FEVE Fluoropolymer Coatings Market Size 2025-2029

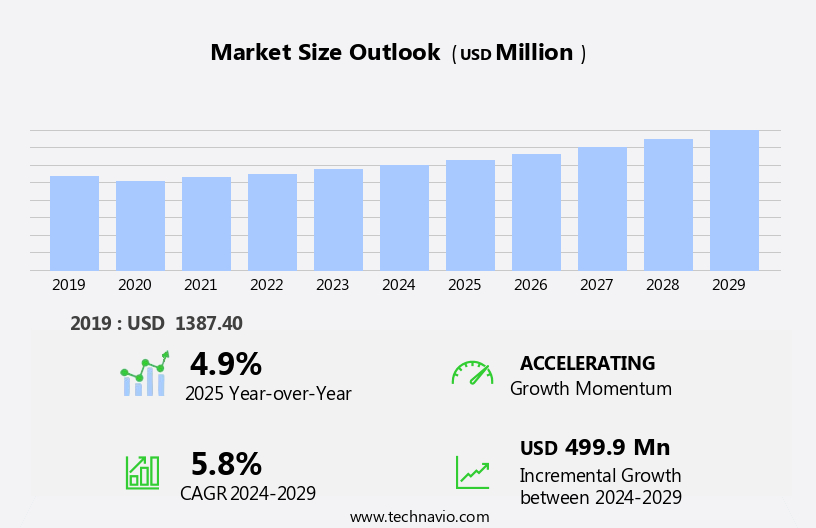

The FEVE fluoropolymer coatings market size is forecast to increase by USD 499.9 million, at a CAGR of 5.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing population in urban regions and the subsequent expansion of infrastructure projects. The demand for FEVE fluoropolymers is particularly high in construction and industrial applications due to their exceptional resistance to chemicals, heat, and weathering. The automotive sector is another key driver for the market, as the industry's shift towards lightweight and fuel-efficient vehicles increases the use of FEVE fluoropolymers in engine components and exterior coatings. The market is diverse, catering to various industries, including automotive, aerospace, oil & gas, mining, marine, power generation, and furniture. However, the market faces challenges from stringent environmental policies and regulations related to the use of FEVE fluoropolymers. These regulations, aimed at reducing the environmental impact of these materials, may increase production costs and restrict their usage in certain applications.

- Companies in the market must navigate these challenges by investing in research and development to create more sustainable and eco-friendly alternatives. Additionally, strategic partnerships and collaborations can help companies stay competitive and meet the evolving demands of various industries. Moreover, advanced coatings such as self-healing, smart, and protective coatings are gaining traction due to their performance and lifespan advantages in harsh environments.

What will be the Size of the FEVE Fluoropolymer Coatings Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Fluoropolymer coatings continue to be a dynamic and evolving market, with ongoing advancements and applications across various sectors. These high-performance coatings, which include fluorocarbon and FEVE coatings, offer exceptional heat resistance, surface tension, and durability. The demand for fluoropolymer coatings is driven by their ability to enhance the performance of substrates in diverse industries. In the aerospace sector, FEVE coatings are utilized for their excellent corrosion resistance and adhesion properties, ensuring the longevity and safety of aircraft components. Energy coatings, on the other hand, are employed in the power generation industry for their UV resistance and ability to withstand high temperatures. The market is also driven by its versatility and sustainability advantages in various industries, particularly automotive paint and construction.

Coating thickness plays a crucial role in the effectiveness of these coatings, with advanced technologies enabling precise application and consistent results. Surface modification techniques, such as plasma treatment and chemical vapor deposition, are increasingly used to improve the compatibility of coatings with various substrates. Coating recycling and waste management are also gaining importance as sustainability becomes a priority, with renewable resources and biodegradable coatings emerging as viable alternatives. Regulatory compliance and environmental considerations are key factors shaping the market. ASTM and ISO standards ensure consistent quality and performance, while humidity testing, salt spray tests, and other durability assessments evaluate the coatings' ability to withstand harsh conditions.

Coil coatings, containers coatings, industrial wood coatings, automotive coatings, and construction coatings are other significant applications. Coating systems, including powder coating, electrostatic coating, dip coating, and spray coating, offer customizable solutions for various industries. The ongoing research and development in this field continue to unveil new possibilities, from non-stick coatings and protective coatings to anti-fouling coatings and specialty coatings.

How is this FEVE Fluoropolymer Coatings Industry segmented?

The FEVE fluoropolymer coatings industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Construction

- Aviation and aerospace

- Marine

- Automotive

- Others

- Product

- Water-based

- Solvent-based

- Powder-based

- Distribution Channel

- Direct sale

- Indirect sale

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

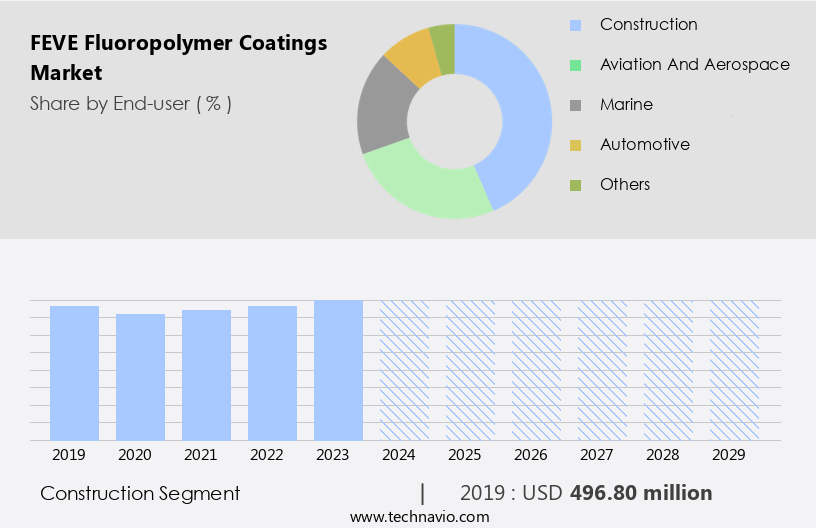

. By End-user Insights

The construction segment is estimated to witness significant growth during the forecast period. The market encompasses a range of high-performance coatings utilized in various industries for their exceptional properties. In the construction sector, FEVE coatings are employed as architectural coatings to safeguard structures from environmental stressors like UV radiation, humidity, chemicals, and pollution. These coatings ensure long-lasting protection, enhancing a building's aesthetic appeal while minimizing maintenance requirements. Skyscrapers, commercial buildings, bridges, stadiums, and other infrastructure projects frequently incorporate FEVE fluoropolymer coatings to maintain their structural integrity. Regulatory compliance is crucial in this market, with surface preparation and adhesion properties playing significant roles in coating performance. FEVE coatings exhibit excellent surface tension and durability, making them suitable for diverse applications.

Bio-based coatings and renewable resources are gaining traction in the market, aligning with environmental regulations. Coating systems employing FEVE coatings undergo rigorous testing for film formation, salt spray, and humidity resistance, among others. Corrosion resistance and wear resistance are essential properties, especially in marine and automotive applications. Coating thickness and application methods, including powder coating, dip coating, and electrostatic coating, influence the market dynamics. FEVE coatings are also integral to high-tech industries, such as electronics and aerospace, due to their UV resistance and chemical resistance. Coating recycling and waste management are emerging trends, with ISO and ASTM standards guiding industry practices.

The Construction segment was valued at USD 496.80 million in 2019 and showed a gradual increase during the forecast period.

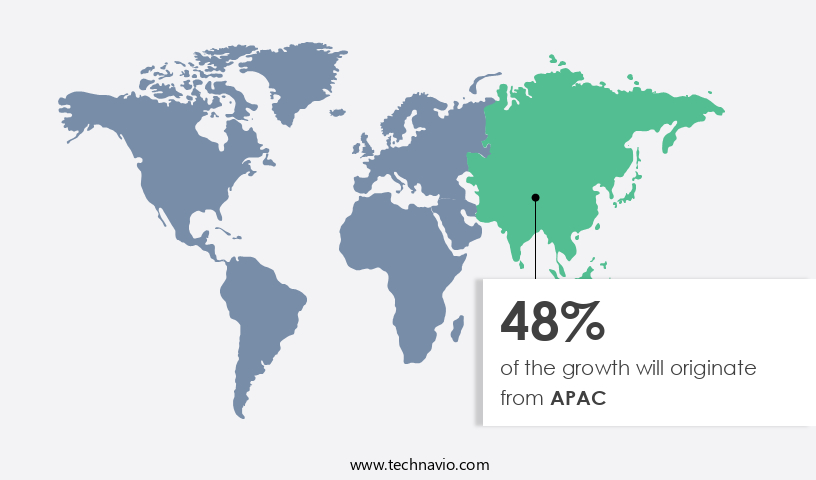

Regional Analysis

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to the increasing demand for high-performance coatings with superior heat resistance and surface tension properties. FEVE fluoropolymer coatings offer excellent substrate compatibility, making them suitable for various industries such as automotive, construction, electronics, and aerospace. Bio-based coatings are gaining popularity due to their renewable resources and regulatory compliance, contributing to the market's expansion. Coating systems, including powder and electrostatic application methods, are increasingly being adopted for their durability and wear resistance. FEVE fluoropolymer coatings are used extensively in food processing and marine industries for their anti-fouling properties and resistance to humidity and salt spray.

In the automotive sector, these coatings provide non-stick and protective features, enhancing the overall performance of the vehicles. High-performance coatings with UV resistance and chemical resistance are in high demand, particularly in the electronics industry for their protective properties. Coating thickness and film formation are crucial factors in ensuring the effectiveness of FEVE fluoropolymer coatings. ASTM and ISO standards play a vital role in regulating the quality and performance of these coatings. The APAC region holds the largest share in the market due to the increasing industrialization and infrastructure development in countries like China and India. The region's construction sector is witnessing significant growth, with governments investing in housing projects and infrastructure development, leading to increased demand for FEVE fluoropolymer coatings.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of FEVE Fluoropolymer Coatings Industry?

- The increase in population growth within urban areas and the subsequent expansion of infrastructure projects serve as the primary catalyst for market growth. The market is witnessing significant growth due to the increasing demand for high-performance coatings in various industries. These coatings offer superior heat resistance and surface tension, making them ideal for applications in sectors such as food processing and electronics. The market's expansion can be attributed to the need for substrate compatibility, regulatory compliance, and durability testing. Fluorocarbon coatings and bio-based coatings are gaining popularity due to their UV resistance and eco-friendliness, respectively. Coating performance is a critical factor driving market growth, as these coatings provide excellent protection against harsh environments and chemicals.

- Surface preparation plays a crucial role in ensuring the effectiveness of fluoropolymer coatings. The market's future looks promising, with ongoing research and development focusing on enhancing coating properties and expanding their applications. The demand for high-performance coatings is expected to remain strong, particularly in industries where productivity and efficiency are key drivers.

What are the market trends shaping the FEVE Fluoropolymer Coatings Industry?

- The automotive sector is experiencing significant growth, representing an emerging market trend. This expansion is driven by various factors, including advancements in technology and increasing consumer demand for more efficient and eco-friendly vehicles. FEVE fluoropolymer coatings have gained significant attention in various industries due to their exceptional properties, including superior adhesion and excellent corrosion resistance. These coatings are widely used in various sectors, such as electronics, automotive, construction, and marine, among others. In the automotive industry, FEVE coatings offer a high-quality finish and durable protection, making them an ideal choice for manufacturers seeking to innovate and enhance the look and feel of their vehicles. The global automotive industry has seen steady growth, with U.S. New light-vehicle sales reaching approximately 15.9 million units in 2024, marking a 2.8% increase over the previous year.

- FEVE coatings offer unparalleled durability and resistance to harsh weather conditions, making them a popular choice for various applications. For instance, in the electronics industry, FEVE coatings provide excellent protection against humidity and chemicals, ensuring the longevity of sensitive components. In the construction sector, FEVE coatings offer excellent color retention and resistance to UV light, making them an ideal choice for exterior applications. Moreover, FEVE coatings are increasingly being used in powder coating and electrostatic coating applications due to their excellent flow and leveling properties. Additionally, the growing trend towards using renewable resources in coatings has led to the development of FEVE coatings derived from sustainable sources, further increasing their appeal.

What challenges does the FEVE Fluoropolymer Coatings Industry face during its growth?

- The stringent environmental policies and regulations imposed on the use of FEVE fluoropolymers pose a significant challenge to the industry's growth. These regulations mandate strict adherence to emission limits and waste management protocols, increasing production costs and limiting the industry's expansion. Compliance with these regulations requires substantial investments in research and development of alternative, more sustainable fluoropolymer solutions. FEVE fluoropolymer coatings, which include aerospace and energy coatings, are subject to stringent regulations due to the use of solvent-based coatings, which consist of volatile chemicals that are hazardous to the environment. Regulatory bodies in Europe, MEA, and North America have imposed regulations to control the harmful effects of such coatings. For instance, the Clean Air Act regulates volatile organic compounds (VOCs) and hazardous air pollutant (HAP) emissions and specifies performance standards for controlling emissions from various types of coatings, including solvent-based coatings. The usage of polytetrafluoroethylene (PTFE), a common fluoropolymer, is impacted by new regulations on perfluorooctanoic acid (PFOA).

- The eradication process in making PTFE in small sizes for coating has been demonstrated to create PFOA. Therefore, to replace traditional PTFE, low PFOA alternatives are being explored. Coating thickness, surface modification, film formation, and coating recycling and waste management are critical aspects of the FEVE coatings market. Coating thickness is essential to ensure the desired protective properties, while surface modification enhances the coating's adhesion and durability. Film formation is crucial for achieving the desired properties, such as non-stick and heat resistance. Coating recycling and waste management are essential for minimizing environmental impact and reducing costs. ASTM standards, such as the salt spray test and coating standards, ensure the quality and performance of FEVE coatings. Decorative coatings, such as PTFE coatings, are also gaining popularity due to their aesthetic appeal and protective properties.

Exclusive Customer Landscape

The FEVE fluoropolymer coatings market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the FEVE fluoropolymer coatings market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, FEVE fluoropolymer coatings market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A and I COATINGS - The company specializes in providing five distinct fluoropolymer coatings: water-based Enviroflon and solvent-based Vitreflon.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A and I COATINGS

- AGC Inc.

- Akzo Nobel NV

- Anhui Sinograce Chemical Co. Ltd.

- Arkema

- BASF SE

- IFS Coatings

- Jotun AS

- KCC Co. Ltd.

- PPG Industries Inc.

- The Sherwin Williams Co.

- Tnemec Co Inc

- Unova Paint Products Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in FEVE Fluoropolymer Coatings Market

- In March 2023, DuPont, a leading global materials science company, introduced a new line of FEVE fluoropolymer coatings called "Radanite XL." This innovative product series offers enhanced chemical resistance and improved thermal stability, making it suitable for various industries, including oil and gas, chemical processing, and power generation (DuPont Press Release, 2023).

- In August 2024, PPG Industries, a leading coatings manufacturer, announced a strategic partnership with H.B. Fuller, a global adhesives provider. The collaboration aims to combine PPG's fluoropolymer coatings expertise with H.B. Fuller's adhesives technology to develop advanced bonding solutions for various industries (PPG Industries Press Release, 2024).

- In January 2025, Solvay, a global chemical company, completed the acquisition of Dicoma, a German specialty chemicals manufacturer. This acquisition significantly expanded Solvay's fluoropolymer coatings portfolio, enabling the company to cater to the growing demand for high-performance coatings in the automotive and electronics industries (Solvay Press Release, 2025).

- In May 2025, the European Union's REACH regulation approved the use of certain fluoropolymers in coatings applications. This approval is expected to boost the demand for FEVE fluoropolymer coatings in Europe, particularly in industries such as automotive, construction, and electronics (European Chemicals Agency Press Release, 2025).

Research Analyst Overview

- The market encompasses a range of innovative technologies, including surface cleaning and characterization, plasma spraying, and various coating types such as phosphate conversion, topcoat, and primer coatings. These coatings exhibit desirable properties like impact resistance, scratch resistance, chemical stability, and hydrolysis resistance, making them indispensable in industries requiring high-performance protective coatings. Advancements in coating technologies include atomic layer deposition, sol-gel coating, and sputter deposition, which offer enhanced adhesion testing and coating life cycle. Pigment dispersions and x-ray diffraction play crucial roles in ensuring uniformity and quality of the coatings. Market trends lean towards the development of advanced coatings with superior thermal shock resistance, anti-reflective properties, superhydrophobic characteristics, and self-cleaning capabilities.

-

The FEVE Fluoropolymer Coatings Market is advancing with superior curing processes and efficient coating application methods. Enhanced abrasion resistance and precise color matching drive innovation, while coating waste management ensures sustainability. Industries benefit from specialized aerospace coatings, electronics coatings, and medical coatings designed for durability. Functional food processing coatings and robust marine coatings extend longevity in demanding environments. Protective phosphate conversion coatings improve adhesion, supported by rigorous surface characterization techniques. The market prioritizes high-performance topcoat coatings, clear coatings, and advanced formulations like superhydrophobic coatings and self-cleaning coatings. Additionally, anti-glare coatings enhance optical applications. As demand grows, FEVE coatings continue to redefine material protection with cutting-edge technology and environmental responsibility.

- Coating thickness measurement and chromate conversion coating are essential aspects of the market, ensuring optimal coating performance and longevity. Coating degradation is a significant challenge, necessitating continuous research and innovation in anti-glare, anti-reflective, and hydrolysis resistance coatings. The market is dynamic, with ongoing advancements in technology and evolving industry demands shaping its future trajectory.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled FEVE Fluoropolymer Coatings Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 499.9 million |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

4.9 |

|

Key countries |

China, US, India, Germany, Japan, UK, South Korea, France, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this FEVE Fluoropolymer Coatings Market Research and Growth Report?

- CAGR of the FEVE Fluoropolymer Coatings industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the FEVE fluoropolymer coatings market growth of industry companies

We can help! Our analysts can customize this FEVE fluoropolymer coatings market research report to meet your requirements.