Formic Acid Market Size 2025-2029

The formic acid market size is forecast to increase by USD 592.9 million at a CAGR of 5.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for this compound as a preservative in various industries, including food and beverages, pharmaceuticals, and agriculture. Direct syntheses of formic acid in acidic media have made its production more cost-effective and accessible, expanding its application base. However, the market is not without challenges. The presence of cost-effective substitutes, such as acetic acid and propionic acid, poses a threat to formic acid's market share. To capitalize on the opportunities presented by this market, companies must focus on innovation and differentiation.

- Developing new applications and improving the production efficiency of formic acid can help companies gain a competitive edge. In India, the growing demand for cattle feed has led to the use of formic acid as an animal feed preservative. Additionally, collaborations and partnerships with key players in related industries can provide valuable synergies and expand market reach. Overall, the market offers significant growth potential for companies that can navigate the competitive landscape and address the challenges presented by substitutes.

What will be the Size of the Formic Acid Market during the forecast period?

- Formic acid, with the chemical formula HCOOH and recognized as the simplest carboxylic acid and the simplest organic acid, holds a significant position in various industries due to its unique acid properties. This versatile compound is extensively used as a preservative in the dairy sector, livestock feed, and silage preservation. In the energy sector, formic acid is employed as a fuel cell additive, contributing to the reduction of greenhouse gas emissions and carbon footprint, offering sustainable solutions in the context of climate change and the transition away from fossil fuels. Additionally, formic acid plays a crucial role in the production of methanoic acid, transfer hydrogenation, and chemical synthesis.

- Its applications extend to the processed food industry, where it serves as a preservative and antibacterial agent, and in the leather sector, where it is used as a tanning agent and preservative. Furthermore, formic acid is utilized in animal feed, textile dyeing, and rubber production, among other applications. Overall, the market is experiencing strong growth, driven by the increasing demand for sustainable solutions and the versatility of this essential organic acid.

How is this Formic Acid Industry segmented?

The formic acid industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Agriculture and animal feed

- Leather

- Textile

- Chemicals and pharmaceuticals

- Others

- Grade Type

- Grade 85%

- Grade 94%

- Grade 99%

- Others

- Application

- Animal Feed

- Silage

- Leather tanning

- Textile dyeing

- Geography

- APAC

- Australia

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- Germany

- UK

- Middle East and Africa

- South Africa

- South America

- APAC

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period. Formic acid, with the chemical formula HCOOH and simple carboxylic acid structure, is a corrosive organic compound widely used in various industries. This colorless, pungent liquid is employed as an antibacterial agent, silage additive, and animal feedstock. In high concentrations, it undergoes exponential development through processes like Carbonylation of Methanol, Oxidation of Formaldehyde, and Transfer Hydrogenation. Formic acid is integral to industries such as Leather Production, Cleaning Agent, Finishing textiles, and Performance Materials. It's also used in Performance Chemicals, Dispersions and Pigments, Care Chemicals, Industrial Solutions, Surface Technologies, and Agricultural Solutions. Applications include Fluoro Silicone, Hydrogen Peroxide, Hydrogen Gas, Carbon Dioxide, and Hydrogen Storage Processes.

Formic acid plays a role in mitigating climate change by reducing carbon emissions in the Dairy sector and Fuel cells. It's also used in the Livestock industry, Acetic Acid production, and Oil and Gas industries. In the Metallurgy Industry, Leather industry, and Rubber industry, formic acid functions as a carboxylic acid, enhancing the properties of various materials. In household cleaning products and processed food, formic acid serves as a preservative. In agriculture, it's used as a liquid storage and regulatory guideline compliance tool. Formic acid is an occupational hazard substance, and its handling requires adherence to safety guidelines.

Get a glance at the market report of share of various segments Request Free Sample

The Offline segment was valued at USD 1.45 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

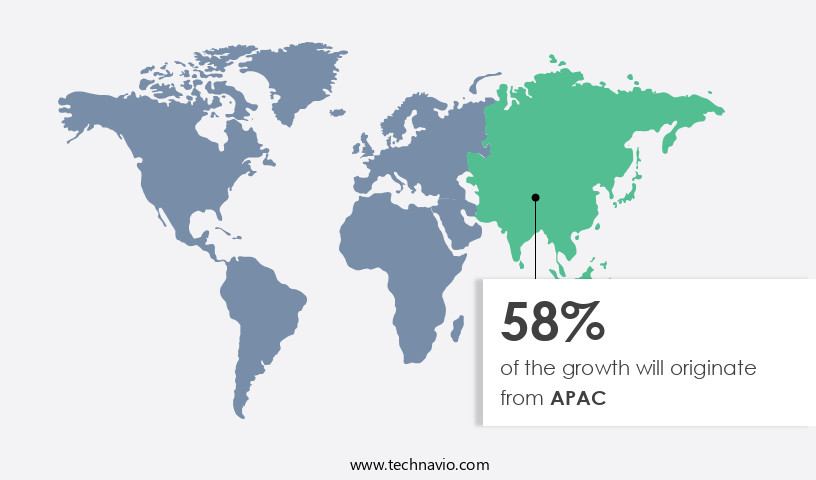

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is projected to experience significant growth due to increasing demand from industries such as rubber, agriculture, leather, and textile, particularly in China and India. The region's low production costs and rapidly expanding market in China are expected to attract substantial investments from major players. APAC holds a prominent position in global rubber production, thereby fueling the demand for formic acid. In India, the growing demand for cattle feed has led to the use of formic acid as an animal feed preservative. In 2024, APAC accounted for the largest share in rubber production.

This market growth is driven by its applications as an antibacterial agent in animal feedstock, leather manufacturing, and cleaning agent in finishing textiles, performance materials, dispersions and pigments, care chemicals, industrial solutions, surface technologies, and agricultural solutions. Formic acid is also used in fluoro silicone, hydrogen peroxide, hydrogen gas, and carbon dioxide production through environmentally friendly processes. The dairy sector, livestock industry, and power application sectors are other significant end-users of formic acid. Despite its corrosive nature as a strong carboxylic acid (HCOOH), formic acid is the simplest carboxylic acid and an essential chemical in various industries.

Its applications extend to the production of methanoic acid, acetic acid, and other industrial chemicals. The market's growth is influenced by regulatory guidelines and safety concerns due to its potential occupational hazard substance status.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Formic Acid Industry?

- Rising demand for formic acid as a preservative is the key driver of the market. Formic acid plays a crucial role in the production of silage, a process used to preserve green fodder or grass as animal feed during winter months. The primary objective of silage making is to minimize nutrient loss. Formic acid is extensively used in this process due to its excellent preservation capabilities. Although molasses is commonly added to provide energy for lactic acid fermentation, the inclusion of formic acid enhances the fermentation process. The global animal feed industry is experiencing significant growth, driven by the increasing demand for dairy and animal protein products.

- In India, for instance, the feed consumption for cattle exceeds seven million tons annually, leading to substantial compound feed production. Formic acid's application in silage making contributes to the efficiency and effectiveness of the animal feed industry.

What are the market trends shaping the Formic Acid Industry?

- Direct syntheses of formic acid in acidic media are the upcoming market trend. The market is experiencing significant advancements due to the global push towards reducing carbon dioxide emissions. A new CO2 hydrogenation process has emerged, enabling the direct synthesis of formic acid using a homogeneous ruthenium catalyst. This process, carried out in dimethyl sulfoxide (DMSO) and as an aqueous solution, eliminates the need for additives. The market is witnessing the commercialization of various chemical reactions as a result.

- Additionally, the dehydrogenation of catalysts is gaining popularity in the preparation of formic acid. This process allows for the reuse of catalysts in both solvents multiple times without decreasing their synthesis capacity. Overall, these innovations are contributing to the growth and development of the market.

What challenges does the Formic Acid Industry face during its growth?

- The presence of cost-effective substitutes is a key challenge affecting the industry's growth. Formic acid, a colorless, pungent liquid, is widely used in various industries due to its unique properties. However, its high cost has opened the door for cost-effective substitutes, posing a challenge to the market's growth. Some of these substitutes include peptides, microflora enhancers, potassium sorbate, sodium sorbate, and acetic acid.

- Potassium sorbate, a salt of sorbic acid, is commonly used as a food preservative, although formic acid is known to be a more effective preservative. Citric acid, a common substitute in the cosmetics and pharmaceutical industries, can adjust pH levels in a wide range of skin products, replacing formic acid in these applications. These substitutes' affordability and similar functionalities make them attractive alternatives to formic acid, impacting the market's dynamics.

Exclusive Customer Landscape

The formic acid market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the formic acid market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, formic acid market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - The company offers formic acid in Europe under the Protectol FM brand Offers formic acid in Europe under the Protectol FM brand.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Eastman Chemical Co.

- GNFC Ltd.

- Joshi Agrochem Pharma Pvt. Ltd.

- Kakdiya Chemicals

- Kemira Oyj

- Luxi Chemical Group Co. Ltd.

- Merck KGaA

- MERU CHEM PVT. LTD.

- NuGenTec

- PETRONAS Chemicals Group Berhad

- Pon Pure Chemicals Group

- ProChem Inc.

- RXChemicals

- Shandong Acid Technology Co. Ltd.

- Shandong Jiuan Chemical Industry Co. Ltd.

- Shijiazhuang Taihe Chemical Co. Ltd.

- Thermo Fisher Scientific Inc.

- Tokyo Chemical Industry Co. Ltd.

- Vizag Chemical International

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Formic acid, with the chemical formula HCOOH, is a colorless, pungent, and highly corrosive organic compound. It is the simplest carboxylic acid and plays a significant role in various industries due to its unique acid property. Formic acid is widely used in the manufacturing of rubber and serves as an antibacterial agent in animal feedstock. In the rubber industry, it acts as a curing agent and improves the performance of rubber products. In the livestock industry, it is used as an additive to enhance animal health and productivity. Formic acid's acid property makes it an essential component in various industrial processes.

For instance, it is used in the production of oxalic acid through the oxidation of formic acid. This process is environmentally friendly as it replaces traditional methods that involve the use of hazardous chemicals. Moreover, formic acid is used in the production of performance materials and performance chemicals. It is used in the manufacturing of dispersions and pigments, care chemicals, and industrial solutions. In surface technologies, it is used as a finishing textile agent, providing a smooth and even finish to textiles. Formic acid is also used in the leather industry as a preservative and in leather production as a tanning agent.

It is a crucial component in the production of hydrogen peroxide, hydrogen gas, and carbon dioxide through various processes. The use of formic acid is not limited to these industries alone. It is used in the dairy sector as a preservative and in the fuel cells industry as a catalyst. In the power application sector, it is used in the hydrogen storage process. In the agricultural solutions sector, it is used as a silage additive, enhancing the preservation of animal feed. Formic acid's use is expanding exponentially due to its versatility and environmental benefits. However, its highly corrosive nature poses an occupational hazard, and regulatory guidelines are in place to ensure its safe handling and disposal.

Formic acid is used in various grade types, including those for silage additives, textile dyeing, rubber chemicals, pharmaceutical intermediates, and leather and tanning. It is also used in the oil and gas industry, metallurgy industry, and the production of household cleaning products. Formic acid's use in various industries is driven by the need for environmentally safe processes. For instance, it is used as a replacement for fossil fuels in the production of chemical energy, reducing greenhouse gas emissions and carbon emissions. In the dairy industry, it is used as a feed additive to improve animal health and productivity, reducing the need for antibiotics.

Formic acid is a versatile organic compound with a wide range of applications in various industries. Its unique acid property makes it an essential component in the production of various products, from rubber and leather to performance materials and industrial solutions. Despite its highly corrosive nature, its environmental benefits and versatility make it a valuable commodity in the global market.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

209 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 592.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.0 |

|

Key countries |

China, US, India, Japan, South Korea, Canada, Germany, Australia, UK, and South Africa |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Formic Acid Market Research and Growth Report?

- CAGR of the Formic Acid industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the formic acid market growth and forecasting

We can help! Our analysts can customize this formic acid market research report to meet your requirements.