Fumaric Acid Market Size 2024-2028

The fumaric acid market size is forecast to increase by USD 400.2 million at a CAGR of 7.44% between 2023 and 2028. The market is witnessing significant growth due to its increasing application in various industries, including paint, rubber, beverage, and convenience food. In the paint industry, fumaric acid is used as a corrosion inhibitor and an acidifier. In the rubber industry, it acts as a speciality plasticizer and a stabilizer. The beverage industry, particularly in the production of wines and juices, utilizes fumaric acid as a food additive to enhance taste and improve the stability of the beverages. Moreover, the trend toward reducing carbon emissions and adhering to environmental regulations is driving the demand for bio-based fumaric acid. This eco-friendly alternative to petroleum-based fumaric acid is gaining popularity due to its sustainable production process and lower carbon footprint. However, the market faces challenges from substitutes such as citric acid and malic acid, which offer similar functionalities at lower prices. To remain competitive, market players must focus on innovation and differentiation to cater to evolving consumer preferences and regulatory requirements.

Fumaric acid, a dicarboxylic organic acid, plays a significant role in various industries due to its unique properties. This acid, naturally found in fruits and vegetables, is also produced synthetically for commercial use. Fumaric acid is widely used as an acidulant and flavor enhancer in the food industry. It is particularly popular in the production of fruits and vegetables, where it helps to regulate acidity and improve taste. Apples and grapes are among the fruits that benefit from the addition of fumaric acid. In the case of vegetables, carrots are a notable example of its application.

Moreover, beyond food, fumaric acid serves essential functions in other industries. In the production of synthetic resins and plastics, it acts as a plasticizer and polymer. The paint industry also utilizes fumaric acid as a key ingredient, enhancing the durability and performance of paints. The rubber industry is another significant consumer of fumaric acid. It functions as a plasticizer, improving the flexibility and workability of rubber. In the beverage industry, fumaric acid is used as an acidity regulator in various drinks, contributing to their taste and consistency. Fumaric acid is also employed in the convenience food sector. In the production of glucose syrups and sucrose, it acts as a catalyst, increasing efficiency and reducing production costs.

In the realm of fungi, fumaric acid is used as a nutrient source, facilitating their growth and development. This application is particularly relevant in the production of certain pharmaceuticals and industrial enzymes. In summary, fumaric acid is a versatile organic acid with a wide range of applications across various industries. Its use as an acidulant, flavor enhancer, plasticizer, and acidity regulator is essential in the food, paint, rubber, beverage, and convenience food industries. Additionally, its role as a nutrient source in the production of fungi is significant in specific applications within the pharmaceutical and industrial enzyme sectors.

Market Segmentation

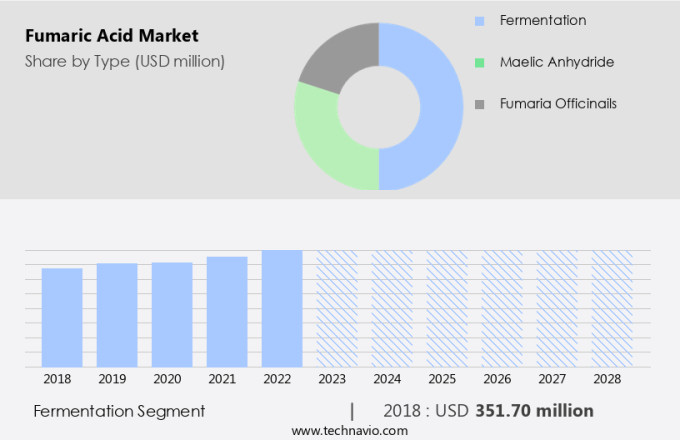

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Fermentation

- Maelic anhydride

- Fumaria officinails

- Application

- Food and beverages

- Unsaturated polyester resins

- Rosin paper sizes

- Alkyd resins

- Others

- Geography

- APAC

- China

- India

- Japan

- North America

- US

- Europe

- Germany

- South America

- Middle East and Africa

- APAC

By Type Insights

The fermentation segment is estimated to witness significant growth during the forecast period. Fumaric acid, a dicarboxylic organic acid, plays a significant role in various industries due to its properties as an acidulant, flavor enhancer, and pH regulator. In the food industry, fumaric acid is commonly used in fruits, vegetables, and beverages, including apples, grapes, and carrots, to enhance taste and preserve freshness. In industrial applications, fumaric acid is used as a raw material in the production of polymers and textiles. The increasing cost of petroleum-derived fumaric acid has led to the exploration of alternative production methods, particularly fermentation using renewable resources. This process yields approximately 85% fumaric acid, which is three times less expensive than its petrochemically derived counterpart.

Get a glance at the market share of various segments Request Free Sample

The fermentation segment was valued at USD 351.70 million in 2018 and showed a gradual increase during the forecast period. The use of submerged fermentation systems and efficient product recovery methods has resulted in economically viable yields and productivity. With the rising cost of fossil feedstocks, fermentatively produced fumaric acid may become a cost-effective alternative to petrochemically derived maleic acid in the production of unsaturated dibasic acids in polyester resins during the forecast period. Furthermore, advancements in metabolic engineering techniques offer opportunities for enhancing fumaric acid production through low-pH fermentations. In conclusion, the demand for fumaric acid is expected to grow due to its versatile applications and the potential for cost savings through alternative production methods. Fermentation technology and metabolic engineering offer promising avenues for enhancing fumaric acid production and reducing reliance on petroleum-derived sources.

Regional Insights

APAC is estimated to contribute 46% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market experienced significant growth in 2023, with APAC leading the global market share. The region's thriving food and beverage industry, coupled with increasing consumer awareness of organic food additives, fuels this growth. Fumaric acid, a versatile food additive, functions as an acidity regulator and flavor enhancer in various applications, including carbonated beverages and synthetic resins for plastics. Its use extends to improving the shelf life of food products and balancing sweetness. Two primary forms of fumaric acid, trans-fumaric and cis-fumaric acid, are utilized in different industries. Trans-fumaric acid is commonly used as a food additive, while cis-fumaric acid is employed in the production of synthetic resins for plastics.

However, hygroscopicity, a property of fumaric acid, enhances its ability to absorb moisture, making it an essential ingredient in various food products. The demand for fumaric acid is driven by the increasing consumption of convenience and packaged food products in APAC. Developed economies like Australia, Singapore, and Japan are leading the way in the adoption of natural food additives, further boosting market growth. The market in APAC is projected to expand at a substantial rate during the forecast period.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

The introduction of ethnic and innovative flavors is the key driver of the market. Fumaric acid plays a significant role in various industries, including food and beverage, automotive, cosmetics, and plastics. In the food sector, it is used as a flavor enhancer and preservative, particularly in ethnic cuisine and ready-to-drink beverages. Its non-hygroscopic property makes it ideal for use in pre-blends and dry mixes, preventing moisture absorption and product degradation. Moreover, the convenience food industry's growth has led to an increased demand for fumaric acid as a food additive. In the automotive industry, it is used as a plasticizer and alkyd resin extender. In the cosmetics industry, it is used as a rosin-sized sheathing paper sizing agent and a cosmetic ingredient.

Furthermore, the market is vast, with numerous applications in various industries. Its versatility and functionality make it a popular choice for manufacturers. As consumers continue to seek unique and authentic flavors in their food and beverages, the demand for fumaric acid is expected to grow. Fumaric acid is also used in the production of polymer and petrochemicals. Its use in these industries is essential in creating high-quality products and improving their performance. The market for fumaric acid is expected to grow steadily, driven by increasing demand from various end-use industries. In conclusion, fumaric acid is a versatile and functional chemical used in various industries, including food and beverage, automotive, cosmetics, and plastics. Its unique properties make it an essential ingredient in creating high-quality products and improving their performance. The market is vast, and its demand is expected to grow as consumers seek unique and authentic flavors and industries continue to innovate and improve their products.

Market Trends

The increased consumption of organic food additives is the upcoming trend in the market. Fumaric acid, derived from the plant Fumaria Officinalis, is a crucial organic compound used in various industries, including the production of unsaturated polyester resins, vehicle manufacturing, and construction. In the automotive sector, it is employed as a component in anchoring grouts and mortars for body filler applications. In the construction industry, fumaric acid is utilized in the production of concrete and coatings, often in conjunction with maleic anhydride. The increasing popularity of organic food products in the market is driving the demand for fumaric acid. This trend is attributed to the growing consumer interest in healthier and more natural food options.

As a result, the organic food industry is witnessing significant growth, leading to increased demand for organic food additives. Despite the benefits, organic products have a shorter shelf life compared to conventional products due to the absence of synthetic preservatives. However, the convenience of easily accessible organic food products in retail stores is offsetting this challenge. Major players in the market include Bartek Ingredients, among others. These companies are investing in research and development to expand their product offerings and cater to evolving consumer preferences. The use of fumaric acid in various applications, such as food additives, industrial applications, and pharmaceuticals, is expected to ensure its continued demand in the US market.

Market Challenge

The increased threat of substitutes from citric acid and malic acid is a key challenge affecting the market growth. Fumaric acid is experiencing significant competition from other acidulants, particularly citric acid and malic acid, in various industries. Citric acid, a natural preservative and tartness producer in carbonated beverages, is widely used in processed foods and the beverage industry due to its water softening properties. As a weak organic acid, it effectively breaks down trace metals in water. Additionally, citric acid has extensive applications in cosmetics and pharmaceuticals, acting as a pH adjuster in skincare products. Given the diverse uses of citric acid, manufacturers prioritize its production on a large scale over fumaric acid. In the paint industry, fumaric acid serves as a valuable ingredient due to its ability to improve the stability and durability of paints.

In the rubber industry, it acts as a plasticizer, enhancing the flexibility and workability of rubber. In the convenience food and drinks sector, fumaric acid is employed as a food additive, preserving the taste and texture of various products. In the wine industry, it functions as a stabilizer, preventing the precipitation of tartrates. Environmental regulations are increasingly stringent, driving the demand for bio-based fumaric acid. This eco-friendly alternative to petroleum-derived fumaric acid is gaining popularity due to its reduced carbon emissions and sustainability.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Actylis - The company offers fumaric acid, which is used as a lubricant in capsule and tablet formulations.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agarwal Life Sciences Pvt. Ltd.

- Anmol Chemicals Group

- Bartek Ingredients Inc.

- Central Drug House Pvt. Ltd.

- Changmao Biochemical Engineering Co. Ltd.

- Changzhou Yabang Chemical Co. Ltd.

- Dastech International Inc.

- Fuso Chemical Co. Ltd.

- Henan GP Chemicals Co. Ltd.

- Joshi Agrochem Pharma Pvt. Ltd.

- Merck KGaA

- NIPPON SHOKUBAI CO. LTD

- Paari Chem Resources Pvt. Ltd.

- Polynt Spa

- RXChemicals

- SIP Chemical Industries

- The Chemical Co.

- UPC Technology Corp.

- XST Biological Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Fumaric acid, a dicarboxylic organic acid, plays a significant role in various industries due to its versatile properties. This white crystalline powder is widely used as an acidulant, flavor enhancer, and pH regulator in the food industry. Fumaric acid is naturally found in fruits and vegetables, including apples, grapes, carrots, and others. In the food sector, it is used to enhance flavors, maintain acidity, and improve the sweetness balance in various food products and beverages. Industrially, fumaric acid is utilized in the production of resins, alkyd paints, unsaturated polyester resins, and plastics. It acts as a plasticizer, enhancing the flexibility and durability of these materials.

In summary, in the automotive industry, fumaric acid is used in coatings, vehicle production, and concrete. Fumaric acid also holds health benefits, particularly for individuals with medical conditions such as psoriasis, acne, and hyperpigmentation. It is an acceptable daily intake for humans, and its rosin size is comparable to that of citric acid, malic acid, tartaric acid, succinic acid, and other organic acids. The production of fumaric acid can be derived from various sources, including rosin, maleic anhydride, and fermentation using Fumaria officinalis. The use of bio-based fumaric acid is gaining popularity due to environmental regulations and the reduction of carbon emissions. It is also used in rosin-sized sheathing paper, cosmetics, animal feed, and fungi.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

178 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.44% |

|

Market growth 2024-2028 |

USD 400.2 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.39 |

|

Regional analysis |

APAC, North America, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 46% |

|

Key countries |

China, US, India, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Actylis, Agarwal Life Sciences Pvt. Ltd., Anmol Chemicals Group, Bartek Ingredients Inc., Central Drug House Pvt. Ltd., Changmao Biochemical Engineering Co. Ltd., Changzhou Yabang Chemical Co. Ltd., Dastech International Inc., Fuso Chemical Co. Ltd., Henan GP Chemicals Co. Ltd., Joshi Agrochem Pharma Pvt. Ltd., Merck KGaA, NIPPON SHOKUBAI CO. LTD, Paari Chem Resources Pvt. Ltd., Polynt Spa, RXChemicals, SIP Chemical Industries, The Chemical Co., UPC Technology Corp., and XST Biological Co. Ltd. |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch