344.2 million |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 45% |

|

Key countries |

US, China, Germany, UK, France, Japan, South Korea, India, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Anyang Wanhua Metal Material Co. Ltd., DMS Powders, Elkem ASA, Feng Erda Group, Hafsil AS, Henan Star Metallurgy Material Co. Ltd., Inner Mongolia Pusheng Iron and Steel Co Ltd., KOVOHUTY Dolny Kubin s.r.o., Mechel PAO, Pioneer Carbide Pvt. Ltd., Tongfa Abrasive Trading Co Ltd., Westbrook Resources Ltd., and Zhenxin Metallurgical Materials Co Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies