Floss Picks Market Size 2024-2028

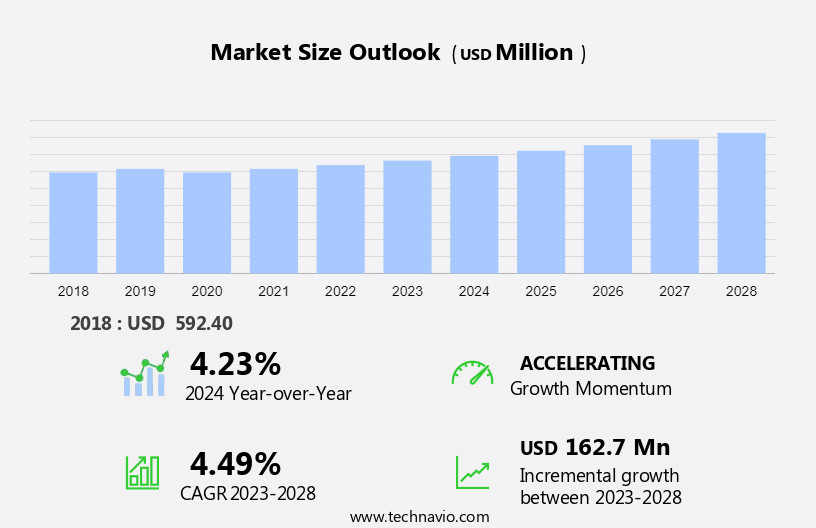

The floss picks market size is forecast to increase by USD 162.7 million at a CAGR of 4.49% between 2023 and 2028.

- The oral care market, specifically the segment for dental floss and floss picks, is experiencing significant growth In the US market. Dental experts continue to emphasize the importance of maintaining good oral hygiene, leading to an increase In the demand for dental floss and floss picks. Consumers are becoming more health-conscious and are seeking effective solutions for oral care. In response, various alternatives to traditional plastic floss picks have emerged, including those made from eco-friendly materials such as bamboo and charcoal. These substitutes cater to the growing trend of consumer healthcare and sustainability.

- The availability of these products through various e-commerce platforms has also made them easily accessible to consumers, further fueling market growth. Overall, the market for dental floss and floss picks is expected to continue its upward trajectory due to these key trends and consumer preferences.

What will be the Size of the Floss Picks Market During the Forecast Period?

- The market encompasses innovative oral care solutions designed to effectively clean interdental areas and improve overall oral health and care. . This market exhibits significant growth due to increasing awareness of dental problems such as tooth decay and gum disease. Consumers are increasingly seeking sustainable alternatives to conventional dental floss and interdental brushes, leading to the popularity of eco-friendly options like biodegradable floss picks made from bamboo, cornstarch, or plant-based plastics. Personalized oral care is also gaining traction, with customized floss picks and ergonomic handles catering to individual needs. Orthodontic appliances and oral hygiene practices for kids and teenagers are further expanding the market's reach.

- Flavored floss, curved and flat variants, and ergonomic handles contribute to the market's diversity. The market's direction is towards addressing dental issues while minimizing environmental impact, with a focus on preventive dental care and addressing food particles around the gumline and between teeth.

How is this Floss Picks Industry segmented and which is the largest segment?

The floss picks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Disposable

- Reusable

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Japan

- Middle East and Africa

- South Africa

- South America

- Brazil

- North America

By Product Insights

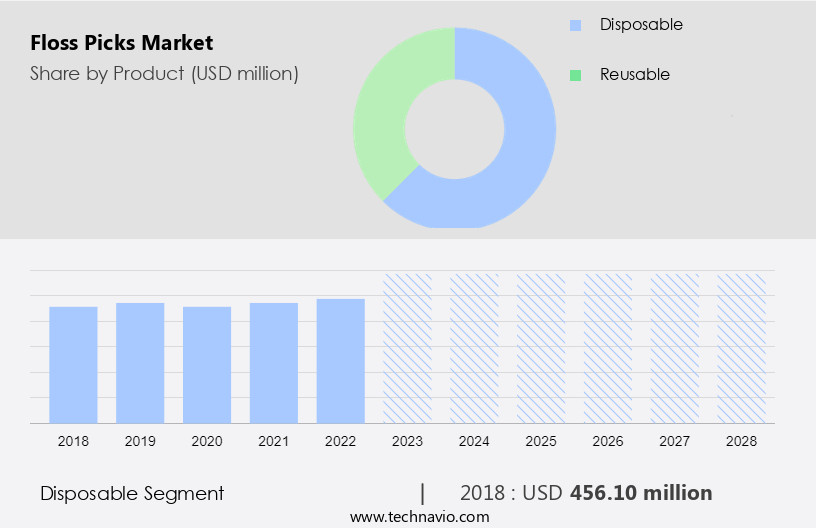

The disposable segment is estimated to witness significant growth during the forecast period. Disposable floss picks have gained significant popularity In the oral care market due to the rising demand for convenient dental hygiene solutions. In 2023, the market for disposable floss picks experienced growth, driven by their availability in various retail formats, including supermarkets and pharmacies. Consumers have shown a preference for Y-shaped floss picks with replaceable heads, contributing to the segment's expansion during the forecast period. Additionally, disposable floss picks have been widely adopted in healthcare facilities to maintain oral hygiene and prevent the transmission of communicable diseases, including COVID-19. The market for floss picks is expected to continue its growth trajectory, fueled by the increasing awareness of preventive dental care and the availability of innovative materials such as biodegradable bamboo, cornstarch, and plant-based plastics.

These eco-friendly alternatives cater to the growing demand for sustainable dental care products. Furthermore, customized floss picks and orthodontic appliances catering to sensitive gums and dental conditions have expanded the market's reach. The market encompasses various types of floss picks, including F-shaped, Y-shaped, and curved variants, designed for different interdental areas and dental problems, such as tooth decay, gum disease, and cavities. The market also offers antimicrobial properties, ergonomic handles, and plaque removal tools, making it a comprehensive solution for maintaining oral health. Consumers can purchase these dental care products from both online stores and traditional retailers. The market for floss picks is expected to remain a significant contributor to the overall oral hygiene and dental care products industry.

Get a glance at the Floss Picks Industry report of share of various segments Request Free Sample

The Disposable segment was valued at USD 456.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

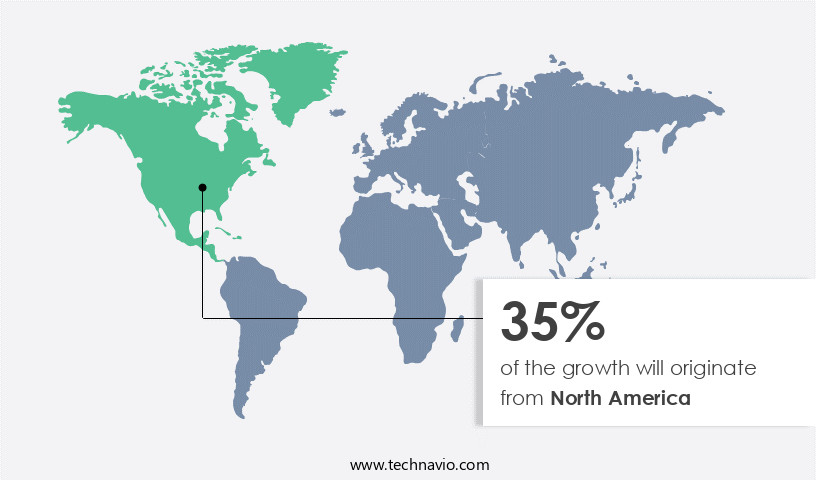

North America is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market for floss picks in North America has experienced growth due to increasing consumer awareness regarding oral health and the availability of innovative dental care products. The American Dental Association (ADA) advocates for flossing as an essential oral hygiene practice, as it effectively removes plaque between teeth and contributes to gum health. This practice is also linked to a reduced risk of periodontal disease. The American Association for Cancer Research (AACR) further encourages flossing to minimize the risk of oral cancer. Floss picks, a type of dental floss product, offer convenience and ease of use, making them a popular choice among consumers.

These picks come in various shapes, such as F and Y, and are available in biodegradable, sustainable materials, including bamboo, cornstarch, and plant-based plastics. Customized floss picks catering to orthodontic appliances, sensitive gums, and dental conditions are also available. Floss picks are disposable or reusable and may possess antimicrobial properties. They are available at pharmacies, online stores, and other retailers, making them easily accessible for personalized oral care. The cleaning experience of floss picks can help remove food particles and plaque from interdental areas and along the gumline, contributing to overall oral health and preventive dental care. Flavored floss and ergonomic handles further enhance the user experience.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Floss Picks Industry?

- Increasing recommendations of from dental experts to maintain oral hygiene is the key driver of the market.Floss picks have gained popularity as an essential tool for maintaining oral hygiene and preventing dental problems. These disposable or reusable picks are designed to help remove food particles and debris from interdental areas, particularly around the gumline, where conventional toothbrushes and toothbrushes cannot reach. The market for floss picks is driven by the increasing awareness of the importance of preventive dental care and the potential consequences of poor oral health, such as tooth decay, gum disease, and periodontal disease. Sustainable alternatives to traditional plastic floss picks have emerged, including those made from biodegradable materials like bamboo, cornstarch, and plant-based plastics. These eco-friendly options appeal to consumers who are conscious of their environmental impact. Innovative materials and designs, such as antimicrobial properties, ergonomic handles, and customized shapes like F and Y, enhance the cleaning experience.

- Floss picks are recommended for individuals with orthodontic appliances, sensitive gums, and dental conditions. They are also suitable for kids and teenagers, who may find it challenging to use conventional dental floss or interdental brushes. Pharmacies and online stores offer a wide range of floss picks, including flavored options and variants with anti-slip grips and replaceable heads. Tongue scrapers are sometimes included in floss pick sets for comprehensive oral hygiene. The market for floss picks is expected to grow as people become more conscious of their oral health and the role it plays In their overall health and wellness. The convenience and effectiveness of floss picks make them an attractive alternative to traditional toothpicks and interdental cleaning methods. However, it is crucial to choose the right floss pick for your specific dental needs and maintain proper usage to maximize its benefits.

What are the market trends shaping the Floss Picks Industry?

- Rising oral health awareness among consumers is the upcoming market trend. Floss picks are essential tools for maintaining optimal oral health by removing plaque and food particles from interdental areas, including the gumline. These picks contribute significantly to preventing bad breath, tooth decay, and advanced periodontal diseases such as gingivitis and periodontitis. The increasing awareness of personalized oral care and the importance of good dental hygiene practices, particularly in developed regions, have fueled the demand for floss picks and other dental floss products. The American Dental Association (ADA) recommends the use of interdental cleaners, including floss, to ensure proper care for teeth and gums. Innovative materials, such as biodegradable bamboo, cornstarch, and plant-based plastics, are gaining popularity due to their sustainable and eco-friendly attributes.

- Floss picks come in various shapes, including F and Y, and ergonomic handles for a better cleaning experience. Additionally, some floss picks offer antimicrobial properties, flavored floss, and customized designs for orthodontic appliances and sensitive gums. Reusable and replaceable head options are also available for those seeking a more sustainable alternative to disposable floss picks. Overall, floss picks play a crucial role in maintaining oral health and preventing dental ailments, making them an essential component of preventive dental care. They can be found in pharmacies, online stores, and supermarkets, alongside other oral health and dental care products.

What challenges does the Floss Picks Industry face during its growth?

- Availability of substitute products is a key challenge affecting the industry growth. Interdental brushes offer an effective alternative to traditional floss picks for improving oral hygiene. Their thin build and availability in round or cone-shaped designs enable better plaque removal in hard-to-reach areas, such as interdental gaps and along the gumline. Manufacturers provide interdental brushes with short or long handles for improved grip and ease of use. These products are ideal for individuals with dental accessories, including dentures, bridges, gum implants, and braces. Brands like Colgate-Palmolive Co and Procter & Gamble offer various interdental brush variants catering to different interdental gap sizes.

- The use of interdental brushes, along with regular toothbrushing, enhances oral health by reducing the risk of dental problems, such as tooth decay, gum disease, cavities, gingivitis, and periodontal disease. These conditions can be caused by food particles, processed food, and sugary beverages. Interdental brushes are disposable but can also be reusable, with replaceable heads and antimicrobial properties, ensuring a clean and hygienic cleaning experience. They are available at pharmacies, online stores, and supermarkets, making them accessible for personalized oral care practices.

Exclusive Customer Landscape

The floss picks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the floss picks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, floss picks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

BAMBO EARTH LLC - The company specializes in providing a range of eco-friendly floss picks, including those infused with bamboo charcoal and mint flavor. These picks offer an effective and sustainable solution for oral hygiene, appealing to consumers prioritizing eco-consciousness and fresh breath. The bamboo charcoal infusion is known for its natural ability to absorb bacteria and impurities, while the mint flavor adds a refreshing touch to daily dental care routines.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BAMBO EARTH LLC

- Colgate Palmolive Co.

- Dr. Wild and Co. AG

- Grinnatural Inc.

- M C Schiffer GmbH

- PERFECT GROUP CORP., LTD.

- Peri dent Ltd.

- Perrigo Co. Plc

- Pesitro Healthcare Products Co.Ltd.

- Prestige Consumer Healthcare Inc.

- Shanghai Grow Win Eco Products Co. Ltd.

- Sunstar Suisse SA

- The Humble Co.

- The Procter and Gamble Co.

- Zhejiang NetSun Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market for oral hygiene products, specifically floss picks, has seen significant growth in recent years as consumers prioritize preventive dental care and personalized oral health solutions. Innovative materials, such as biodegradable and plant-based plastics, bamboo, and cornstarch, have entered the market, catering to the increasing demand for sustainable and eco-friendly alternatives. Floss picks, a type of dental tool designed for interdental cleaning, come in various shapes and sizes, including F-shape and Y-shape, to effectively reach and clean interdental areas around the gumline. These tools offer a more comfortable and efficient cleaning experience compared to conventional dental floss. Personalized oral care is a growing trend, with customized floss picks and orthodontic appliances designed for individuals with sensitive gums or dental conditions.

Antimicrobial properties are also a desirable feature in floss picks, providing additional protection against dental ailments such as tooth decay, gum disease, sensitive toothpaste and periodontal disease. The market for floss picks is diverse and caters to various consumer needs. Pharmacies and online stores are the primary distribution channels for these products, making them easily accessible to consumers. Oral hygiene and dental care products continue to evolve, with flavored floss, ergonomic handles, replaceable heads, and tongue scrapers being some of the recent innovations. The dental problems associated with food particles and plaque build-up can lead to dental disorders such as cavities, gingivitis, and dental disorders.

Processed food and sugary beverages are significant contributors to these issues. Traditional toothpicks and interdental brushes are alternative options for interdental cleaning, but floss picks offer a more comprehensive cleaning experience. The market for floss picks is not limited to adults but also caters to kids and teenagers, emphasizing the importance of dental hygiene practices from a young age. Dentists and dental professionals recommend regular interdental cleaning as part of preventive dental care. The market for floss picks is expected to continue growing, driven by increasing consumer awareness of oral health and the availability of innovative products. The trend towards sustainable and eco-friendly alternatives is also expected to influence the market, with more companies exploring the use of biodegradable and plant-based materials. In conclusion, the market for floss picks is a dynamic and growing industry, catering to the increasing demand for personalized oral health solutions and sustainable alternatives. The trend towards preventive dental care and the availability of innovative products are expected to drive the market's growth In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.49% |

|

Market growth 2024-2028 |

USD 162.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Key countries |

US, China, Canada, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Floss Picks Market Research and Growth Report?

- CAGR of the Floss Picks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the floss picks market growth of industry companies

We can help! Our analysts can customize this floss picks market research report to meet your requirements.