Filled Fresh Pasta Market Size 2025-2029

The filled fresh pasta market size is forecast to increase by USD 3.43 billion at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing preference for ready-to-cook and instant food products among consumers. This trend is particularly prominent in Europe, where demand for filled fresh pasta is on the rise from various regions. However, market growth is not without challenges. Fluctuations in raw material costs pose a significant threat to market players, as price volatility can impact profitability and product affordability. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on optimizing their supply chains, exploring alternative raw material sources, and investing in research and development to innovate and differentiate their offerings. Consumers are increasingly seeking authenticity and local flavors, leading to a growing demand for traditional pasta varieties, noodles, and regional specialties.

- By staying agile and responsive to market dynamics, players can seize opportunities in the evolving filled fresh pasta landscape and build sustainable, profitable businesses. Moreover, the market is facing challenges from false claims made by some companies regarding the nutritional value and authenticity of their products, including filled fresh pasta.

What will be the Size of the Filled Fresh Pasta Market during the forecast period?

- The market exhibits dynamic growth, driven by the enduring appeal of traditional pasta dishes and the emergence of innovative culinary trends. With a significant global market size and continuous expansion, key factors fueling this growth include the increasing popularity of pasta artisans and the integration of data analytics in pasta production. Sustainability and customer experience are also critical priorities, leading to advancements in pasta manufacturing processes and the implementation of loyalty programs. The industry outlook is promising, with pasta tourism, education, and collaborations contributing to the sector's cultural significance. Health-conscious consumers seek out pasta made from durum wheat semolina, which is rich in vitamins, iron, and dietary fiber, providing sustained energy.

How is this Filled Fresh Pasta Industry segmented?

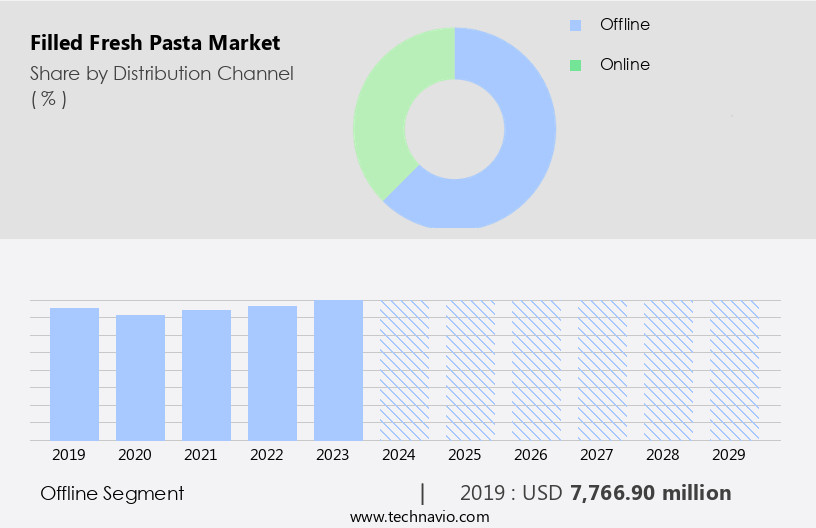

The filled fresh pasta industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Commercial

- Residential

- Geography

- Europe

- France

- Germany

- Italy

- Spain

- UK

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- Europe

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. The market encompasses the sales of pasta products with various fillings through both online and offline channels. In the offline segment, revenue is generated via sales at specialty stores, hypermarkets, supermarkets, department stores, and drugstores. However, the preference for online shopping has led to a decline in offline sales. To counteract this trend, retailers are expanding their presence in local and regional markets and increasing their operations at different locations. Product differentiation is a key strategy in the market, with offerings catering to various dietary restrictions, including vegetarian, gluten-free, vegan, kosher, and halal. Quality control is paramount in maintaining the freshness and texture of pasta, with companies investing in advanced pasta making equipment such as pasta sheeting machines, pasta forming machines, and pasta filling machines. Health-conscious consumers are increasingly seeking pasta made from durum wheat semolina, which is rich in B vitamins, iron, and dietary fiber

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 7.77 billion in 2019 and showed a gradual increase during the forecast period. Innovations in flavors and pasta shapes, as well as the use of local ingredients, have contributed to the growth of the gourmet food sector within the market. Consumer preferences for convenience foods, meal kits, and online grocery have also driven market growth. Companies are focusing on food safety, sustainable practices, and fine dining presentations to attract customers. Shelf life is extended through vacuum packaging, modified atmosphere packaging, and frozen storage. Brand building and ingredient sourcing are essential aspects of the market, with companies seeking to differentiate themselves through unique pasta colors, organic pasta, and artisan pasta offerings. The market is expected to continue growing, driven by consumer preferences and the expansion of retail formats. The market for plant-based pasta alternatives, such as those made from barley, legumes, and cauliflower, is also growing. Companies are investing in pasta production technology, ensuring food safety, and catering to diverse consumer needs to maintain a competitive edge.

Regional Analysis

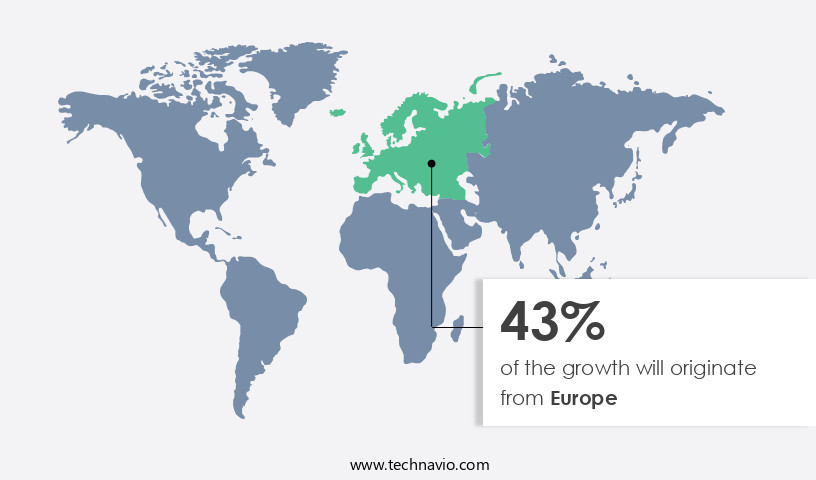

Europe is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The European market is experiencing significant growth due to several factors. Rising disposable income and increasing household expenditure on food and beverages are key drivers. The popularity of ethnic cuisine, particularly Italian, is also contributing to market expansion. Europe is a significant player in the global pasta trade, with Italy being the largest manufacturer of fresh pasta. Despite the increasing demand for convenient and packaged pasta options, fresh and high-quality pasta remains popular in Europe. Product differentiation through flavor innovations, vegetarian and dietary restriction options, and unique pasta shapes is a significant trend in the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Filled Fresh Pasta Industry?

- Growing preference for ready-to-cook and instant food products is the key driver of the market. The global market for filled fresh pasta is experiencing significant growth due to the increasing preference for ready-to-cook and instant food products among consumers, particularly among the working population. This trend is driven by the rise in the number of working women, who seek convenient and time-saving meal options. Filled fresh pasta, with its variety of delicious fillings such as mushrooms, beef, cheese, and spinach, has gained popularity as a go-to dish for many. As a result, numerous companies are focusing on launching precooked or instant-filled fresh pasta to cater to this growing demand. This market dynamic is expected to drive the growth of The market during the forecast period.

-

Quality control, food safety, and sustainable practices are essential considerations for market players. Pasta production equipment, such as pasta sheeting machines, filling machines, and extruders, are crucial for maintaining consistency and efficiency. Filled pasta, such as ravioli and tortellini, with meat, cheese, seafood, or vegetable fillings, is a gourmet food trend. Meal kits, online grocery, and restaurant supply are emerging channels for pasta sales. Consumer preferences for local ingredients, organic, gluten-free, vegan, kosher, and halal pasta continue to shape the market. Longer shelf life through vacuum packaging, modified atmosphere packaging, and frozen storage is essential for meeting consumer demands.

What are the market trends shaping the Filled Fresh Pasta Industry?

- Increasing demand for filled fresh pasta from different parts in Europe is the upcoming market trend. The European market for filled fresh pasta has experienced significant growth due to increasing consumer preference for this type of pasta. Different regions in Europe offer unique varieties of filled fresh pasta based on local taste preferences. For instance, Piemonte, a region in Italy, is renowned for its agnolotti, a square pasta filled with a combination of cooked meats and green leafy vegetables. Pasta presentation and recipe ideas are crucial for brand building and consumer engagement. Ingredient sourcing, food safety, and adherence to dietary restrictions are essential for maintaining consumer trust. Pasta culture and tradition remain essential to the market's growth and appeal.

- Another example is casoncelli, a filled fresh pasta from Lombardia, which features various types of fillings such as meats and vegetables. These regional variations add to the diversity and appeal of the market in Europe. Innovation hubs and training programs foster continuous improvement, while regulations ensure food safety and quality standards. Market research, e-commerce, and digital marketing strategies are transforming the way pasta is distributed and consumed. Overall, the market remains an exciting and evolving landscape, driven by a rich cultural heritage and a commitment to culinary excellence. Organic food products, made from organic wheat, have also emerged as a preferred choice for health-conscious consumers.

What challenges does the Filled Fresh Pasta Industry face during its growth?

- Fluctuations in raw material costs is a key challenge affecting the industry growth. The cost of raw materials poses a significant challenge for the market. Tomatoes, garlic, sugar, and onions are essential ingredients, and their price fluctuations can negatively impact production costs. For instance, garlic, which is extensively used in various pasta varieties, is primarily produced in China, making it a crucial factor in market pricing. However, risks such as economic instability, adverse weather conditions, and disease outbreaks can disrupt the supply of these raw materials. Consequently, manufacturers may face increased production costs and potential profitability concerns. It is imperative for industry players to closely monitor and manage the cost of raw materials to maintain competitiveness and profitability in the market.

- Producers invest in advanced pasta making equipment, such as pasta sheeting machines and filling machines, to ensure consistent product quality. These machines help create uniform pasta shapes and evenly distribute fillings, enhancing the overall eating experience. Food allergens pose a challenge in the filled pasta market. Producers must adhere to stringent food safety regulations and labeling requirements to cater to consumers with allergies. Modified atmosphere packaging and vacuum packaging help extend the shelf life of filled pasta products, ensuring freshness and quality. Flavor innovations are a significant trend in the filled pasta market. Producers experiment with various ingredients and combinations to create unique and exciting flavors.

Exclusive Customer Landscape

The filled fresh pasta market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the filled fresh pasta market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, filled fresh pasta market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Barilla G. e R. Fratelli Spa - The company specializes in artisanal, handcrafted filled fresh pasta.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barilla G. e R. Fratelli Spa

- BRE.MA.A GROUP Srl

- Ebro foods SA

- Fresh Pasta Co.

- Lillys Fresh Pasta

- Pappardelles Pasta

- Pasta and Pasta

- Pastaio di Maffei S and C. srl

- Pastificio Avesani srl

- Pastificio Gaetarelli s.r.l

- Rana USA Inc.

- RPs Pasta Co.

- Spaghetto Factory

- Ugo Foods Group Ltd.

- Voltan Spa

- Waitrose and Partners

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The filled pasta market encompasses a diverse range of products, with various types of pasta shapes and fillings catering to an expansive consumer base. This sector of the food industry has experienced significant growth due to several key market dynamics. Product differentiation plays a crucial role in the filled pasta market. Manufacturers continually innovate by introducing new pasta shapes, textures, and fillings to cater to evolving consumer preferences. Vegetarian, vegan, gluten-free, and other dietary restriction-friendly options have gained popularity, reflecting the increasing importance of catering to diverse dietary needs. Quality control is another essential aspect of the filled pasta market.

Meat, vegetable, cheese, and seafood fillings are popular choices, with gourmet food enthusiasts seeking out artisan and specialty pasta offerings. Sustainable practices are increasingly important in the filled pasta market. Producers are focusing on sourcing local ingredients and implementing eco-friendly production methods to reduce their carbon footprint. This not only appeals to consumers who prioritize sustainability but also helps differentiate brands in a competitive market. The convenience factor is a major driver in the filled pasta market. Meal kits and online grocery services have made it easier for consumers to access a wide variety of filled pasta options from the comfort of their homes. StartFragment

The pasta industry thrives through creative concepts like pasta shop innovations and efficient pasta factory setups. Skilled pasta chef expertise and advanced pasta maker tools drive production. Pasta innovation shapes market trends, while strategic pasta branding and appealing pasta packaging design captivate consumers. Engaging pasta marketing campaigns complement effective pasta retail strategy and tailored pasta foodservice solutions. A pasta supply chain ensures smooth pasta distribution and optimized pasta logistics. Competitive pasta pricing enhances appeal amidst intense pasta competition. A positive pasta industry outlook attracts significant pasta investment, fostering breakthroughs in pasta technology and pasta automation. Emphasis on pasta sustainability, minimizing pasta food waste, and promoting pasta recycling aligns with eco-conscious goals. Industry pasta regulations ensure compliance and quality.

Restaurant supplies and foodservice providers also rely on filled pasta for their menus, contributing to the market's growth. Filled pasta has a rich cultural significance, particularly in Italian cuisine. However, it is enjoyed worldwide, transcending geographic boundaries. The market caters to various consumer segments, from home cooks to fine dining establishments, and continues to evolve with changing consumer preferences and trends. The filled pasta market is a dynamic and diverse sector of the food industry, driven by product innovation, quality control, and consumer preferences. Producers must continually adapt to meet the evolving needs of their customers while adhering to strict food safety regulations and sustainability practices. The market's growth is fueled by trends such as convenience, flavor innovations, and the increasing importance of catering to dietary restrictions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

198 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 3.43 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, Italy, Germany, France, Canada, China, Spain, Japan, UK, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Filled Fresh Pasta Market Research and Growth Report?

- CAGR of the Filled Fresh Pasta industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the filled fresh pasta market growth of industry companies

We can help! Our analysts can customize this filled fresh pasta market research report to meet your requirements.