Gelcoat Market Size 2024-2028

The gelcoat market size is forecast to increase by USD 462.4 million at a CAGR of 6% between 2023 and 2028.

- The market is driven by the expansion of industries such as marine and transportation, with a focus on boats and trains. The demand for gelcoat in these sectors is fueled by the need for glossy, durable finishes that enhance appearance and provide weather resistance. Polyester resin is the primary material used in producing gelcoat, offering a balance between cost and performance. However, increasing concerns over emissions and the shift towards fuel efficiency have led to a growing interest in alternative coatings like epoxy gel. Quality control is a significant challenge in the gelcoat industry, as maintaining consistent gloss levels and preventing defects requires rigorous testing and adherence to standards. It is commonly used in the manufacturing of prosthetics, dental restoratives, and other medical equipment.

- Moreover, Gelcoat is also used in the production of medical devices due to its biocompatibility and resistance to chemicals and moisture. The market is also witnessing a trend towards matte finishes, which offer improved durability and reduced weathering compared to traditional glossy coatings. Overall, the market is poised for continued growth, driven by the demands of various industries and the ongoing quest for high-quality, cost-effective coatings.

What will be the Size of the Market During the Forecast Period?

- Gelcoat is a type of coating used primarily in the manufacturing of fiberglass reinforced plastic (FRP) products. Its unique properties, such as corrosion resistance, abrasion resistance, and a glossy finish, make it an ideal choice for various industries. In this article, we will discuss the current market trends and applications of gelcoat in different sectors. Gelcoat plays a significant role in the industrial coatings market due to its superior weathering resistance and chemical resistance. It is commonly used in the production of tanks, pipes, and other industrial equipment to protect against environmental factors and chemical exposure.

- In the transportation sector, gelcoat is used extensively in the production of fuel-efficient vehicles, including cars, buses, trucks, boats, and yachts. Its low weight and high strength make it an excellent choice for vehicle manufacturing, while its weathering resistance and glossy finish enhance the aesthetic appeal of boats and yachts. In the construction industry, gelcoat is used as a protective coating for various building materials, such as fiberglass insulation and roofing. Its ability to withstand weathering and UV radiation makes it an ideal choice for sustainable construction projects. Gelcoat is also used in the production of medical devices due to its biocompatibility and resistance to chemicals and moisture.

- It is commonly used in the manufacturing of prosthetics, dental restoratives, and other medical equipment. In the rail industry, gelcoat is used in the production of train bodies and interiors due to its durability and resistance to wear and tear. Its ability to withstand extreme temperatures and weathering makes it an excellent choice for train manufacturing. Gelcoat is also used as a primer for epoxy resin applications, providing excellent adhesion and corrosion resistance. It is commonly used in the production of industrial equipment, pipes, and tanks. In conclusion, gelcoat is a versatile coating with a wide range of applications across various industries.

- Moreover, its unique properties, such as corrosion resistance, abrasion resistance, and a glossy finish, make it an ideal choice for industrial coatings, transportation, building materials, medical devices, and train production. The demand for gelcoat is expected to grow due to the increasing focus on sustainable transportation solutions and energy-efficient buildings. Gelcoat suppliers continue to innovate and develop new gelcoat products to meet the evolving needs of different industries.

How is this market segmented and which is the largest segment?

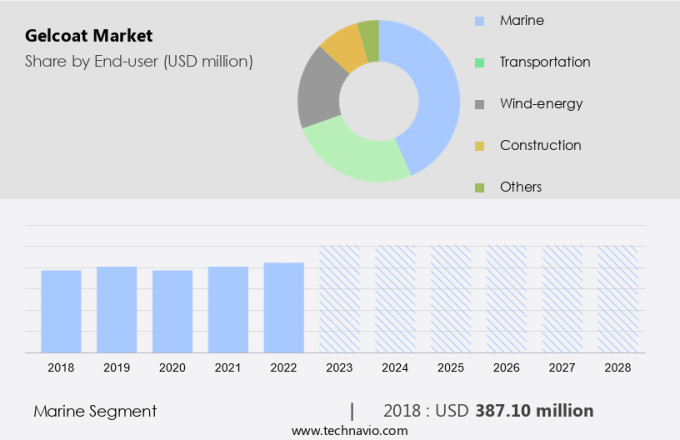

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Marine

- Transportation

- Wind-energy

- Construction

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By End-user Insights

- The marine segment is estimated to witness significant growth during the forecast period.

The market holds significant importance in the United States, particularly within the transportation sector, including boats and trains. Gelcoat, a type of coating made from polyester resin, is extensively utilized for its glossy finish, durability, and resistance to weathering. In the marine industry, this coating is commonly applied to decks, hulls, power boats, and motor yachts to enhance their appearance and shield against UV radiation and chemical attacks. The preference for polyester gelcoat over epoxy alternatives is due to its superior resistance to UV degradation. The expansion of the recreational boat and shipping industries in the US is projected to fuel the demand for gelcoat.

Additionally, this growth is driven by the increasing focus on fuel efficiency and the desire for high-quality finishes in transportation. While matte finishes are gaining popularity, the high-gloss finish of gelcoat continues to be a preferred choice for many applications. As a result, the market in the US transportation industry is expected to experience steady growth in the coming years. To ensure the highest quality control, manufacturers use advanced techniques to apply and cure the gelcoat. This attention to detail ensures that the final product not only looks great but also provides optimal protection against the elements. In summary, the US the market, driven by the marine and transportation industries, offers significant opportunities for growth due to the increasing demand for durable, aesthetically pleasing coatings that can withstand the rigors of transportation use.

Get a glance at the market report of share of various segments Request Free Sample

The marine segment was valued at USD 387.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

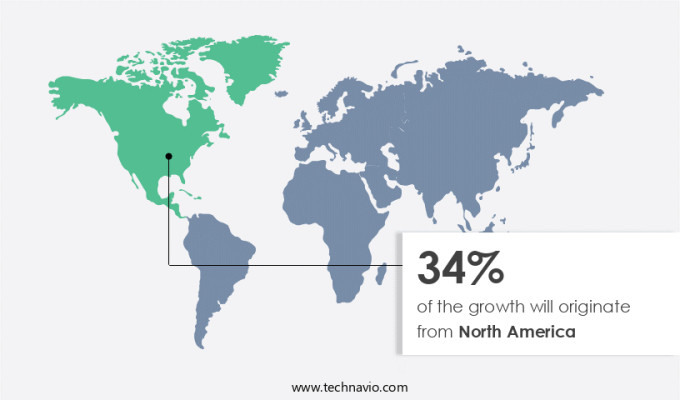

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market holds a significant position due to the expanding marine and transportation industries. The preference for gelcoat in these sectors is driven by its ability to provide a glossy finish and protective shield on fiberglass surfaces. This coating not only enhances the visual appeal but also safeguards against wear and tear, especially in adverse weather conditions.

In the marine industry, the use of vinyl ester and polyester resins for in-mold surface coating applications is on the rise. Central America's rapid industrialization is expected to fuel the demand for gelcoat in this region, leading to increased exports from North America. Despite the maturity of the market in North America, the potential for growth lies in catering to eco-friendly trends and stricter environmental mandates. Gelcoat manufacturers can focus on developing eco-friendly alternatives to meet the evolving customer needs and regulatory requirements. This strategic approach will not only help in maintaining customer satisfaction but also ensure long-term market growth.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Gelcoat Market?

Growth of the marine industry and upcoming yacht projects are the key drivers of the market.

- In the marine industry, gelcoats play a crucial role in providing durable and visually appealing finishes for boats, pools, and vehicle exteriors. These advanced materials offer protection against diverse weather conditions, UV radiation, and chemical attack. Gelcoats are preferred for their corrosion resistance and thermal expansion properties, ensuring the longevity of metal components. The boating industry relies heavily on gelcoats for their high-quality finish and aesthetic appeal. The demand for gelcoats is expected to grow significantly due to the increasing number of yacht projects and recreational activities in the US, Canada, California, and Alaska. The superior properties and durability of gelcoats make them a preferred choice in the marine industry.

- Additionally, the spray up process is commonly used to apply gelcoats, ensuring an even and smooth finish. Gelcoats offer both UV resistance and chemical resistance, making them ideal for use in marine environments. Tooling gelcoats are also available, providing a protective layer during the manufacturing process. To maintain the image and appearance of boats, it's essential to use high-quality gelcoats. The use of gelcoats not only enhances the aesthetic appeal but also ensures the protection of the underlying materials. By investing in premium gelcoats, boat owners can ensure their vessels remain in excellent condition, even in harsh weather conditions.

- In conclusion, gelcoats are a vital component in the marine industry, providing both functional and aesthetic benefits. Their durability, resistance to weather and environmental conditions, and high-quality finish make them a preferred choice for boat owners and manufacturers alike. The growing demand for recreational boating activities in North America is expected to fuel the growth of the market in the coming years.

What are the market trends shaping the Gelcoat Market?

Strategic initiatives undertaken by leading vendors is the upcoming trend in the market.

- The market for vehicles in the US is experiencing notable expansion, with advancements in technology and heightened research and development efforts driving growth. Key industry players, including BASF, Akzo Nobel N.V., HK Research Corp., and Scott Bader Co., are actively pursuing strategic initiatives to gain a competitive edge. These initiatives, such as acquisitions, partnerships, product launches, and investment in R&D, are contributing to the development of innovative gelcoat grades and expanding applications. Gelcoats are essential for vehicles, particularly those designed for water use, as they protect the underlying composite materials from the damaging effects of water, carbon dioxide, and abrasion.

- Also, the increasing focus on vehicle fuel efficiency and the global climate agenda is further fueling the demand for gelcoats, as they contribute to improved fuel economy and reduced emissions. Additionally, gelcoats are finding applications beyond automotive and marine industries, with potential uses in sanitary ware and truck bodies. The market's growth is underpinned by the continuous efforts of manufacturers to address the challenges of shrinkage during application and ensure the highest possible product quality. The use of advanced resins and chemicals is helping to mitigate these issues and create matte finishes that are increasingly popular among consumers. By staying abreast of the latest trends and innovations, businesses in the market can position themselves for success and capitalize on the growing demand for high-performance, eco-friendly coatings.

What challenges does Gelcoat Market face during the growth?

The increased price of gel coats is a key challenge affecting the market growth.

- The market in the United States has seen a notable price rise due to escalating costs of key raw materials, including styrene, glycols, and liquid epoxy resins (LER). These materials are indispensable for the production of gelcoats. The increase in raw material prices has also resulted in higher packaging and transportation costs, leading to an overall price hike for gelcoats. Despite these challenges, the demand for gelcoats remains strong in various sectors, such as marine, automotive, construction, and wind energy.

- However, the marine industry continues to be a significant consumer, fueled by the rise in leisure activities and tourism. Innovations in gelcoat technology, like enhanced UV resistance and durability, are propelling market growth, notwithstanding the cost pressures. The hand lay-up process and open molding are commonly used methods for manufacturing gelcoats, while closed molding and vacuum infusion processes offer dimensional precision and lightweight vehicles. Gelcoats are crucial for providing protective and aesthetic finishes to composite materials in these industries.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Allnex GMBH

- Ashland Inc.

- BASF SE

- BUFA GmbH and Co. KG

- Eastman Chemical Co.

- Hacotech GmbH

- HK Research Corp.

- Huntsman Corp.

- INEOS Group Holdings S.A.

- Interplastic Corp.

- MADER SA

- Nivitex Fibreglass and Resins

- Poliya Polyester Industry and Trade Ltd. Sti.

- Polynt SpA

- RESOLTECH SAS

- Scott Bader Co. Ltd.

- Sicomin Epoxy Systems

- Sika AG

- Sogel Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Gelcoats are specialized types of resins used to create a protective and decorative layer on various transportation vehicles and structures, including cars, boats, trucks, trains, and even aircraft. These high-performance coatings are primarily made of polyester or epoxy resins and are reinforced with composite materials for enhanced durability and resistance to environmental elements. Gelcoats offer several advantages, such as corrosion resistance, UV resistance, chemical resistance, and thermal expansion resistance. They provide a glossy or matte finish, depending on the desired aesthetic appeal, and are known for their longevity and resistance to wear and tear from adverse weather conditions. The global transportation industry is increasingly focusing on fuel efficiency and sustainability, leading to stricter environmental mandates and a growing demand for eco-friendly gelcoats.

Moreover, manufacturers are investing in new production methods, such as vacuum infusion and closed molding, to improve dimensional precision and reduce costs. Customer dissatisfaction with uneven color and texture in gelcoat applications can lead to significant image issues for vehicle manufacturers. To address this, quality control measures and advanced tooling gelcoats are being used to ensure a consistent, high-quality finish. In the automotive sector, gelcoats are used to enhance the appearance and visual appeal of vehicles, while in the boating industry, they protect boats from the harsh marine environment. The aviation industry also uses gelcoats to create a protective shield for aircraft, ensuring their longevity and competitiveness in the market.

In summary, in the maritime sector, advanced materials for construction are increasingly used to enhance boat production, with a focus on lightweight materials for vehicles and marine coatings to reduce carbon dioxide emissions. Gelcoat repair and innovation play a key role in ensuring the durability of fiberglass gelcoat, offering protection against water damage, rust, and UV fading. The development of eco-friendly gelcoat alternatives and formulations with improved temperature tolerance, wear resistance, and color matching is transforming yacht production and boat repairs. Additionally, composite materials are driving advancements in automotive coatings, low-emission vehicles, and green transportation, while epoxy resin applications continue to expand in both transportation and medical device innovation. As cost escalation remains a concern, the need for efficient gelcoat curing, sanding, and polishing processes is growing, alongside efforts to improve gelcoat adhesion and longevity. Green building materials and renewable energy in transportation are crucial to reducing the environmental impact of construction and vehicle production, while also offering promising solutions for future sustainability in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

181 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6% |

|

Market growth 2024-2028 |

USD 462.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.5 |

|

Key countries |

US, China, Germany, UK, Japan, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch