Fluoropolymer Coating Market Size 2024-2028

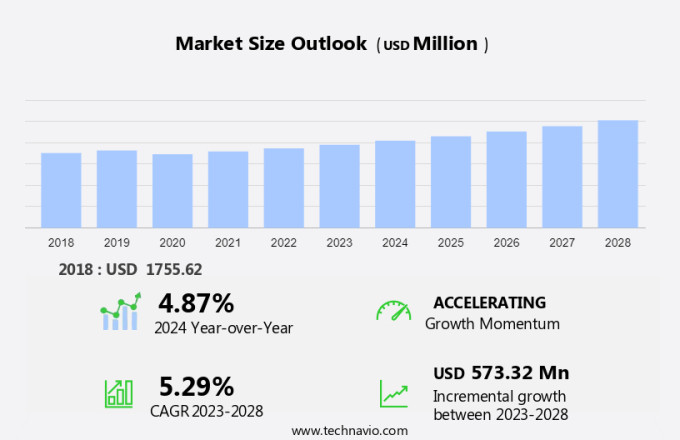

The fluoropolymer coating market size is forecast to increase by USD 573.32 million at a CAGR of 5.29% between 2023 and 2028. The market is witnessing significant growth due to the increasing demand for chemical processing applications in various industries. These coatings offer superior properties such as corrosion protection, chemical resistance, and electricity-resistant, making them essential in various sectors. One of the notable trends in the market is the utilization of ferroelectric polymers, particularly polyvinylidene difluoride (PVDF) and ethylene-tetrafluorinated ethylene polymers (ETFE). These polymers provide excellent anti-galling properties, making them suitable for applications in harsh environments. Moreover, the expanding construction sector and the growing population in urban regions are driving the demand for fluoropolymer coatings. Strict environmental policies and regulations are also pushing companies to adopt these coatings due to their low environmental impact.

The market is witnessing significant growth due to the increasing demand for high-performance coatings in various sectors. These coatings offer superior properties such as chemical resistance, electricity-resistant, anti-galling, and abrasion resistance, making them ideal for numerous applications. In the industrial sector, fluoropolymer coatings are extensively used for corrosion protection in harsh environments. These coatings can withstand extreme temperatures and chemicals, ensuring the longevity of equipment and infrastructure. The renewable energy sector also benefits from fluoropolymer coatings, particularly in wind turbine blades and solar panel manufacturing. Fluoropolymer coatings find extensive applications in the auto component manufacturing industry.

Also, they are used in the production of engine components, exhaust systems, and brake systems due to their high resistance to heat and chemicals. In the vehicle market, these coatings are used for underbody protection, providing excellent resistance to road salt and other corrosive agents. Fluoropolymer coating systems consist of fluoropolymer resin, binder resins, solvent, pigments, and additives. Fluoropolymer resins are the backbone of these coatings, providing the unique properties that make them indispensable in various industries. Ethylene-tetrafluorinated ethylene polymers and polyvinylidene difluoride are common types of fluoropolymer resins used in coatings. Binder resins are added to the fluoropolymer resin to improve the coating's adhesion to the substrate.

Similarly, solvents are used to thin the coating and make it easier to apply. Pigments are added to the coating to provide color, while additives enhance the coating's properties. Fluoropolymer coatings have a wide range of applications in defense, food processing, electrical and electronics, ferroelectric polymers, and more. In defense, these coatings are used for military equipment due to their high durability and resistance to harsh conditions. In food processing, they are used for equipment that comes into contact with food to ensure product safety and longevity. In the electrical and electronics industry, fluoropolymer coatings are used for insulation and protective coatings due to their excellent electrical properties.

In conclusion, the market is witnessing significant growth due to the increasing demand for high-performance coatings in various industries. These coatings offer superior properties such as chemical resistance, electricity-resistant, anti-galling, and abrasion resistance, making them indispensable in numerous applications. The unique properties of fluoropolymer coatings are attributed to their polymeric structure, which consists of fluoropolymer resin, binder resins, solvent, pigments, and additives.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Building and construction

- Electrical and electronics

- Food processing

- Chemical processing

- Others

- Type

- Polytetrafluoroethylene (PTFE) coating

- Polyvinylidene fluoride (PVDF) coating

- Fluoroethylene propylene (FEP) coating

- Ethylene tetrafluoro ethylene (ETFE) coating

- Others

- Geography

- APAC

- China

- India

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Application Insights

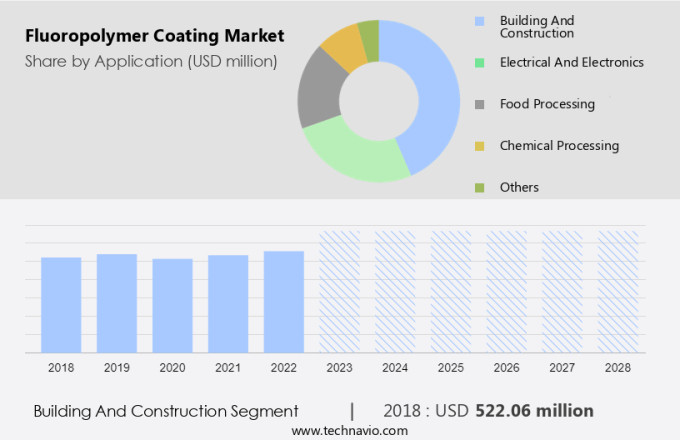

The building and construction segment is estimated to witness significant growth during the forecast period. Fluoropolymer coatings are essential in various industries, including food processing and oil & gas, as well as automobile manufacturing. These coatings are particularly beneficial for metallic substrates such as steel, aluminum, copper, and zinc due to their abrasion-resistant properties. The unique polymeric structure of fluoropolymers is attributed to the fluorine atom, which has a high electronegativity and low polarizability. Consequently, fluorine bonds possess greater energy and strength compared to CH bonds. In exterior architectural coatings, fluoropolymers are highly sought after for their durability and excellent weatherability. However, the demand for fluoropolymers took a hit in 2020, particularly in the industrial coating sector.

Further, fluoropolymer coatings offer superior protection against harsh environments and corrosion, making them indispensable in various industries. The food processing sector relies on these coatings for their ability to withstand high temperatures and chemical exposure. In the oil and gas industry, fluoropolymers are used to coat pipes and equipment to prevent corrosion and increase efficiency. In the automotive sector, these coatings are used to enhance the appearance and durability of vehicle exteriors. In the construction industry, fluoropolymers are valued for their ability to provide long-lasting protection against weathering and wear. Xylan, a type of fluoropolymer coating, is widely used in architectural coatings due to its exceptional weatherability and resistance to UV radiation.

Get a glance at the market share of various segments Request Free Sample

The building and construction segment was valued at USD 522.06 million in 2018 and showed a gradual increase during the forecast period. Despite the challenges faced by some end-user industries in 2020, the market for fluoropolymer coatings is expected to continue growing due to their numerous benefits. In summary, fluoropolymer coatings are a valuable asset in various industries due to their unique properties, including abrasion resistance and excellent weatherability. Their use in architectural coatings, industrial coatings, food processing, oil & gas, and automotive industries is expected to drive the growth of the market. Despite the temporary setbacks faced in 2020, the future looks promising for this market.

Regional Insights

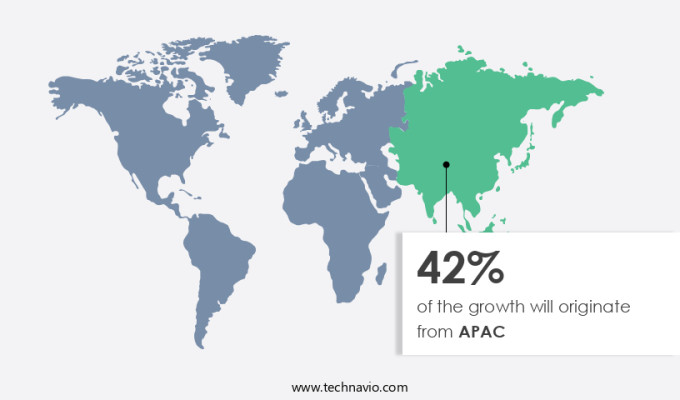

APAC is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market is witnessing significant growth, particularly in the Metal segment, which includes Aluminum, Brass, Cast Iron, Stainless Steel, and Crude Steel. APAC dominates the global market, accounting for the largest share in 2021. The region's growth is attributed to the expanding construction sector in residential and non-residential applications. The increasing industrialization of major economies like China and India, along with other manufacturing industries, fuels the demand for fluoropolymer coatings in APAC. In India, the government's Housing for All by 2022 initiative aims to provide a home for every Indian resident, driving the real estate market's predicted USD1 trillion increase by 2030. The Indian market's potential growth is further focused by the IBEF, estimating a USD9 billion expansion. These factors collectively contribute to the demand for fluoropolymer coatings in APAC.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The rising population in urban regions is the key driver of the market. The global population is projected to exceed 50% urbanization by 2050, according to World Bank data. Urbanization presents opportunities for long-term economic growth, contributing to over 80% of the global GDP. However, managing this growth effectively is crucial to meet the increasing demand for affordable housing, efficient transportation systems, and essential infrastructure. APAC countries, including China, India, Indonesia, Bangladesh, Japan, and Malaysia, are among those experiencing significant urban expansion. High-performance coatings, such as fluoropolymer coating systems, play a vital role in various industries, including renewable energy and automotive manufacturing. Fluoropolymer resins are essential polymeric materials in these coatings, offering superior resistance to harsh environments and extreme temperatures.

In addition, in the renewable energy sector, fluoropolymer coatings protect solar panels and wind turbines from weathering and corrosion. In the industrial sector, they enhance equipment durability and productivity. In the vehicle market, they improve fuel efficiency and reduce emissions. Effective urban planning is essential to accommodate the growing population and meet their needs while minimizing environmental impact. High-performance coatings, like fluoropolymer coatings, contribute to this effort by increasing the lifespan and efficiency of infrastructure and industrial equipment. As urbanization continues, the demand for these coatings is expected to grow, making them an essential investment for businesses and governments alike.

Market Trends

The rapid expansion in construction is the upcoming trend in the market. The construction sector is experiencing expansion in various regions worldwide. The need for fluoropolymers has risen in both residential and commercial structures, including buildings, warehouses, factories, malls, and complexes. Countries have seen significant construction projects due to industrialization and rising disposable income. Notably, China, Malaysia, India, the Philippines, Indonesia, Thailand, Vietnam, the UAE, and Saudi Arabia have planned substantial infrastructure investments, contributing to The market growth. One of the latest developments includes Samsung's announcement to construct a semiconductor manufacturing facility worth up to USD17 billion in Taylor, near Austin, Texas. Fluoropolymers, such as polyvinylidene difluoride and ethylene-tetrafluorinated ethylene polymers, offer superior corrosion protection, chemical resistance, and electricity resistance, making them essential for various industries.

Also, their anti-galling properties make them ideal for applications in harsh environments, particularly in the construction sector. The increasing demand for these high-performance coatings is driven by the need for durable and long-lasting coatings in infrastructure projects.

Market Challenge

The strict environmental policies and regulations is a key challenge affecting the market growth. Fluoropolymer coatings, which include binder resins, solvents, pigments, and additives, are widely used in various industries such as defense, food processing, and electrical electronics. However, the use of solvent-based coatings, which consist of volatile chemicals, poses environmental risks due to their hazardous nature. Regulatory bodies in North America, Europe, and the Middle East and Africa (MEA) have imposed strict regulations to control the harmful effects of these coatings. For instance, the Clean Air Act in the US regulates Volatile Organic Compounds (VOC) and Hazardous Air Pollutants (HAP) emissions and sets performance standards for controlling emissions from various types of coatings, including solvent-based ones.

However, one of the common fluoropolymers, Polytetrafluoroethylene (PTFE), is widely used due to its excellent non-stick properties. However, the production process of PTFE in small sizes for coating has been shown to generate Perfluorooctanoic Acid (PFOA), which is a harmful substance. Therefore, to mitigate the environmental impact and health concerns, low PFOA alternatives to traditional PTFE are being sought. In the defense industry, fluoropolymer coatings are used to protect military equipment from harsh environments, while in food processing, they ensure the hygiene and longevity of equipment. In the electrical electronics sector, these coatings provide insulation and protect against corrosion.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akzo Nobel NV: The company offers AFLAS fluoroelastomers used in food processing applications where heat and aggressive chemicals will quickly degrade other types of rubber.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- PTFE Applied Coatings

- Daikin Industries Ltd.

- DuPont de Nemours Inc.

- Endura Coatings

- BASF SE

- Beckers Group

- PPG Industries Inc.

- TIGER Coatings GmbH and Co. KG

- The Chemours Co.

- Chem Processing Inc.

- 3M Co.

- AGC Inc.

- Axalta Coating Systems Ltd.

- The Sherwin Williams Co.

- Metal Coatings Corp.

- Toa Resin Corp. Ltd.

- Nippon Paint Holdings Co. Ltd.

- Innocoat Systems I Pvt. Ltd.

- Tnemec Co. Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fluoropolymer coating systems have gained significant traction in various industries due to their high-performance properties. These coatings, derived from polymeric materials, offer superior corrosion protection, chemical resistance, electricity-resistance, anti-galling, and abrasion resistance. The renewable energy sector and industrial sector are major consumers of fluoropolymer coatings, with applications in wind turbines and solar panels, respectively. In the industrial sector, fluoropolymer coatings are used extensively in auto component manufacturing and the vehicle market. Fluoropolymer resin, binder resins, solvent, pigments, and additives are key ingredients in the production of these coatings. The defense sector also utilizes fluoropolymer coatings for their exceptional properties in harsh environments.

In summary, Ferroelectric polymers, such as polyvinylidene difluoride (PVDF) and ethylene-tetrafluorinated ethylene polymers (ETFE), are commonly used in fluoropolymer coating systems. These polymers provide excellent protection for steel, metallic substrates like aluminum, copper, zinc, and non-metals like xylan. Polyphenylene sulfide (PPS) and copolymers of ethylene are also used in various applications. Fluoropolymer coatings find extensive use in the oil and gas industry, textile, pharmaceutical, aerospace, electrical vehicles, and architectural coatings. They are used in chemical processing, electrical and electronics, and semiconductor equipment components. The metal segment, including aluminum, brass, cast iron, and stainless steel, is a significant end-user of fluoropolymer coatings.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.29% |

|

Market growth 2024-2028 |

USD 573.32 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.87 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 42% |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

PTFE Applied Coatings, Akzo Nobel NV, Daikin Industries Ltd., DuPont de Nemours Inc., Endura Coatings, BASF SE, Beckers Group, PPG Industries Inc., TIGER Coatings GmbH and Co. KG, The Chemours Co., Chem Processing Inc., 3M Co., AGC Inc., Axalta Coating Systems Ltd., The Sherwin Williams Co., Metal Coatings Corp., Toa Resin Corp. Ltd., Nippon Paint Holdings Co. Ltd., Innocoat Systems I Pvt. Ltd., and Tnemec Co. Inc. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch