Fruit-Flavored Soft Drinks Market Size 2025-2029

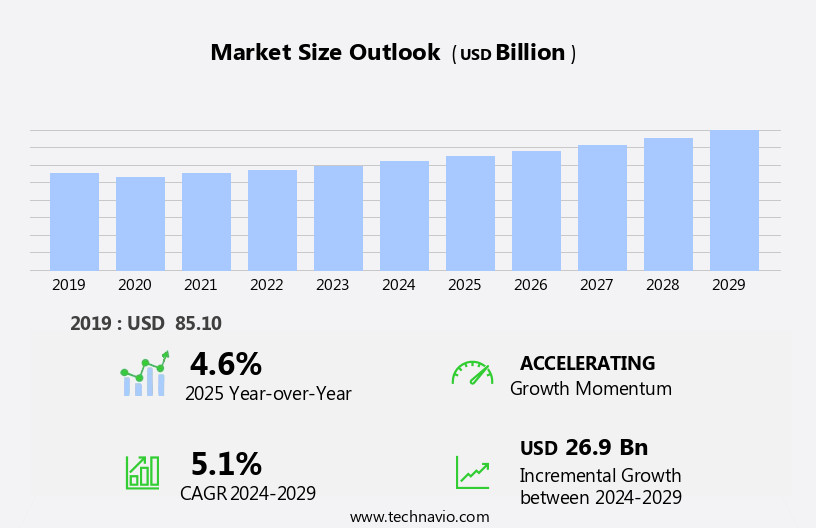

The fruit-flavored soft drinks market size is forecast to increase by USD 26.9 billion at a CAGR of 5.1% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by product innovations and the increasing demand for craft soft drinks. Consumers are increasingly seeking healthier and more natural beverage options, leading to a surge in demand for fruit-flavored soft drinks that are perceived as healthier than traditional sugary sodas. This trend is further fueled by the growing popularity of artisanal and small-batch beverages. However, the market faces challenges related to the rising obesity rates and related health issues. Governments and health organizations continue to push for regulations on sugar content in beverages, which could limit the growth potential for fruit-flavored soft drinks if they are perceived as unhealthy due to high sugar content.

- Additionally, increasing competition from other healthy beverage categories, such as bottled water and functional beverages, poses a significant threat to the market. Companies must navigate these challenges by offering low-sugar or sugar-free options and focusing on product differentiation and innovation to maintain market share.

What will be the Size of the Fruit-Flavored Soft Drinks Market during the forecast period?

- The fruit-flavored soft drink market continues to evolve, driven by shifting consumer preferences and emerging trends. Health-conscious consumers seek out sugar-free and low-calorie options, leading to the proliferation of natural and artificial sweeteners. Grocery stores and convenience stores alike stock an array of fruit-flavored beverages, from glass bottles of peach soda to aluminum cans of tropical fruit-flavored drinks. Product differentiation is key, with brands offering unique twists on classic flavors such as cherry, grape, and citrus. Seasonal trends also influence the market, with berry flavors gaining popularity during summer months. New product development is a constant force, with functional beverages integrating fruit extracts and natural flavors to cater to diet-conscious consumers.

- Shelf life and packaging materials, such as recycled plastic bottles and glass, are also important considerations. Sports drinks and energy drinks, with their unique functional benefits, carve out a niche within the market. Consumption patterns continue to shift, with online retailers gaining ground and offering convenience and variety. The fruit-flavored soft drink market is a dynamic and ever-changing landscape, with new trends and innovations continually unfolding. Brands that stay attuned to consumer preferences and adapt to market shifts will thrive in this evolving market.

How is this Fruit-Flavored Soft Drinks Industry segmented?

The fruit-flavored soft drinks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- FFCSD

- FFNCSD

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

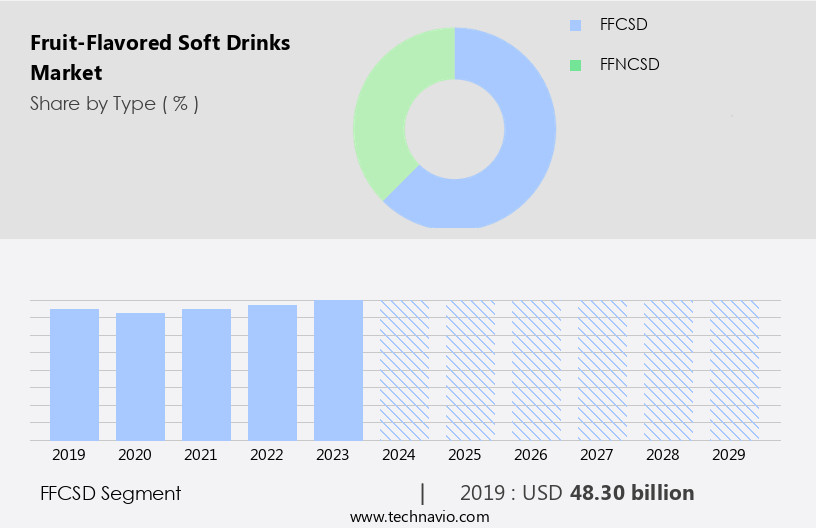

The ffcsd segment is estimated to witness significant growth during the forecast period.

The fruit-flavored carbonated soft drink market in the US is experiencing a shift in consumer preferences. Traditional brands like Pepsi and Coca-Cola have reported decreasing volume sales due to the rising popularity of bottled water and other healthier alternatives. Consumers are increasingly health-conscious and are seeking low-sugar and low-calorie options. In response, companies have introduced sugar-free and diet versions of their fruit-flavored soft drinks. Product differentiation is also key, with new flavors and product lines, such as peach and berry, being introduced to cater to diverse consumer tastes. Shelf life and packaging are also important considerations, with some brands opting for glass bottles and recycled packaging to appeal to eco-conscious consumers.

Sports drinks and energy drinks, which often contain high levels of sugar and caffeine, have also faced criticism from health-conscious consumers. Instead, functional beverages and fruit juices, which offer natural flavors and health benefits, are gaining popularity. Convenience stores and grocery stores remain key sales channels, but online retailers are also gaining traction due to their convenience and wide product selection. New product development is a major trend in the market, with companies investing in research and development to create innovative and healthier options. Natural and artificial flavors are being used to cater to different consumer preferences, with tropical and cherry flavors being particularly popular.

Emerging markets, such as those in Asia and South America, offer significant growth opportunities for companies looking to expand their reach. Seasonal trends and consumer preferences play a role in sales patterns, with sales of fruit-flavored soft drinks increasing during the summer months. Consumer preferences for citrus, grape, and apple flavors also vary depending on the region and demographics. Overall, the market is dynamic and evolving, with companies constantly adapting to changing consumer preferences and market trends.

The FFCSD segment was valued at USD 48.30 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

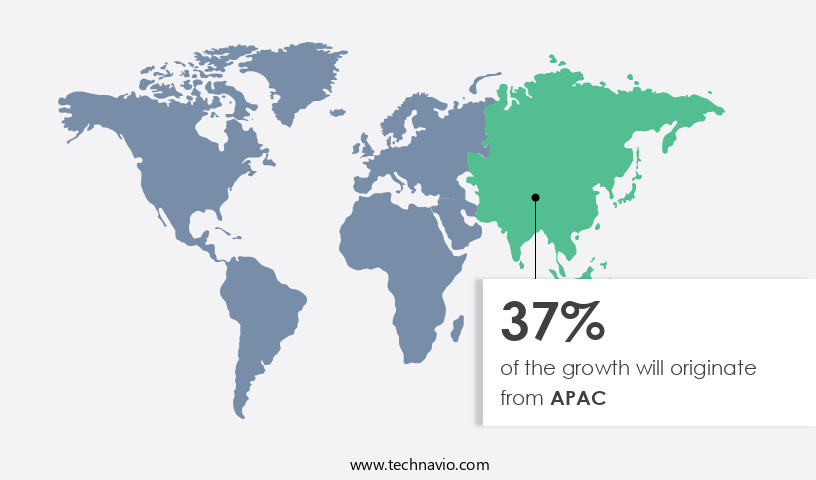

APAC is estimated to contribute 37% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America experienced significant growth in 2024, with the US leading the charge. Consumers' preferences are shifting towards healthier options, leading to a decline in carbonated soft drink sales due to health concerns. However, the market is not without innovation. New product development continues apace, with offerings that include up to ten fruit-flavored, sugar-free options in both glass bottles and plastic or aluminum containers. These bottles boast longer shelf lives, appealing to health-conscious consumers and those seeking convenience. Seasonal trends and consumer preferences influence the market, with peach, berry, and tropical flavors gaining popularity. Fruit extracts and natural flavors are increasingly preferred over artificial ones, and functional beverages, sports drinks, and energy drinks are also making their mark.

Online retailers and convenience stores are key distribution channels, catering to the demand for quick and easy purchases. Emerging markets are also showing growth, with diet-conscious consumers driving demand for low-calorie and sugar-free options. The market's evolution reflects a focus on product differentiation, catering to diverse consumer preferences and lifestyles.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Fruit-Flavored Soft Drinks Industry?

- Product innovations serve as the primary catalyst for market growth and development.

- The market is characterized by continuous product innovations, driven by companies' efforts to enhance their offerings in terms of ingredients, formulation, and packaging. For instance, The Coca-Cola Company introduced new spiced flavor soft drinks in February 2024, combining traditional cola taste with raspberry and spiced flavors. In response to the growing health and wellness trend among consumers, many market players are launching functional beverages with added benefits.

- Product innovation is often accompanied by strategic marketing and branding initiatives, with companies highlighting unique features and benefits through targeted advertising campaigns to attract and retain customers. These strategies contribute to the market's growth and competitiveness.

What are the market trends shaping the Fruit-Flavored Soft Drinks Industry?

- The professional trend in the beverage industry is the rising demand for craft soft drinks. This growing preference reflects a notable market shift towards artisanal and authentic consumer choices.

- The market in the US is witnessing significant growth due to the rising preference for brand loyalty and unique product offerings among health-conscious consumers. This segment caters to the demand for sugar-free and low-calorie options, which aligns with the health-focused lifestyle trend. Craft soft drink manufacturers produce their beverages in small batches, using premium and natural ingredients, and offering unconventional packaging, such as glass bottles. These factors contribute to the increasing popularity of craft soft drinks among millennials, who are open to experimenting with new flavors and products. Major retailers, including supermarket chains, have recognized this trend and are allocating more shelf space to craft soft drink brands.

- Companies like Jones Soda, Reed Brooklyn Soda Works, Dry Sparkling, and Cool Mountain Beverages are capitalizing on this market opportunity by offering a range of fruit-flavored, sugar-free, and low-calorie options. These products are accessible to consumers through various retail and online channels. Overall, the market in the US is experiencing a high growth rate, driven by the increasing demand for healthier and more unique beverage options.

What challenges does the Fruit-Flavored Soft Drinks Industry face during its growth?

- The escalating obesity rates and the resulting health concerns pose a significant challenge to the industry's growth trajectory.

- The market faces a significant challenge due to the rising health concerns and increasing obesity rates worldwide. According to recent research, approximately 1.9 billion adults, or nearly 39% of the global population, were overweight or obese in 2022. This trend is expected to continue, with approximately 80% of adults with overweight and obesity projected to live in Low- and Middle-Income Countries by 2035. Obesity can lead to various health issues, including high blood pressure, diabetes, and joint problems. In response to these health concerns, consumers have become more conscious of their sugar and calorie intake. As a result, there has been a shift towards healthier beverage options, such as fruit juices and sports drinks with longer shelf life and natural fruit extracts.

- Seasonal trends also play a role in the market, with berry flavors being particularly popular during certain seasons. Convenience stores have capitalized on this trend by offering a wide range of fruit-flavored beverages, catering to consumers' demand for convenience and on-the-go options. Overall, the market dynamics of the fruit-flavored soft drinks industry are influenced by factors such as health awareness, consumer preferences, and seasonal trends.

Exclusive Customer Landscape

The fruit-flavored soft drinks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the fruit-flavored soft drinks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, fruit-flavored soft drinks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AriZona Beverages USA LLC - This company specializes in an assortment of fruit-infused soft drinks, renowned for their invigorating flavors derived from natural ingredients.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AriZona Beverages USA LLC

- Britvic plc

- Brooklyn Soda Works

- Callaway Family Co.

- Cool Mountain Beverages Inc.

- Dabur India Ltd.

- DRY Soda Co.

- Hydro One Beverages

- Jones Soda Co.

- Keurig Dr Pepper Inc.

- Monster Energy Co.

- Nestle SA

- Nichols plc

- Ocean Spray Cranberries Inc.

- Orangina

- PepsiCo Inc.

- Red Bull GmbH

- Schweppes

- Sugam Products

- The Coca Cola Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Fruit-Flavored Soft Drinks Market

- In February 2024, PepsiCo, a leading player in the market, introduced a new product line called "Bubly Sparkling Water Fruit," which includes six new flavors, as per the company's official press release. This expansion aimed to cater to the growing consumer demand for healthier beverage options with natural flavors.

- In March 2025, Coca-Cola and Starbucks announced a strategic partnership to create a new line of coffee-flavored beverages, including fruit-flavored soft drinks, as reported by Reuters. This collaboration was expected to strengthen both companies' positions in the market by leveraging each other's strengths and expertise.

- In May 2024, The Coca-Cola Company completed the acquisition of Full Harvest, a produce rescue company, for an undisclosed amount, as per the company's SEC filing. This acquisition was a significant step towards reducing food waste and enhancing the sustainability of Coca-Cola's fruit-flavored soft drink offerings.

- In October 2025, the European Union approved new regulations on marketing and labeling of fruit-flavored soft drinks, requiring a 10% fruit juice content minimum and clearer labeling of added sugars, as reported by the European Commission. This policy change aimed to promote healthier choices and transparency in the market.

Research Analyst Overview

The market exhibits dynamic market penetration, with consumers increasingly seeking healthier and more natural options. Ingredient traceability and transparency have become crucial factors in consumer behavior analysis. Flavor masking techniques enable manufacturers to create complex taste profiles while maintaining sustainability initiatives. Competitive landscape analysis reveals a focus on innovation trends, such as mouthfeel analysis and taste perception. Product development strategies prioritize shelf stability and brand positioning, utilizing various distribution channels and price points. Packaging materials and label designs play a significant role in consumer appeal, while concentrate blends and marketing campaigns cater to diverse target audiences.

Customer insights and market research techniques inform supply chain management and brand perception strategies. Sustainability initiatives and consumer demographics continue to shape the competitive landscape, with a growing emphasis on ingredient sourcing and product lifecycle management.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Fruit-Flavored Soft Drinks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

182 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.1% |

|

Market growth 2025-2029 |

USD 26.9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.6 |

|

Key countries |

US, China, Canada, India, Germany, France, Mexico, UK, Brazil, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Fruit-Flavored Soft Drinks Market Research and Growth Report?

- CAGR of the Fruit-Flavored Soft Drinks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the fruit-flavored soft drinks market growth of industry companies

We can help! Our analysts can customize this fruit-flavored soft drinks market research report to meet your requirements.