Emergency Ambulance Vehicles Market Size 2025-2029

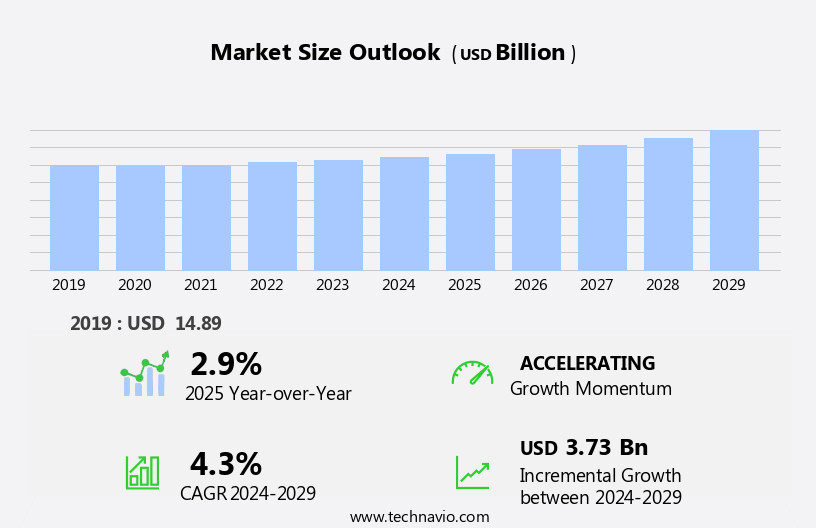

The emergency ambulance vehicles market size is forecast to increase by USD 3.73 billion at a CAGR of 4.3% between 2024 and 2029.

What will be the Size of the Emergency Ambulance Vehicles Market During the Forecast Period?

How is this Emergency Ambulance Vehicles Industry segmented and which is the largest segment?

The emergency ambulance vehicles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Vehicle Type

- Basic life support (BLS)

- Advanced life support (ALS)

- Type

- Modular design

- Monocoque design

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Japan

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- Brazil

- North America

By Vehicle Type Insights

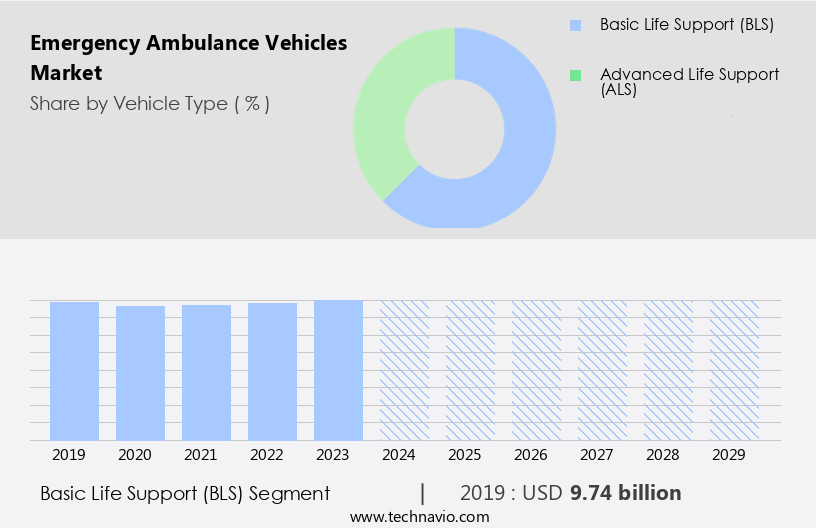

- The basic life support (bls) segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of ambulance types, with basic life support (BLS) ambulances representing a substantial segment. BLS ambulances are engineered to offer essential medical care and transport for patients with stable conditions, requiring medical attention during transit. Staffed by emergency medical technicians (EMTs) and paramedics, these vehicles ensure urgent medical intervention for patients. Equipped with fundamental medical supplies, BLS ambulances incorporate oxygen supplies for breathing assistance, stretchers for safe patient transport, and trauma kits for addressing minor injuries. Moreover, these vehicles play a pivotal role in disaster response and cardiac care units. The aging population's increasing mortality rate and the prevalence of cardiovascular emergencies, such as heart attacks and cardiovascular diseases, necessitate advancements in emergency medical services.

The market value is driven by the need for cost-effective items, healthcare access, and timely transportation. Expert analysis reveals a growing demand for critical medical interventions on-site, including ventilators, defibrillators, and diagnostic equipment. The market is influenced by healthcare policies, investments, and regulatory reforms, addressing operational costs and healthcare infrastructure development. Emergency ambulance vehicles cater to modern hospitals, general hospitals, and hard-to-reach locations, ensuring effective medical care for clients.

Get a glance at the Emergency Ambulance Vehicles Industry report of share of various segments Request Free Sample

The Basic life support (BLS) segment was valued at USD 9.74 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

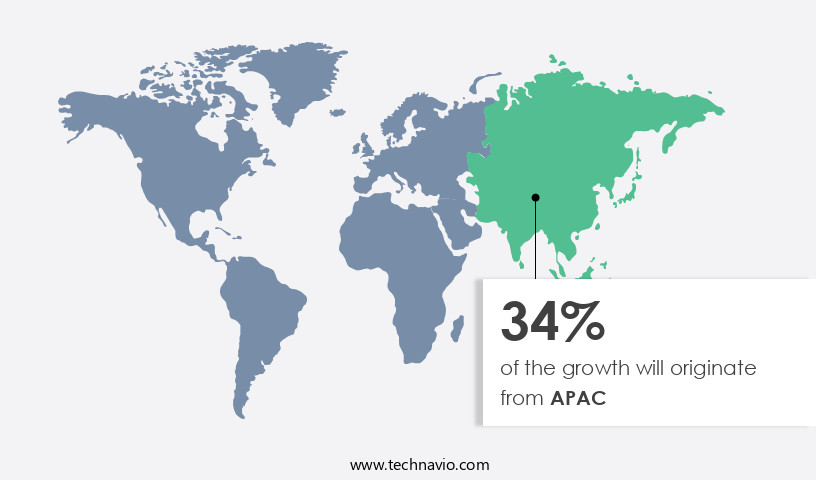

- APAC is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American the market is witnessing significant growth due to escalating road accidents and an expanding elderly population. According to the National Highway Traffic Safety Administration (NHTSA), approximately 40,990 people lost their lives in motor vehicle crashes In the US in 2023. In Canada, fatalities, serious injuries, and total injuries increased in 2022, with 1,931 fatalities marking the second-highest count In the past decade. This trend highlights the importance of efficient emergency ambulance services to deliver prompt medical care and transportation. Additionally, the aging population is another major driver, as per the Administration on Aging, the 65+ population In the US is projected to reach 83.7

million by 2050. This demographic shift increases the demand for emergency medical services, including ambulances, to address the rising number of falls, heart attacks, and cardiovascular emergencies. The market value is further propelled by investments in healthcare infrastructure, advancements in critical medical interventions such as ventilators, defibrillators, trauma kits, and cost-effective items like oxygen supplies. Disaster response and healthcare policies also play a crucial role in market growth. Despite regulatory reforms and operational costs, the market is expected to continue expanding due to the need for on-site medical care and reimbursement for emergency services.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Emergency Ambulance Vehicles Industry?

Rising healthcare demands is the key driver of the market.

What are the market trends shaping the Emergency Ambulance Vehicles Industry?

New product launches by vendors is the upcoming market trend.

What challenges does the Emergency Ambulance Vehicles Industry face during its growth?

Compliance with regulatory and safety standards is a key challenge affecting the industry growth.

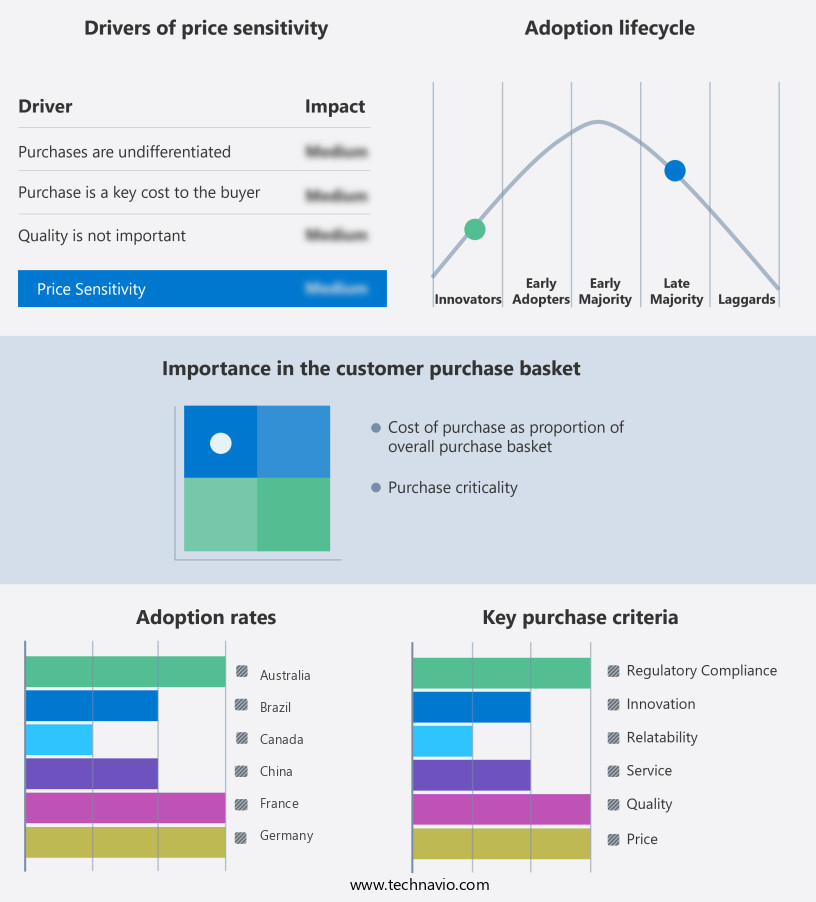

Exclusive Customer Landscape

The emergency ambulance vehicles market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the emergency ambulance vehicles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, emergency ambulance vehicles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AmbulanceMed - The market encompasses a range of specialized vehicles designed for medical transport, including intensive care ambulances and gynecological mobile health units. These vehicles are outfitted with advanced medical equipment to provide critical care to patients en route to hospitals. The market for these vehicles caters to various medical needs and applications, ensuring efficient and effective emergency response services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AmbulanceMed

- Ashok Leyland Ltd.

- Demers Ambulances

- Excellance Inc

- Frazer Ltd

- Infinity Chassis Units

- Lenco Industries Inc.

- Mahindra and Mahindra Ltd.

- Medix Specialty Vehicles LLC

- Mobile Hospital Designers and Developers India Pvt Ltd

- Osage Industries Inc

- REV Group Inc.

- Tata Motors Ltd.

- Wietmarscher Ambulanz und Sonderfahrzeug GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The emergency ambulance vehicle market encompasses a vital segment of the healthcare industry, providing urgent medical transportation and on-site care for individuals in need of critical interventions. This market caters to various medical emergencies, including cardiovascular diseases, falls among the elderly, and road accidents. The aging population is a significant factor driving the growth of the emergency ambulance vehicle market. With increasing life expectancy and the rising prevalence of chronic conditions, the demand for timely medical attention and transportation is on the rise. Elderly individuals, in particular, are more susceptible to falls and cardiovascular emergencies, making the need for emergency medical services increasingly essential.

The healthcare infrastructure plays a crucial role In the market's dynamics. Modern hospitals and general healthcare facilities require efficient and cost-effective items, such as stretchers, ventilators, defibrillators, and trauma kits, to be readily available In their ambulance fleets. These vehicles serve as an extension of the healthcare facilities, ensuring that medical personnel can provide critical care during transportation to the hospital. The healthcare access and Medicaid policies also influence the market. As healthcare policies evolve, there is a growing emphasis on providing affordable and accessible emergency medical services to a broader population. This trend is expected to continue, leading to increased investments In the development and deployment of emergency ambulance vehicles.

Regulatory reforms and operational costs are essential factors shaping the market. Regulations governing the design, manufacturing, and maintenance of emergency ambulance vehicles ensure the safety and effectiveness of these critical assets. Operational costs, including fuel, maintenance, and personnel expenses, are ongoing considerations for ambulance service providers. The market value of emergency ambulance vehicles is influenced by various factors, including the number of emergency cases, healthcare policies, and investments in research and development. The market is expected to grow as the demand for efficient and cost-effective emergency medical services continues to rise. The emergency ambulance vehicle market is a dynamic and essential component of the healthcare industry.

Its role in providing timely transportation and on-site medical care for individuals in need of critical interventions is invaluable. As the population ages and healthcare policies evolve, the market is poised for continued growth and innovation.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 3.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.9 |

|

Key countries |

US, China, Germany, India, UK, Japan, Canada, France, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Emergency Ambulance Vehicles Market Research and Growth Report?

- CAGR of the Emergency Ambulance Vehicles industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the emergency ambulance vehicles market growth of industry companies

We can help! Our analysts can customize this emergency ambulance vehicles market research report to meet your requirements.