Flexible Insulation Market Size 2024-2028

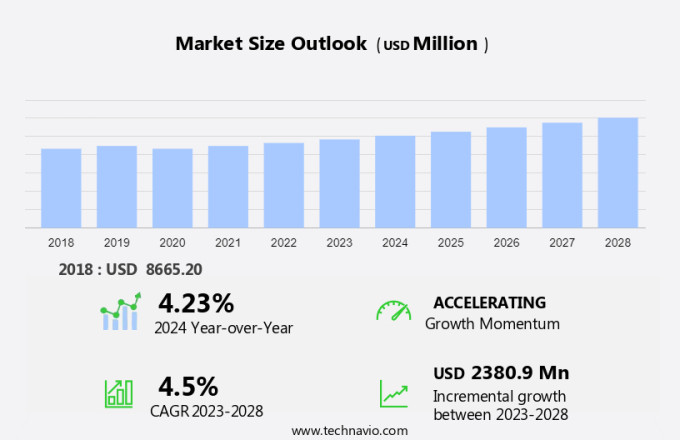

The flexible insulation market size is forecast to increase by USD 2.38 billion at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by several key factors. In emerging economies, the construction industry's increased demand for energy-efficient solutions is fueling market expansion. Additionally, the global construction industry's growth trajectory is creating new opportunities for flexible insulation products. Another significant market trend is the fluctuation in crude oil prices, which has led to a greater focus on energy efficiency and cost savings. These factors, combined with advancements in technology and increasing awareness of the environmental benefits of insulation, are expected to continue driving market growth in the coming years. The market is poised for expansion, with a focus on innovation, sustainability, and cost-effectiveness.

The Flexible Insulating Materials market encompasses a range of materials, including fiberglass, rubber, elastomeric foam, and aerogels, used for thermal, acoustic, and electrical insulation in various industries. In construction, these materials enhance energy efficiency in buildings by reducing operational costs and greenhouse gas emissions. Fiberglass and foamed plastics, such as cross-linked polyethylene and polystyrene, are commonly used for thermal insulation. Elastomeric polymers, like Elastomer and Aerogel, offer flexibility and excellent insulating properties for buildings and transportation sector applications. In the automotive industry, flexible insulating materials improve fuel efficiency and reduce noise levels. In aerospace, they ensure temperature control and protect against electromagnetic interference.

In addition, industrial manufacturing applications include insulating pipes and equipment to maintain process temperatures and prevent energy loss. Flexible insulating materials offer numerous benefits, including energy savings, improved comfort, and reduced environmental impact. As the demand for energy efficiency and sustainability grows, the market for these materials is expected to expand significantly. Key players in the market include manufacturers of fiberglass, rubber, elastomeric foam, and aerogels.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Material

- Fiberglass

- Elastomers

- Others

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- APAC

By Material Insights

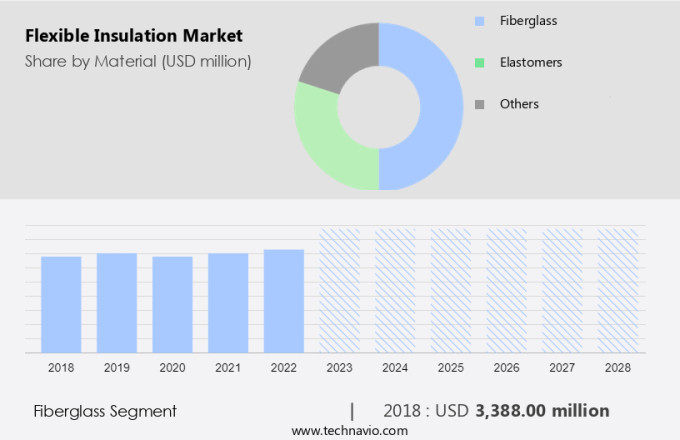

The fiberglass segment is estimated to witness significant growth during the forecast period. The market encompasses thermal, acoustic, and electrical insulation solutions designed for various applications in building and construction, the transportation sector, and consumer products. These insulating materials offer essential properties such as lightweight, non-combustible, tear strength, and corrosion-resistance. In building and construction, flexible insulation plays a crucial role in enhancing energy efficiency by reducing energy loss through heat transmission. It is integral to meeting building energy codes and minimizing greenhouse gas emissions. Flexible insulation materials include elastomeric polymers, foamed plastics, and polyolefin. Thermal insulation helps maintain process temperatures and prevent condensation, while acoustic insulation reduces noise levels. Electrical insulation ensures safety by protecting wires and cables from electrical currents.

Further, flexible insulation finds extensive use in pipe work, refrigerators and freezers, jet-engine ducting, aircraft components, and commercial construction. The market's growth is driven by the increasing demand for energy efficiency in buildings and the housing sector. Flexible insulating materials like polystyrene and glass contribute significantly to the insulation properties and structural flexibility, making them ideal for installation in various applications.

Get a glance at the market share of various segments Request Free Sample

The fiberglass segment was valued at USD 3.39 billion in 2018 and showed a gradual increase during the forecast period.

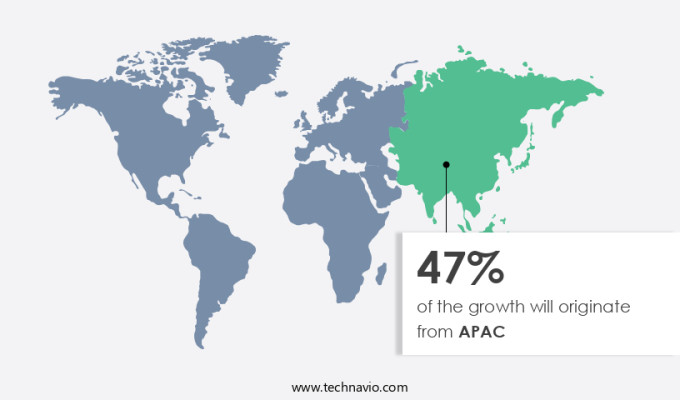

Regional Insights

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Flexible insulation is a crucial component in various industries, including construction, automotive, aerospace, and industrial manufacturing, for enhancing energy efficiency and reducing operational costs. Fiberglass, rubber, elastomeric foam, aerogels, and cross-linked polyethylene are diverse insulation materials used in these sectors. Fiberglass is widely used in construction for thermal insulation in buildings due to its excellent insulating properties. Elastomeric foam and rubber offer flexibility and are effective in acoustic insulation. Aerogels, a porous, lightweight material, provide superior insulation for buildings, automotive, and industrial applications. Eco-friendly insulation materials, such as bio-based insulation, are gaining popularity due to global awareness and financial challenges posed by raw material pricing and oil prices.

Moreover, modern architectural designs demand lightweight, space-efficient insulation solutions, making advanced materials like elastomers and aerogels increasingly relevant. In the automotive industry, insulation is crucial for weight reduction and fuel efficiency. Similarly, in aerospace, insulation is vital for maintaining temperature and pressure conditions. Building Systems offer a range of insulation solutions, including fiberglass, elastomer, aerogel, and cross-linked polyethylene, catering to diverse applications. Insulation is essential for floor, wall, duct, automotive, and industrial applications, ensuring thermal insulation, electrical insulation, and overall system performance.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The increased demand from construction industry in emerging economies is the key driver of the market. The market has witnessed notable growth in various sectors, including Building and Construction and Transportation, due to the increasing focus on Energy efficiency and reducing energy loss. Thermal Insulation, Acoustic Insulation, and Electrical Insulation are essential components in these industries, where Flexible insulating materials, such as Elastomeric polymers, Glass, and Foamed plastics, offer Structural flexibility for pipe work, flexible air ducts, and aircraft components. In the Building and construction sector, Flexible insulation materials are crucial for meeting Building energy codes and enhancing Efficiency in buildings, particularly in the Housing sector. Lightweight, Non-combustible, Tear strength, and Corrosion-resistant properties are essential for these materials.

Similarly, the market encompasses applications in Commercial construction, Refrigerators and freezers, Water coolers, and Jet-engine ducting. The entry of European construction players in the Chinese market has further fueled the demand for these materials, making China a significant player in The market. Despite the challenges in the real estate sector, China's construction industry continues to grow, contributing to the reduction of Greenhouse gas emissions and the improvement of Energy efficiency in Buildings.

Market Trends

The growth in construction industry is the upcoming trend in the market. The construction industry plays a pivotal role in driving economic and social development, with a focus on energy, transportation, and electricity infrastructure. Industrial construction projects, including chemical factories, food processing plants, and petroleum refineries, are significant contributors to this growth, particularly in developing countries. In the realm of construction and infrastructure, flexible insulation materials, specifically foams, are essential for thermal and electrical insulation. These materials offer superior insulation properties, are resistant to chemicals, and exhibit structural flexibility, making them suitable for various applications. Flexible insulation is used extensively in building and construction, pipe work, and transportation sectors, including flexible air ducts for heating, ventilation, and air conditioning systems, insulation for refrigerators and freezers, jet-engine ducting, and aircraft components.

In the commercial construction sector, energy efficiency and building codes mandate the use of insulation materials to minimize energy loss and reduce greenhouse gas emissions. Flexible insulating materials, such as elastomeric polymers, glass, and foamed plastics like polyolefin and polystyrene, provide excellent insulation and are lightweight, non-combustible, and tear-resistant. These properties make them ideal for various applications, including insulation for buildings, consumer products, and industrial processes, where high process temperatures and condensation are prevalent. The market continues to expand, driven by the increasing demand for energy efficiency and the need to reduce energy loss in buildings and consumer products.

Market Challenge

The fluctuation in crude oil prices is a key challenge affecting the market growth. The market encompasses a variety of insulating materials, including elastomeric polymers and foamed plastics, used for thermal, acoustic, and electrical insulation in diverse applications. In building and construction, flexible insulation is utilized for pipe work, flexible air ducts, and jet-engine ducting in the transportation sector. It is also employed in refrigerators and freezers, commercial construction, and housing sector to enhance energy efficiency and reduce greenhouse gas emissions. Materials such as monomers, prepolymers, stabilizers, and colorants are used to manufacture flexible insulating materials like polyurethane foam. The production of key reactive materials, particularly diisocyanates, is crucial in foam production. Isocyanates, such as toluene diisocyanate (TDI) and polymeric isocyanate, are the most common choices.

Similarly, these isocyanates are derived from benzene and its derivatives, which are primarily sourced from crude oil. The fluctuation in crude oil prices impacts the cost of these raw materials, subsequently increasing the manufacturing cost of flexible insulation and its applications. Despite the price volatility, the market is projected to expand due to significant investments in the US and stringent building energy codes that prioritize efficiency in buildings. The insulating properties, structural flexibility, and ease of installation of these materials contribute to reduced energy loss and heat transmission, making them essential for consumer products and industrial applications alike.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

BASF SE -The company offers SLENTEX which is non-combustible, flexible insulation material used in industrial applications.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aeroflex USA Inc.

- Altana AG

- Armacell International SA

- Aspen Aerogels Inc.

- Berkshire Hathaway Inc.

- Compagnie de Saint Gobain

- Continental AG

- Dow Chemical Co.

- Fletcher Building Ltd.

- Kingspan Group Plc

- Knauf Insulation

- L ISOLANTE K FLEX S.p.A.

- NICHIAS Corp

- Owens Corning

- Pacor Inc.

- Superlon Holdings Berhad

- Thermaflex

- Thermaxx Jackets

- Trocellen GmbH

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for energy efficiency in various industries. Fiberglass, rubber, elastomeric foam, and aerogels are the primary types of flexible insulation materials used in thermal insulation applications. In the construction sector, flexible insulation materials are used for floor wall, duct, and acoustic insulation to improve energy efficiency and reduce operational costs. In the automotive industry, lightweight and space-efficient insulation solutions made of elastomers and aerogels are used for fuel efficiency and weight reduction. The aerospace industry also utilizes advanced materials like aerogels for thermal insulation, while industrial manufacturing relies on cross-linked polyethylene and elastomeric foam for electrical insulation.

Similarly, global awareness towards eco-friendly insulation materials has led to the increasing use of bio-based insulation materials. The market is influenced by several factors, including raw material pricing, financial challenges, and oil prices. However, the benefits of using flexible insulation materials, such as energy efficiency, weight reduction, and improved operational costs, outweigh the challenges. Furthermore, modern architectural designs require innovative insulation solutions, leading to the development of advanced materials like aerogels and elastomers. The market is expected to grow steadily in the coming years, with the construction sector and automotive industry being the major contributors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.38 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

APAC, North America, Europe, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 47% |

|

Key countries |

US, Japan, China, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aeroflex USA Inc., Altana AG, Armacell International SA, Aspen Aerogels Inc., BASF SE, Berkshire Hathaway Inc., Compagnie de Saint Gobain, Continental AG, Dow Chemical Co., Fletcher Building Ltd., Kingspan Group Plc, Knauf Insulation, L ISOLANTE K FLEX S.p.A., NICHIAS Corp, Owens Corning, Pacor Inc., Superlon Holdings Berhad, Thermaflex, Thermaxx Jackets, and Trocellen GmbH |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch