Food And Beverage Filling Equipment Market Size 2024-2028

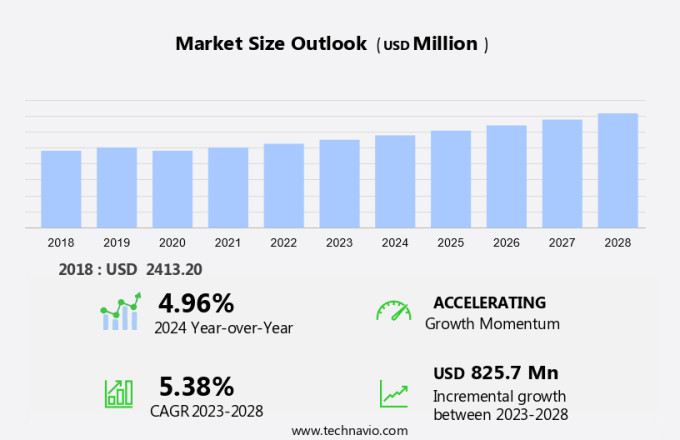

The food and beverage filling equipment market size is forecast to increase by USD 825.7 million, at a CAGR of 5.38% between 2023 and 2028.

- The market is driven by the growing efficiency and accuracy requirements in the food and beverage industry. The increasing demand for automation and advanced technology in filling processes is a significant trend shaping the market. The brewing industry's expansion, in particular for beer products, is a key growth factor, as it necessitates large-scale production and precise filling processes. However, rising energy costs pose a substantial challenge for market participants. Energy-intensive filling processes can significantly increase operational expenses, making it crucial for companies to adopt energy-efficient technologies and optimize their energy usage.

- To remain competitive, market players must balance the need for advanced filling equipment with the need to minimize energy consumption and costs. This dynamic market requires strategic planning and continuous innovation to capitalize on opportunities while effectively managing challenges. Companies that can efficiently address these challenges and offer cost-effective, high-performance filling solutions will be well-positioned for success.

What will be the Size of the Food And Beverage Filling Equipment Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the demand for automation and increased overall equipment effectiveness (OEE). Aseptic filling processes, utilizing clean-in-place systems, have gained significant traction, reducing product changeover time and enhancing production line efficiency. Sanitary design features, such as piston filling technology and linear filling machines, ensure product safety and maintain the highest standards of hygiene. Operators prioritize safety features, including automatic capping systems and container handling systems, while energy consumption metrics remain a critical concern. Septic filling solutions, with their precision filling control and waste reduction methods, have become essential in the industry. The market anticipates a 5% annual growth rate, driven by advancements in liquid filling technology, packaging integration systems, and remote diagnostics systems.

For instance, a leading food manufacturer implemented a data acquisition system, resulting in a 20% reduction in production downtime. This innovation enabled real-time quality control checks, ensuring consistent product output and customer satisfaction. Furthermore, the integration of volume filling accuracy, maintenance procedures, label application systems, and Conveyor Belt systems has streamlined production processes, ultimately increasing overall efficiency.

How is this Food And Beverage Filling Equipment Industry segmented?

The food and beverage filling equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Rotary fillers

- Aseptic fillers

- Volumetric fillers

- Net weight fillers

- Others

- Geography

- North America

- US

- Europe

- Germany

- Italy

- The Netherlands

- APAC

- China

- Rest of World (ROW)

- North America

By Product Insights

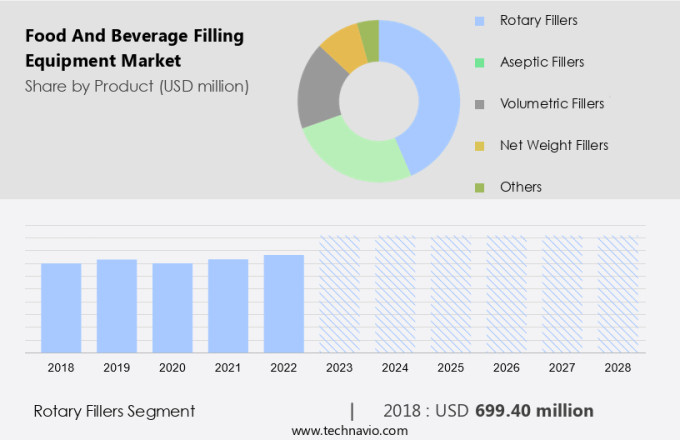

The rotary fillers segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant advancements, driven by the integration of automation and overall equipment effectiveness (OEE) to enhance production line efficiency and material handling. Aseptic filling processes and clean-in-place systems ensure product safety and reduce changeover times. Septic filling solutions with sanitary design features and piston filling technology cater to the demand for hygienic and precise filling. Linear filling machines and automatic capping systems streamline the production process, while energy consumption metrics and pneumatic filling systems focus on reducing energy usage and production downtime. Precision filling control and waste reduction methods contribute to improved quality control checks and liquid filling technology.

Process control software, filling machine speed, and rotary filling machines optimize production line performance, with data acquisition systems and weight measurement accuracy ensuring traceability and accuracy. Maintenance procedures and label application systems maintain equipment functionality, and high-speed bottling lines cater to increasing demand. According to recent research, the market is expected to grow by 5% annually, as the industry adapts to the evolving consumer preference for convenient and safe Food And Beverage Packaging solutions. For instance, a leading food manufacturer achieved a 20% increase in production efficiency by implementing a rotary filler system with a remote diagnostics system and precision filling control.

The Rotary fillers segment was valued at USD 699.40 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

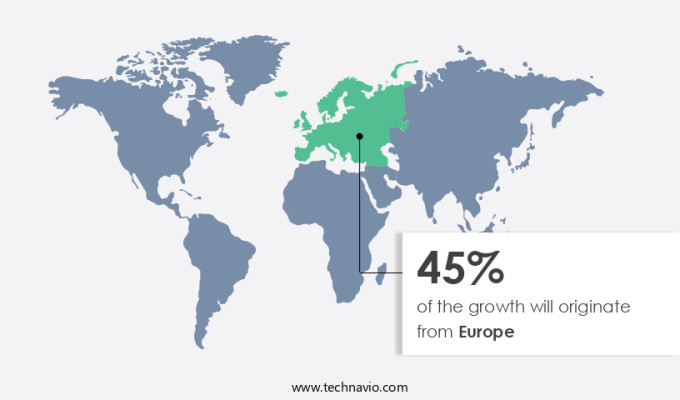

Europe is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The European food and beverage industry, as the largest manufacturing sector in the EU, experiences significant growth due to increasing population and disposable income. This expansion drives the demand for advanced filling equipment to maintain production efficiency and ensure product quality. Filling equipment automation, such as piston filling technology and linear filling machines, plays a crucial role in enhancing overall equipment effectiveness (OEE) and reducing product changeover time. Aseptic filling processes and clean-in-place systems ensure sanitary design features, enabling the production of safe and hygienic products. Energy consumption metrics are increasingly important, leading to the adoption of pneumatic filling systems and automatic capping systems for improved material handling efficiency.

Innovative technologies, like precision filling control and remote diagnostics systems, contribute to production line efficiency and downtime reduction. Waste reduction methods, such as process control software and filling machine speed optimization, further boost the market's growth. For instance, a leading food and beverage manufacturer in the UK achieved a 20% reduction in production downtime by implementing a high-speed bottling line with advanced filling technology. The European the market is expected to grow by over 5% annually, fueled by the increasing demand for automation and innovation. The market encompasses various solutions, including rotary filling machines, data acquisition systems, weight measurement accuracy, conveyor belt systems, product traceability systems, and label application systems.

Maintenance procedures and volume filling accuracy are essential considerations to ensure long-term equipment performance and customer satisfaction.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for automated and high-performance filling solutions. High-speed liquid filling machines and automatic bottle filling systems are becoming increasingly popular, as they offer precision filling capabilities for viscous products and ensure sanitary design for food applications. Sanitation and cleanliness are critical factors in the food and beverage industry, and filling equipment must adhere to stringent clean-in-place system validation requirements. Automated capping and labeling systems, integrated packaging solutions, and production line optimization strategies are essential components of modern filling systems, helping to reduce downtime and improve efficiency in the filling process. Advanced process control software, remote monitoring filling systems, and predictive maintenance strategies are also gaining traction in the market. These technologies enable data-driven filling optimization, ensuring filling machine reliability and reducing the total cost of ownership. Robust filling machine design and flexible changeover filling systems are also essential for meeting the diverse needs of the food and beverage industry. Weight measurement calibration is another critical aspect of filling equipment, ensuring accurate and consistent product filling. Food safety compliance standards continue to evolve, and filling equipment manufacturers must prioritize these regulations to ensure the safety and quality of their products. Overall, The market is expected to continue growing, driven by the need for efficient, reliable, and flexible filling solutions.

What are the key market drivers leading to the rise in the adoption of Food And Beverage Filling Equipment Industry?

- The focus on enhancing the efficiency and accuracy of document filling is a primary market driver for Professional Services.

- In the food processing industry, accuracy and efficiency are paramount to ensure product quality and higher productivity. Filling equipment plays a crucial role in maintaining these parameters. With under-filled containers posing a risk to consumer satisfaction and brand reputation, food processing companies prioritize the use of advanced filling equipment. Highly accurate filling machines maximize operational throughput, minimize downtime, and reduce maintenance requirements. The accuracy of filling equipment depends on the specific product and filling technology employed. For instance, a study revealed that implementing a volumetric filling system led to a 15% increase in production efficiency for a leading food processing company.

- The market is projected to grow by over 4% annually, driven by the increasing demand for automated and efficient production processes.

What are the market trends shaping the Food And Beverage Filling Equipment Industry?

- The brewing industry is experiencing significant growth and represents an emerging market trend.

- Beer production is a significant industry, with China, the US, Brazil, Germany, and Mexico being among the leading countries. China, in particular, has seen a robust increase in beer production, with growth nearly in double digits in percentage terms. In 2020, China was the world's largest beer producer and consumer. The country's advantage lies in its availability of low-cost skilled labor, enabling bulk production. The US and Brazil rank second and third in beer production. The demand for beer is driven by several factors.

- Rapid economic development, altering consumer spending patterns, and rising disposable incomes are the primary reasons for the growth in the beer market. These trends are expected to continue, leading to a surge in demand for beer in the coming years. The beer industry is witnessing a burgeoning growth, offering numerous opportunities for businesses.

What challenges does the Food And Beverage Filling Equipment Industry face during its growth?

- The increasing energy costs pose a significant challenge to the growth of various industries.

- The market is driven by the increasing demand for automated production processes in the food and beverage industry. However, rising energy costs pose a significant challenge for end-users, as filling equipment consumes a substantial amount of electrical energy. For instance, high-viscosity food products and those with large particulates require more power due to the increased stress on the filler's rotor. Consequently, vacuum fillers and pressure fillers, which use vacuum and pressure, respectively, for filling operations, also have high energy consumption rates.

- According to recent industry reports, the market is expected to grow by over 5% annually, driven by the need for efficient and cost-effective production solutions.

Exclusive Customer Landscape

The food and beverage filling equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food and beverage filling equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food and beverage filling equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Aetnagroup S.p.A - This company specializes in providing advanced liquid filling solutions through innovative machines like the Libra R, Libra LT, and Libra FLEX. Their offerings cater to various industries, ensuring efficient and accurate filling processes. These machines are renowned for their versatility, adaptability, and high-performance capabilities.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Aetnagroup S.p.A

- APACKS

- ATS Automation Tooling Systems Inc.

- CDA France

- COZZOLI MACHINE Co.

- ECOLEAN AB

- GEA Group AG

- Hema

- IMA Industria Macchine Automatiche Spa

- INDEX 6 Ltd.

- John Bean Technologies Corp.

- KHS GmbH

- Krones AG

- OPTIMA packaging group GmbH

- Riggs Autopack Ltd.

- Serac Group SA

- Shemesh Automation Ltd.

- Tetra Pak Group

- Trepko Group

- UFlex Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food And Beverage Filling Equipment Market

- In January 2024, Tetra Pak, a leading food processing and packaging solutions company, launched its new Aseptic Drinking Carton Fillers, the Tetra Flex™ Edge 360 and Tetra Flex™ Edge 360 Eco, designed to enhance production efficiency and sustainability in the dairy and beverage industries (Tetra Pak Press Release).

- In March 2024, KHS, a global solutions provider for the beverage, food, and non-food industry, announced a strategic partnership with Schmalbach-Lubeca, a German filling technology specialist, to expand its portfolio of filling systems and strengthen its presence in the European market (KHS Press Release).

- In May 2024, Bosch Packaging Technology, a global supplier of process and packaging technology, secured a significant order from Danone, a leading food company, to supply its VFFS (Vertical Form, Fill, and Seal) packaging technology for a new production line in the United States, marking a substantial expansion for Bosch in the North American market (Bosch Packaging Technology Press Release).

- In February 2025, the European Union approved new regulations on single-use plastics, which included restrictions on the use of certain types of food and beverage packaging, driving increased demand for sustainable filling equipment solutions, such as those utilizing cartons and PET bottles (European Commission Press Release).

Research Analyst Overview

- The market for food and beverage filling equipment continues to evolve, driven by advancements in technology and shifting consumer preferences. The integration of material handling robots, cartoning equipment, and vision inspection systems streamlines production processes and enhances product quality. CIP cleaning validation and container sterilization ensure hygiene standards, while product contamination control systems mitigate risks. Flexible filling solutions cater to various product viscosities, from jar filling systems to pouch filling machines. Equipment lifecycle cost, spare parts inventory management, and automated process control are essential considerations for optimizing production and reducing downtime. Leak detection systems and filling valve technology ensure product integrity, and operator training programs maintain a skilled workforce.

- According to recent studies, the market is projected to grow by over 5% annually, with increasing demand for can sealing technology and case packing machines. For instance, a leading food manufacturer experienced a 15% increase in production efficiency by implementing a new filling machine with advanced automated process control and maintenance scheduling features.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food And Beverage Filling Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.38% |

|

Market growth 2024-2028 |

USD 825.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.96 |

|

Key countries |

Germany, US, China, The Netherlands, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food And Beverage Filling Equipment Market Research and Growth Report?

- CAGR of the Food And Beverage Filling Equipment industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, APAC, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food and beverage filling equipment market growth of industry companies

We can help! Our analysts can customize this food and beverage filling equipment market research report to meet your requirements.