Freight Forwarding Market Size 2025-2029

The freight forwarding market size is valued to increase USD 51.62 billion, at a CAGR of 4.1% from 2024 to 2029. Increasing international trade will drive the freight forwarding market.

Major Market Trends & Insights

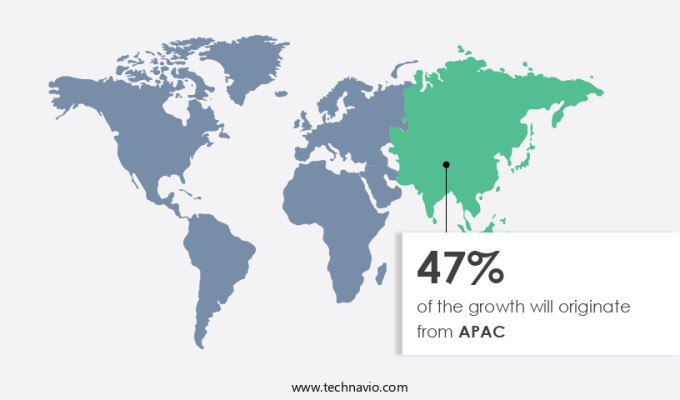

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Mode Of Transportation - Land freight segment was valued at USD 108.41 billion in 2023

- By Application - Industrial and manufacturing segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 34.47 billion

- Market Future Opportunities: USD 51.62 billion

- CAGR : 4.1%

- APAC: Largest market in 2023

Market Summary

- The market encompasses the global trade of transporting goods from one place to another, utilizing various modes of transportation such as air, sea, and land. Core technologies and applications, including the increasing usage of AI and ML, are revolutionizing the industry by optimizing logistics, enhancing supply chain visibility, and reducing operational costs. Service types or product categories, such as less-than-container load (LCL) and full container load (FCL), cater to diverse customer needs. Regulations, including the International Maritime Organization's (IMO) carbon intensity indicators and the European Union's (EU) Green Deal, are driving market evolution. With international trade continuing to grow, the market is expected to unfold with significant opportunities, despite challenges like high fuel and transportation costs.

- According to recent estimates, the market is projected to account for over 30% of the global logistics market share by 2026. Related markets such as the logistics and transportation industries also contribute to the market's dynamics.

What will be the Size of the Freight Forwarding Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Freight Forwarding Market Segmented and what are the key trends of market segmentation?

The freight forwarding industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Mode Of Transportation

- Land freight

- Ocean freight

- Air freight

- Application

- Industrial and manufacturing

- Retail and E-commerce

- Food and beverages

- Healthcare

- Others

- Service Type

- Transportation and warehousing

- Value-added services

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Mode Of Transportation Insights

The land freight segment is estimated to witness significant growth during the forecast period.

The land freight segment, encompassing both road and rail transportation, is a crucial component of the global freight forwarding market. This segment plays a pivotal role in facilitating the movement of goods over land, supporting both domestic and international trade.Road freightThe road freight segment is dynamic and vital, involving the transportation of goods via trucks, trailers, and other road vehicles. It serves as a primary mode of transport for a wide range of commodities, including manufactured goods, consumer products, and raw materials. One of the key attributes of road freight forwarding is its flexibility and last-mile connectivity. Road transports ability to reach remote locations and access points unattainable by other modes of transport provides a competitive edge for timely and efficient deliveries. This flexibility is particularly advantageous for industries with time-sensitive goods that require direct-to-door delivery and distribution.Road freights integration into multi-modal transportation networks further enhances its efficiency.

The Land freight segment was valued at USD 108.41 billion in 2019 and showed a gradual increase during the forecast period.

By seamlessly connecting with other modes of transport such as rail and sea, road freight ensures the smooth and continuous movement of goods across various stages of the supply chain. This capability is essential for maintaining the flow of goods and meeting the demands of modern logistics.Rail freightThe rail freight segment is another critical component of the freight forwarding industry, responsible for the transportation of goods by rail between countries, as well as across continents. This segment encompasses a diverse array of services, including cargo handling, transportation management, customs clearance, and documentation compliance. Rail freight serves as a vital link in the global logistics network, facilitating the efficient movement of goods over long distances.One of the key advantages of rail freight forwarding is its cost-effectiveness and efficiency in transporting large volumes of commodities. Rail transport is particularly well-suited for goods that are not time-sensitive and can benefit from the economies of scale offered by trainloads of cargo.

The extensive rail network and intermodal connections make rail freight an integral part of multi-modal transportation, contributing to the seamless movement of goods across diverse geographic regions and marketplaces.Rail freights ability to handle bulk commodities, such as minerals, agricultural products, and industrial goods, underscores its importance in supporting various industries. By providing a reliable and efficient means of transport, rail freight helps businesses manage their supply chains effectively and meet market demands.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Freight Forwarding Market Demand is Rising in APAC Request Free Sample

The APAC region is experiencing a notable expansion in the market, fueled by escalating internet penetration, burgeoning international trade activities, and favorable government policies. As of early 2024, India, with 751.5 million internet users and a penetration rate of 52.4%, China, boasting 1.09 billion users and a penetration rate of 76.4%, and Japan, hosting 104.4 million users and an 85% penetration rate, illustrate substantial digital connectivity.

This pervasive internet usage is propelling the growth of e-commerce, which, in turn, is driving the demand for proficient freight forwarding services to manage the escalating volume of online transactions and deliveries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical component of the global supply chain, facilitating the efficient movement of goods between different locations. Freight forwarders play a pivotal role in optimizing Intermodal Freight Transportation routes, integrating efficient Warehouse Management Systems, and implementing real-time cargo tracking and tracing technologies. These strategies help reduce lead times, improve supply chain visibility and transparency, and mitigate risks in complex global logistics networks. Effective freight rate negotiation is another essential aspect of freight forwarding, enabling businesses to analyze logistics costs for improved profitability. Freight forwarders leverage technology for efficient freight auditing and utilize advanced logistics software for enhanced efficiency.

They also manage complex documentation processes effectively and implement effective strategies for Reverse Logistics. In the realm of Cold Chain logistics, freight forwarders ensure compliance with international shipping regulations and provide efficient dangerous goods handling and transportation. Last-mile delivery efficiency and speed are also prioritized, with freight forwarders optimizing e-commerce logistics for speed and efficiency. Comparatively, the adoption of technology in freight forwarding has led to significant improvements. For instance, the use of real-time cargo tracking and tracing technologies has increased by 30% over the past five years, enabling businesses to have greater control over their shipments.

Furthermore, freight forwarders have seen a 25% reduction in lead times through route optimization, resulting in substantial cost savings and increased customer satisfaction. In conclusion, freight forwarders are instrumental in streamlining customs brokerage procedures, managing inventory efficiently across multiple distribution centers, and developing effective strategies for reverse logistics. By continuously leveraging technology, freight forwarders ensure compliance with international shipping regulations, optimize e-commerce logistics, and improve order fulfillment through optimized processes.

What are the key market drivers leading to the rise in the adoption of Freight Forwarding Industry?

- The significant expansion of international trade serves as the primary catalyst for market growth.

- The market is undergoing continuous evolution, fueled by the increasing volume of international trade. This shift is necessitating advanced logistics solutions to manage the growing number of global shipments. For instance, India's merchandise exports have experienced substantial growth, rising from USD314 billion in 2013/14 to USD451 billion in 2023/24. Key export commodities include petroleum products, diamonds, packaged medicaments, jewelry, and rice. The primary destinations for these exports are the US, United Arab Emirates (UAE), Netherlands, China, and Bangladesh. This expansion in exports highlights India's expanding role in global trade, underscoring the importance of efficient freight forwarding services to meet the escalating demand.

- The freight forwarding sector is adapting to this trend by focusing on innovation and technology to streamline operations and enhance service offerings. For example, digitalization is enabling real-time tracking and monitoring of shipments, while automation is reducing manual processes and improving accuracy. Moreover, collaborations and partnerships between freight forwarders and technology providers are driving the development of integrated logistics solutions that cater to the unique needs of various industries. Despite these advancements, challenges persist, such as regulatory complexities, geopolitical tensions, and increasing competition. Freight forwarders must navigate these obstacles to maintain their competitive edge and provide value-added services to clients.

- By staying informed of market trends and leveraging technology, freight forwarders can effectively address these challenges and continue to play a vital role in the global supply chain.

What are the market trends shaping the Freight Forwarding Industry?

- The increasing adoption of artificial intelligence (AI) and Machine Learning (ML) technologies is a notable trend in the freight forwarding industry.

- In 2024, The market continues its dynamic evolution, with Artificial Intelligence (AI) and Machine Learning (ML) playing pivotal roles. Beyond automation, these technologies are strategic assets, shaping intelligent decision-making across the supply chain. AI-driven platforms analyze carrier APIs, historical data, and internal rate sheets to generate optimized, margin-protecting quotes in seconds. Route optimization is more agile, with ML algorithms considering real-time traffic, fuel costs, and environmental impact to determine the most efficient and sustainable paths. These advancements streamline operations, reduce costs, and enhance customer satisfaction.

- The freight forwarding landscape is characterized by continuous innovation, with companies investing in advanced technologies to stay competitive. AI and ML are transforming the industry, enabling freight forwarders to navigate complex logistics challenges and deliver superior value to clients.

What challenges does the Freight Forwarding Industry face during its growth?

- The escalating fuel and transportation costs pose a significant challenge to the expansion of the freight forwarding industry.

- The market is currently facing a significant challenge with the continuous rise in fuel and transportation costs. These expenses represent a substantial portion of freight forwarders' budgets, making it essential for them to reconsider their financial strategies and operational practices. For instance, in 2024, fuel prices in major economies like India and the United States continued to put pressure on logistics and supply chain operations. In Bengaluru, petrol and diesel prices were priced at approximately USD123 and USD105 per barrel, respectively.

- These increases have led to budget constraints and squeezed profit margins for freight forwarders. As a result, they are exploring various cost-cutting measures, such as optimizing their transportation networks, implementing fuel surcharges, and negotiating better rates with carriers. Despite these efforts, the ongoing fuel price volatility remains a significant challenge for the freight forwarding industry.

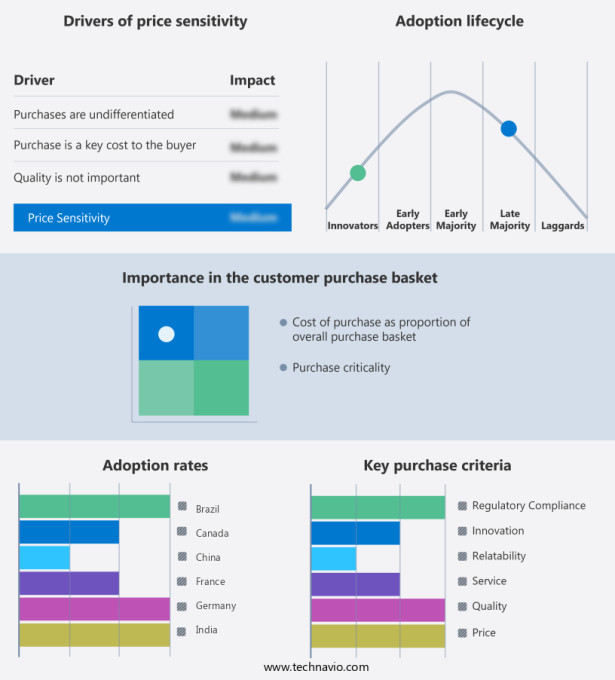

Exclusive Customer Landscape

The freight forwarding market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the freight forwarding market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Freight Forwarding Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, freight forwarding market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AP Moller Maersk AS - This company specializes in logistics, delivering reliable and cost-effective transportation solutions for customs clearance, packaging, special services, and storage. Their offerings ensure streamlined supply chain management, catering to various industries with precision and efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AP Moller Maersk AS

- APT Logistics

- AWL India Pvt. Ltd.

- C H Robinson Worldwide Inc.

- CEVA Logistics SA

- DACHSER SE

- DB Schenker

- DHL International GmbH

- Dimerco Express Corp

- DSV AS

- FedEx Corp.

- GEODIS

- Hellmann Worldwide Logistics SE and Co KG

- Kuehne Nagel Management AG

- Manitoulin Group of Companies

- Nippon Express Holdings Inc.

- SEKO Logistics

- Sinotrans Ltd

- Uber Technologies Inc.

- United Parcel Service Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Freight Forwarding Market

- In January 2024, DHL Supply Chain, a leading global logistics provider, announced the launch of its new digital freight forwarding platform, DHL Digital Freight Forwarding, aimed at simplifying international trade and enhancing supply chain visibility for businesses (DHL Press Release, 2024).

- In March 2024, Kuehne + Nagel, a major freight forwarding company, entered into a strategic partnership with IBM to leverage IBM's digital supply chain platform and AI capabilities, aiming to enhance end-to-end supply chain visibility and efficiency for their customers (IBM Press Release, 2024).

- In May 2024, DB Schenker, a global logistics services provider, acquired a significant stake in iContainers, a digital freight forwarding platform, to expand its digital freight forwarding capabilities and strengthen its market position (DB Schenker Press Release, 2024).

- In April 2025, the European Union approved the Digital Green Certificate, an initiative to facilitate the free movement of people during the COVID-19 pandemic by providing proof of vaccination, test results, or recovery status. This development is expected to positively impact the market, as it will boost cross-border trade and logistics activities (European Commission Press Release, 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Freight Forwarding Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.1% |

|

Market growth 2025-2029 |

USD 51.62 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

US, China, Japan, Germany, Canada, India, UK, South Korea, Brazil, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and intricate world of logistics, the market continues to evolve, shaping the way businesses manage their supply chains. This market encompasses a range of services, from customs compliance and order fulfillment to third-party logistics, e-commerce logistics, and freight consolidation. The importance of customs compliance cannot be overstated, as it ensures the smooth movement of goods across borders. In this regard, freight forwarders facilitate the process by providing customs brokerage services and navigating complex regulations. Meanwhile, third-party logistics providers offer a broad spectrum of services, including order fulfillment, distribution networks, and reverse logistics.

- E-commerce logistics has significantly impacted the market, necessitating the need for efficient order fulfillment and last-mile delivery. Freight consolidation plays a crucial role in reducing shipping costs, while global logistics networks and intermodal transportation enable seamless movement of goods across various modes of transport. The implementation of advanced technologies, such as cargo tracking systems, logistics software, and freight auditing, has revolutionized the industry. These tools facilitate route optimization, freight rate negotiation, and supply chain visibility, among other benefits. Moreover, cold chain logistics ensures the safe handling of temperature-sensitive goods, while cargo insurance protects against potential losses.

- The market is characterized by the continuous optimization of supply chains. Inventory management systems and warehouse management systems help businesses maintain optimal stock levels, while Transportation Management Systems facilitate carrier selection and documentation management. Multimodal transport and shipping documentation are essential components of the freight forwarding process, ensuring the efficient and secure movement of goods. In conclusion, the market is a vital aspect of the global supply chain, offering a multitude of services to help businesses manage their logistics needs. From customs compliance to last-mile delivery, the market continues to evolve, adapting to the ever-changing landscape of international trade.

What are the Key Data Covered in this Freight Forwarding Market Research and Growth Report?

-

What is the expected growth of the Freight Forwarding Market between 2025 and 2029?

-

USD 51.62 billion, at a CAGR of 4.1%

-

-

What segmentation does the market report cover?

-

The report segmented by Mode Of Transportation (Land freight, Ocean freight, and Air freight), Application (Industrial and manufacturing, Retail and E-commerce, Food and beverages, Healthcare, and Others), Service Type (Transportation and warehousing and Value-added services), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing international trade, High fuel and transportation costs associated with freight forwarding

-

-

Who are the major players in the Freight Forwarding Market?

-

Key Companies AP Moller Maersk AS, APT Logistics, AWL India Pvt. Ltd., C H Robinson Worldwide Inc., CEVA Logistics SA, DACHSER SE, DB Schenker, DHL International GmbH, Dimerco Express Corp, DSV AS, FedEx Corp., GEODIS, Hellmann Worldwide Logistics SE and Co KG, Kuehne Nagel Management AG, Manitoulin Group of Companies, Nippon Express Holdings Inc., SEKO Logistics, Sinotrans Ltd, Uber Technologies Inc., and United Parcel Service Inc.

-

Market Research Insights

- The market is a dynamic and intricate system that facilitates the global movement of goods. Freight costs represent a significant portion of order processing expenses, making freight capacity a critical consideration for businesses. In 2020, the average logistics cost per container was approximately USD2,500, while the average cost per pallet was around USD500. Network design, supply chain mapping, warehouse space, and shipping schedules are essential elements of freight forwarding. Cargo handling, packaging requirements, and shipping lanes also play a significant role in delivery optimization. Inventory control, transportation modes, delivery schedules, and carrier contracts are integral components of effective freight forwarding.

- Customs regulations, demand forecasting, lead times, and logistics costs further impact the efficiency of the process. Performance metrics, import export procedures, and port congestion influence transit times. By addressing these factors, businesses can ensure the timely and cost-effective transportation of their goods, enhancing their competitive edge in the global market.

We can help! Our analysts can customize this freight forwarding market research report to meet your requirements.