GaN RF Devices Market Size 2024-2028

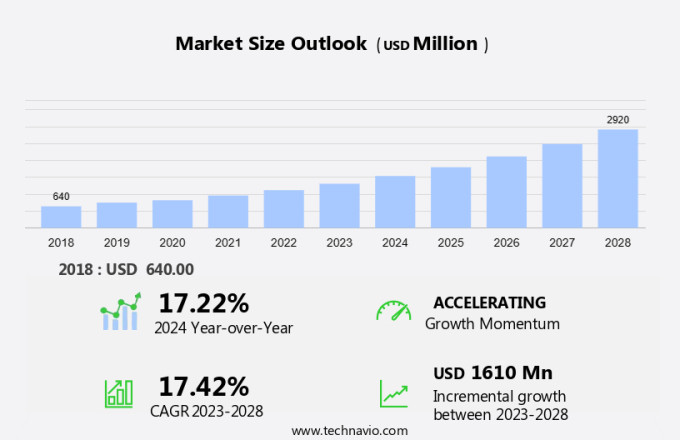

The GaN RF devices market size is forecast to increase by USD 1.61 billion at a CAGR of 17.42% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing use in broadcasting applications. GaN RF devices offer superior power handling capabilities and efficiency, making them an ideal choice for broadcasting applications. Another trend driving market growth is the growing prominence of GaN-on-Diamond technology, which provides enhanced power density and thermal management. Furthermore, GaN RF devices are also gaining popularity in aerospace, defense, optoelectronics, and quantum devices due to their high-temperature operation capabilities and energy efficiency. However, the high cost of raw materials and production process poses a challenge to market growth. Despite this, the market is expected to continue expanding due to the increasing demand for GaN RF devices in various end-use industries such as telecommunications, military and aerospace, and industrial automation. The market analysis report provides a comprehensive study of these trends and growth factors, offering valuable insights for stakeholders and market participants.

What will be the Size of the GaN RF Devices Market During the Forecast Period?

- The High-Power Electronics (HPE) market, specifically In the realm of Gallium Nitride (GaN) RF devices, continues to experience significant growth due to their superior electrical and thermal properties. GaN RF devices exhibit excellent power handling capabilities and high electron mobility, making them ideal for use in various applications such as radio frequency amplifiers and power converters. The thermal properties of GaN RF devices are a critical factor In their performance. Phonons, quantum mechanical vibrations of the crystal lattice, significantly impact lattice thermal conductivity. First-principles modeling, including quantum perturbation theory and density functional theory, are employed to understand phonon distributions and thermal transport in GaN.

- Moreover, GaN RF devices come in both p-type and n-type varieties, with the barrier height and specific contact resistivity being essential factors In their thermal stability. The development of AlGaN/GaN heterostructures and ternary alloys has led to enhanced device performance and improved thermal management. Nanostructures, such as quantum dots and nanowires, are also being explored to further optimize GaN RF devices' thermal and electrical properties.

How is this GaN RF Devices Industry segmented and which is the largest segment?

The GaN RF devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Cellular infrastructure

- Defense and military

- CATV

- Others

- Material

- GaN-on-Si

- GaN-on-SiC

- GaN-on-Diamond

- Geography

- APAC

- China

- Japan

- South Korea

- Europe

- Germany

- North America

- US

- South America

- Middle East and Africa

- APAC

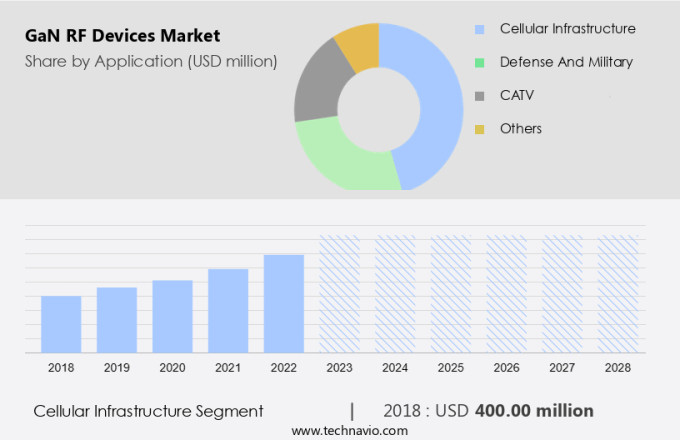

By Application Insights

- The cellular infrastructure segment is estimated to witness significant growth during the forecast period.

GaN RF devices have gained significant traction In the telecommunications industry due to their high power density, switching frequency, and efficiency. These properties make GaN RF devices ideal for establishing 5G infrastructure, as they can handle more power than other high-frequency technologies and offer high instantaneous bandwidths, which are essential for wider frequency bands and carrier aggregation in telecom networks. The energy consumption in telecom networks primarily comes from the RF chain. GaN RF devices' superior properties, such as high power density, power added efficiency, and ease in impedance-matching, enable improved overall efficiency In the RF chain, making them indispensable for the implementation of 5G wireless networks. In data centers, GaN RF devices' ability to reduce carbon footprint and improve energy efficiency is a significant advantage.

Get a glance at the GaN RF Devices Industry report of share of various segments Request Free Sample

The cellular infrastructure segment was valued at USD 400.00 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

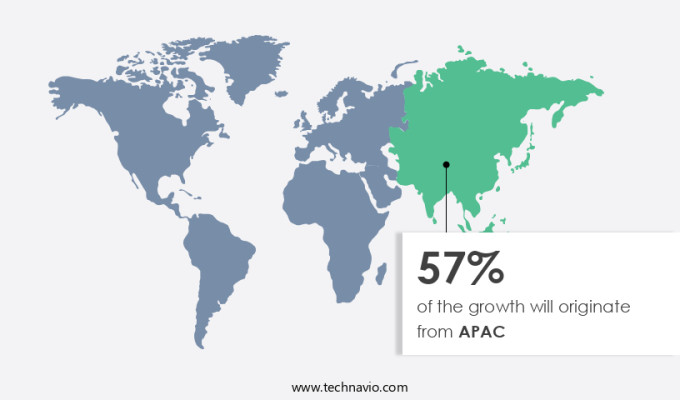

- APAC is estimated to contribute 57% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in APAC is projected to experience significant growth during the forecast period, driven by increasing defense and military expenditures In the region. China, in particular, is leading this trend due to its continuous increase in defense budget over the past decade. This growth in defense spending will result in an expanded military workforce and increased demand for ammunition, leading to a heightened need for GaN RF devices. Additionally, the demand for improved cellular networks in developing countries such as China, India, South Korea, Taiwan, and Malaysia will further fuel the market growth in APAC. The region's market will expand rapidly due to its applications in various end-use industries, including telecommunications, military and defense, and consumer electronics.

Market Dynamics

Our GaN RF devices market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of GaN RF Devices Industry?

Increasing use in broadcasting applications is the key driver of the market.

- GaN RF devices, derived from High-Power Electronics, exhibit exceptional properties that make them increasingly sought-after in various industries. GaN RF transistors outperform their GaAs and silicon counterparts due to superior power output and superior thermal conductivity. This high lattice thermal conductivity, a key thermal property, stems from the interaction of phonons, the quantum mechanical particles responsible for heat transport. First-principles modeling and phonon distributions have been instrumental in understanding thermal transport in P-Type GaN and N-Type GaN. AlGaN/GaN heterostructures and ternary alloys further enhance GaN RF devices' performance in various applications. GaN RF devices are essential for power conversion technologies, particularly in high-power, high-frequency, and high-temperature operations.

- Moreover, they find applications in diverse sectors, including automotive, consumer electronics, fast chargers, aerospace, defense, optoelectronics, data centers, quantum devices, and more. The environmental friendliness of GaN RF devices, with a lower carbon footprint and energy savings, adds to their appeal. GaN RF devices' miniaturization and compatibility with electronic designs, such as those from Cadence, make them suitable for various industry applications. Thermal stability and breakdown field are crucial factors In thermal transient testing for GaN RF devices. GaN RF devices' applications extend to sensor applications and RF power amplifiers. As GaN RF devices continue to evolve, they will play a significant role in carbon emissions reduction, energy savings, and sustainability.

What are the market trends shaping the GaN RF Devices Industry?

Growing prominence of GaN-on-Diamond is the upcoming market trend.

- GaN RF devices, a crucial component in high-power electronics, exhibit superior performance in various applications, including power conversion technologies, radio frequency (RF) applications, sensor applications, and optoelectronics. The thermal properties of GaN RF devices, particularly P-Type GaN and N-Type GaN, significantly impact their efficiency and reliability. Phonon distributions and lattice thermal conductivity are essential factors influencing thermal transport In these devices. First-principles modeling is employed to understand the thermal behavior of GaN RF devices at the atomic level. The thermal stability of GaN RF devices is essential for their successful implementation in demanding applications. The barrier height and specific contact resistivity of AlGaN/GaN heterostructures and ternary alloys are critical in optimizing device performance.

- In addition, GaN RF devices' thermal properties are crucial for high-temperature operation and low-voltage as well as high-voltage applications. Industrial diamond, with its superior thermal conductivity, offers a promising solution for enhancing the thermal properties of GaN RF devices. The adoption of GaN-on-Diamond wafers paves the way for high-performance, resilient power electronics. This approach addresses the challenges of improving efficiency and device lifetime, safety requirements, and optimized cost. The use of diamond substrates also reduces carbon footprint and enhances energy efficiency, making GaN RF devices more sustainable for various industry applications. GaN RF devices' adoption in automotive applications, consumer electronics, fast chargers, aerospace, defense, and data centers is on the rise due to their high efficiency, environmental friendliness, and miniaturization.

What challenges does the GaN RF Devices Industry face during its growth?

High cost of raw materials and production process is a key challenge affecting the industry growth.

- The market is experiencing significant growth due to the increasing demand for High-Power Electronics in various industries. GaN RF devices, including P-Type GaN and N-Type GaN, exhibit superior thermal properties, making them ideal for applications requiring high power handling and efficiency. However, the high cost of raw materials and complex manufacturing process pose challenges to market expansion. First-principles modeling and electrothermal modeling are utilized to enhance the thermal transport properties of AlGaN/GaN Heterostructures and Ternary Alloys, thereby improving device performance. Phonon distributions and lattice thermal conductivity are critical factors influencing thermal stability in GaN RF devices. GaN RF devices offer advantages such as high breakdown field, thermal transient testing, and suitability for sensor applications.

- In addition, they are expected to replace silicon-based RF devices In the future due to their superior efficiency and environmental friendliness. GaN RF devices are finding applications in various industries, including automotive, consumer electronics, power conversion technologies, aerospace, defense, optoelectronics, data centers, and quantum devices. The high average selling price of GaN RF devices is attributed to the novelty of this technology and its application in high-power, high-voltage, and high-temperature operations. GaN RF devices are essential components in power amplifiers, fast chargers, and Terahertz (THz) devices, contributing to carbon emissions reduction and energy savings. Electronic designs using GaN RF devices are becoming increasingly popular due to their miniaturization capabilities and compatibility with Cadence and other industry applications.

Exclusive Customer Landscape

The gan rf devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gan rf devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gan rf devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ampleon Netherlands BV

- Broadcom Inc.

- Fujitsu Ltd.

- GaN Systems

- Infineon Technologies AG

- Integra Technologies Inc.

- MACOM Technology Solutions Inc.

- Microchip Technology Inc.

- Mitsubishi Electric Corp.

- Northrop Grumman Corp.

- NXP Semiconductors NV

- Qorvo Inc.

- Raytheon Technologies Corp.

- RFHIC Corp.

- STMicroelectronics International N.V.

- Sumitomo Electric Industries Ltd.

- Texas Instruments Inc.

- Toshiba Corp.

- United Monolithic Semiconductors Holding SAS

- NTT Advanced Technology Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Gallium Nitride (GaN) RF devices have emerged as a game-changer In the high-power electronics industry due to their superior thermal properties and electrical performance. The unique lattice thermal conductivity of GaN makes it an ideal material for RF power conversion technologies, enabling efficient energy transfer and minimizing thermal losses. First-principles modeling and advanced simulation techniques have played a crucial role in understanding the phonon distributions and thermal transport properties of GaN. These studies have led to the development of high-performance GaN RF devices, including p-type and n-type GaN, which exhibit excellent specific contact resistivity and barrier height.

In addition, the integration of AlGaN/GaN heterostructures and ternary alloys has further enhanced the performance of GaN RF devices. These advancements have led to the creation of miniaturized, high-efficiency RF power amplifiers and power supplies, suitable for various applications, including automotive, consumer electronics, aerospace, defense, and optoelectronics. Electrothermal modeling and thermal transient testing have become essential in evaluating the performance and reliability of GaN RF devices under different operating conditions. The ability to operate GaN RF devices at high temperatures and under high electric fields has expanded their applications in various industries. The environmental friendliness and energy efficiency of GaN RF devices have also gained significant attention.

Moreover, the reduced carbon footprint and energy savings offered by GaN RF devices make them an attractive alternative to traditional power conversion technologies. Moreover, GaN RF devices have shown promise in sensor applications, data centers, and quantum devices, further expanding their market potential. The demand for GaN RF devices is driven by the increasing need for high-power, efficient, and reliable RF power conversion technologies. The market is expected to grow significantly due to the increasing adoption of GaN RF devices in various industries, including automotive, consumer electronics, aerospace, defense, and optoelectronics. The miniaturization of GaN RF devices has led to their integration into various applications, such as fast chargers, power supplies, and high-voltage applications.

Furthermore, the development of GaN RF devices for low-voltage applications has also gained significant attention due to the increasing demand for energy-efficient electronic designs. Therefore, the market is driven by the increasing demand for high-power, efficient, and reliable RF power conversion technologies. The unique thermal properties and electrical performance of GaN make it an ideal material for various applications, including automotive, consumer electronics, aerospace, defense, and optoelectronics. The ongoing research and development efforts In the field of GaN RF devices are expected to lead to significant advancements In the coming years.

|

GaN RF Devices Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

177 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 17.42% |

|

Market growth 2024-2028 |

USD 1.61 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

17.22 |

|

Key countries |

US, China, Japan, South Korea, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this GaN RF Devices Market Research and Growth Report?

- CAGR of the GaN RF Devices industry during the forecast period

- Detailed information on factors that will drive the GaN RF Devices growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gan rf devices market growth of industry companies

We can help! Our analysts can customize this gan rf devices market research report to meet your requirements.