Fine Arts Logistics Market Size 2025-2029

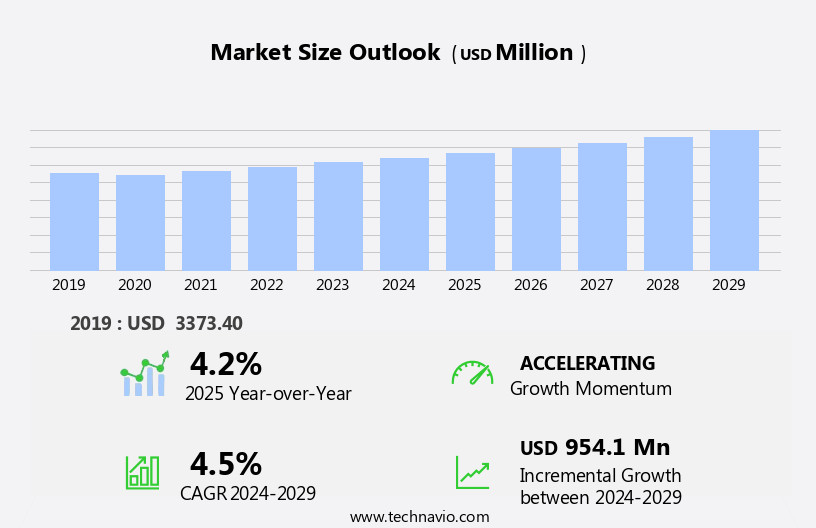

The fine arts logistics market size is forecast to increase by USD 954.1 million, at a CAGR of 4.5% between 2024 and 2029.

- The market is experiencing significant shifts, driven by the increasing prevalence of online retail and e-commerce channels. This digital transformation is redefining the landscape, necessitating advanced logistics solutions for the secure and efficient transport of valuable fine arts pieces. Simultaneously, technological advances are streamlining processes, enabling real-time tracking, and enhancing security measures. However, the market faces challenges, primarily high operational costs and competitive pricing pressures.

- Companies must navigate these obstacles by implementing cost-effective strategies, optimizing their supply chain networks, and leveraging technology to improve efficiency and reduce costs. To capitalize on opportunities and remain competitive, players in the market must stay abreast of these trends and challenges, continually innovating to meet evolving customer demands and expectations.

What will be the Size of the Fine Arts Logistics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market is characterized by its continuous and evolving nature, with various sectors interconnected in facilitating the movement, preservation, and sale of artistic creations. Art platforms and marketplaces play a pivotal role in showcasing and selling art, while art research institutions contribute to the historical context and analysis of artistic works. Art sales are driven by a multitude of factors, including auction logistics, art advisory services, and art brokerage. The integration of technology, such as NFT art and auction software, has revolutionized the way art is bought and sold. Gallery shipping and art relocation require specialized handling and transportation vehicles, ensuring the safe and secure transport of valuable artworks.

Art management software and tracking systems facilitate inventory management, climate control, and customs clearance. Art collectors and institutions require climate-controlled storage solutions, preservation programs, and insurance coverage for their valuable collections. Art education and art criticism contribute to the ongoing appreciation and promotion of artistic works. Art handling equipment, crating services, and damage prevention measures ensure the safe installation and transportation of artworks for exhibitions and auctions. Route optimization and art databases facilitate the efficient organization and logistics of art events. Art prices and market data are closely monitored by art investors, who rely on art appraisal and valuation services to make informed decisions.

Art consulting and art financing services offer expert advice and financial solutions for collectors and institutions. The market is a dynamic and interconnected ecosystem, with ongoing activities and evolving patterns shaping the way art is bought, sold, transported, and preserved.

How is this Fine Arts Logistics Industry segmented?

The fine arts logistics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Art dealers and galleries

- Auction houses

- Museum and art fair

- Others

- Type

- Transportation

- Storage

- Packaging

- Others

- Product Type

- Paintings

- Sculptures

- Antiques

- Photography

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By End-user Insights

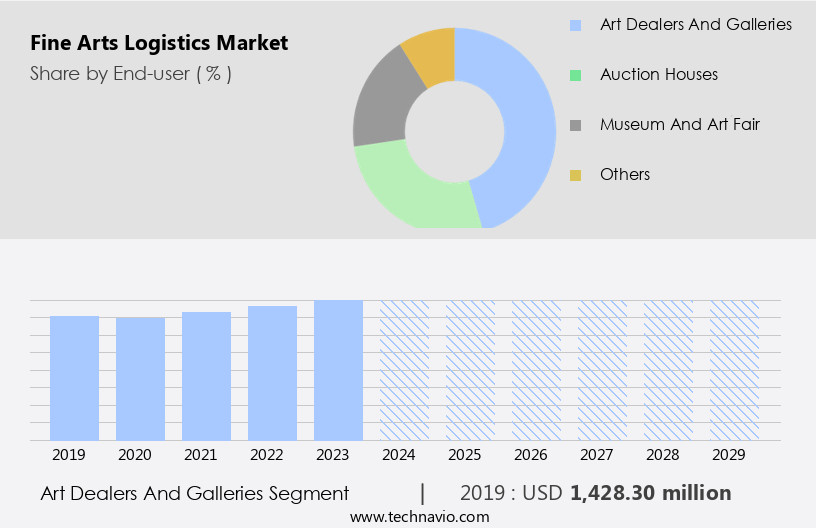

The art dealers and galleries segment is estimated to witness significant growth during the forecast period.

The market encompasses various entities that facilitate the movement and management of fine arts, including international shipments, museum transport, art brokerage, art advisory services, NFT art, art auction logistics, art relocation, art management software, art installation, transport vehicles, art collection management, art finance, shipping documentation, art public relations, art preservation programs, customs clearance, art consulting, art appraisal, climate controlled storage, art museums, packing materials, art fairs, art dealers, crating services, tracking systems, art handling equipment, exhibition installation, route optimization, art databases, art prices, art auction software, art preservation, climate control systems, art platforms, art research, art sales, gallery shipping, art trends, art marketing, artwork handling, art restoration, art collectors, art education, art auctions, damage prevention, inventory management, transportation security, exhibition logistics, art software, art technology, art criticism, art promotion, fine art storage, art transportation, art valuation, inventory tracking, art sales software, art galleries, and specialized packaging.

Art dealers and galleries represent a significant segment, as they eliminate marketing burdens on artists and enhance brand value, while charging approximately half the retail price. However, artists must cease marketing efforts when associated with a gallery to uphold the gallery's reputation. Museum transport requires specialized vehicles and handling equipment, while art auction logistics involves complex documentation, customs clearance, and shipping arrangements. Art advisory services, consulting, and appraisal provide expertise for collectors and institutions, while art finance and insurance coverage secure investments. Climate-controlled storage and preservation programs ensure the longevity of fine arts. Art technology, such as tracking systems, route optimization, and art databases, streamlines logistics and research, while art education and criticism foster appreciation and understanding.

The market for digital art is growing, with NFTs and art auction software offering new opportunities. Inventory management, transportation security, and exhibition logistics ensure the safe and efficient handling of fine arts. Fine arts logistics is a complex and evolving industry that requires specialized knowledge and expertise.

The Art dealers and galleries segment was valued at USD 1,428.30 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

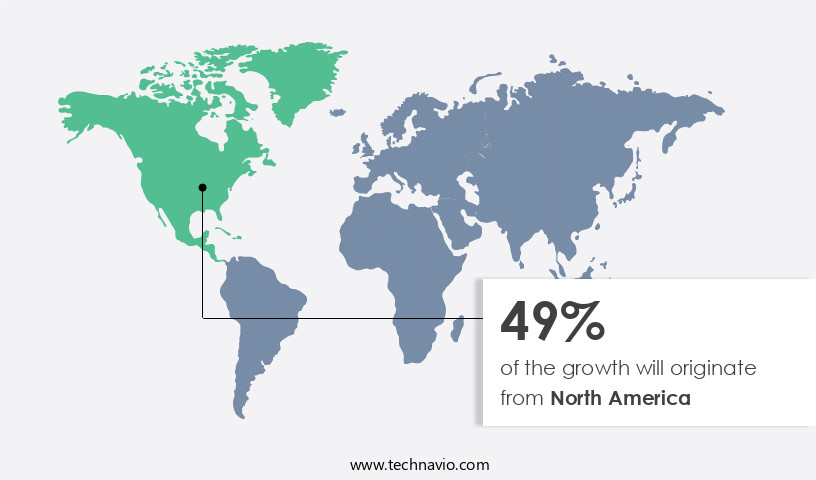

North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the market, North America, specifically the US, holds a significant position due to its status as the world's largest market for trading art and antiques. The arts and culture sector contributes 4.5% to the US Gross Domestic Product (GDP), surpassing industries like construction, agriculture, and transportation. Key players in this industry include companies involved in performing arts, independent artists, writers, and entertainers, and those engaged in advertising, design, and related fine arts activities. In 2020, the US accounted for the second-highest dollar value in exported paintings and drawings. Art history intertwines with the present as museums transport priceless pieces, while art brokerage and advisory services facilitate transactions.

NFT art, a digital innovation, joins traditional art in the marketplace. Art auction logistics ensures seamless sales, while art relocation services help collectors expand their collections. Art management software, climate-controlled storage, and inventory tracking systems streamline operations. Art installation, transport vehicles, and crating services ensure the safe handling of artwork. Art finance, shipping documentation, customs clearance, and art consulting services provide essential support. Art preservation programs and climate control systems ensure the longevity of pieces. Art education and research contribute to the market's growth, with art prices and sales data shaping trends. Art galleries, art fairs, and dealers showcase and sell artwork, while tracking systems and art handling equipment enable efficient exhibition installation and route optimization.

Art databases and auction software facilitate research and sales. Art restoration, damage prevention, and risk assessment services maintain the value and integrity of collections. Art collectors invest in art as an asset class, with insurance coverage protecting their investments. Art institutions, including museums and galleries, preserve and promote art for public education and appreciation. The integration of technology, such as climate control systems and art platforms, enhances the market's accessibility and reach. In summary, the market in North America is a dynamic and interconnected ecosystem of players and services, with the US dominating the scene due to its significant economic contribution and cultural influence.

The market's evolution reflects the integration of traditional and digital art, the importance of preservation, and the role of technology in facilitating transactions and education.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fine Arts Logistics Industry?

- The emergence of online retail and e-commerce channels has become a pivotal driver in market growth, significantly expanding consumer reach and convenience.

- The market is experiencing significant growth due to the increasing popularity of online sales platforms. Art consulting and appraisal services, climate-controlled storage, and crating services are in high demand to ensure the safe transportation and preservation of art pieces. Art museums and dealers rely on advanced tracking systems, art handling equipment, and exhibition installation services for efficient and secure handling of valuable art collections. Route optimization, art databases, and art auction software are essential tools for art businesses to manage their operations effectively. Climate control systems and art preservation techniques are crucial to maintain the integrity and value of art pieces.

- The market dynamics are driven by the convenience and ease of purchasing art online, as well as the ability to access detailed product information and compare prices. The increasing penetration of the internet and smartphones worldwide is further fueling the shift towards online sales channels. Art fairs and exhibitions continue to play a vital role in showcasing and promoting fine art, providing opportunities for artists and dealers to connect with potential buyers. Packing materials and crating services ensure the safe transportation of art pieces to and from these events. Overall, the market is a dynamic and evolving industry, driven by advancements in technology and the growing demand for convenient and secure art transactions.

What are the market trends shaping the Fine Arts Logistics Industry?

- The trend in the fine arts industry is being shaped by technological advances in logistics. These innovations are mandatory for professional and efficient art handling and transportation.

- The market is witnessing significant advancements in technology integration, enhancing the efficiency and security of services. Companies offer RFID technology for inventory tracking, GPS-enabled transportation trucks for real-time location monitoring, and MIS services for effective data management. These IT-enabled solutions streamline logistics processes, ensuring timely transportation and delivery, and optimizing inventory management. Moreover, CRM solutions are increasingly being adopted by fine arts logistics providers, enabling a more transparent and collaborative relationship with shippers. This technology provides real-time updates on the status of artworks, reducing complexity and uncertainty in the supply chain process. Art platforms, collectors, and galleries benefit from these advanced logistics services, as they prioritize damage prevention, transportation security, and exhibition logistics.

- Art education institutions and auction houses also rely on fine arts logistics companies for art research, sales, marketing, artwork handling, and art restoration. In conclusion, the integration of technology in fine arts logistics is a key trend driving market growth. RFID, GPS, CRM, and MIS solutions are transforming the industry by improving operational efficiency, inventory management, and customer service.

What challenges does the Fine Arts Logistics Industry face during its growth?

- The industry's growth is significantly impacted by the dual challenges of high operational costs and competitive pricing.

- The market experiences intense competition due to the growing demand for specialized services from art dealers, galleries, and museums. These customers seek cost-effective solutions for art promotion, transportation, storage, valuation, inventory tracking, and sales. Logistics providers must balance customer demands for lower prices with the need to cover rising costs, such as fuel expenses, which have eroded profits from fixed-term contracts. To remain competitive, providers offer value-added services, including art criticism, condition reports, protective measures, risk assessment, art market data, and insurance coverage.

- The increasing popularity of digital art adds another layer of complexity to the market, requiring logistics providers to adapt to new packaging and transportation requirements. Despite these challenges, the market continues to grow, driven by the value of art as an investment and the importance of preserving and promoting cultural heritage.

Exclusive Customer Landscape

The fine arts logistics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fine arts logistics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fine arts logistics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Asian Logistics Agencies Srl - This company specializes in fine arts logistics, providing expert solutions for art installation, storage, and international shipping.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Asian Logistics Agencies Srl

- CONVELIO SAS

- Crown Worldwide Group

- Deutsche Bahn AG

- Deutsche Post AG

- DMS International Ltd.

- FedEx Corp.

- Fidelis Packers and Movers

- Globe Moving and Storage Co. Pvt. Ltd.

- Gulf Warehousing Co. Q.P.S.C.

- hasenkamp Holding GmbH

- Katolec Corp.

- Lotus Fine Arts

- Nippon Express Holdings Inc.

- Rangel Invest Investimentos Logisticos S.A.

- SOS Global GmbH

- Star Worldwide Group Pvt. Ltd.

- United Artlogistics Pvt. Ltd.

- Vulcan Fine Art

- Writer Business Services Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fine Arts Logistics Market

- In January 2024, Art Logistics International (ALI), a leading player in the market, announced the launch of its innovative climate-controlled storage solution, "ArtVault," in New York City (Source: ALI Press Release). This development aimed to cater to the growing demand for temperature-controlled storage facilities for valuable art collections.

- In March 2024, Fine Art Handlers & Shippers (FAH&S), a major player, entered into a strategic partnership with a leading technology firm, TechVentures, to develop a digital platform for seamless art logistics management (Source: FAH&S Press Release). This collaboration aimed to streamline the art logistics process, making it more efficient and transparent for clients.

- In May 2024, White Glove Logistics, a significant player, completed the acquisition of Art Transporters, a European art logistics company, expanding its geographic reach and market presence (Source: White Glove Logistics Press Release). The acquisition added over 50 new clients and increased the company's capacity by 30%.

- In February 2025, the European Union (EU) approved the new Art Logistics Regulation, which set stringent safety and security standards for the transport and storage of fine arts (Source: EU Press Release). This regulatory development aimed to protect valuable art collections and promote trust within the market.

Research Analyst Overview

- The market encompasses a range of services essential to the preservation, transportation, and commercialization of artistic creations. Valuation of art collections is a critical component, ensuring accurate pricing for art market research and investment strategies. Art blockchain technology emerges as a game-changer, providing secure, transparent provenance and authentication. Restoration techniques and conservation efforts preserve the longevity of art pieces, while security measures protect against theft and damage. Art insurance brokers mitigate financial risks, and art NFT marketplaces revolutionize the digital art scene. Art investment strategies and marketing plans leverage market analysis and content marketing to maximize returns.

- Art logistics providers specialize in handling and shipping, employing certification programs and digital art preservation methods. Art authentication, fraud prevention, and shipping platforms ensure the authenticity and safe delivery of art pieces. Subscription services offer access to exclusive collections and e-commerce platforms expand reach. Art market trends indicate a growing interest in provenance, sustainability, and technology integration.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fine Arts Logistics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

230 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 954.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.2 |

|

Key countries |

US, Canada, Germany, UK, China, Japan, France, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fine Arts Logistics Market Research and Growth Report?

- CAGR of the Fine Arts Logistics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fine arts logistics market growth of industry companies

We can help! Our analysts can customize this fine arts logistics market research report to meet your requirements.