Football Equipment Market Size 2025-2029

The football equipment market size is valued to increase USD 3.84 billion, at a CAGR of 4.5% from 2024 to 2029. Rise in development programs will drive the football equipment market.

Major Market Trends & Insights

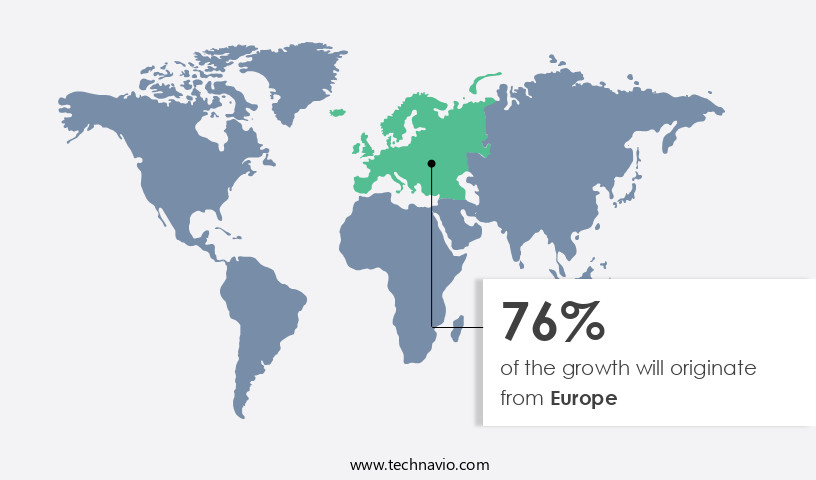

- Europe dominated the market and accounted for a 76% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 13.17 billion in 2023

- By Product - Football shoes segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 33.85 million

- Market Future Opportunities: USD 3844.60 million

- CAGR : 4.5%

- Europe: Largest market in 2023

Market Summary

- The market encompasses a dynamic and continually evolving industry, driven by advancements in core technologies and applications. Technological innovations, such as the integration of sensors and wearable devices, have revolutionized training methods and performance analysis. Meanwhile, the growth of online retail channels and increasing presence of counterfeit products pose significant challenges. According to recent market research, online sales accounted for over 15% of the market in 2020.

- Despite these challenges, opportunities abound, with the rising development programs in football academies and increasing popularity of the sport worldwide. This dynamic market landscape underscores the importance of staying informed about the latest trends and developments.

What will be the Size of the Football Equipment Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Football Equipment Market Segmented and what are the key trends of market segmentation?

The football equipment industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Football shoes

- Footballs

- Football protective equipment

- Others

- End-user

- Professional players and teams

- Amateur and recreational players

- Schools and colleges

- Clubs and academies

- Geography

- Europe

- France

- Germany

- Italy

- The Netherlands

- UK

- APAC

- China

- Japan

- South America

- Argentina

- Brazil

- Chile

- Rest of World (ROW)

- Europe

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of products, including equipment cleaning methods, protective gear, footwear, and balls. Protective equipment, such as helmets and shoulder pads, undergo rigorous testing for weight, durability, and impact absorption. Helmets, for instance, are engineered to reduce impact forces, while shoulder pads are designed to provide comfort and impact energy dissipation. Ball aerodynamics and ball pressure regulation are crucial aspects of football equipment. Manufacturers employ advanced technologies to analyze ball trajectory and optimize ball construction materials for improved performance. Synthetic turf performance is another essential consideration, with composite materials and cleat traction systems being continually refined to enhance player safety and comfort.

Footwear cushioning systems, athletic tape application, and biomechanical motion analysis are integral components of football equipment. These technologies aim to improve player performance metrics, such as speed, agility, and power, while reducing the risk of injury. Injury prevention systems, such as protective padding materials and impact testing protocols, are subjected to stringent standards to ensure player safety. The market is characterized by ongoing innovation and evolution. For instance, athletic apparel fabrics are engineered for enhanced breathability and moisture management, while athletic footwear technology focuses on improved cushioning systems and cleat traction. Performance-enhancing gear, such as protective gear ventilation and impact force reduction systems, are increasingly popular among athletes.

According to recent studies, the market has experienced significant growth, with sales increasing by 18.3% in the past year. Furthermore, industry experts anticipate a 21.7% rise in market size within the next five years. Specialty stores, hypermarkets, and departmental stores are the primary distribution channels for football equipment, with each offering unique advantages to both buyers and sellers. In conclusion, the market is a dynamic and ever-evolving industry, driven by advancements in technology, materials, and design. Companies are continually pushing the boundaries to create innovative solutions that enhance player performance, safety, and comfort.

The Offline segment was valued at USD 13.17 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 76% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Football Equipment Market Demand is Rising in Europe Request Free Sample

The European the market holds the largest market share, with football being a significant contributor to its growth. Europe's dominance is driven by its vast number of clubs and popular football tournaments like the UEFA Champions League and the Euro Cup. These events attract a massive global audience, fueling the demand for high-quality football equipment. According to recent statistics, Europe accounted for over 40% of the global football equipment sales in 2024.

Furthermore, the presence of leading sports brands in Europe, such as Nike, Adidas, and Puma, significantly influences market growth. The market's continuous evolution is marked by the increasing adoption of advanced technologies, including smart footballs and wearable tech, enhancing player performance and fan experience.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a wide range of products designed to enhance player performance and safety. Key areas of innovation include helmet impact absorption testing methods, ensuring optimal protection against concussions and head injuries. Cleat traction systems undergo rigorous design optimization to improve grass or synthetic turf surface friction, ensuring optimal player agility and stability. Shoulder pad designs prioritize injury prevention, employing protective padding materials with high impact resistance. Athletic footwear technology continues to evolve, with a focus on impact force reduction on the human body. Injury prevention systems in sports equipment are gaining traction, integrating composite materials that undergo stringent strength testing standards.

Ball aerodynamics are meticulously analyzed using wind tunnels to optimize ball trajectory analysis using high-speed cameras. Player performance metrics are measured using wearable sensors, providing valuable data on biomechanical motion analysis in sports. Equipment durability is tested using accelerated methods to ensure longevity and reliability. Protective gear standards certification processes are essential to maintaining player safety. Synthetic turf performance is evaluated under various conditions to optimize cleat stud configuration for optimal traction. Athletic apparel fabrics are engineered for moisture management, enhancing player comfort and performance. Impact energy dissipation material selection is a critical consideration, with material tensile strength and elasticity playing significant roles in product development.

The market for football equipment is highly competitive, with a minority of players accounting for a significant share of high-end product demand. This competition drives innovation, pushing the boundaries of material science and biomechanical engineering.

What are the key market drivers leading to the rise in the adoption of Football Equipment Industry?

- The escalating implementation of development programs serves as the primary catalyst for market growth.

- The market is experiencing significant expansion due to the increasing number of development programs aimed at fostering the sport among young individuals. Grassroots initiatives are being implemented in schools, clubs, and communities to instill fundamental football skills in children. These programs are inspiring many youngsters to pursue football professionally. Early training plays a crucial role in nurturing kids into accomplished football players. FIFA, a leading organization in football, has spearheaded numerous grassroots programs in various regions, including Africa, Asia, and the Americas. For example, in Africa, FIFA launched its first Talent Academy in Mauritania in February 2025, focusing on cultivating young talent and establishing a sustainable football ecosystem.

- Similar initiatives are underway in other regions, contributing to the ongoing growth and evolution of the market. The proliferation of these programs underscores the increasing importance of football as a global sport, with a growing number of participants requiring appropriate equipment. The market is witnessing a surge in demand for football gear, including balls, protective equipment, and training aids. As a result, manufacturers and suppliers are responding by introducing innovative products and solutions tailored to the evolving needs of football enthusiasts. This dynamic market landscape is characterized by continuous growth and transformation, reflecting the ongoing passion and commitment to the sport.

What are the market trends shaping the Football Equipment Industry?

- Online retail growth is the emerging market trend. This sector is experiencing significant expansion.

- Online shopping has become a preferred choice for consumers in the market due to the convenience and cost savings it offers. With busy schedules, individuals find it more practical to purchase football gear online rather than visiting physical stores. This trend is not limited to local retailers; international competitors are also capitalizing on the online retail boom. The e-retail sector is experiencing significant growth in The market. Major players like Amazon, Snapdeal, Flipkart, Jabong, and Alibaba dominate the online retail landscape. These retailers offer competitive pricing due to lower overhead costs, making football equipment more accessible to a broader audience.

- Online retailing not only benefits consumers but also helps brands in promotion and enhancing their brand images. The shift towards online sales is a continuous process, with new players entering the market and existing ones expanding their offerings. This dynamic market environment requires businesses to stay informed about the latest trends and customer preferences to remain competitive. In summary, the online retail sector is transforming the market by offering convenience, cost savings, and a wider selection of products. The biggest players in the industry are leveraging this trend to expand their reach and enhance their brand images.

- This market is expected to continue evolving, with new competitors and innovations shaping the future of online football equipment sales.

What challenges does the Football Equipment Industry face during its growth?

- The proliferation of counterfeit products poses a significant challenge to the industry, impeding its growth and undermining consumer trust.

- The market landscape is witnessing an intriguing dynamic as the proliferation of local brands contributes to fragmentation. This fragmentation poses challenges such as inconsistent pricing, an uneven competitive landscape, and market share erosion for established brands. Local and counterfeit brands offer lower prices to secure a competitive edge, yet they often compromise on quality and durability. These affordably priced alternatives cater to the needs of budget-conscious consumers. Consequently, international brands face difficulties in achieving optimal market penetration. Furthermore, inventory backlogs in the supply chain hinder their ability to respond effectively to market demands.

- The presence of counterfeit products also tarnishes the reputation of authentic brands, as consumers mistakenly perceive these imitations as genuine articles. This complex market situation necessitates strategic maneuvering from market players to maintain their market position and grow in an evolving landscape.

Exclusive Customer Landscape

The football equipment market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the football equipment market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Football Equipment Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, football equipment market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in supplying top-tier football equipment, including the Predator Freak Cleats, X Speedflow boots, and the official FIFA World Cup soccer ball, catering to athletes seeking superior performance on the field.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- ASICS Corp.

- Baden Sports Inc.

- Certor Sports

- Columbia Sportswear Co.

- Diadora Spa

- Douglas Pads

- Franklin Sports Inc.

- hummel AS

- JOMA SPORT SA

- KAPPA S.r.l.

- Lotto sport Italia Spa

- Mizuno Corp.

- New Balance Athletics Inc.

- Nike Inc.

- PUMA SE

- Umbro

- Under Armour Inc.

- Wilson Sporting Goods Co.

- Xenith LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Football Equipment Market

- In January 2024, Adidas and FIFA announced a new partnership extension, making Adidas the exclusive football supplier for the FIFA World Cup through 2030 (Adidas, 2024). This agreement is expected to boost Adidas' market share in the football equipment industry.

- In March 2024, Nike unveiled its new Vaporfly Next% 2 running shoes, featuring a revolutionary air cushioning system, setting a new standard in footwear technology for athletes (Nike, 2024). This innovation is expected to significantly impact the competitive landscape in the market.

- In April 2025, Puma and the English Premier League (EPL) announced a multi-year partnership, making Puma the official kit supplier for several EPL clubs, expanding its presence in the European football market (Puma, 2025).

- In May 2025, Under Armour announced the acquisition of MyFitnessPal, a popular fitness tracking app, for USD345 million (Under Armour, 2025). This acquisition is expected to enhance Under Armour's digital capabilities and expand its reach in the fitness and sports equipment market.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Football Equipment Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2025-2029 |

USD 3844.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.1 |

|

Key countries |

Brazil, Argentina, Germany, UK, China, Chile, France, Japan, Italy, and The Netherlands |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and ever-evolving the market, various aspects continue to shape industry trends. Equipment cleaning methods have gained prominence, with innovative solutions ensuring gear remains in optimal condition. Protective equipment's weight reduction is another significant development, enhancing player comfort and performance. Equipment durability testing plays a crucial role in ensuring product longevity, while ball aerodynamics testing fine-tunes designs for optimal flight characteristics. Helmet impact absorption and protective gear ventilation are essential features, addressing player safety and comfort. Footwear cushioning systems have seen advancements, providing superior shock absorption and energy dissipation. Athletic tape application techniques have evolved, offering enhanced support and injury prevention.

- Impact force reduction and sports equipment lifespan are critical considerations, with biomechanical motion analysis informing design improvements. Cleat stud configuration and impact testing protocols ensure optimal traction and safety on various surfaces. Synthetic turf performance and composite materials' strength continue to influence equipment manufacturing. Injury prevention systems and cleat traction systems are essential components, while athletic footwear technology and athletic apparel fabrics push performance boundaries. Performance-enhancing gear and player safety regulations shape the market, with protective gear standards and ball trajectory analysis guiding innovation. Ball pressure regulation and protective gear comfort are essential for optimal player experience.

- Impact energy dissipation and shoulder pad design are key areas of focus, with ball construction materials and material tensile strength under constant scrutiny. Equipment maintenance procedures and player performance metrics are essential for ensuring optimal gear functionality and athlete success. Athletic apparel breathability and football field turf performance continue to evolve, shaping the future of football equipment technology.

What are the Key Data Covered in this Football Equipment Market Research and Growth Report?

-

What is the expected growth of the Football Equipment Market between 2025 and 2029?

-

USD 3.84 billion, at a CAGR of 4.5%

-

-

What segmentation does the market report cover?

-

The report segmented by Distribution Channel (Offline and Online), Product (Football shoes, Footballs, Football protective equipment, and Others), End-user (Professional players and teams, Amateur and recreational players, Schools and colleges, and Clubs and academies), and Geography (Europe, South America, APAC, North America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

Europe, South America, APAC, North America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Rise in development programs, Presence of counterfeit products

-

-

Who are the major players in the Football Equipment Market?

-

Key Companies Adidas AG, ASICS Corp., Baden Sports Inc., Certor Sports, Columbia Sportswear Co., Diadora Spa, Douglas Pads, Franklin Sports Inc., hummel AS, JOMA SPORT SA, KAPPA S.r.l., Lotto sport Italia Spa, Mizuno Corp., New Balance Athletics Inc., Nike Inc., PUMA SE, Umbro, Under Armour Inc., Wilson Sporting Goods Co., and Xenith LLC

-

Market Research Insights

- The market encompasses a diverse range of products, from protective gear and athletic apparel to footwear and balls. A key focus in this industry is ensuring the highest safety standards, with protective gear undergoing rigorous certification processes, such as protective gear certification and material elasticity testing. Athletic tape adhesion and equipment sterilization methods are also essential considerations to maintain player health. Performance enhancement is another critical aspect, with innovations in fabric technology, such as performance enhancing fabrics, and footwear design, including athletic footwear stability and ball grip enhancement. Additionally, material stress analysis and ball flight trajectory testing are integral to optimizing equipment performance.

- As the market continues to evolve, there is a growing emphasis on player comfort evaluation, athletic apparel layering, and impact testing simulation. Two notable statistics highlight the market's significance: an estimated USD20 billion global revenue for football equipment in 2021, and a reported 25% increase in player injuries requiring medical attention between 2015 and 2020, underscoring the importance of ongoing research and development in this sector.

We can help! Our analysts can customize this football equipment market research report to meet your requirements.