Fighter Aircraft Market Size 2025-2029

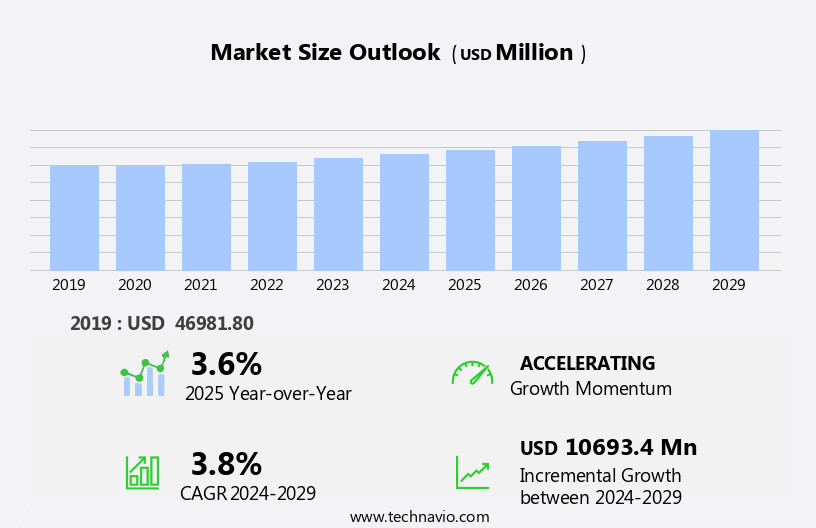

The fighter aircraft market size is forecast to increase by USD 10.69 billion, at a CAGR of 3.8% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of military aircraft in various fleets worldwide. This expansion is fueled by continuous modernization efforts and the need to maintain a robust defense capability. Furthermore, escalating military spending, particularly in emerging economies, is creating new opportunities for market participants. However, the market faces challenges as well. The barriers to adopting new technology and equipment pose a significant obstacle. Military organizations often face budget constraints and complex procurement processes, making it difficult to integrate advanced technology into their existing fleets.

- To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of technological advancements and develop innovative solutions to address the unique needs of military customers. By focusing on collaboration and customization, they can build strong relationships and establish a competitive edge in the dynamic the market.

What will be the Size of the Fighter Aircraft Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Fourth-generation fighters are integrated with advanced technologies such as electronic countermeasures, intercept capability, data links, helmet-mounted displays, electronic attack, and multirole capabilities. These systems are seamlessly integrated into the aircraft, enhancing situational awareness and mission effectiveness. Technical support plays a crucial role in maintaining the readiness of these complex platforms. Turbofan engines, electronic warfare systems, and air combat tactics are continually refined to improve aircraft performance and survivability. Precision-guided munitions and air-to-ground missiles expand the mission scope of fighter aircraft, while thrust-to-weight ratios and payload capacities are optimized for various applications.

Network-centric warfare, sensor fusion, and reconnaissance missions are becoming increasingly important, necessitating advanced communication systems and real-time data processing capabilities. Combat radius, air defense, and air superiority remain key performance indicators, driving the development of new technologies and aircraft designs. Aircraft availability and mission readiness are critical for operational success. Logistics support, spare parts, and fighter aircraft maintenance are essential components of any fleet management strategy. The integration of fifth- and sixth-generation fighters, high-bypass turbofan engines, and stealth technology continues to redefine the fighter aircraft landscape. Fighter aircraft are continually upgraded through mid-life upgrades and air-to-air refueling capabilities, ensuring their relevance in the ever-evolving battlefield environment.

The ongoing integration of advanced technologies and materials, such as composite materials and titanium alloys, further enhances the capabilities of these platforms. In the realm of fighter aircraft, the dynamics are continuous and ever-changing, with new challenges and opportunities emerging constantly. The integration of various systems and technologies into complete, integrated solutions is key to maintaining a competitive edge in this dynamic market.

How is this Fighter Aircraft Industry segmented?

The fighter aircraft industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Fixed-wing

- Rotorcraft

- Technology

- Conventional take-off and landing

- Short take-off and landing

- Vertical take-off and landing

- Product

- Light Attack

- Electronic Warfare

- Multi-Role Fighter

- Trainer

- Other Types

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

. By Type Insights

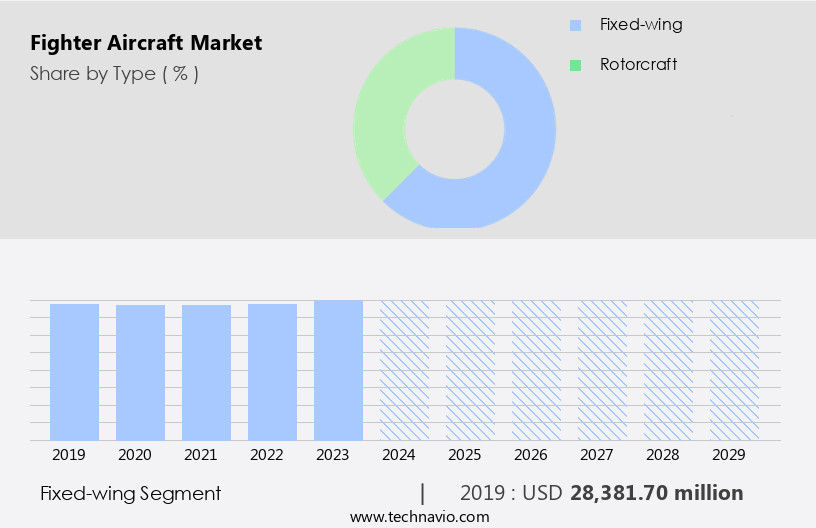

The fixed-wing segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, including fixed-wing and rotary-wing aircraft. Fixed-wing fighter aircraft, which differ from propeller-driven models, are characterized by their high-performance capabilities. These aircraft are integral to air defense, air superiority, and multirole missions. Technologically advanced features such as electronic countermeasures, intercept capability, data links, helmet-mounted displays, and electronic warfare systems are increasingly incorporated into fourth-generation fighters. Flight simulators and pilot training programs are essential for maintaining mission readiness and aircraft availability. Fifth- and sixth-generation fighters, equipped with stealth technology, high-bypass turbofan engines, composite materials, and advanced avionics, offer enhanced capabilities. Network-centric warfare, sensor fusion, and reconnaissance missions are facilitated by features like situational awareness, air-to-air refueling, and mid-life upgrades.

Air-to-air and air-to-ground missiles, air defense systems, and air combat tactics are essential components of fighter aircraft arsenals. Countermeasure systems, command and control, and logistics support ensure the structural integrity and operational efficiency of these aircraft. The market is driven by the increasing demand for advanced fighter aircraft to counter evolving threats and maintain air superiority. Fighter aircraft maintenance, pilot training, and spare parts are crucial aspects of the market. The focus on enhancing thrust-to-weight ratio, payload capacity, and combat radius further fuels the growth of the market. The integration of advanced technologies, such as composite materials and countermeasure systems, is expected to continue shaping the market landscape.

The Fixed-wing segment was valued at USD 28.38 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in Asia Pacific (APAC) is characterized by significant investments from countries like India, China, and Japan in upgrading their existing fleets and developing indigenous advanced fighter aircraft. Defense authorities in the region are prioritizing research and development to build sophisticated fighter jets capable of performing optimally in challenging environments and catering to diverse mission requirements. China, being the world's second-largest military spender, is at the forefront of these efforts. Advanced technologies such as electronic countermeasures, intercept capability, data links, helmet-mounted displays, electronic warfare systems, and air combat tactics are being integrated into these new-age fighter aircraft.

Fourth-generation fighters are being replaced with fifth and sixth-generation models featuring stealth technology, network-centric warfare, sensor fusion, and reconnaissance missions. Flight simulators and flight control systems are essential components of fighter aircraft development, ensuring mission readiness and aircraft availability. Air-to-air and air-to-ground missiles, precision-guided munitions, and thrust-to-weight ratios are critical factors in enhancing the aircraft's combat capabilities. Countries are also focusing on upgrading their fighter aircraft through mid-life upgrades (MLUs) and aircraft refueling capabilities to extend their operational range and combat radius. Structural integrity, pilot training, and logistics support are crucial aspects of maintaining these advanced fighter fleets.

Investments in countermeasure systems, composite materials, and advanced engine technologies like high-bypass turbofans are driving the evolution of fighter aircraft. The market is witnessing a shift towards multirole fighter aircraft that can perform various mission profiles, including air defense, air superiority, and strike missions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fighter Aircraft Industry?

- The significant growth in the military aviation sector, driven by the increasing acquisition of military aircraft, serves as the primary market catalyst.

- The market is experiencing significant growth due to escalating investments in the acquisition and modernization of military aircraft. The market's expansion is driven by the increasing demand for advanced fighter aircraft for strike missions and air defense. High-performance, fifth- and sixth-generation fighters with features such as high-bypass turbofan engines, countermeasure systems, composite materials, and air-to-air refueling capabilities are in high demand. Mid-life upgrades (MLUs) are also a key trend, extending the fatigue life of existing aircraft. In recent years, Europe and Asia Pacific have emerged as major markets for fighter aircraft, with countries like Japan, Vietnam, and the Philippines expanding their fleets to counter territorial disputes and regional conflicts.

- The market is expected to continue growing as countries prioritize modernizing their military capabilities.

What are the market trends shaping the Fighter Aircraft Industry?

- Military spending is currently experiencing an upward trend in the market. This increase in defense expenditures represents a significant development in global economic and geopolitical landscapes.

- The market is driven by the increasing need for advanced air defense capabilities among nations. Modernizing existing fighter fleets and investing in long-range airborne surveillance and strike platforms have become essential due to the growing threat of advanced anti-access offensive weapon systems. The escalating global investment in defense and security, totaling USD841 billion in 2024, underscores the importance of maintaining a strong air force. Technical support for fourth-generation fighters continues to be a priority, ensuring intercept capability, electronic countermeasures, and multirole functionality. Advanced technologies such as data links, helmet-mounted displays, and air-to-ground missiles enhance situational awareness and flight control systems for pilots.

- Electronic attack capabilities are also crucial for maintaining air superiority and countering enemy threats. Flight simulators play a vital role in training pilots and maintaining readiness, ensuring that forces remain prepared for various mission scenarios. The integration of these advanced technologies and capabilities continues to shape the future of fighter aircraft development.

What challenges does the Fighter Aircraft Industry face during its growth?

- The adoption of new technology and equipment is hindered by various barriers, posing a significant challenge to the industry's growth.

- The market dynamics are shaped by the integration of advanced technologies to enhance combat capabilities. Turbofan engines power these aircraft, providing optimal thrust-to-weight ratios for improved mission readiness and aircraft availability. Electronic warfare systems and air combat tactics are essential components, enabling superior situational awareness and precision-guided munitions. Regulations play a significant role in the market, with companies required to comply with stringent norms at various levels. The rapid advancement of technology necessitates continuous upgrades, making it challenging for military forces to keep up. New technologies, such as network-centric warfare, sensor fusion, reconnaissance missions, and titanium alloys, are essential for maintaining a competitive edge.

- Investment in research and development is crucial to incorporate these advancements into fighter aircraft. The integration of these technologies enhances the aircraft's payload capacity, enabling them to carry a wider range of weapons and sensors. Ultimately, the focus on advanced technologies ensures mission success while minimizing aircraft downtime.

Exclusive Customer Landscape

The fighter aircraft market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fighter aircraft market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fighter aircraft market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - The Eurofighter Typhoon aircraft is a sophisticated military aircraft engineered for advanced aerial combat capabilities. Its primary function includes the carriage and deployment of air-to-air missiles, enhancing its role as a formidable force in modern aerospace defense. The Eurofighter Typhoon's design incorporates cutting-edge technology, ensuring optimal performance and versatility in various mission scenarios. This aircraft's agility and advanced avionics system enable it to effectively counter threats and maintain air superiority.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- Aviation Industry Chengdu Aircraft Industry Group Co. Ltd.

- BAE Systems Plc

- Dassault Aviation SA

- Embraer SA

- Hindustan Aeronautics Ltd.

- Kawasaki Heavy Industries Ltd.

- Korea Aerospace Industries, Ltd.

- Leonardo Spa

- Lockheed Martin Corp.

- Mitsubishi Heavy Industries Ltd.

- Northrop Grumman Corp.

- Piper Aircraft Inc.

- Rostec

- Saab AB

- Textron Inc.

- The Boeing Co.

- United Aircraft Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fighter Aircraft Market

- In February 2023, Lockheed Martin unveiled the F-35 Lightning II RCS Reduction Program, a significant technological advancement aimed at reducing the radar cross-section (RCS) of the F-35 fighter jets, making them less detectable to adversaries (Lockheed Martin Press Release). In April 2024, Boeing and Saab announced a strategic partnership to develop the T-X Advanced Trainer, marking a major shift in military training programs with Boeing providing the engines and Saab supplying the wings and systems integration (Boeing and Saab Press Release). In June 2024, the Indian Ministry of Defence signed a contract with Russia's Rostec Corporation for the procurement of 21 MiG-29 fighter jets, signifying a key geographic expansion for the Russian the market in Asia (Indian Defence Ministry Press Release). In November 2025, Raytheon Technologies and Honeywell International revealed their collaboration on the development of an advanced avionics system for the F-15EX Eagle fighter jets, representing a significant technological leap in the avionics sector for fighter aircraft (Raytheon Technologies and Honeywell Press Release).

Research Analyst Overview

- The market is characterized by continuous advancements in technology, with key areas of focus including air combat simulation, advanced avionics, and human-machine interface. Autonomous flight and data fusion are driving the development of next-generation aircraft, enabling superior air superiority operations and maritime patrol capabilities. Laser-guided bombs and standoff weapons enhance offensive maneuvering, while missile defense systems, including anti-ballistic missiles and anti-ship missiles, ensure defensive capabilities. Electronic intelligence (ELINT) and signal intelligence (SIGINT) technologies provide crucial real-time data for situational awareness. Augmented reality (AR) and virtual reality (VR) training tools enhance cockpit ergonomics and improve air combat maneuvering skills. Artificial intelligence (AI) and machine learning algorithms optimize flight performance and support decision-making during air combat and counter-insurgency (COIN) operations.

- Hypersonic missiles and directed-energy weapons represent the future of long-range strike capabilities, while anti-radiation missiles and air-to-surface radar systems ensure effective engagement against various threats. The integration of these technologies and the ongoing pursuit of air dominance shape the dynamic and competitive the market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fighter Aircraft Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.8% |

|

Market growth 2025-2029 |

USD 10693.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, China, Japan, India, UK, Germany, Canada, South Korea, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fighter Aircraft Market Research and Growth Report?

- CAGR of the Fighter Aircraft industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fighter aircraft market growth of industry companies

We can help! Our analysts can customize this fighter aircraft market research report to meet your requirements.