Fresh Cranberries Market 2024-2028

The fresh cranberries market size is projected to increase by USD 11.6 million at a CAGR of 5.09% between 2023 and 2028. The market is experiencing significant growth, driven by increasing consumer awareness of the health benefits associated with consuming fresh cranberries. These benefits include their high nutritional value, antioxidant properties, and potential role in preventing urinary tract infections. Additionally, the advent of smart packaging technologies is enabling longer shelf life and preserving the freshness of cranberries, making them more accessible to consumers. There is an increase in demand for dried cranberries due to factors such as increasing awareness about the nutritional benefits of the consumption of dried fruits, such as dried cranberries. For example, in July 2020, Walmart Canada announced its investment to improve its in-store and online shopping experiences and upgrade its distribution. Furthermore, the rising demand for dried cranberries as a popular snack and ingredient in various food and beverage applications is also fueling market growth. Overall, the market is poised for continued expansion due to these key trends and the growing consumer preference for healthy and wellness food options.

Market Overview

The Market shows an accelerated CAGR during the forecast period.

To get additional information about the market, Request a Free Sample

Market Dynamics

Fresh Cranberries belong to the Subgenus oxycoccus of the Genus Vaccinium, within the family Ericaceae. The Vaccinium species, including Fresh Cranberries, are evergreen dwarf shrubs or trailing vines that produce edible berries. Fresh Cranberries are rich in Antioxidant properties and Anti-inflammatory properties due to the presence of Phytochemicals such as Citric acid and Benzoic acid. The Processing industries focus on producing Processed counterparts like Juices, Jams, Jellies, Sauces, Dried cranberries, Powders, Extracts, Cranberry poultices, Medicinal teas, Dyes, and more. Fresh Cranberries are typically harvested through Wet harvesting in Water filled bogs, maintaining their firm texture. The market for Fresh Cranberries and their Processed counterparts continues to grow due to their numerous health benefits. Growing investments in advanced agricultural technologies and sustainable farming practices are boosting the production of cranberries, known for their high antioxidant content and anti-inflammatory properties that support urinary tract health and combat urinary tract infections (UTIs).

Key Market Driver

One of the key factors driving the market growth is the growth of organized retail. The main factor that is fuelling the growth of organized retail is the rapid expansion of supermarkets, hypermarkets, and specialty stores.

Furthermore, some of the prominent retail stores including Walmart Inc. (Walmart) and Tesco PLC (Tesco) are rapidly expanding their retail stores regionally and globally to increase their market share. Furthermore, there is a potential opportunity for organized retail in developing economies due to factors such as increasing disposable income of people, rapidly increasing consumer spending, and the growth of the population. Hence, such factors are positively impacting the market which, in turn, will drive the market growth during the forecast period.

Significant Market Trends

A key factor shaping the market growth is the rising popularity of private-label fresh cranberries. The private labeling of fresh cranberries is a primary trend in the global market. Several prominent retailers globally are launching their own brands of fresh fruit products, such as fresh cranberries, due to the growing demand for fresh fruits from consumers.

For example, Tesco sells its own private-label fresh cranberries under the Tesco Cranberries 300G name. The main advantage of private labeling of fresh cranberries is that it significantly decreases the purchasing cost of consumers which is positively impacting the market. Hence, such factors are expected to drive market growth during the forecast period.

Major Market Challenge

Rising demand for dried cranberries is one of the key challenges hindering the market growth. Some of the main types of dried cranberries which has a strong demand include dried fruits in the form of snacks and cereals.

Moreover, there is an increasing demand for processed and dried fruits, such as dried cranberries from food manufacturing companies, such as confectionery manufacturers, bakeries, and dairy companies in order to manufacture their products. Furthermore, dried cranberries are mostly consumed as snacks due to their better preservation properties than fresh cranberries. Hence, such factors are negatively impacting the market. Therefore, it is expected to hinder the market growth during the forecast period.

Market Segmentation

By Type

The increasing demand for the inorganic segment will increase the market growth during the forecast period. Cranberry crops are mostly in the specialty crops segment and are grown using pesticides. Inorganic cranberries are subjected to a pesticide-intensive process to prevent infestation by insects and the growth of fungus. These inorganic crops are prone to infestation by insects and fungal attacks on crops as these are grown for a long period of time and are harvested only once a year. Several farmers use different types of herbicides and pesticides to boost the production of cranberry crops during harvest. Another significant issue for cranberry growers is the growth of weeds and grasses in cranberry bogs. As a result, the growers utilize the chemicals including aminothiazole, which is a chlorophyll inhibitor used to clear bog grasses and weeds. Despite these issues, factors such as the high demand for inorganically grown fresh cranberries and their easy availability and lower cost can fuel the growth of this segment, which in turn will drive the market growth during the forecast period.

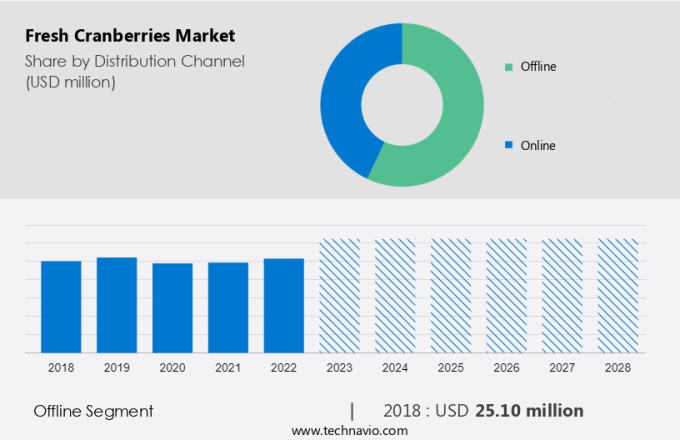

By Distribution Channel

The offline segment is estimated to witness significant growth during the forecast period. Some of the key sources of offline distribution channels where consumers can buy fresh fruits, including cranberries include traditional brick-and-mortar retail outlets, farmers' markets, and specialty stores. Several supermarkets, grocery chains, and local markets have a dedicated section for fresh fruits, which offers consumers a variety of fresh fruits, such as organic and inorganic varieties. For instance, Walmart Inc. offers a wide range of organic fruits, such as fresh cranberries.

The offline segment was the largest segment and was valued at USD 25.10 million in 2018.

For a detailed summary of the market segments Request for Sample Report

Some of the different types of organic fresh produce comprise organic bananas, fresh organic strawberries, organic red seedless grapes, and others. Additionally, there is an increasing preference for these outlets as they cater to the demand for healthier and sustainably produced food options. In addition, there is a significant purchase from farmer's markets as they offer a direct link between local farmers and consumers. Furthermore, it enables shoppers to purchase fresh fruits, vegetables, and other products directly from farmers, creating a sense of community and supporting local economies. Moreover, it allows consumers to inspect and physically assess the quality of fresh fruits, including cranberries, before making a purchase which fuels the adoption of this segment. Hence, such factors are expected to fuel the adoption of this segment which in turn will drive the market growth during the forecast period.

By Region

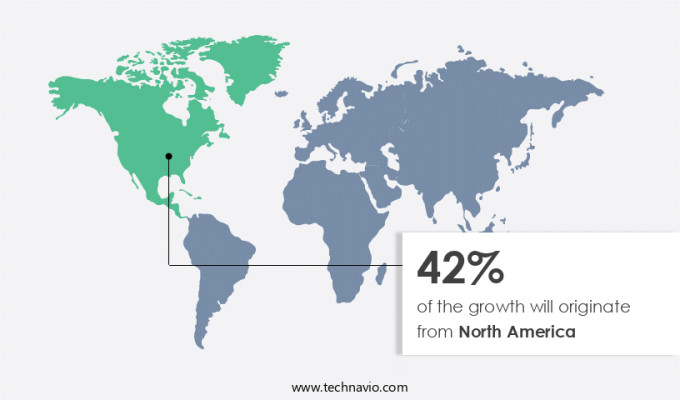

North America is estimated to contribute 42% to the growth of the global market during the forecast period

Get a glance at the market share of various regions View PDF Sample

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. One of the main countries that are significantly contributing to the market growth is the US. The main factor that significantly contributes to the market growth in North America is the presence of major market players. For instance, Ocean Spray is one of the prominent market players which represents 600 cranberry growers in Massachusetts, Wisconsin, New Jersey, Oregon, and Washington, and is one of the largest exporters of fresh cranberries.

Some of the main factors that fuel the growth of the market in North America are the favorable weather conditions and the growth of the retail sector. Furthermore, there is an increasing demand for cranberries to produce juices and beverages in North America due to the health benefits of consuming fresh cranberries. Hence, such factors are driving the market growth during the forecast period.

Company Overview

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Key Offering - Canneberge Quebec Inc: The company offers Fresh Quebec cranberries that are slightly tart berries with a unique taste.

- Key Offering - Cape Blanco Cranberries Inc: The company offers vine ripened cranberries and bulk frozen cranberries.

- Key Offering - Cape Cod Select: The company offers whole fresh and frozen cranberries that are triple sorted.

The market report also includes detailed analyses of the competitive landscape of the market and information about 13 market companies, including:

- Decas Cranberry Products Inc.

- Fresh Meadows Cranberries

- Habelman Bros. Co.

- Ocean Spray Cranberries Inc.

- Seaview Cranberries Inc.

- Fruit dOr

- Honestly Cranberry

- Meduri Farms Inc.

- Michigan Cranberry Co.

- Wetherby Cranberry Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Segment Overview

The market forecast report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in USD Million for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Distribution Channel Outlook

- Offline

- Online

- Type Outlook

- Inorganic

- Organic

- Geography Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- South America

- Chile

- Argentina

- Brazil

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

Fresh Cranberries belong to the Subgenus oxycoccus of the Genus Vaccinium, known for their tart taste and vibrant red color. The Vaccinium plant species, including Fresh Cranberries, are rich in phytochemicals, offering antioxidant and anti-inflammatory properties. Processing industries produce various cranberry products like juices, jams, jellies, sauces, dried cranberries, powders, extracts, cranberry poultices, medicinal teas, and even dyes. Evergreen dwarf shrubs or trailing vines, Fresh Cranberries thrive in cooler climates, primarily in the Northern Hemisphere. They are grown in water-filled bogs and harvested using wet harvesting techniques.

Furthermore, fresh cranberries have a firm texture and are often used in both sweet and savory dishes due to their unique tartness. Cranberries offer numerous health benefits, including a high vitamin content, and are of great consumer interest due to their antioxidant and anti-inflammatory properties. However, processed counterparts may contain additives like citric acid and benzoic acid to enhance shelf life and prevent damage during transportation and storage. The market for Fresh Cranberries and their processed counterparts is driven by consumer interest in sustainability and ethical farming practices. Despite the lower shelf life and risk of damage, the demand for these nutrient-rich fruits continues to grow. Processed cranberry products, such as Milk Chocolate Dipped Cranberry and Dark Chocolate Dipped Cherry, are becoming popular in specialty food shops, convenience stores, and online sales channels. Their culinary uses in sweet dishes and high consumption rates reflect increasing health consciousness in Western diets, while impulse buying trends in urban areas drive sales through local grocery stores and independent retailers. Lingonberries also contribute to Nordic and Baltic cuisines, complementing the versatility and medicinal value of cranberries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.09% |

|

Market growth 2024-2028 |

USD 11.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.61 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, Germany, China, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Canneberge Quebec Inc., Cape Blanco Cranberries Inc., Cape Cod Select, Decas Cranberry Products Inc., Fresh Meadows Cranberries, Fruit dOr, Habelman Bros. Co., Honestly Cranberry, Meduri Farms Inc., Michigan Cranberry Co., Ocean Spray Cranberries Inc., Seaview Cranberries Inc., and Wetherby Cranberry Co. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Market Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for Market forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

BUY NOW Full Report and Discover more

What are the Key Data Covered in this Market Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming market trends and analysis and changes in consumer behavior

- Growth of the market industry across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough market growth analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive market analysis and report on the factors that will challenge the market research and growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch