Fluorinated Ethylene Propylene (FEP) Market Size 2024-2028

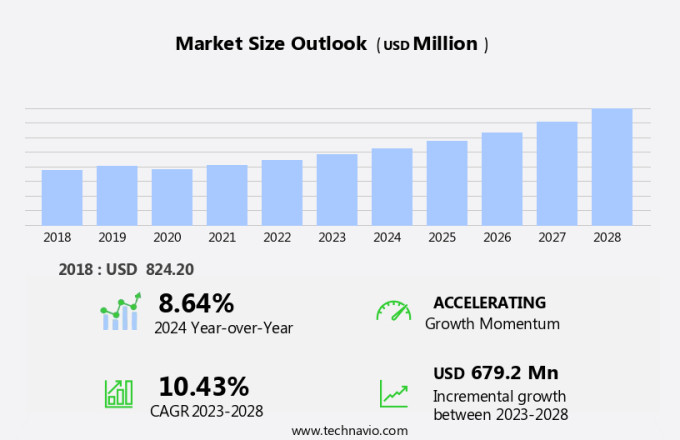

The fluorinated ethylene propylene (FEP) market size is forecast to increase by USD 679.2 million at a CAGR of 10.43% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for FEP coatings in various industries. Key end-users, such as automotive electrical, and electronics, are expanding their capacity to meet the rising demand for these coatings. However, the market is also facing challenges due to stringent regulations on the use of perfluorooctanoic acid (PFOA)-related materials. These regulations have led to the development of alternative fluorinated materials, which are expected to gain traction In the market. The market is a significant segment of the global fluoropolymer industry, characterized by its versatile applications and unique properties. FEP, a copolymer of tetrafluoroethylene (TFE) and hexafluoropropylene (HFP), offers superior non-stick properties, making it a popular choice for cookware and PTFE replacing applications. Additionally, the growing awareness of the health and environmental concerns associated with PFOA and other fluorinated compounds is driving the research and development of more sustainable and eco-friendly FEP alternatives. Overall, the FEP market is expected to continue its growth trajectory, driven by these trends and challenges.

What will be the Size of the Fluorinated Ethylene Propylene (FEP) Market During the Forecast Period?

- FEP's excellent chemical resistance, high dielectric strength, and high temperature tolerance make it an essential component in various industries, including electrical insulation, photovoltaic cells, and medical equipment. FEP polymers are available in various forms, such as pellets and granules, which are used to produce FEP coatings, resins, and compound formulations. These products find extensive applications in diverse sectors, including automotive, aerospace, and chemical processing.

- Additionally, FEP's non-stick properties are often compared to those of Polytetrafluoroethylene (PTFE) and Perfluoroalkoxy (PFA), but FEP exhibits better processing characteristics and higher melt strength. The FEP market is influenced by several factors, including the increasing demand for energy-efficient technologies, such as shale gas production and renewable energy sources, which drive the need for high-performance insulation materials. Furthermore, the growing medical industry's reliance on FEP for medical devices and implants also contributes to the market's growth. Overall, the FEP market is expected to experience steady growth due to its unique properties and expanding applications.

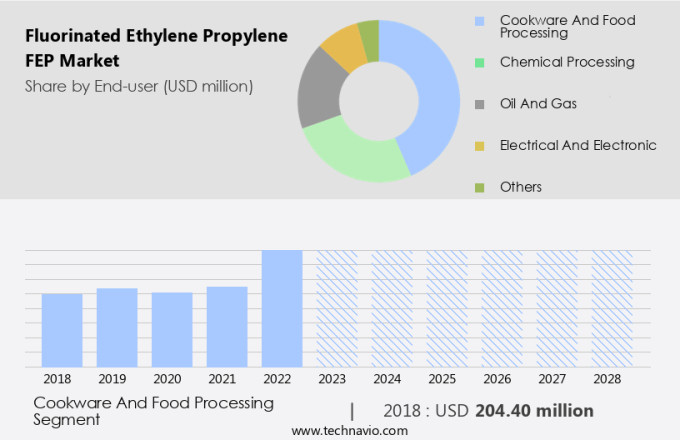

How is this Fluorinated Ethylene Propylene (FEP) Industry segmented and which is the largest segment?

The fluorinated ethylene propylene (FEP) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Cookware and food processing

- Chemical processing

- Oil and gas

- Electrical and electronic

- Others

- Product

- Films and sheets

- Pellets and granules

- Tubes

- Coatings

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- Europe

- Germany

- UK

- Middle East and Africa

- South America

- North America

By End-user Insights

- The cookware and food processing segment is estimated to witness significant growth during the forecast period.

Fluorinated Ethylene Propylene (FEP) is a significant player In the fluoropolymer market, primarily used for manufacturing nonstick coatings In the cookware industry. FEP coatings, including those based on Polytetrafluoroethylene (PTFE) and Teflon, provide excellent chemical resistance, friction reduction, and high-temperature tolerance. The nonstick properties of FEP have gained popularity due to the increasing preference for minimum oil usage in cooking. The pandemic led to a growth in cooking as a hobby, further increasing the demand for nonstick cookware. In response, companies expanded their product offerings to cater to regions such as India, the US, the UK, Australia, Hong Kong, Korea, and Japan.

Additionally, FEP is also utilized in various industries, including electrical insulation, photovoltaic cells, and the medical sector, due to its dielectric strength and biocompatibility. FEP resin is also used In the production of FEP sheet products, films, and lining materials. The coatings segment, specifically FEP coating technology, plays a crucial role in various applications, including semiconductor-related industries.

Get a glance at the Fluorinated Ethylene Propylene (FEP) Industry report of share of various segments Request Free Sample

The cookware and food processing segment was valued at USD 204.40 million in 2018 and showed a gradual increase during the forecast period.

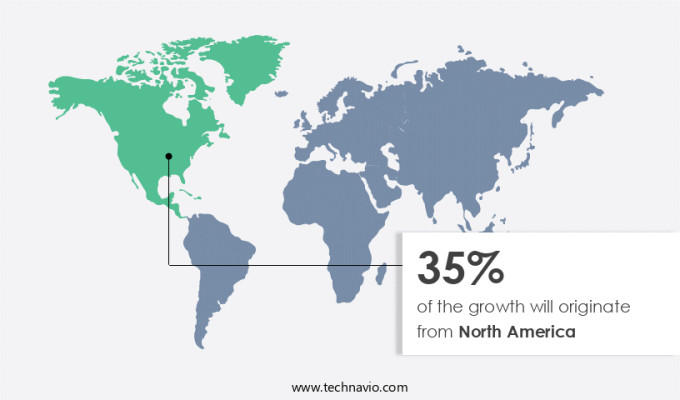

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Fluorinated Ethylene Propylene (FEP) is a versatile fluoropolymer widely used in North America for various applications, including cookware and food processing, electrical and electronics, medical devices, automotive, furniture, and pharmaceuticals. In the medical industry, FEP is employed in precision coatings and critical components such as catheters and catheter liners, fiber optics, and intravenous catheters. The expanding presence of furniture manufacturers in North America is anticipated to boost FEP demand due to its non-stick properties and high-temperature tolerance.

Additionally, the growing construction industry in Canada will fuel the use of FEP in insulation and coating applications. In the electrical industry, FEP is valued for its excellent chemical resistance, dielectric strength, and electrical insulation properties. FEP resin is also used in the production of polytetrafluoroethylene (PTFE), Teflon, PFA, and Tetrafluoroethylene (TFE), among other fluoropolymers. The FEP market encompasses various segments, including coatings, tubing, sheet products, and lining materials, catering to diverse industries. The increasing adoption of FEP in photovoltaic cells and semiconductor-related applications further underscores its importance In the fluoropolymer market.

Market Dynamics

Our fluorinated ethylene propylene (FEP) market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Fluorinated Ethylene Propylene (FEP) Industry?

Increasing demand for FEP coatings is the key driver of the market.

- Fluorinated Ethylene Propylene (FEP) is a high-performance fluoropolymer widely used in various industries due to its exceptional non-stick properties, chemical resistance, and high-temperature tolerance. FEP pellets and granules are the primary raw materials for manufacturing FEP resin, which is further processed into various forms such as coatings, film, sheet products, and tubing. FEP coatings are increasingly preferred over PTFE and Teflon in cookware applications due to their superior non-stick properties, higher wear resistance, and oxidation resistance. In the electrical industry, FEP is utilized as an insulating material for outdoor electrical wires and as a jacketing material for optical fiber cables due to its resistance to sunlight and excellent dielectric strength. FEP is also a valuable material In the semiconductor industry, where it is used for the production of electrical fittings and appliances. In photovoltaic cells, FEP film is employed as an encapsulant material to protect the sensitive semiconductor components from environmental factors. FEP compound formulations and extrusion processes are used to create various FEP lining materials for various applications.

- Additionally, FEP's biocompatibility makes it a popular choice In the medical industry for various applications, including medical tubing, medical devices, and medical equipment. FEP encapsulation technology is used to protect sensitive medical components from moisture and other environmental factors. FEP's unique properties make it a valuable material in various industries, including the chemical industry, where it is used for chemical processing equipment, and the medical industry, where it is used for medical devices and equipment. FEP's demand is expected to grow due to its increasing usage in various applications, including energy production, particularly in shale gas production, and in the production of photovoltaic cells. Polyfluor Plastics bv and AGC are some of the leading manufacturers of FEP resin and FEP-based products. The FEP polymer market is expected to grow significantly due to its increasing usage in various industries and applications. FEP's unique properties make it a versatile material with a wide range of applications, making it a valuable addition to the fluoropolymer market.

What are the market trends shaping the Fluorinated Ethylene Propylene (FEP) Industry?

Capacity expansion by key end-users is the upcoming market trend.

- The market is primarily driven by the expansion plans of end-users in various industries. FEP is utilized in the form of pellets and granules to produce coatings and films, which find extensive applications in sectors such as automotive and aerospace, building and construction, consumer goods, food and beverages packaging, and others. For instance, in March 2022, Volvo announced the expansion of its Research and Development (R&D) operations in India, making it the company's largest development site outside Sweden. Similarly, in June 2021, Volvo announced plans to expand its manufacturing plant for electric cars in South Carolina, US. FEP is a type of fluoropolymer, specifically a copolymer of Tetrafluoroethylene (TFE) and Hexafluoropropylene (HFP). Its unique properties, including chemical resistance, high-temperature tolerance, and nonstick properties, make it a preferred choice for various industries. In the consumer goods sector, FEP is extensively used in cookware under brands like Teflon and Tefal, which are known for their nonstick properties. FEP is also widely used in electrical insulation applications due to its excellent dielectric strength. In the medical industry, FEP is used In the form of tubing and sheet products for medical devices and equipment due to its biocompatibility and FEP encapsulation technology.

- Additionally, FEP coating technology is used in photovoltaic cells to enhance their efficiency and durability. AGC Chemicals, Polyfluor Plastics bv, and AGC's Chiba plant are significant contributors to the FEP market. The demand for FEP polymer is expected to increase due to its semiconductor-related applications and the growing energy demand from the shale gas production industry. The FEP compound formulations and extrusion processes are continually evolving to cater to the diverse needs of end-users. The coatings segment is expected to dominate the FEP market due to its wide applications in various industries. In summary, the FEP market is poised for growth due to the expansion plans of end-users and the unique properties of FEP. The demand for FEP is expected to increase in various industries, including automotive and aerospace, building and construction, consumer goods, food and beverages packaging, and medical. The FEP polymer's chemical resistance, high-temperature tolerance, nonstick properties, and biocompatibility make it a preferred choice for various applications. The FEP market is expected to grow significantly In the coming years, driven by the expanding applications and the increasing demand for high-performance materials.

What challenges does the Fluorinated Ethylene Propylene (FEP) Industry face during its growth?

Stringent regulations on the use of perfluorooctanoic acid (PFOA)-related material is a key challenge affecting the industry growth.

- The market involves the production and distribution of FEP pellets and granules, which are further processed into various forms such as FEP coatings, films, sheets, and tubing. FEP, a copolymer of tetrafluoroethylene (TFE) and hexafluoropropylene (HFP), is known for its non-stick properties and chemical resistance. It is widely used in cookware under brands like Teflon and Teflon PTFE, as well as in electrical insulation, photovoltaic cells, and semiconductor-related applications. FEP's high-temperature tolerance and dielectric strength make it a preferred choice for various industries. AGC Chemicals, Polyfluor Plastics bv, and other leading fluoropolymer market players produce FEP compound formulations and employ FEP extrusion processes for manufacturing FEP lining materials and coatings. The coatings segment, specifically FEP coating technology, is a significant contributor to the market's growth. In the medical industry, FEP encapsulation technology is used for biocompatible applications due to its excellent chemical resistance and biocompatibility.

- Additionally, FEP sheet products and FEP tubing market cater to diverse industries, including medical, energy, and electrical. The market dynamics are influenced by regulatory compliance, technological advancements, and increasing demand for high-performance materials. However, concerns regarding the environmental impact of FEP and its degradation products, such as perfluorooctanoic acid (PFOA), have led to stringent regulations. For instance, the European Union's Regulation (EU) 2020/784 restricts the use of PFOA and related compounds, setting a maximum concentration of 0.005 parts per million (ppm) In the environment. Such regulations are essential to mitigate potential health and environmental risks.

Exclusive Customer Landscape

The fluorinated ethylene propylene (FEP) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fluorinated ethylene propylene (FEP) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fluorinated ethylene propylene (FEP) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry. The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- AGC Inc.

- Compagnie de Saint Gobain

- Daikin Industries Ltd.

- DuPont de Nemours Inc.

- Gasco Inc.

- Gujarat Fluorochemicals Ltd.

- HaloPolymer OJSC

- Hindustan Organic Chemicals Ltd.

- Hubei Everflon Polymer Co. Ltd.

- ITAFLON s.r.l

- Jiangsu Meilan Chemical Co. Ltd.

- Poly Plast Chemi Plants India Pvt Ltd.

- RTP Co.

- Shandong Hua Fluorochemical Co. Ltd.

- Shanghai Huayi 3F New Materials Co. Ltd.

- The Chemours Co.

- Zeus Co. Inc.

- Zhejiang Fotech International Co. Ltd.

- ZheJiang Yonghe Refrigerant Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fluorinated Ethylene Propylene (FEP) is a type of fluoropolymer, a high-performance plastic known for its exceptional properties. FEP is a copolymer of tetrafluoroethylene (TFE) and hexafluoropropylene (HFP), with the monomer ratio being approximately 70:30. This unique composition imparts desirable characteristics to FEP, making it a preferred choice in various industries. FEP's primary attributes include superior chemical resistance, high dielectric strength, and excellent high-temperature tolerance. These properties make FEP an ideal material for various applications, such as electrical insulation, coatings, and linings. FEP's non-stick properties are another significant advantage. While it is not as well-known as polytetrafluoroethylene (PTFE), FEP offers similar non-stick characteristics but with better flexibility and processability. This versatility makes FEP an attractive alternative to PTFE in certain applications, such as In the production of pellets and granules for cookware and non-stick coatings. FEP's chemical resistance is a critical factor in its widespread use. It can withstand harsh chemicals and environments, making it suitable for applications in various industries, including the medical sector. FEP's biocompatibility and encapsulation technology make it an excellent choice for medical applications, such as medical tubing and medical devices.

Additionally, FEP's high dielectric strength and high-temperature tolerance make it an excellent material for electrical insulation applications. Its ability to withstand high voltages and temperatures makes it an ideal choice for high-voltage electrical equipment and photovoltaic cells. FEP's coatings segment is a significant market, with FEP coating technology being used in various industries. FEP film manufacturing and FEP sheet products are widely used in various applications, including lining materials for chemical processing equipment and semiconductor-related applications. The FEP market is driven by the increasing demand for high-performance materials in various industries. The growth of the energy sector, particularly shale gas production, has led to an increased demand for FEP due to its excellent chemical resistance and high-temperature tolerance. Additionally, the growing demand for renewable energy sources, such as solar and wind, has led to an increased demand for FEP in photovoltaic cells.

Thus, FEP compound formulations and FEP extrusion processes are continually evolving to meet the changing demands of various industries. Companies specializing in FEP production, such as Polyfluor Plastics BV and AGC, are investing in research and development to improve the properties and processing capabilities of FEP. In summary, Fluorinated Ethylene Propylene (FEP) is a high-performance plastic with exceptional properties, including superior chemical resistance, high dielectric strength, and excellent high-temperature tolerance. Its versatility and wide range of applications make it a preferred choice in various industries, including electrical insulation, coatings, medical, and renewable energy. The FEP market is driven by the increasing demand for high-performance materials and the growing demand for renewable energy sources. Companies specializing in FEP production are continually innovating to meet the changing demands of various industries.

|

Fluorinated Ethylene Propylene (FEP) Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.43% |

|

Market growth 2024-2028 |

USD 679.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.64 |

|

Key countries |

US, China, Germany, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fluorinated Ethylene Propylene (FEP) Market Research and Growth Report?

- CAGR of the Fluorinated Ethylene Propylene (FEP) industry during the forecast period

- Detailed information on factors that will drive the Fluorinated Ethylene Propylene (FEP) growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fluorinated ethylene propylene (FEP) market growth of industry companies

We can help! Our analysts can customize this fluorinated ethylene propylene (FEP) market research report to meet your requirements.