Food And Beverage Packaging Market Size 2025-2029

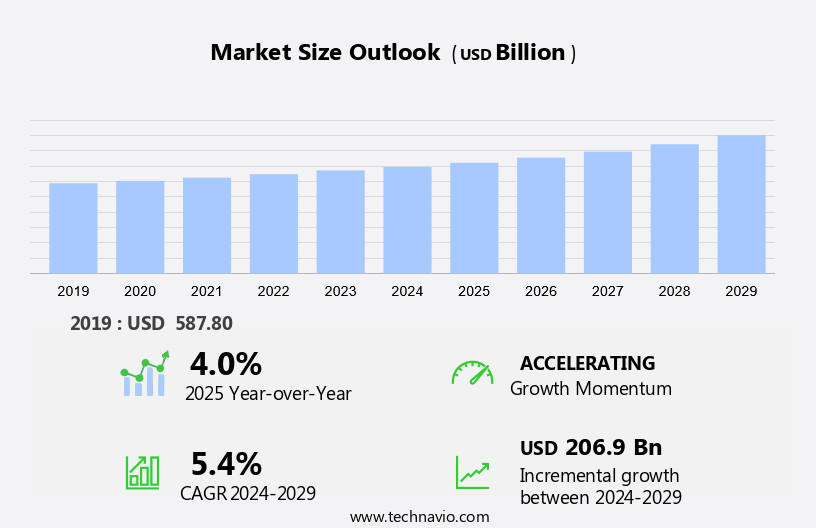

The food and beverage packaging market size is forecast to increase by USD 206.9 billion at a CAGR of 5.4% between 2024 and 2029.

What will be the Size of the Food And Beverage Packaging Market During the Forecast Period?

How is this Food And Beverage Packaging Industry segmented and which is the largest segment?

The food and beverage packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Plastic

- Glass

- Metal

- Biodegradable materials

- Application

- Beverages

- Food

- Frozen foods

- Others

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- North America

- Canada

- US

- South America

- Middle East and Africa

- APAC

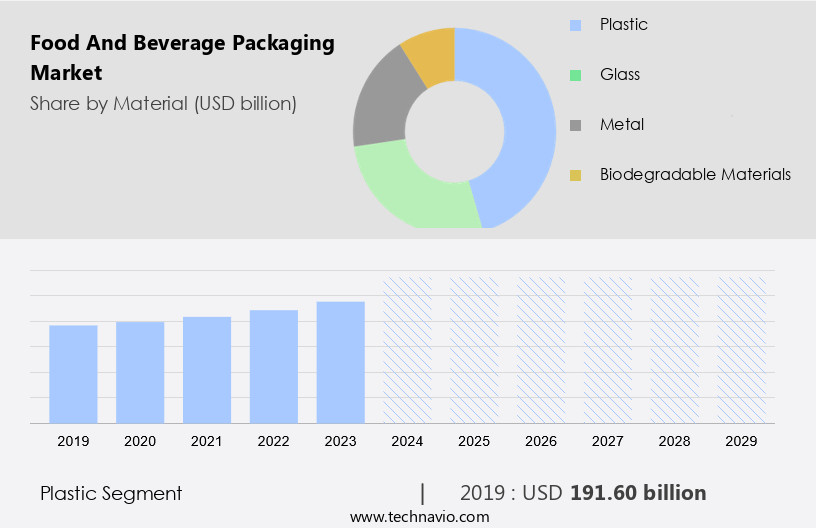

By Material Insights

The plastic segment is estimated to witness significant growth during the forecast period. The market is driven by the widespread use of plastic packaging due to its versatility, durability, and cost-effectiveness. Plastics, including polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), and polystyrene (PS), serve distinct functions in this sector. PE, specifically low-density PE (LDPE) and high-density PE (HDPE), is extensively used due to its flexibility and strength, respectively. LDPE is popular in fresh produce packaging, while HDPE is commonly used in milk and juice containers. PET, another crucial material, dominates the beverage sector. Packaging research focuses on enhancing packaging efficiency, food protection, and adherence to food safety standards. Sustainable packaging solutions, such as bio-based materials, e-commerce packaging, compostable packaging, and tampering indicators, are gaining popularity for their role in food waste reduction and packaging sustainability.

Packaging trends include temperature indicators, temperature control packaging, packaging automation, and sustainable packaging development. Packaging cost optimization, packaging compliance, and minimizing environmental impact are key considerations for industry players. Polylactic acid (PLA) and other eco-friendly packaging materials are increasingly used for their reduced environmental impact. The packaging industry continues to innovate with bioplastic packaging, recyclable packaging solutions, and circular economy packaging. Packaging logistics, consumer behavior, portion-controlled packaging, and accessibility are also critical factors influencing market growth.

Get a glance at the market report of various segments Request Free Sample

The Plastic segment was valued at USD 191.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

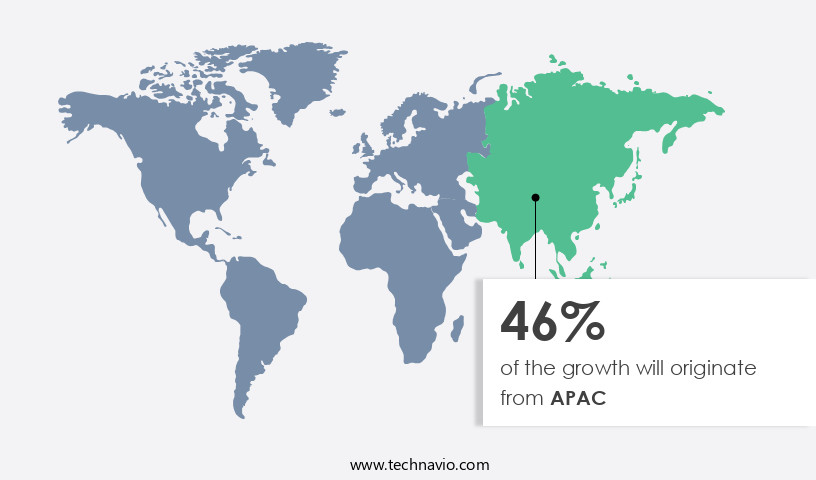

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Asia Pacific the market is experiencing notable growth due to rising consumption, technological advancements, and sustainability initiatives. With India being a significant contributor, per capita packaging consumption has nearly doubled over the past decade, reaching 8.6 kg in 2023. This growth underscores the sector's importance In the Indian economy, where it ranks as the fifth largest sector. The market is expanding at an annual rate of 22%-25%, making India an attractive hub for innovative packaging solutions. Sustainability is a key focus In the Asia Pacific packaging market, with a shift towards bio-based materials, compostable packaging, and circular economy packaging.

Packaging cost optimization, temperature control, and freshness preservation are crucial considerations. Packaging regulations, branding, and labeling are essential aspects of the industry, with a growing emphasis on PLA packaging, recyclable solutions, and sustainable manufacturing processes. The food supply chain, packaging logistics, and consumer behavior also influence market trends. Packaging automation, temperature indicators, and freshness indicators are crucial for food preservation and food safety standards. Packaging materials, such as eco-friendly and biodegradable options, are gaining popularity to reduce waste and minimize environmental impact.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Food And Beverage Packaging Industry?

- Increase in consumption of beverages is the key driver of the market.The market is significantly driven by the increasing consumption of beverages and food products. This trend necessitates advanced and efficient packaging solutions to maintain product quality, safety, and freshness throughout the food supply chain. In 2023, global beer consumption reached approximately 187.9 million kiloliters, an increase of around 200,000 kiloliters from the previous year. This growth represents a demand for over 296.9 billion 633 ml bottles, highlighting the need for robust packaging that can handle large volumes while minimizing waste and environmental impact. Packaging research and development focus on innovations such as bio-based materials, compostable packaging, and sustainable packaging solutions to reduce food waste and improve sustainability.

Packaging technology advances include temperature control packaging, tampering indicators, and freshness and temperature indicators to ensure food safety and preserve product quality. Packaging cost optimization and compliance with food safety standards are also critical factors In the market. Packaging automation, branding, and labeling are essential for efficient production and effective marketing. Meal kit packaging, e-commerce packaging, and portion-controlled packaging cater to changing consumer behavior and preferences. Bulk containers, carton packaging, and pouch packaging are popular choices for cost-effective and accessible solutions. The use of eco-friendly packaging materials, such as polylactic acid (PLA), and recyclable packaging solutions, aligns with the circular economy and reduces the environmental impact of the packaging industry.

Packaging trends include the adoption of bioplastics, plant-based packaging, and circular economy packaging, which prioritize sustainability and waste reduction. Temperature control packaging, freshness indicators, and temperature indicators are essential for food preservation and safety. Packaging logistics and accessibility are also critical considerations for the food and beverage industry. In conclusion, the market is driven by the increasing consumption of food and beverages, which necessitates advanced and efficient packaging solutions. Packaging research and development focus on sustainability, cost optimization, and food safety, while packaging technology advances enable better product preservation and waste reduction. Packaging automation, branding, and labeling are essential for efficient production and effective marketing.

The use of eco-friendly and recyclable packaging materials and solutions aligns with the circular economy and reduces the environmental impact of the packaging industry.

What are the market trends shaping the Food And Beverage Packaging market?

- Strategic collaborations is the upcoming market trend.The market is experiencing a notable shift towards sustainable and innovative solutions, driven by consumer preferences for convenience, freshness, and environmental responsibility. This trend is reflected In the increasing number of strategic collaborations between industry players. For instance, in February 2024, Amcor plc, Stonyfield Organic, and Cheer Pack North America joined forces to develop an all-polyethylene (PE) spouted pouch. This groundbreaking packaging solution offers enhanced moisture and oxygen barrier properties, ensuring the freshness and quality of yogurt. Packaging research and development are key areas of focus, with a growing emphasis on packaging efficiency, food protection, and compliance with food safety standards.

Packaging technology is advancing rapidly, with the adoption of bio-based materials, freshness indicators, temperature indicators, and temperature control packaging. Sustainable packaging solutions, such as compostable packaging and circular economy packaging, are gaining popularity due to their cost optimization and reduced environmental impact. Moreover, the food supply chain is increasingly relying on packaging to minimize food waste and ensure food preservation. Packaging automation, branding, labeling, and logistics are also critical aspects of the packaging industry, with a strong focus on consumer behavior and accessibility. Durable and innovative packaging materials, such as polylactic acid (PLA) and bioplastics, are being adopted to reduce packaging waste and minimize the environmental impact of the industry.

In conclusion, the market is undergoing significant changes, driven by consumer demands for sustainable, convenient, and high-quality packaging solutions. Strategic collaborations, packaging research and development, and the adoption of advanced packaging technologies are key trends shaping the future of the industry.

What challenges does the Food And Beverage Packaging Industry face during its growth?

- High costs associated with sustainable packaging solutions is a key challenge affecting the industry growth.The market is driven by the need for efficient, safe, and sustainable solutions. Packaging research continues to focus on improving food protection and preservation, adhering to food safety standards, and reducing waste. Sustainable packaging trends include the use of bio-based materials, compostable packaging, and circular economy packaging. However, these eco-friendly options often come with a higher cost compared to traditional packaging materials, such as polylactic acid (PLA) and other bioplastics. The cost difference can range from 20% to 30%. For instance, a simple cardboard box may cost less than USD1, while a recycled plastic container could be slightly more expensive, depending on its size and quality.

Packaging automation, branding, labeling, and logistics are also key industry trends. The food supply chain, food processing, and consumer behavior continue to influence packaging development. As the market evolves, recyclable packaging solutions and eco-friendly materials, such as carton packaging, pouch packaging, and bioplastic packaging, are becoming increasingly popular. Packaging cost optimization is a crucial consideration for businesses, as they strive to balance sustainability and affordability. Freshness indicators, temperature indicators, and temperature control packaging are essential for maintaining food quality during transportation and storage. Packaging compliance with regulations and minimizing environmental impact are also important factors In the market.

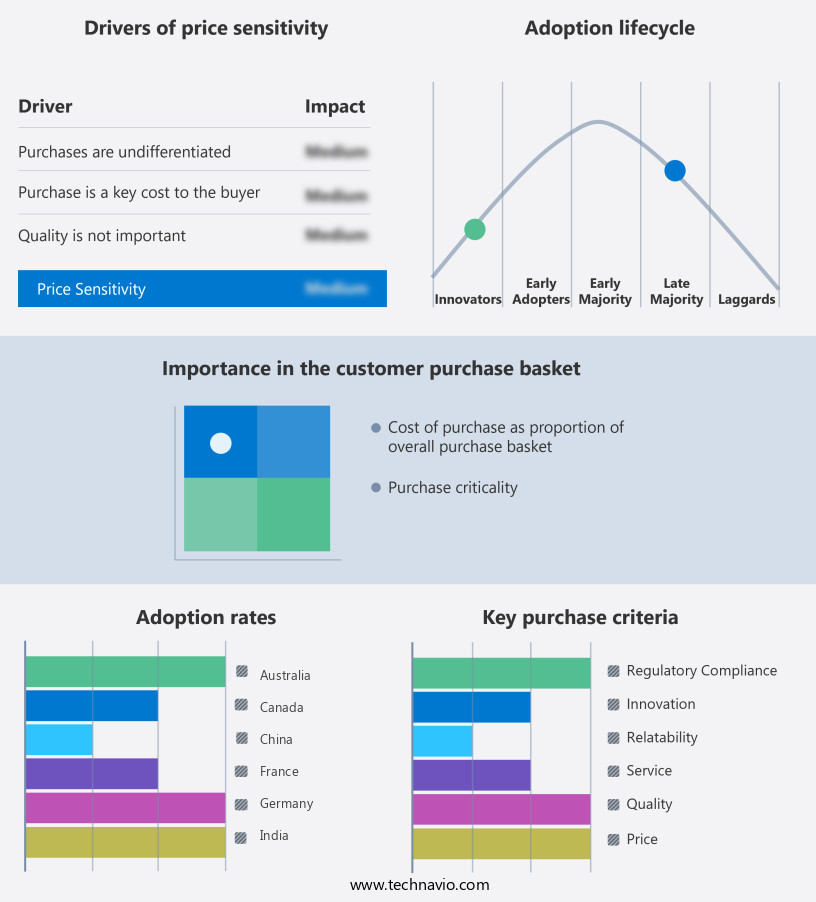

Exclusive Customer Landscape

The food and beverage packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food and beverage packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food and beverage packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Amcor Plc - The company provides a range of food packaging solutions for the market, encompassing AmFiber Performance Paper, EcoGuard, AmPrima Recycle-Ready Solutions, PrimeSeal, LifeSpan, Form-Tite, Flow-Tite, and Packpyrus Paper Base Web. These offerings cater to diverse industry requirements, ensuring product protection, sustainability, and enhanced consumer experience. AmFiber Performance Paper, for instance, offers superior strength and moisture resistance, while EcoGuard ensures food safety with its antimicrobial properties. AmPrima Recycle-Ready Solutions promote circular economy, as they are designed for easy recycling. PrimeSeal and Form-Tite deliver secure seals, preventing contamination and extending shelf life. LifeSpan offers extended durability, and Flow-Tite ensures uniform flow of contents. Packpyrus Paper Base Web provides a sustainable alternative to plastic, contributing to reduced carbon footprint. Overall, these solutions address the evolving needs of the food packaging industry, prioritizing sustainability, functionality, and consumer convenience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- American Packaging Corp.

- Ball Corp.

- Berry Global Inc.

- Crown Holdings Inc.

- EPL Ltd.

- Graphic Packaging Holding Co.

- O I Glass Inc.

- PAREKHPLAST INDIA LTD.

- Pearl Polymers Limited

- Sealed Air Corp.

- SIG Group AG

- Smurfit Kappa Group

- Sonoco Products Co.

- TCPL Packaging Ltd

- Tetra Pak International SA

- UFlex Ltd.

- WestRock Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The packaging industry plays a crucial role In the food and beverage sector, ensuring product protection, preservation, and safety throughout the supply chain. Packaging research continues to prioritize efficiency and sustainability, with a focus on reducing food waste and environmental impact. Packaging technology advances have led to innovations such as temperature control packaging, freshness indicators, and tampering indicators. These solutions help maintain food quality and safety, extending shelf life and enhancing consumer confidence. Cost optimization is another significant consideration In the packaging industry. Polylactic acid (PLA) and other eco-friendly packaging materials have gained popularity due to their sustainability and cost-effectiveness.

Bio-based materials, compostable packaging, and circular economy packaging are all part of this trend, aligning with consumer preferences for more sustainable options. Regulations and compliance are essential aspects of the food packaging market. Strict food safety standards dictate the use of specific packaging materials and manufacturing processes. Automation and labeling technologies have streamlined compliance processes, ensuring accurate and consistent adherence to regulations. Packaging development is a continuous process, driven by consumer behavior and market trends. Meal kit packaging, portion-controlled packaging, and e-commerce packaging are all areas of growth, reflecting changing consumer preferences and shopping habits. Sustainability remains a key focus In the food packaging industry, with a shift towards plant-based and bioplastic packaging solutions.

Durable and recyclable packaging options are also in demand, as the industry strives to minimize waste and reduce its environmental footprint. Packaging marketing plays a significant role in differentiating brands and products. Effective branding and labeling strategies can help companies stand out in a crowded market, while clear and accessible packaging designs cater to consumer needs and preferences. The food processing industry also benefits from advanced packaging technologies, with temperature control and protective packaging solutions ensuring product integrity during transportation and storage. Packaging logistics is another critical aspect of the food supply chain, with efficient and cost-effective solutions essential for maintaining product freshness and reducing waste.

In conclusion, the market is a dynamic and evolving industry, driven by consumer preferences, sustainability initiatives, and technological advancements. Companies that prioritize innovation, efficiency, and sustainability are well-positioned to succeed in this competitive landscape.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

216 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 206.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Japan, India, UK, Germany, South Korea, France, Australia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food And Beverage Packaging Market Research and Growth Report?

- CAGR of the Food And Beverage Packaging industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food and beverage packaging market growth of industry companies

We can help! Our analysts can customize this food and beverage packaging market research report to meet your requirements.