APAC Fuel Additives Market Size and Trends

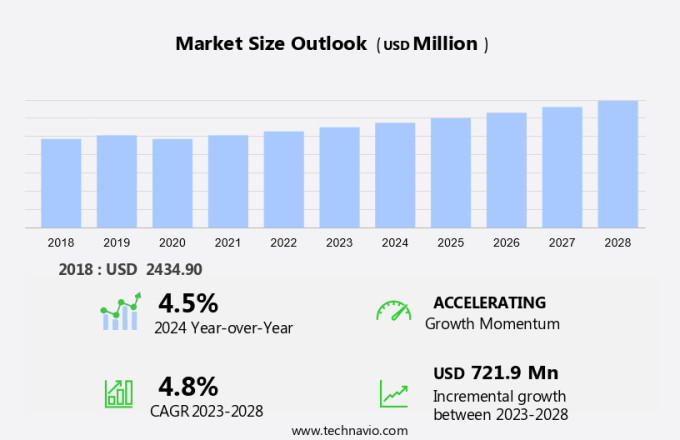

The APAC fuel additives market size is forecast to increase by USD 721.9 million, at a CAGR of 4.8% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for ultra-low sulfur diesel (ULSD) and advancements in fuel additive technology. In the heavy-duty operations sector, the focus on improving power output, fuel efficiency, and engine reliability has led to a heightened interest in fuel additives. These additives enhance combustion efficiency, reducing emissions and improving overall engine performance. However, challenges such as microbial contamination and fuel oxidation pose threats to fuel stability, necessitating the use of effective fuel additives. As the automotive industry shifts towards electric vehicles, the demand may decrease. Nevertheless, the market will continue to evolve, driven by the need for cleaner, more efficient fuels and advanced engine technologies.

The market plays a crucial role in the transportation sector by enhancing the performance and efficiency of hydrocarbon fuels. These additives are incorporated into gasoline, diesel, and other fuel types to improve various aspects, such as engine performance, emission reductions, and fuel economy. Fuel consumption in the automotive industry is a significant concern due to increasing emissions and pollution. Regulatory measures have been implemented to address these issues, leading to stringent emission standards. Fuel additives play a vital role in meeting these standards by improving combustion efficiency and reducing carbon monoxide emissions. Specialty chemicals and metals are the primary components. They are designed to address various challenges in the transportation sector, including emission control, deposit control, and cetane improvement. Emission control additives help reduce harmful pollutants, such as nitrogen oxides and particulate matter, from entering the atmosphere. Detergent additives are used to prevent fuel system deposits, ensuring optimal engine performance. Cetane improvers enhance the ignition quality of diesel fuel, improving combustion efficiency and reducing emissions. The quality of petroleum products and crude oil significantly impacts performance. Natural disasters, such as hurricanes and earthquakes, can disrupt the supply chain, affecting the availability and quality of raw materials. Alternative fuels, such as biofuels and ultra-low sulfur diesel, are gaining popularity due to their environmental benefits.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Application

- Diesel fuel additives

- Gasoline fuel additives

- Aviation fuel additives

- Others

- Geography

- APAC

- China

- India

- Japan

- APAC

By Application Insights

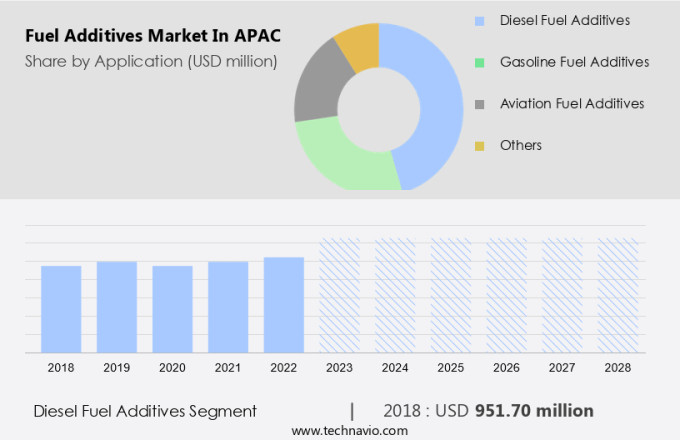

The diesel fuel additives segment is estimated to witness significant growth during the forecast period. Fuel additives play a crucial role in enhancing the performance and efficiency of various types of fuels, including gasoline and aviation fuel. In APAC, the market is witnessing significant growth due to the increasing demand for cleaner and more efficient energy sources.

Get a glance at the market share of various segment Download the PDF Sample

The diesel fuel additives segment was the largest segment and valued at USD 951.70 million in 2018. Octane improvers are widely used in gasoline to improve combustion efficiency and increase heat energy output. In the aviation industry, fuel additives are employed to enhance the performance of jet fuel and reduce emissions during flights. Moreover, fuel additives are extensively used in transportation and electricity production to improve the quality of diesel fuel. Hence, such factors are fuelling the growth of this segment during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

APAC Fuel Additives Market Driver

Rising demand for ULSD is notably driving market growth. In the automotive industry, the implementation of stricter regulatory measures has led automotive makers to focus on reducing fuel consumption and emissions. One solution to this challenge is the use of Ultra Low Sulfur Diesel (ULSD), which contains around 15 parts per million (ppm) of sulfur. ULSD significantly decreases harmful emissions from diesel combustion, contributing to improved air quality and reduced pollution.

To optimize the performance of ULSD, fuel additives such as cetane improvers, octane improvers, antioxidants, and corrosion inhibitors are essential. These additives enhance the combustion efficiency of ULSD, leading to reduced fuel consumption, noise, and smoke exhaust, as well as improved engine performance in cold weather conditions. Furthermore, the use of ULSD in conjunction with emission control devices helps minimize the emission of exhaust gases containing particulate matter and ozone precursors to near-zero levels. Thus, such factors are driving the growth of the market during the forecast period.

APAC Fuel Additives Market Trends

New developments in fuel additives is the key trend in the market. In the realm of power generation for marine, automotive, and industrial operations, cost-effective alternative fuels are gaining traction. Flexibility in fuel selection is becoming a significant driver in the advancement of new technologies and applications.

While gasoline and diesel have historically been the primary fuels, alternative liquid fuels and gases are increasingly utilized in commercial and non-commercial settings due to their affordability and eco-friendliness. Biofuels and synthetic gas are making strides in the energy, aviation, industrial, and automotive industries. Thus, such trends will shape the growth of the market during the forecast period.

APAC Fuel Additives Market Challenge

Growing demand for electric vehicles in automotive industry is the major challenge that affects the growth of the market. The market is facing challenges due to the increasing popularity of electric vehicles (EVs). The automotive industry's shift towards EVs is driven by environmental concerns and the need to reduce carbon emissions.

However, these issues are less prevalent in electric vehicles, as they do not rely on traditional fuel engines. Moreover, fuel additives are also used to address issues such as fuel gelling and antifreeze properties in extreme weather conditions. However, electric vehicles do not require these purposes as they do not use traditional fuel. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Afton Chemical: The company offers fuel additives products such as HiTEC 4133G, OTR-8932G, and OTR 9001G.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Baker Hughes Co.

- BASF SE

- Chevron Corp.

- Clariant International Ltd

- Croda International Plc

- Cummins Inc.

- Dorf Ketal Chemicals India Pvt. Ltd.

- Dow Inc.

- Eastman Chemical Co.

- Eni SpA

- Evonik Industries AG

- Exxon Mobil Corp.

- Infineum International Ltd.

- Innospec Inc.

- Lanxess AG

- Shell plc

- Solvay SA

- The Lubrizol Corp.

- TotalEnergies SE

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Fuel additives play a crucial role in enhancing the performance and efficiency of various types of fuels used in transportation and electricity production. The market is driven by several factors, including the increasing demand for fuel efficiency and emission reductions in automotive production. Fuel additives help improve combustion efficiency, reduce emissions, and enhance engine reliability in both traditional engines and diesel automobiles. Regulatory measures aimed at reducing air pollution and carbon emissions have led to the widespread use of fuel additives. These additives help control fouling of injectors, carbon deposits, and microbial contamination in fuels. They also improve lubricity, cold flow, antifreeze properties, and fuel stability. The market is diverse, catering to the needs of various sectors such as automotive, aviation, and heavy-duty operations.

The use is not limited to hydrocarbon fuels but also extends to biofuels and alternative fuels like electricity. Fuel additives help improve the performance and stability of fuels, ensuring optimal power output and reducing fuel consumption. The quality of crude oil and the resulting fuel can significantly impact the performance and stability of fuels. Fuel additives help mitigate the effects of natural disasters and other factors that can impact fuel quality. They also help improve the cetane number and octane rating of fuels, ensuring optimal engine performance. Fuel additives play a vital role in reducing carbon emissions and improving fuel efficiency. They help improve engine performance, reduce fuel consumption, and enhance engine reliability. The market is expected to grow significantly in the coming years due to the increasing demand for cleaner and more efficient fuels.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.8% |

|

Market growth 2024-2028 |

USD 721.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.5 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Afton Chemical, Baker Hughes Co., BASF SE, Chevron Corp., Clariant International Ltd, Croda International Plc, Cummins Inc., Dorf Ketal Chemicals India Pvt. Ltd., Dow Inc., Eastman Chemical Co., Eni SpA, Evonik Industries AG, Exxon Mobil Corp., Infineum International Ltd., Innospec Inc., Lanxess AG, Shell plc, Solvay SA, The Lubrizol Corp., and TotalEnergies SE |

|

Market dynamics |

Parent market analysis, market report, market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, Market growth and Forecasting, COVID 19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch