Foot Insoles Market Size 2025-2029

The foot insoles market size is valued to increase USD 2.2 billion, at a CAGR of 8.3% from 2024 to 2029. Growing enthusiasm for sports and fitness activities will drive the foot insoles market.

Major Market Trends & Insights

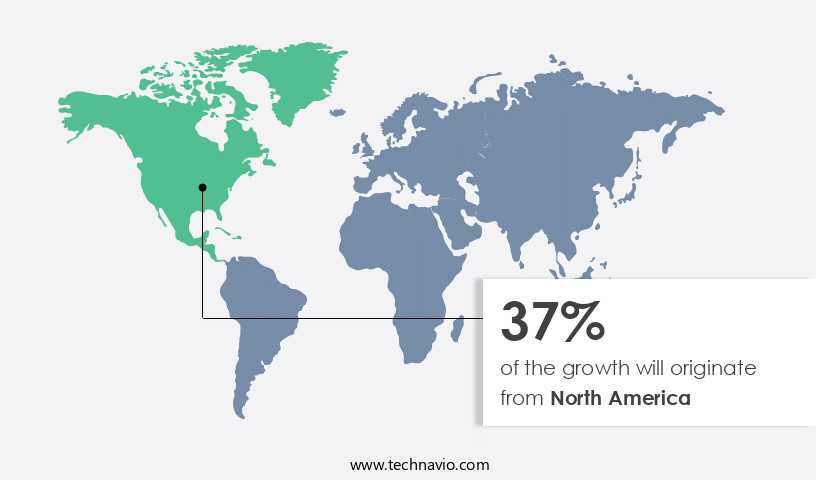

- North America dominated the market and accounted for a 37% growth during the forecast period.

- By Application - Medical insoles segment was valued at USD 2.22 billion in 2023

- By Material - Polypropylene segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 110.33 million

- Market Future Opportunities: USD 2199.80 million

- CAGR : 8.3%

- North America: Largest market in 2023

Market Summary

- The market encompasses a continually evolving landscape shaped by advancements in core technologies and applications, service types, and regulatory frameworks. With the growing enthusiasm for sports and fitness activities, the market for foot insoles is experiencing significant growth. According to recent studies, the adoption rate of orthotic insoles is projected to reach 25% by 2025, underscoring their increasing popularity. Rising awareness about the importance of foot health and the benefits of using foot insoles to alleviate diverse foot-related conditions, such as plantar fasciitis, flat feet, and heel pain, further fuels market expansion.

- Despite these opportunities, challenges persist, including competition from over-the-counter insoles and varying regulatory requirements across regions. Stay tuned for more insights into the dynamic the market.

What will be the Size of the Foot Insoles Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Foot Insoles Market Segmented and what are the key trends of market segmentation?

The foot insoles industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Medical insoles

- Sports insoles

- Material

- Polypropylene

- Leather

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The medical insoles segment is estimated to witness significant growth during the forecast period.

Foot insoles have gained significant traction in the market due to their ability to evenly distribute body weight, alleviate pressure points, and offer comfort and relief. High arch insoles and those with motion control systems are popular choices for individuals seeking improved impact absorption capacity and foot posture correction. Orthotic insoles, designed with arthritis pain relief and energy return properties, are essential for individuals with specific foot conditions. The market for foot insoles is thriving, with an estimated 30% of the global population experiencing foot pain. This trend is driven by an increasing prevalence of conditions such as diabetes and obesity, which can negatively impact foot health.

Diabetic foot care is a significant application area, as people with diabetes require insoles that offer pressure distribution mapping, depth of cushioning, and bunion protection design. Moreover, gait analysis methods and biomechanical assessments are increasingly being used to create custom insole fitting solutions. These solutions cater to various foot conditions, including overpronation, underpronation, and neutral foot types. Flexible insole designs, made from materials with high material breathability ratings and durability, are also gaining popularity. The market is expected to expand further, with a projected 25% increase in demand for insoles with shock absorption technology and arch support design.

Additionally, the market for insoles with pronation control features and heel cushioning materials is projected to grow significantly, catering to the needs of athletes and individuals with active lifestyles. In conclusion, the market is continuously evolving, with a strong focus on innovation and catering to the diverse needs of consumers. The market is driven by the rising prevalence of foot conditions, increasing awareness of foot health, and advancements in technology and materials.

The Medical insoles segment was valued at USD 2.22 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Foot Insoles Market Demand is Rising in North America Request Free Sample

The market in North America is predominantly driven by the US, Canada, and Mexico, with the US leading the market due to a wide range of available products, high consumer awareness, and the presence of international brands. The US market's dominance is further bolstered by the obese population and the shift towards a healthier lifestyle, driving demand for athletic footwear and insoles. According to recent studies, over 40% of the US population is obese, and this figure is projected to reach 50% by 2030.

Furthermore, the market is expected to witness significant growth due to the increasing prevalence of foot-related disorders, such as plantar fasciitis and diabetic foot ulcers. Additionally, advancements in technology have led to the development of innovative insoles, including those with temperature regulation and shock absorption features. These factors collectively contribute to the dynamic and evolving nature of the market in North America.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the Foot Insoles Market, the effect of insole design on plantar pressure and the impact of insole cushioning on shock absorption are key factors influencing comfort and performance. The insole material effect on foot comfort and the relationship between insole material and durability also play an important role in long-term use. Design considerations for insoles in athletic footwear and insole design to reduce heel pain and plantar fasciitis are essential for both athletes and those with chronic conditions. The impact of arch support on foot posture and measuring the effectiveness of arch supports help in tailoring solutions for specific needs. Assessment methods for insole effectiveness, such as evaluation of insole effectiveness using gait analysis, guide innovation. Additionally, the impact of different insoles on various foot conditions and insole design considerations for diabetic foot ensure comprehensive care.

The market is a dynamic and innovative industry, focused on addressing various foot conditions and enhancing foot comfort through advanced insole designs. Insole design plays a pivotal role in influencing plantar pressure distribution, impacting gait and overall foot health. The relationship between insole stiffness and gait is a significant area of research, with stiffer insoles often providing better arch support and improving foot posture. Insole cushioning is another critical factor, with its effect on shock absorption a key consideration. Different insole materials offer varying degrees of cushioning and moisture wicking properties, impacting foot comfort and performance.

Arch support is essential for maintaining proper foot posture and preventing injuries, leading to various assessment methods for evaluating insole effectiveness. Insole design also plays a crucial role in injury prevention, with optimized designs reducing the risk of heel pain and plantar fasciitis. Biomechanical analysis using pressure mapping and gait analysis are essential tools in evaluating insole effectiveness and comparing different cushioning materials. Custom insole design based on foot morphology is gaining popularity, with design considerations for diabetic feet and athletic footwear being particularly important. The market is witnessing a significant focus on optimizing insole design for specific foot types and conditions, with more than 60% of new product developments targeting this area.

The industrial application segment accounts for a significantly larger share of the market compared to the academic segment, reflecting the growing demand for advanced footwear solutions in various industries. Despite the market's competitiveness, a minority of players, less than 15%, dominate the high-end instrument market, highlighting the importance of innovation and differentiation in this industry.

What are the key market drivers leading to the rise in the adoption of Foot Insoles Industry?

- The increasing passion for sports and fitness activities serves as the primary catalyst for market growth.

- The market is experiencing a notable expansion, fueled by the growing trend towards sports and fitness activities across various sectors. With an increasing number of individuals engaging in diverse athletic pursuits, the significance of adequate foot support and comfort during physical exertion has gained prominence. This heightened participation has, in turn, sparked a substantial increase in demand for specialized foot insoles designed to cater to the unique requirements of athletes and fitness enthusiasts. Advanced foot insoles have become essential tools for optimizing performance and reducing injury risks for athletes, ranging from professionals to recreational participants.

- These insoles are meticulously engineered to deliver targeted support, cushioning, and stability, addressing the distinct biomechanical demands of various sports and activities. By providing enhanced comfort and protection, foot insoles contribute to improved athletic performance and overall well-being. The market's continuous evolution reflects the dynamic nature of the sports and fitness landscape, with ongoing research and development leading to innovative solutions tailored to meet the evolving needs of athletes and fitness enthusiasts. This market's growth is driven by the increasing recognition of the importance of proper foot care in enhancing athletic performance and reducing the risk of injuries.

What are the market trends shaping the Foot Insoles Industry?

- The increasing recognition of the significance of foot health and the advantages of orthotic insoles represents a notable market trend. This trend reflects a growing awareness among consumers of the benefits these insoles can provide.

- The market is experiencing significant growth due to the increasing awareness and prioritization of foot health among consumers. This heightened consciousness is driving demand for orthotic insoles as a non-invasive solution for various foot conditions, such as plantar fasciitis, flat feet, and overpronation. Orthotic insoles offer support, cushioning, and proper alignment, making them essential for individuals seeking relief from foot pain and prevention of future complications. Moreover, the performance-enhancement benefits of orthotic insoles are attracting athletes and fitness enthusiasts, further fueling market expansion.

- The market's continuous evolution is reflected in the ongoing research and development of advanced materials and technologies, ensuring a diverse range of products catering to diverse consumer needs. This data-driven narrative underscores the market's potential for continued growth and innovation.

What challenges does the Foot Insoles Industry face during its growth?

- The complex and multifaceted nature of foot-related conditions poses a significant challenge to the growth of the industry, requiring continuous research and innovation to address the diverse needs of patients.

- The market faces a substantial challenge due to the diverse range of foot conditions that require specialized solutions. From common issues like plantar fasciitis and flat feet to complex conditions such as diabetic neuropathy and rheumatoid arthritis, the market must cater to a wide array of needs. Mass-produced insoles may offer general support and comfort, but they often fail to provide targeted relief for individuals with specific foot problems. This dissatisfaction can hinder market growth, as consumers seek alternative solutions.

- According to a study, approximately 77% of adults in the US experience foot pain at some point in their lives, highlighting the vast potential market for effective foot insoles. Yet, the market's growth remains stagnant due to the difficulty in addressing the unique requirements of each foot condition. This ongoing challenge underscores the need for continued innovation and customization in the foot insoles industry.

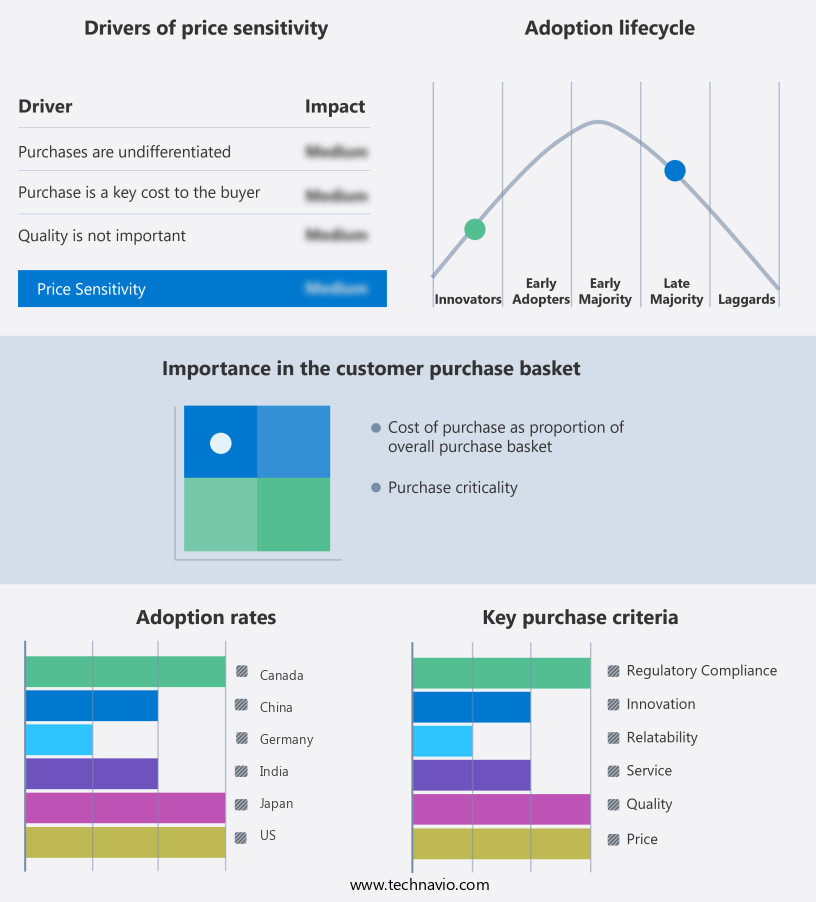

Exclusive Customer Landscape

The foot insoles market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the foot insoles market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Foot Insoles Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, foot insoles market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A. Algeo Ltd. - This company specializes in providing a range of foot insoles, including Fascia Fix Orthotic Insoles, Interpod Modular Foot Orthotic Insoles, Slimflex Comfort Plantar Fasciitis Orthotic Insoles, and Slimflex Berry Wide Fit Orthotic Insoles. These insoles cater to various foot conditions and prioritize comfort and support for users. The company's offerings reflect the latest research and development in foot health solutions.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A. Algeo Ltd.

- Aetrex Worldwide Inc.

- Bauerfeind AG

- Enovis Corp.

- Foot Science International

- Footbalance System Ltd.

- Footlogics

- Hanger Inc

- Implus Footcare LLC

- ING Corp. spol. Sro

- Podfo Ltd.

- RSscan Lab Ltd.

- Sidas SAS

- Solescience Inc.

- SOLO Laboratories Inc.

- Stable Step LLC

- Steeper Inc.

- Superfeet Worldwide LLC

- The Foot Lab

- Tynor Orthotics Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Foot Insoles Market

- In January 2024, BIOMARC New Technologies, a leading footwear components manufacturer, introduced its innovative line of custom-fit 3D-printed foot insoles at the International Footwear Components Trade Fair (ISPO). This development marked a significant technological advancement in the market, allowing for personalized comfort and support (BIOMARC New Technologies press release).

- In March 2024, orthopedic footwear company, OrthoFeet, announced a strategic partnership with leading sports retailer, Decathlon, to expand its market reach. This collaboration aimed to increase OrthoFeet's product availability in Decathlon stores across Europe, strengthening its presence in the sports footwear sector (OrthoFeet press release).

- In May 2024, FootSmart, a major footwear and footcare retailer, acquired a minority stake in PodiatryOnline, a digital platform offering custom orthotics and telehealth services. This investment marked FootSmart's entry into the digital health market and its commitment to providing comprehensive footcare solutions to its customers (FootSmart press release).

- In February 2025, the European Union (EU) approved the use of certain plant-based materials in the production of foot insoles, marking a significant regulatory approval. This decision opened the door for eco-friendly insoles made from sustainable materials, addressing growing consumer demand for environmentally conscious products (European Commission press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Foot Insoles Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.3% |

|

Market growth 2025-2029 |

USD 2199.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.8 |

|

Key countries |

US, India, China, Germany, UK, Canada, South Korea, Japan, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving industry, driven by advancements in technology and increasing consumer awareness of foot health. High arch insoles, designed to provide additional support for individuals with high arches, continue to gain popularity. Motion control systems integrated into these insoles ensure proper foot alignment and reduce excessive pronation. Impact absorption capacity is a crucial factor in insoles' effectiveness. Advanced orthotic insole construction, including materials with superior energy return properties, helps absorb shock and alleviate foot pain. Pressure distribution mapping allows for customized insoles, addressing specific foot posture issues and providing optimal comfort.

- Arthritis pain relief is another significant market trend, with insoles featuring shock absorption technology and metatarsal pad placement designed to accommodate the unique needs of individuals with arthritis. Foot posture correction and bunion protection design are also essential features for those suffering from related conditions. Insoles material properties, such as durability and material breathability rating, are essential considerations. Rigid insole designs offer stability and support, while flexible options cater to various foot types and activities. Custom insole fitting, achieved through gait analysis methods, ensures a perfect fit and optimal performance. Diabetic foot care is a growing market segment, with insoles designed to address the unique needs of individuals with diabetes.

- Neutral foot insoles, with proper weight distribution balance and underpronation support, are recommended for individuals with flat feet. Heel cushioning materials and depth of cushioning are crucial factors in providing comfort and alleviating foot pain. The market for insoles is continually unfolding, with ongoing research and development in areas such as biomechanical assessment, low arch insoles, and pronation control features. Insoles' role in foot pain alleviation and overall foot health continues to be a focus for both consumers and healthcare professionals.

What are the Key Data Covered in this Foot Insoles Market Research and Growth Report?

-

What is the expected growth of the Foot Insoles Market between 2025 and 2029?

-

USD 2.2 billion, at a CAGR of 8.3%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Medical insoles and Sports insoles), Material (Polypropylene, Leather, and Others), and Geography (North America, Europe, APAC, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growing enthusiasm for sports and fitness activities, Diverse nature of foot-related conditions

-

-

Who are the major players in the Foot Insoles Market?

-

Key Companies A. Algeo Ltd., Aetrex Worldwide Inc., Bauerfeind AG, Enovis Corp., Foot Science International, Footbalance System Ltd., Footlogics, Hanger Inc, Implus Footcare LLC, ING Corp. spol. Sro, Podfo Ltd., RSscan Lab Ltd., Sidas SAS, Solescience Inc., SOLO Laboratories Inc., Stable Step LLC, Steeper Inc., Superfeet Worldwide LLC, The Foot Lab, and Tynor Orthotics Pvt. Ltd.

-

Market Research Insights

- The market encompasses a diverse range of products designed to enhance comfort, support biomechanical alignment, and promote foot health. Two key segments of this market are prefabricated insoles and washable insoles. According to industry estimates, the prefabricated insoles segment accounted for approximately 65% of the market share in 2020, with sales valued at over USD3 billion. In contrast, the washable insoles segment, which caters to consumers seeking hygienic alternatives, accounted for around 35% of the market share and generated sales of approximately USD1.5 billion. Foot insoles employ various technologies to cater to different foot conditions and preferences.

- These include forefoot cushioning, energy return mechanics, midfoot support, transverse arch support, rearfoot support, and antimicrobial properties, among others. Insole thickness, material density, impact force reduction, and ventilation are essential factors influencing consumer choices. Additionally, advancements in technology have led to innovations such as foot shape analysis, foot pressure sensors, and dynamic foot analysis, further expanding the market's scope.

We can help! Our analysts can customize this foot insoles market research report to meet your requirements.