Sports Fishing Equipment Market Size 2025-2029

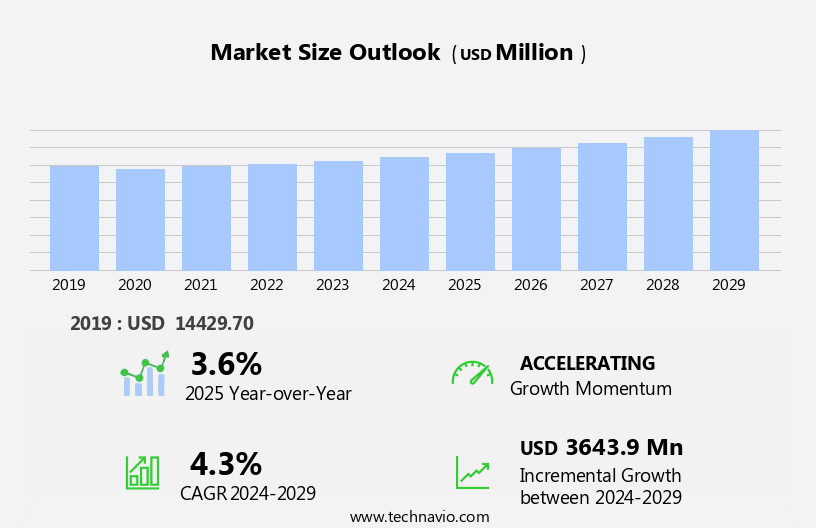

The sports fishing equipment market size is forecast to increase by USD 3.64 billion at a CAGR of 4.3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing popularity of recreational fishing in North America. Key trends in this market include the expansion of product offerings, particularly in marine electronics such as GPS and motor vehicles equipped with sensors. Consumers are also showing a preference for pre-owned and rental variants of sports fishing equipment to reduce costs. LED lighting and apparel with integrated technology, such as gloves with built-in GPS and LED tickers, are also gaining traction in the market. These advancements aim to enhance the fishing experience and improve safety and efficiency for anglers. Overall, the market is poised for continued growth, driven by these trends and the enduring appeal of the sport.

What will be the Size of the Sports Fishing Equipment Market During the Forecast Period?

- The market encompasses a wide range of gear used by anglers for recreational fishing activities. Key product categories include fishing rods, fishhooks, lines, baits, sinkers, and various accessories such as grappling hooks, fishbrains, and marine electronics technology. The market is driven by the growing popularity of outdoor leisure activities, particularly fishing, which attracts a large and diverse participant base.

- Equipment sales continue to rise, fueled by advancements in technology, such as GPS systems and side-scanning sonar, that enhance the fishing experience. Anglers increasingly rely on these tools to locate fish and improve their catch rates. Overall, the market is a dynamic and expanding industry, providing innovative solutions for those seeking to enjoy the pastime of fishing.

How is this Sports Fishing Equipment Industry segmented and which is the largest segment?

The sports fishing equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fishing rod

- Fishing reel

- Fishing lure

- Others

- Distribution Channel

- Offline

- Online

- End-user

- Individual consumers

- Sports organizers

- Clubs

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- APAC

- China

- India

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

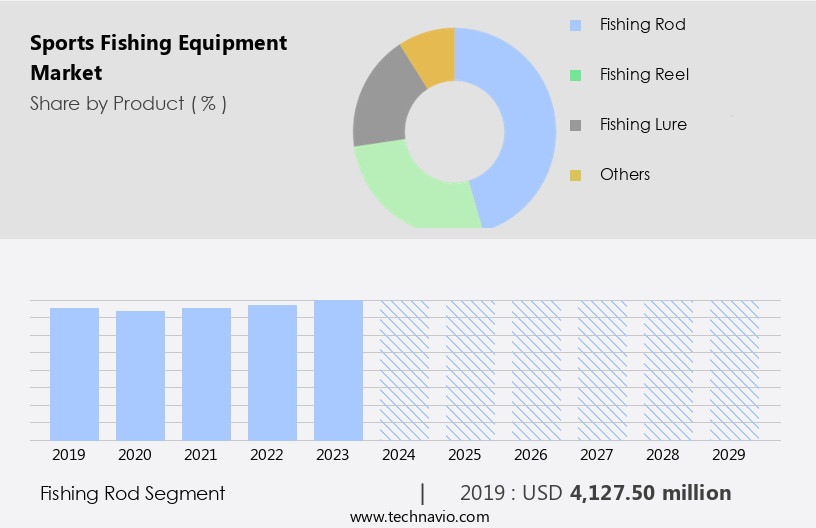

- The fishing rod segment is estimated to witness significant growth during the forecast period. Fishing equipment, including rods, fishhooks, lines, baits, sinkers, and handheld tools such as spears and harpoons, is essential for recreational and commercial fishing activities. The fishing industry encompasses various water-based sports and leisure activities, including recreational fishing, trawling, seining, gillnetting, and line fishing. Fishing rods, a crucial component of this equipment, come in various lengths and styles, including casting, spinning, fly fishing, and pen rods. The selection of a fishing rod depends on the fishing environment and the target fish species. Other fishing gear includes sensors, such as GPS systems, side-scanning sonar, and radar pulses, used in marine electronics technology for saltwater fishing applications. Fishing associations and recreational fishing clubs cater to sports fishermen, offering day-ticket coarse fisheries and artificial trout lakes.

Get a glance at the market report of share of various segments Request Free Sample

The fishing rod segment was valued at USD 4.13 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- Europe is estimated to contribute 30% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Another region contributing significantly to the market is North America. Consumer spending on outdoor recreation in the US surpasses that of certain product categories, such as pharmaceuticals and motor vehicles. Mexico also has a thriving sports fishing industry, with numerous attractive fishing locations.

For more insights on the market size of various regions, Request Free Sample

Equipment sales encompass various items, including fishing rods, fishhooks, lines, baits, sinkers, recreational fishing gear, handheld tools, spears, harpoons, and electronics like sensors, GPS systems, side-scanning sonar, and radar pulses.

Market Scope

The scope of this study includes the pure play sales of sports fishing equipment, also known as fishing gear or tackle, along with the accessories such as fishing rods, reels, lines, hooks, lures, baits, terminal tackle, fishing accessories, and related gear. The vendor selection and market analysis are conducted based on the aforementioned scope and parameters.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Sports Fishing Equipment Industry?

- Rise in popularity of recreational fishing is the key driver of the market. The market is driven by the increasing participation in recreational fishing, making it one of the most popular outdoor leisure activities worldwide. In the US, recreational fishing ranks second after jogging as a preferred pastime. Fishing enthusiasts engage in various techniques such as line fishing, trapping, trawling, seining, and gillnetting, using gear like fishing rods, fishhooks, lines, baits, sinkers, grappling hooks, spears, and harpoons. Recreational fishing can be practiced in both freshwater and saltwater. In industrialized countries, exclusive fish stocks are reserved for recreational fishing. The availability of numerous fishing locations, including lakes, rivers, ponds, and coastal areas, has broadened the reach of this activity.

- The fishing industry caters to various types of anglers, including coarse anglers, offshore anglers, and game anglers. The market is also influenced by the adoption of advanced technologies like sensors, marine electronics, GPS systems, side-scanning sonar, radar pulses, transducers, and automatic identification systems, particularly in saltwater fishing applications. Light-tackle fishing techniques and the use of braided fishing lines and monofilament alternatives have gained popularity in recent years. Despite the benefits, abandoned fishing gear remains a concern for the environment. Fishing-related expenses include the consumption of fish and the cost of equipment and memberships in fishing associations and recreational fishing clubs.

What are the market trends shaping the Sports Fishing Equipment Industry?

- Product portfolio expansion in the global sports fishing equipment market is the upcoming market trend. The market is witnessing growth due to the introduction of innovative gear. Companies are expanding their product lines to cater to various fishing techniques and customer preferences. For instance, Sage Manufacturing unveiled new models, TROUT LL, PAYLOAD, and TROUT SPEY HD, at the European Fishing Tackle Trade Exhibition, integrating KonneticHD technology for enhanced fishing performance. Innovation is a key driver in the market, with companies integrating advanced features such as sensors, marine electronics technology, and GPS systems into fishing equipment. These technologies enable sports fishermen to locate fish stocks more effectively and improve their chances of a successful catch.

- Additionally, the availability of alternatives to traditional lines, such as braided fishing lines and monofilament, caters to the diverse needs of recreational anglers. The integration of technology in sports fishing equipment is also attracting new customers, particularly those interested in offshore fishing applications and deep-dropping techniques. Moreover, the growing popularity of water-based sports activities, fishing associations, recreational fishing clubs, and fishing sports is further fueling the demand for advanced fishing equipment. Despite the growth, the market faces challenges such as the increasing consumption of fish and the issue of abandoned fishing gear, which can negatively impact fish stocks and the environment.

What challenges does the Sports Fishing Equipment Industry face during its growth?

- Preference for pre-used and rental variants of sports fishing equipment is a key challenge affecting the industry growth. The market experiences varying consumer preferences. While some seek advanced features in their gear, others opt for affordable, pre-owned options.

- End-users can discover pre-owned fishing rods, fishhooks, lines, baits, sinkers, and other equipment through advertisements and online marketplaces like Gumtree and eBay. Repair shops also offer pre-used sports fishing equipment. The popularity of pre-owned equipment may dampen sales of new units and hinder market expansion during the forecast period. Despite this challenge, companies continue to innovate, introducing improved fishing gear to cater to diverse customer needs.

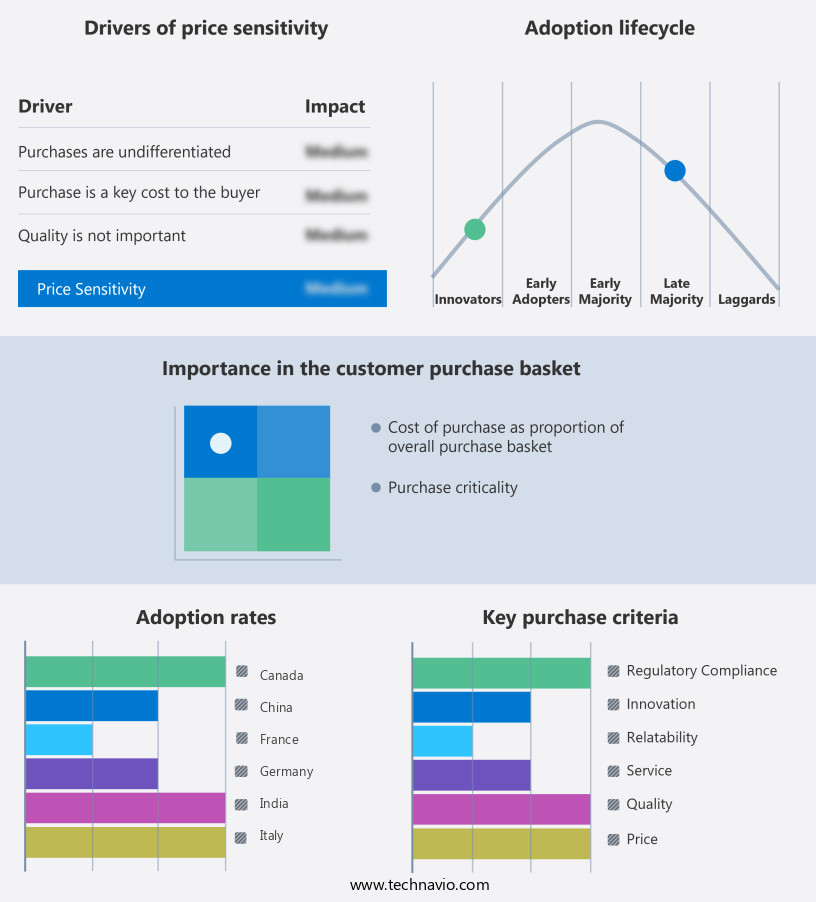

Exclusive Customer Landscape

The sports fishing equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the sports fishing equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, sports fishing equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AFTCO Mfg. Co. Inc. - The company offers sports fishing equipment such as bottoms, shirts, outerwear, hats, fishing gloves, lures, bags and others.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BPS Direct LLC

- Eagle Claw Fishing Tackle Co.

- Eppinger Manufacturing

- Gamakatsu USA Inc.

- GLOBERIDE Inc.

- Grandt Industries Inc.

- Jim Teeny Inc.

- O. Mustad and Son A.S.

- OKUMA FISHING TACKLE Co. Ltd.

- PRADCO Outdoor Brands Inc.

- Pure Fishing Inc.

- Rapala VMC Corp.

- Rather Outdoors Corp.

- Rome Specialty Co. Inc.

- Sea Master Enterprise Co. Ltd.

- SHIMANO INC.

- St. Croix of Park Falls Ltd.

- Taylor Fly Fishing

- Tica Fishing Tackle

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of products designed to enhance the experience of anglers participating in water-based recreational activities. This market caters to various fishing techniques, including line fishing, grappling, and trapping, among others. Fishing gear comprises essential items such as rods, reels, lines, hooks, baits, sinkers, and handheld tools like spears and harpoons. The fishing industry continues to evolve, driven by advancements in technology and the growing popularity of fishing as a leisure activity. Marine electronics technology, including GPS systems, side-scanning sonar, radar pulses, and transducers, have revolutionized fishing by enabling anglers to locate fish more effectively and navigate water bodies with greater precision.

In addition, automatic identification systems have also gained traction in the offshore fishing industry, enhancing safety and efficiency. Light-tackle fishing techniques have gained significant attention in recent years, with anglers favoring alternatives to traditional monofilament lines, such as braided lines. These advanced materials offer increased strength, durability, and sensitivity, allowing for more effective fishing in various saltwater applications. Deep-dropping techniques, popular among offshore anglers, require specialized equipment, including heavy-duty rods and reels, to target large fish species at great depths. The fishing community comprises various groups, including coarse anglers, offshore anglers, and game anglers. These anglers share a common passion for the sport but may have distinct preferences and requirements when it comes to equipment.

For instance, coarse anglers often frequent day-ticket coarse fisheries and artificial trout lakes, while offshore anglers venture into deeper waters for larger catches. Fishing associations and recreational fishing clubs play a crucial role in fostering a sense of community and promoting sustainable fishing practices. These organizations provide opportunities for anglers to connect, learn, and engage in educational programs, ensuring the long-term health of fishing stocks and the preservation of the sport. Despite the numerous advancements in fishing equipment and technology, abandoned fishing gear remains a significant concern for the environment. Efforts to address this issue include the development of biodegradable fishing lines and the promotion of responsible fishing practices among anglers.

Moreover, fishing sports continue to be a popular form of outdoor leisure activity, with associated expenses including equipment sales, fuel, bait, and travel costs. As the market for fishing equipment continues to grow, manufacturers and retailers must stay informed about consumer preferences, technological advancements, and regulatory requirements to remain competitive.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 3.64 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.6 |

|

Key countries |

US, Canada, China, UK, Germany, Japan, India, France, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Sports Fishing Equipment Market Research and Growth Report?

- CAGR of the Sports Fishing Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the sports fishing equipment market growth of industry companies

We can help! Our analysts can customize this sports fishing equipment market research report to meet your requirements.