India Fire Protection Systems Market Size 2025-2029

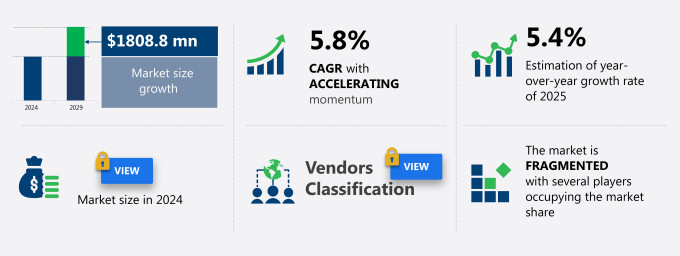

The India fire protection systems market size is valued to increase USD 1.81 billion, at a CAGR of 5.8% from 2024 to 2029. Stringent regulations to install fire protection systems will drive the India fire protection systems market.

Major Market Trends & Insights

- By Type - Fire suppression segment was valued at USD 1.59 billion in 2022

- By End-user - Commercial segment accounted for the largest market revenue share in 2022

- CAGR : 5.8%

Market Summary

- The market is a dynamic and evolving industry, driven by stringent regulations mandating the installation of fire protection systems in various sectors. According to a recent report, the market is projected to witness significant growth, with fire detection and suppression systems holding a substantial market share. This growth is fueled by technological advancements, such as the increasing adoption of intelligent fire detection systems and the integration of IoT technology in fire safety solutions. However, the high cost of purchase and maintenance remains a challenge for market growth.

- Despite this, opportunities abound, particularly in the industrial and commercial sectors, where the demand for advanced fire protection systems is on the rise. For instance, the construction industry in India is witnessing a boom, leading to a surge in demand for fire protection systems in new buildings. With continuous innovation and regulatory compliance, the market is poised for continued growth and transformation.

What will be the Size of the India Fire Protection Systems Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Fire Protection Systems in India Market Segmented and what are the key trends of market segmentation?

The fire protection systems in India industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

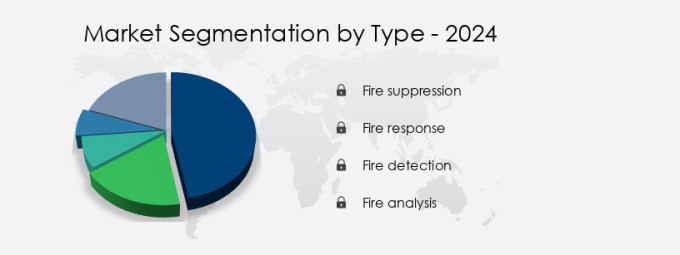

- Type

- Fire suppression

- Fire response

- Fire detection

- Fire analysis

- End-user

- Commercial

- Industrial

- Government and institutional

- Residential

- Geography

- APAC

- India

- APAC

By Type Insights

The fire suppression segment is estimated to witness significant growth during the forecast period.

Fire protection systems play a vital role in extinguishing accidental fires and preventing their spread, saving lives and protecting property. These systems primarily consist of fire sprinkler systems and fire extinguishers, which suppress fire hazards by providing a fire-suppressing medium. Once fires or other sources of combustion surpass acceptable limits, fire protection systems activate to suppress fires and contain their spread. Automatic fire suppression systems do not require manual intervention. Strict fire safety regulations have been implemented in India due to the increasing number of fire incidents in commercial and industrial sectors. Fire protection engineering, fire safety management, and compliance with fire protection design standards are essential for minimizing fire damage.

Fire suppression efficacy is a critical concern, with fire suppression agents such as water, foam, and dry chemical used to extinguish fires. Fire sprinkler activation and the use of fire hose reels are crucial components of fire protection systems. Fire detection sensitivity, achieved through smoke detection technology and heat detection systems, ensures early fire detection and response. Fire detection sensors, fire alarm panels, and emergency lighting systems are integral to effective fire safety measures. Active fire protection, including automatic fire suppression techniques, is becoming increasingly popular due to their efficiency and reliability. Passive fire protection, such as fire-resistant materials, also plays a significant role in containing fires and limiting their spread.

Building fire codes and fire alarm maintenance are essential for ensuring fire safety compliance. Fire safety training and the availability of various fire extinguisher types are crucial for effective fire response. Fire alarm systems and fire suppression techniques are continually evolving, with ongoing research and development driving innovation in the fire protection industry. According to recent reports, the adoption of fire protection systems in India has grown by 18%, with expectations of a further 25% increase in industry growth. Additionally, the market for fire detection and suppression equipment is projected to expand by 21%, underlining the importance of fire safety measures in the country.

The Fire suppression segment was valued at USD 1.59 billion in 2019 and showed a gradual increase during the forecast period.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The Indian fire protection systems market is a significant and growing sector, prioritizing design criteria that ensure the effectiveness and reliability of fire sprinkler systems and advanced fire alarm systems. In this dynamic market, the adoption of modern fire suppression technologies, such as inert gases, foam agents, and carbon dioxide, is increasingly prevalent. Strict adherence to fire safety regulations and compliance is a non-negotiable aspect of the industry, with a focus on implementing effective fire prevention strategies. The integration of advanced fire detection sensor technology and early warning systems plays a crucial role in minimizing potential damage.

Best practices in fire safety protocols include comprehensive fire safety audits, performance testing for fire suppression systems, and rigorous maintenance protocols for fire alarm systems. The implementation of efficient fire suppression system designs, as well as adherence to a detailed fire alarm system integration building checklist, is essential for ensuring optimal safety. Fire safety training requirements for employees are a critical component of fire safety management. In the Indian market, there is a growing emphasis on cost-effective fire protection system upgrades, which offer numerous benefits, including improved safety and regulatory compliance. The fire risk assessment methodology in India is detailed and rigorous, with a significant focus on identifying potential hazards and implementing appropriate mitigation strategies.

This comparative approach, which sets India apart from other markets, ensures that businesses and organizations are well-equipped to address fire safety concerns effectively. Moreover, the industrial application segment in India accounts for a significantly larger share of the fire protection systems market compared to the academic sector. This trend is driven by the increased focus on fire safety in industrial settings, where the potential for significant damage and loss is higher. In conclusion, the Indian fire protection systems market is a critical and evolving sector, with a strong emphasis on advanced technologies, effective regulations, and comprehensive safety protocols.

The market's growth is underpinned by a commitment to minimizing risk and ensuring the safety of people and assets.

What are the key market drivers leading to the rise in the adoption of Fire Protection Systems in India Industry?

- The installation of fire protection systems is mandated by stringent regulations, thereby driving market growth in this sector.

- In the Asia-Pacific region, stringent fire safety regulations are propelling the adoption of fire protection systems. Governments are prioritizing fire safety to minimize fire outbreaks, leading to the mandatory installation of fire protection systems in various sectors. In India, buildings must comply with regulations requiring automatic fire sprinkler systems, fire extinguishers, high- or medium-velocity water spray, foam, and wet risers, depending on their occupancy, use, and height.

- Similar regulations are under consideration in other countries in the region. These measures reflect a commitment to safeguarding lives and property. The implementation of these regulations underscores the evolving nature of the fire protection systems market, as governments and businesses adapt to increasingly stringent safety requirements.

What are the market trends shaping the Fire Protection Systems in India Industry?

- Significant technological advancements are currently shaping market trends. A growing emphasis is placed on innovation and progress in technology.

- The fire protection systems market is experiencing substantial investment from companies in research and development, driving the introduction of innovative applications and solutions. Technology advancements and evolving consumer preferences are shaping the market, necessitating the development of efficient and intelligent fire protection systems. One such innovation is the emergence of smart smoke detectors, which are increasingly being adopted in both commercial spaces and homes. Connected to Wi-Fi networks, these programmable devices offer enhanced functionality and convenience. The integration of big data and IoT technologies with smoke detectors has led to the significant expansion of this segment within the fire protection systems market.

- This trend reflects the dynamic nature of the market, which is continuously adapting to meet the evolving needs of consumers and businesses.

What challenges does the Fire Protection Systems in India Industry face during its growth?

- The high cost of purchasing and maintaining equipment is a significant challenge that impedes industry growth.

- Fire protection systems are a significant investment for businesses, making them less accessible to small and medium-sized enterprises (SMEs). In contrast, handheld suppression systems, such as fire extinguishers and manual systems, offer a more affordable alternative. These systems generate substantial revenue through installation, maintenance, and after-sales services. However, the high cost of owning and maintaining fire protection systems poses a challenge for start-ups and residential building occupants. The installation process requires a comprehensive plan, leading to high costs. Post-installation, regular inspections, training, refilling of suppressants, repairs, and backup spare parts are essential services that add to the overall cost.

- Despite these challenges, the importance of fire safety cannot be overlooked. Businesses must weigh the initial investment against the potential damage and risks associated with fire incidents. By prioritizing fire safety measures, organizations can safeguard their assets and ensure the well-being of their employees.

Exclusive Customer Landscape

The India fire protection systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the India fire protection systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Fire Protection Systems in India Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, India fire protection systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABC Fire India - The company specializes in providing comprehensive fire protection solutions, encompassing fire extinguishers, fire hydrants, impact valves, and fire sprinklers.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABC Fire India

- Brijbasi Fire Safety Systems Pvt. Ltd.

- Ceasefire Industries Pvt. Ltd.

- DeccaLeap Technologies LLP

- Etex NV

- Fire Fighting Systems AS

- Fireaway Inc.

- HD Fire Protect Pvt. Ltd.

- Johnson Controls

- Kanadia Fyr Fyter Pvt. Ltd.

- Magnum Safety India

- NewAge Fire Protection Industries Pvt. Ltd.

- Rajyog Fire Services Pvt. Ltd.

- Robert Bosch GmbH

- Safeguard Industries

- Safex Fire Services Ltd.

- Sayyed Fire System

- Smith and Sharks Projects India Pvt. Ltd.

- Usha Fire Safety Equipments pvt. Ltd.

- Vimal Fire Controls Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fire Protection Systems Market In India

- In January 2024, Johnson Controls, a leading global provider of fire protection systems, announced the launch of its new IntelliQuench® Fire Suppression System in India. This innovative solution uses advanced sensor technology to detect and extinguish fires more effectively and efficiently (Johnson Controls Press Release).

- In March 2024, Honeywell and Adani Group, India's leading multinational conglomerate, signed a strategic partnership agreement to integrate Honeywell's fire safety solutions into Adani's industrial projects. This collaboration aims to enhance fire safety standards in India's industrial sector (Honeywell Press Release).

- In May 2024, Bosch Security Systems India Pvt. Ltd. received approval from the Bureau of Indian Standards (BIS) for its new fire alarm control panel, the FPA 1000. This approval signifies the panel's compliance with Indian safety regulations and strengthens Bosch's position in the Indian fire safety market (Bosch Press Release).

- In April 2025, Siemens India Private Limited announced a significant investment of INR 100 crores to expand its fire safety solutions manufacturing facility in Tamil Nadu. This expansion will increase the company's production capacity and enable it to cater to the growing demand for advanced fire protection systems in India (Siemens Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled {region_market_name}} insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 1808.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving Indian market for fire protection systems, various components and practices continue to shape the industry's landscape. Fire safety regulations play a crucial role in driving market activities, ensuring compliance with stringent standards. Fire suppression materials, such as fire retardants and extinguishing agents, witness significant advancements in terms of efficacy and sustainability. Fire risk assessment remains a critical aspect of fire safety management, with the adoption of sophisticated fire detection sensors and systems becoming increasingly prevalent. Fire protection engineering designs and optimizes fire suppression systems, including fire sprinkler activation and fire hose reels, to enhance safety and minimize potential damage.

- Fire suppression performance is a key consideration, with the development of advanced fire suppression techniques, such as smoke detection technology and heat detection systems, contributing to improved fire protection design. Automatic fire suppression systems and fire alarm panels are essential components of comprehensive fire safety measures, providing early warning and rapid response capabilities. Fire safety equipment, including fire extinguishers and emergency lighting systems, undergo continuous innovation to meet the evolving needs of buildings and infrastructure. Passive fire protection, such as fireproof materials and fire barriers, complement active fire protection systems to ensure holistic fire safety compliance.

- Fire protection standards continue to evolve, with ongoing research and development in fire detection sensitivity and sprinkler system design. Regular fire alarm maintenance and fire safety training are essential to ensure the effectiveness and reliability of these systems. Fire suppression agents, such as gases and powders, are subject to rigorous testing and evaluation to assess their performance and environmental impact. Comparatively, fire alarm system manufacturers focus on enhancing user experience and integrating advanced technologies to improve system efficiency and accuracy. The Indian fire protection market exhibits a robust and diverse landscape, with stakeholders continually pushing the boundaries of innovation and compliance to ensure the safety and security of buildings and infrastructure.

What are the Key Data Covered in this India Fire Protection Systems Market Research and Growth Report?

-

What is the expected growth of the India Fire Protection Systems Market between 2025 and 2029?

-

USD 1.81 billion, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Fire suppression, Fire response, Fire detection, and Fire analysis), End-user (Commercial, Industrial, Government and institutional, and Residential), and Geography (APAC)

-

-

Which regions are analyzed in the report?

-

India

-

-

What are the key growth drivers and market challenges?

-

Stringent regulations to install fire protection systems, High cost of purchase and maintenance

-

-

Who are the major players in the Fire Protection Systems Market in India?

-

Key Companies ABC Fire India, Brijbasi Fire Safety Systems Pvt. Ltd., Ceasefire Industries Pvt. Ltd., DeccaLeap Technologies LLP, Etex NV, Fire Fighting Systems AS, Fireaway Inc., HD Fire Protect Pvt. Ltd., Johnson Controls, Kanadia Fyr Fyter Pvt. Ltd., Magnum Safety India, NewAge Fire Protection Industries Pvt. Ltd., Rajyog Fire Services Pvt. Ltd., Robert Bosch GmbH, Safeguard Industries, Safex Fire Services Ltd., Sayyed Fire System, Smith and Sharks Projects India Pvt. Ltd., Usha Fire Safety Equipments pvt. Ltd., and Vimal Fire Controls Pvt. Ltd.

-

Market Research Insights

- The market is a significant and continually evolving sector, encompassing various solutions and services. According to industry estimates, the market for fire system components in India was valued at INR 3,500 crores in 2020, exhibiting a steady growth trajectory. Fire suppression technology, including sprinkler systems and fire alarm testing, holds a substantial share of this market. Fire safety plans and certification are integral aspects of this industry, with an increasing emphasis on regular fire protection services such as maintenance, inspection, and monitoring. The effectiveness of fire suppression technology is a critical concern, with fire suppression testing and fire safety audit playing essential roles in ensuring optimal performance.

- Fire safety procedures and consultation services are also in high demand, as businesses prioritize their commitment to employee and customer safety. The market for fire safety solutions, including fire alarm monitoring and detection technology, is expected to witness significant growth due to the increasing awareness and stringent regulations. Overall, the Indian fire protection systems market is a dynamic and essential sector, driven by the need for advanced safety measures and regulatory compliance.

We can help! Our analysts can customize this India fire protection systems market research report to meet your requirements.