Floor Adhesive Market Size 2024-2028

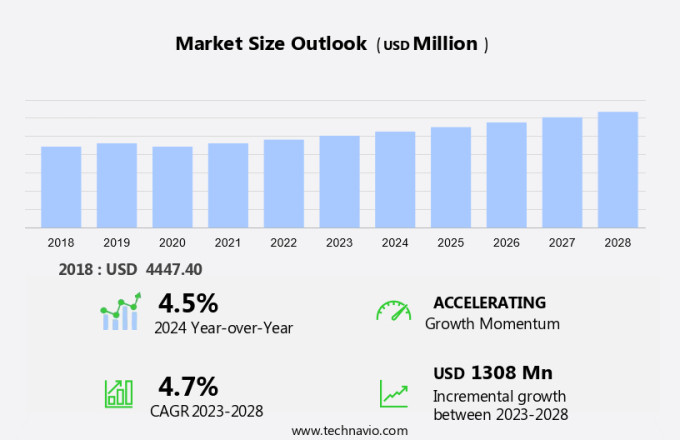

The floor adhesive market size is forecast to increase by USD 1.31 billion, at a CAGR of 4.7% between 2023 and 2028.

- The market is experiencing significant growth, fueled primarily by the booming global construction industry. This sector's expansion creates a substantial demand for floor adhesives, as new buildings and infrastructure projects require reliable bonding solutions. Another key trend shaping the market is the increasing preference for eco-friendly adhesives. Consumers and regulatory bodies are increasingly conscious of the environmental impact of their choices, leading to a surge in demand for adhesives with lower Volatile Organic Compounds (VOC) emissions. However, the market faces challenges as well. Stringent environmental regulations are being enforced to reduce VOC emissions, which can limit the use of traditional adhesive formulations.

- Companies must adapt by developing innovative, low-emission alternatives to meet these regulations and maintain their market position. In summary, the market is driven by the construction industry's expansion and the shift towards eco-friendly products, while navigating the challenges of environmental regulations. Companies seeking to capitalize on this market's opportunities must stay informed of regulatory developments and invest in research and development to create sustainable, low-emission adhesive solutions.

What will be the Size of the Floor Adhesive Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting market dynamics. Adhering to stringent building codes and ASTM standards, floor adhesives play a crucial role in ensuring floor protection and sustainability. VOC emissions and open time are key considerations in adhesive selection for various applications, including commercial and residential settings. Floor preparation is essential, with substrate evaluation and joint preparation crucial for successful installation. Contact adhesives and trowel applications are popular methods for wood flooring installation, while roller applications dominate in tile installation. Traffic wear and slip resistance are essential factors in floor coatings, with epoxy resins and acrylic adhesives leading the way.

Floor maintenance and cleaning products are integral to maintaining floor longevity. Pot life, curing time, and temperature effects are critical application factors, with LEED certification and green building standards increasingly influencing market trends. Water-based adhesives and solvent-based adhesives each have their applications, with heavy-duty applications requiring high adhesive strength and spreading rates. Safety standards and leveling compounds are essential for ensuring floor alignment and safety during installation. Moisture testing and humidity effects are critical considerations in floor preparation, with ANSI standards and carpet installation also impacting market dynamics. The ongoing unfolding of market activities highlights the continuous need for adhesive innovation and adaptation to evolving market demands.

How is this Floor Adhesive Industry segmented?

The floor adhesive industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Residential

- Commercial

- Industrial

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

.

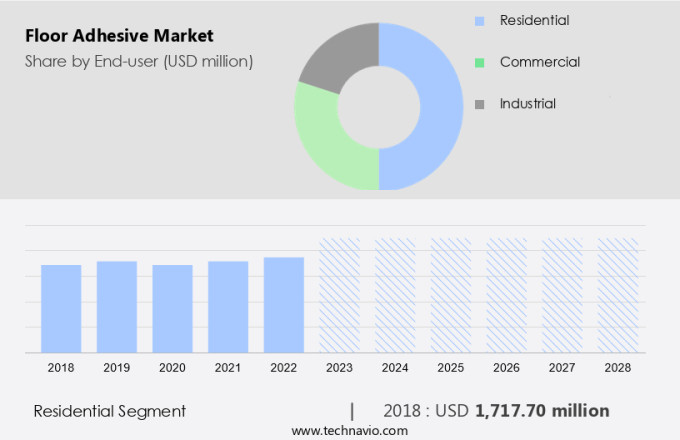

By End-user Insights

The residential segment is estimated to witness significant growth during the forecast period.

In the market, residential applications represent a significant segment due to the ongoing construction activity in this sector. Post the 2007 financial crisis, the residential market has experienced steady growth in the United States, with a slowdown anticipated in North America due to builders having met previous demand through overcapacity. The Asia Pacific region, being the largest market, is projected to expand at a moderate pace due to the limited adoption of construction lifts and the scarcity of high-rise structures. Governments worldwide offer tax incentives to boost homeownership among the middle-income population, contributing to the growth of the residential market.

Floor thickness and ASTM standards are crucial factors in adhesive selection. Adhering to these standards ensures floor protection and minimizes VOC emissions. Open time and surface cleaning are essential considerations during floor installation, while polyurethane adhesives offer advantages such as high tensile and shear strength. Sustainability is a growing concern, leading to the preference for water-based adhesives and adherence to LEED certification and green building standards. Floor refinishing and maintenance involve various floor cleaning products and application methods, including spray, roller, and trowel applications. Safety standards and curing time are essential factors in floor installation, with building codes and ANSI standards guiding the process.

Moisture testing is crucial in tile installation, while joint preparation and substrate evaluation are essential for adhesive coverage and slip resistance. Heavy-duty applications, such as commercial and industrial floors, require adhesives with high pot life and adhesive strength. Epoxy resins and acrylic adhesives are popular choices for their durability and resistance to foot traffic and temperature effects. Wood flooring installation and carpet installation also rely on specialized adhesives and application methods. Floor maintenance includes the use of floor polishes, leveling compounds, and spreading rates to ensure proper adhesive application and floor alignment. Expansion joints and control joints are essential for managing floor movement and ensuring safety standards are met.

Adhesive thickness and application methods are critical factors in achieving optimal floor performance.

The Residential segment was valued at USD 1.72 billion in 2018 and showed a gradual increase during the forecast period.

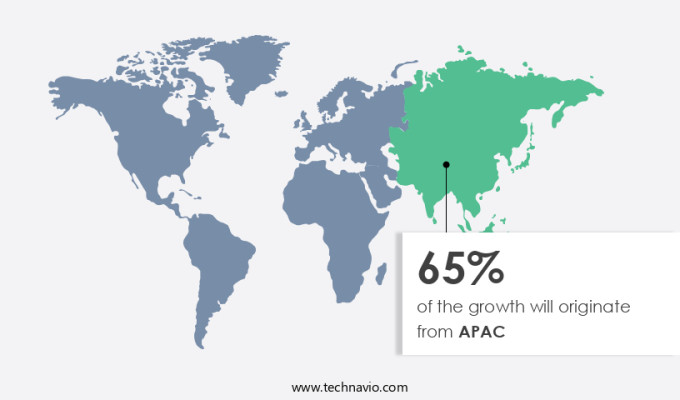

Regional Analysis

APAC is estimated to contribute 65% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The floor adhesives market experiences significant growth due to increasing construction activities and infrastructure development in regions like Asia Pacific. Commercial and residential sectors' expansion fuels the demand for industrial adhesives. ASTM and ANSI standards ensure product quality and safety. Floor thickness and substrate evaluation are crucial factors in adhesive selection. Sustainability considerations, such as VOC emissions and pot life, influence product preferences. Floor refinishing and maintenance require suitable adhesives and cleaning products. Polyurethane and water-based adhesives cater to various applications, including tile, vinyl, wood, and carpet installations. Tensile and shear strength, slip resistance, and curing time are essential performance attributes.

LEED certification and green building standards prioritize eco-friendly adhesives. Adhesive application methods include roller, trowel, and spray applications. Floor preparation, moisture testing, and joint preparation are essential steps in the installation process. Safety standards and leveling compounds ensure a level and safe floor surface. Epoxy resins and acrylic adhesives offer high adhesive strength and durability for heavy-duty applications. Temperature effects and humidity influence adhesive performance. Major companies in the market include Pidilite Industries Ltd., Arkema, and Jowat SE, among others. They focus on innovation, product development, and expanding production units to meet the growing demand. Building codes and safety standards regulate the market.

Adhesive coverage, spreading rates, and adhesive thickness are essential factors in adhesive selection for various applications.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Floor Adhesive Industry?

- The rapidly expanding global construction industry serves as the primary catalyst for market growth.

- The market plays a significant role in the construction industry, particularly in tile and vinyl flooring installation. Substrate evaluation is crucial in selecting the appropriate adhesive for a specific application, ensuring proper adhesive coverage and slip resistance. LEED certification and green building standards are driving the demand for water-based adhesives due to their eco-friendliness. Tensile and shear strength are essential factors in assessing the adhesive's durability and performance under temperature effects. ANSI standards provide guidelines for joint preparation and installation procedures, ensuring a high-quality end product. Both water-based and solvent-based adhesives have their advantages and applications, depending on the specific requirements.

- In residential applications, ease of use and low odor are essential considerations for homeowners. The construction industry's growth is influenced by public investment in non-residential buildings and structures, transport, and public safety sectors. Adhering to industry standards and ensuring optimal adhesive performance are essential to maintaining a professional image and delivering a quality product.

What are the market trends shaping the Floor Adhesive Industry?

- The adoption of eco-friendly adhesives is gaining momentum as the latest market trend. This shift towards sustainable adhesive solutions is a significant development in the industry.

- The industrial market is experiencing significant growth due to the increasing demand for eco-friendly and low Volatile Organic Compounds (VOC) adhesives. Building codes and commercial applications, particularly in sectors like wood flooring installation, require the use of adhesives that meet stringent environmental regulations. As a result, manufacturers are focusing on producing adhesives using renewable materials such as starch, mussels, oysters, and cellulose insulation. Curing time is a crucial factor in the application of floor adhesives. Epoxy resins, which offer excellent durability and resistance to traffic wear, require longer curing times. In contrast, hydrophilic, starch-based adhesives have a shorter curing time and are cost-effective.

- Layering techniques, such as trowel application and roller application, are commonly used in the flooring industry for application. Pot life and floor maintenance are other essential factors that influence the choice of adhesive. Expansion joints are essential in floor preparation to prevent cracking and ensure the floor's longevity. Floor maintenance involves regular cleaning and polishing using floor polishes. Spray application is another method of applying adhesives, particularly for large-scale commercial applications. Floor preparation is a critical step in ensuring the adhesive's proper bonding to the substrate. In conclusion, the industrial the market is driven by the demand for eco-friendly, low VOC adhesives, and the need for adhesives that meet building codes and commercial applications' requirements.

- Manufacturers are focusing on producing adhesives using renewable materials and innovative application methods to cater to this growing demand. The market is expected to continue its growth trajectory in the coming years.

What challenges does the Floor Adhesive Industry face during its growth?

- Strict regulations governing Volatile Organic Compound (VOC) emissions pose a significant challenge to industry growth. Adhering to these stringent environmental standards adds complexity and cost to manufacturing processes, potentially hindering expansion and competitiveness within the market.

- The market is subject to rigorous regulatory requirements. Regulatory bodies impose stringent regulations on the use of adhesives with high Volatile Organic Compounds (VOC) emissions. For instance, the European Framework Regulation (EC) 1935/2004 mandates that food contact materials must not pose health risks or alter food's composition, smell, or taste. Manufacturing of these materials should adhere to Good Manufacturing Practices (GMP) as per EC 2023/2006. Furthermore, the Leadership in Energy and Environmental Design (LEED) rating system, originated in the US, enforces regulations for low VOC content in wet-applied product categories, including adhesives and sealants. These regulations ensure the production of eco-friendly adhesives that prioritize health and sustainability.

- Application methods, adhesive thickness, and spreading rates are essential factors influencing the choice of floor adhesives for various applications. Heavy-duty applications require high adhesive strength, while moisture testing is crucial for carpet installation to prevent humidity effects. Control joints and floor alignment are also essential considerations for ensuring safety standards. Leveling compounds and floor sealers are additional products used in the installation process. Adhesive strength, moisture resistance, and ease of application are critical factors in determining the suitability of adhesives for specific applications.

Exclusive Customer Landscape

The floor adhesive market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the floor adhesive market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, floor adhesive market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - BOSTIK's floor adhesives deliver enhanced wear resistance, acoustic performance, and comfort.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- ARDEX GmbH

- BASF SE

- Bona AB

- Bostik Ltd.

- Dow Inc.

- DuPont de Nemours Inc.

- Forbo Management SA

- H.B. Fuller Co.

- Henkel AG and Co. KGaA

- Huntsman Corp.

- LATICRETE International Inc.

- Mapei SpA

- Mats Inc.

- Meridian Adhesives Group

- Parker Hannifin Corp.

- Pidilite Industries Ltd

- Sika AG

- Wacker Chemie AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Floor Adhesive Market

- In March 2023, 3M, a leading industrial company, introduced a new line of floor adhesives called "Scotch-Weld DP8000 Series" that offers improved bond strength and faster curing times (3M Press Release). This innovation addresses the growing demand for high-performance adhesives in commercial and industrial applications.

- In July 2024, H.B. Fuller, a global specialty adhesives provider, announced a strategic partnership with BASF, the world's largest chemical producer, to jointly develop and commercialize innovative flooring adhesives using BASF's new resin technology (H.B. Fuller Press Release). This collaboration is expected to strengthen H.B. Fuller's market position and expand its product portfolio.

- In January 2025, Sika AG, a Swiss specialty chemicals company, completed the acquisition of Parexgroup's adhesives business, significantly expanding its presence in the flooring adhesives market (Sika AG Press Release). This strategic move enhances Sika's product offerings and geographic reach, positioning the company as a major player in the industry.

- In May 2025, the European Union (EU) passed new regulations on flooring adhesives, requiring them to contain a minimum of 50% recycled content by 2030 (EU Press Release). This initiative aims to reduce the environmental impact of flooring adhesives and encourages manufacturers to invest in sustainable production methods.

Research Analyst Overview

- The market encompasses a diverse range of products, each catering to specific floor thermal properties, chemical resistance, and accessibility requirements. Floor cleaning equipment and installation tools play crucial roles in maintaining floor longevity, while adhesive performance and bonding properties ensure floor durability during installation. Floor maintenance costs are a significant consideration, with moisture resistance and UV resistance essential for prolonging the life of floor coverings. Subfloor materials and design also impact adhesive selection, as do floor safety concerns and the need for fire resistance and sound absorption. Floor restoration techniques, such as polishing, grouting, and sealing, require specialized adhesives with optimal bonding properties.

- Floor underlayment and moisture barriers are essential for ensuring a level, stable surface and preventing moisture damage. Floor repair and safety are paramount, with adhesives engineered to address various issues, including subfloor damage and slip resistance. Floor design trends favor increased focus on sustainability and eco-friendly flooring solutions, necessitating adhesives with superior environmental performance. In summary, the market is characterized by continuous innovation and adaptation to meet the evolving needs of the flooring industry, with a focus on enhancing floor performance, durability, and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Floor Adhesive Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.7% |

|

Market growth 2024-2028 |

USD 1308 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Floor Adhesive Market Research and Growth Report?

- CAGR of the Floor Adhesive industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the floor adhesive market growth of industry companies

We can help! Our analysts can customize this floor adhesive market research report to meet your requirements.