Gas Masks Market Size 2025-2029

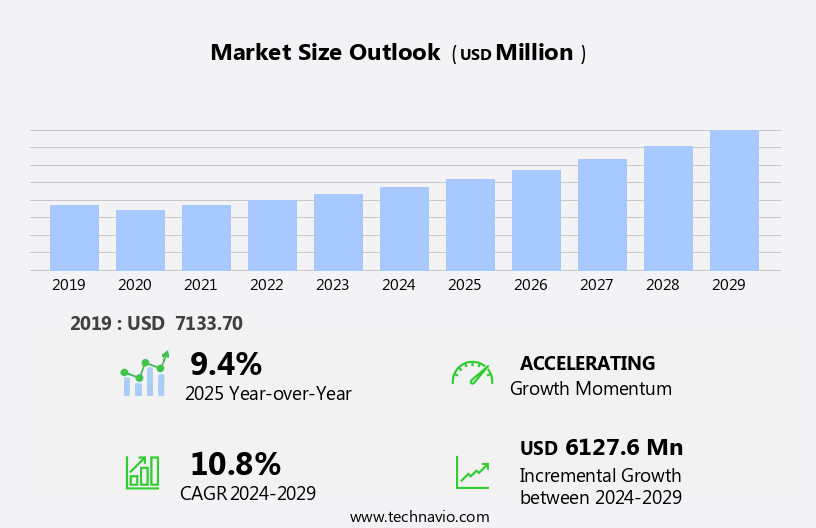

The gas masks market size is forecast to increase by USD 6.13 billion at a CAGR of 10.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand from manufacturing industries and first responders. The manufacturing sector's expansion, particularly in regions with high pollution levels, is driving the need for protective gas masks to ensure worker safety. Meanwhile, first responders' reliance on gas masks to mitigate hazardous environments during emergencies is further fueling market growth. However, this market's growth is not without challenges. Regulatory hurdles impact adoption, as stringent regulations require rigorous testing and certification processes for gas masks.

- Additionally, supply chain inconsistencies temper growth potential due to the complex nature of manufacturing and sourcing components. Despite these challenges, opportunities exist for companies to capitalize on the market's growth by focusing on innovation, regulatory compliance, and supply chain optimization. By addressing these challenges effectively, market participants can differentiate themselves and capture a larger share of this growing market.

What will be the Size of the Gas Masks Market during the forecast period?

- In the dynamic the market, first responders and industrial workers rely on advanced respiratory protection equipment to ensure occupational safety and workplace safety against various inhalation hazards. Gas mask technology continues to evolve, addressing concerns such as breathing resistance, facial seal integrity, and exhalation valve efficiency. Regular mask maintenance, including filter replacement and cartridge replacement, is crucial for optimal performance. Fit testing methods, including qualitative and quantitative fit testing, are essential for ensuring a proper seal and effective voice communication through head harnesses. Gas mask storage and disposal also play significant roles in emergency preparedness and industrial hygiene, particularly when dealing with hazardous materials and airborne contaminants.

- The importance of gas masks extends beyond chemical warfare to pandemic preparedness and disaster response scenarios. Protective equipment, including gas masks, is a critical component of respiratory protection, safeguarding against inhalation hazards and ensuring the health and safety of workers and first responders.

How is this Gas Masks Industry segmented?

The gas masks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Chemical industry

- Oil and gas

- Mining industry

- Healthcare

- Others

- Type

- Disposable respirators

- Powered air purifying respirators

- Supplied air respirators

- Self contained breathing apparatus

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

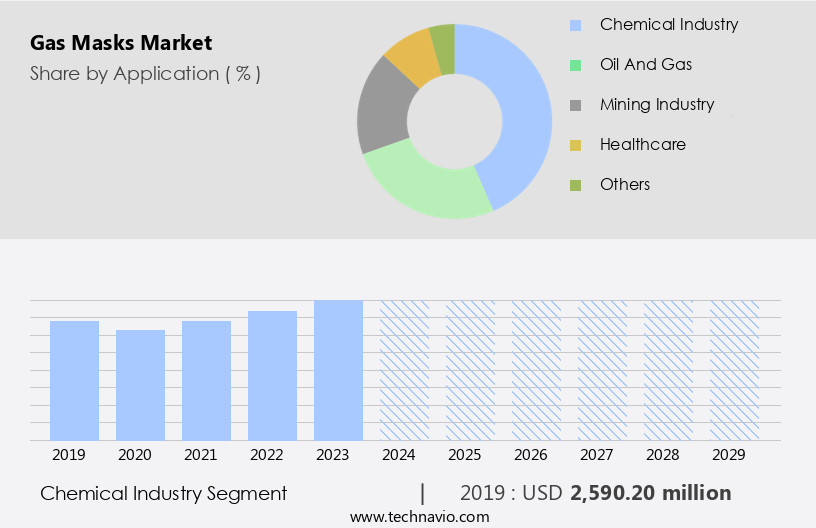

The chemical industry segment is estimated to witness significant growth during the forecast period.

The full-face mask is a crucial component of personal protective equipment (PPE) in various industries, particularly those dealing with hazardous chemicals. Acid gases, inorganic vapors, and organic vapors pose significant risks to workers, necessitating the use of air-purifying respirators, positive pressure, and self-contained breathing apparatuses. These respirators ensure protection against exposure limits of hazardous substances, including carbon monoxide, nitrogen dioxide, hydrogen sulfide, and paint fumes. Noise attenuation is also essential for worker comfort and safety, as industries such as oil and gas and law enforcement often involve high-decibel environments. Service life and expiration dates are critical factors in maintaining the effectiveness of these masks.

Fit testing and protection factor assessments ensure a proper seal and adequate filtration efficiency. In the context of chemical production, hazard identification is paramount. Protection against weld fumes, heat stress, and sulfur dioxide is essential for workers in manufacturing and industrial settings. The chemical industry's diverse subsectors, including petrochemicals, agrochemicals, pharmaceuticals, and specialty chemicals, require various types of PPE. Supplied air respirators and powered air-purifying respirators offer enhanced user comfort and efficiency in extended use scenarios. Emergency response teams rely on self-contained breathing apparatuses for critical situations. Regulations governing the handling and production of hazardous chemicals necessitate the use of advanced PPE technologies.

PPE manufacturers continually innovate to address evolving hazards and user requirements. Filtration efficiency, user comfort, and protection factor remain key considerations in the development of these life-saving devices.

The Chemical industry segment was valued at USD 2.59 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

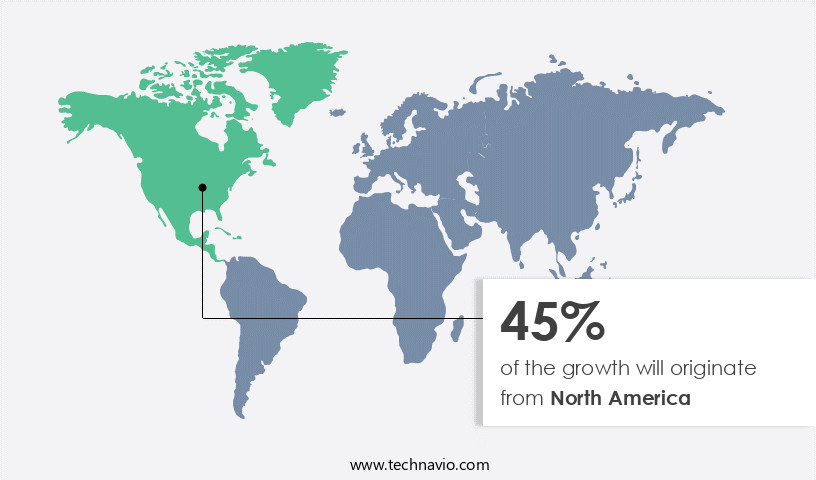

North America is estimated to contribute 45% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the Asia-Pacific region, the market for full-face masks is witnessing significant growth in industries such as manufacturing, construction, and healthcare. The manufacturing industry, a major employer globally, is driving the demand for gas masks due to the hazardous nature of its processes. These include handling acid gases, inorganic vapors, and organic vapors, which pose risks to workers' health. Protection against noise attenuation and heat stress is also essential in many manufacturing environments. Gas masks come in various types, including air-purifying respirators, positive pressure, and self-contained breathing apparatus. Air-purifying respirators filter contaminated air, while positive pressure masks supply clean air from an external source.

Self-contained breathing apparatus provides the wearer with an independent air supply. The construction industry, another significant end-user, requires gas masks to protect workers from hazardous substances like paint fumes and welding fumes. In the healthcare sector, gas masks are used during emergency response situations involving toxic gases such as nitrogen dioxide, hydrogen sulfide, and carbon monoxide. The service life of gas masks is crucial, and regular fit testing and expiration date checks ensure their effectiveness. Protection factors, filtration efficiency, and user comfort are essential considerations in selecting the appropriate mask for specific applications. The oil and gas industry also relies on gas masks to protect workers from harmful gases during drilling and refining processes.

Law enforcement personnel use gas masks during riot control and other hazardous situations. Gas masks are becoming increasingly important as exposure limits to hazardous substances continue to decrease, necessitating better protection for workers. The market is expected to continue evolving, with new technologies and innovations addressing the diverse needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Gas Masks market drivers leading to the rise in the adoption of Industry?

- The manufacturing sector's growing requirement for gas marks serves as the primary catalyst for the market's expansion.

- Gas masks are essential protective equipment used to shield individuals from inhaling harmful gases, smoke, and organic vapors. These masks, which include air-purifying respirators and general-purpose respators, filter out pollutants and provide clean, purified air. In various industries such as paper mills, wood sawmills, textile mills, metal fabrication, oil and gas, and food processing, workers are exposed to potential hazards like sulfur dioxide, weld fumes, and other toxic substances. Chemical plants, specifically those producing chemicals, acids, and organic solvents, pose significant risks due to the more than 20,000 chemicals capable of causing ocular lesions, lung problems, and burns upon contact.

- Negative pressure gas masks, which create a seal around the face and maintain a constant flow of clean air, offer enhanced protection. Filtration efficiency is a crucial factor in ensuring the effectiveness of gas masks, with self-contained breathing apparatus providing the highest level of protection. By utilizing gas masks, businesses can prioritize the health and safety of their workforce, ensuring a harmonious and productive work environment.

What are the Gas Masks market trends shaping the Industry?

- The demand for gas masks among first responders is experiencing significant growth, representing a notable market trend in the emergency response industry. This increasing need for protective equipment underscores the importance of being prepared for potential hazardous situations.

- Gas masks are essential protective equipment for first responders, including firefighters, police officers, and rescue teams, who face hazardous environments with the potential release of toxic gases, vapors, and smoke. In response to the increasing demand for advanced gas masks, market companies focus on producing full-face masks that offer superior protection against acid gases, inorganic vapors, and noise attenuation. These masks provide positive pressure, ensuring a constant flow of clean, purified air, and are designed for improved comfort for extended use.

- The importance of gas masks is underscored by the potential severe damage to property and lives resulting from industrial or commercial fires. By utilizing air-purifying respirators, first responders can effectively mitigate the risks associated with these dangerous situations and ensure their safety during rescue operations.

How does Gas Masks market faces challenges face during its growth?

- The requirement for routine maintenance poses a significant challenge to the industry's growth trajectory.

- Gas masks, including PAPR, SCBA, and other supplied air-purifying respirators, are essential protective equipment for various industries, such as oil and gas, paint manufacturing, and emergency services. These masks feature components like valves, cartridges, breathing tubes, blowers, and pumps, which require proper maintenance and care for efficient and safe operation. Damage or tears in the components can pose risks to the user. Manufacturers provide guidelines for using and maintaining these masks. For instance, air-purifying respirators require additional care and attention. Cartridges should be stored separately in a clean and dry area after use and checked for cracks, tears, holes, and dirty valves before use.

- Alcohol wipes should not be used for cleaning, and cartridges should be disposed of within the set time-limit. Exposure limits to specific gases, such as carbon monoxide, should be considered when using gas masks. Proper fit testing ensures user comfort and adequate protection factor. Regular inspections and maintenance are crucial to ensure the masks' longevity and effectiveness.

Exclusive Customer Landscape

The gas masks market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the gas masks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, gas masks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

3M Co. - The company specializes in providing top-tier gas mask solutions for various industries. Our selection includes the 3M Full Facepiece Reusable Respirator 6900 Large, 3M Scott AV-3000 HT Facepiece, and 3M Ultimate FX Full Facepiece Reusable Respirator FF-402 Medium. These respirators offer superior protection against harmful particles and gases, ensuring the safety and well-being of professionals in hazardous environments. The 3M Full Facepiece Reusable Respirator 6900 Large features a large facepiece for enhanced comfort and a versatile design suitable for multiple applications. The 3M Scott AV-3000 HT Facepiece boasts a high-performance filter system and a low-profile design for increased user mobility. Lastly, the 3M Ultimate FX Full Facepiece Reusable Respirator FF-402 Medium offers a balanced combination of protection, comfort, and ease of use, making it an excellent choice for a wide range of applications. By investing in these advanced gas mask solutions, organizations can safeguard their employees and improve overall operational efficiency.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- airboss.com

- Alpha Pro Tech Ltd.

- Avon Polymer Products Ltd.

- Bullard

- Dragerwerk AG and Co. KGaA

- Duram Mask

- Gateway Safety Inc.

- Honeywell International Inc.

- ILC Dover LP

- Kimberly Clark Corp.

- Moldex Metric

- MSA Safety Inc.

- Optrel AG

- RPB Safety LLC

- RSG Safety BV

- Shalon Chemical Industries

- SHIGEMATSU WORKS CO. LTD.

- Sundstrom Safety AB

- The Metadure Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Gas Masks Market

- In March 2024, 3M, a leading industrial company, announced the launch of its new line of gas masks, the 3M Scott Air-Pak X3500 SCBA (Self-Contained Breathing Apparatus), featuring advanced filtration technology and extended battery life (3M Press Release, 2024). This innovation addresses the growing demand for high-performance protective equipment in industries such as oil and gas, firefighting, and hazardous material handling.

- In July 2025, Honeywell International and DuPont announced a strategic partnership to co-develop advanced gas mask technologies, combining Honeywell's expertise in filtration systems with DuPont's knowledge in materials science (Honeywell Press Release, 2025). This collaboration aims to create next-generation gas masks with enhanced protection against chemical, biological, radiological, and nuclear threats.

- In September 2024, Dräger, a leading international manufacturer of safety technology, acquired the gas mask business unit of MSA Safety Incorporated for approximately USD350 million (MSA Safety Press Release, 2024). This acquisition strengthened Dräger's position in the global gas mask market and expanded its product portfolio, providing synergies and economies of scale.

- In February 2025, the European Union's REACH regulation updated its guidelines on the classification, labeling, and packaging of gases, including those requiring the use of gas masks (European Chemicals Agency, 2025). This regulatory change has led to increased demand for high-quality, compliant gas masks, creating opportunities for market growth and innovation.

Research Analyst Overview

The full-face mask market continues to evolve, driven by the diverse needs of various sectors. These masks, which provide comprehensive protection against acid gases, hazardous inorganic vapors, and other airborne contaminants, are integral to industries such as oil and gas, where exposure to carbon monoxide, hydrogen sulfide, and nitrogen dioxide is common. In addition, paint fumes and weld fumes necessitate the use of masks with high filtration efficiency. Hazard identification plays a crucial role in the selection process, with masks designed to protect against specific hazards. Noise attenuation and user comfort are also essential considerations, as prolonged use can impact performance and productivity.

Air-purifying respirators, positive pressure masks, and supplied air respirators are among the solutions available, each with unique advantages. Positive pressure masks, for instance, offer superior protection against inhalation hazards, while air-purifying respirators are suitable for environments with lower contaminant concentrations. The service life of these masks is a significant concern, with regular fit testing and expiration date checks essential to ensure continued protection. Protection factor, filtration efficiency, and user comfort are key factors influencing the market's dynamics. In law enforcement, masks are used to protect against tear gas and other riot control agents. In emergency response, masks are essential for dealing with situations involving sulfur dioxide, hydrogen sulfide, and other hazardous gases.

Heat stress is another factor influencing mask design, with negative pressure masks offering relief in high-temperature environments. The ongoing unfolding of market activities reveals a dynamic landscape, with continuous innovation and adaptation to meet the evolving needs of various sectors.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Gas Masks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

212 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.8% |

|

Market growth 2025-2029 |

USD 6127.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.4 |

|

Key countries |

Japan, US, China, India, Canada, Germany, UK, France, Brazil, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Gas Masks Market Research and Growth Report?

- CAGR of the Gas Masks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the gas masks market growth of industry companies

We can help! Our analysts can customize this gas masks market research report to meet your requirements.