Generator Market In The Healthcare Industry Size 2024-2028

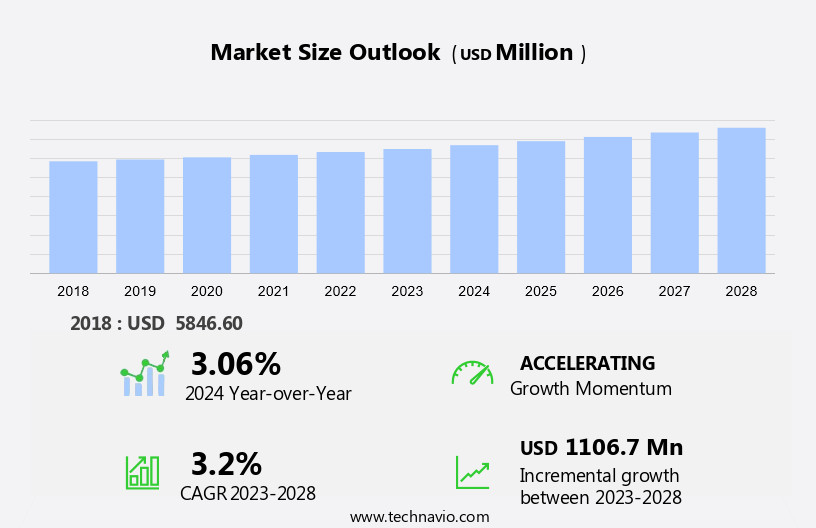

The generator market in the healthcare industry size is forecast to increase by USD 1.11 billion, at a CAGR of 3.2% between 2023 and 2028.

- The market is driven by the unreliable power grid infrastructure in developing countries, necessitating the use of backup power solutions. This trend is particularly prevalent in regions with limited access to stable electricity, where healthcare facilities require uninterrupted power supply for critical operations. Technological advances in generator technology offer opportunities for market growth, with innovations such as fuel efficiency, remote monitoring, and automation enhancing the reliability and efficiency of power generation. However, the market faces challenges in the form of stringent emission regulations. Compliance with these regulations adds to the cost of generator production and maintenance, potentially limiting profitability for market players.

- Navigating these regulatory requirements while maintaining affordability and reliability will be a key challenge for companies seeking to capitalize on market opportunities in the healthcare industry. Additionally, the increasing demand for renewable energy sources may impact the demand for traditional generators, necessitating continuous innovation and adaptation to remain competitive.

What will be the Size of the Generator Market In The Healthcare Industry during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and the increasing demand for personalized and efficient healthcare solutions. Entities such as synthetic patient data, drug efficacy modeling, radiation therapy planning, virtual clinical trials, clinical workflow automation, remote patient monitoring, precision oncology AI, radiology AI assistance, and others, are seamlessly integrated into the healthcare ecosystem. These tools enable the generation of genomic data, treatment response prediction, medical image creation, and the optimization of clinical trials. The ongoing unfolding of market activities reveals the application of AI-powered diagnostics, telehealth platform development, drug discovery platforms, and medical device simulation, among others.

Biomarker identification, prognostic model development, health record generation, and healthcare data anonymization are also crucial components of this dynamic landscape. The continuous integration of these technologies is transforming the healthcare industry, enabling more accurate patient outcome predictions, personalized medicine, and improved patient care.

How is this Generator In The Healthcare Industry Industry segmented?

The generator in the healthcare industry industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Hospitals

- Clinics

- Type

- Stationary

- Portable

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Application Insights

The hospitals segment is estimated to witness significant growth during the forecast period.

In the healthcare industry, the demand for generators is escalating due to the increasing adoption of advanced technologies such as genomic sequencing, treatment response prediction, and ai-powered diagnostics. The generation of genomic data and medical images necessitates the use of sophisticated equipment, which requires a reliable power supply. Hospitals, in particular, are leading the market due to the high demand for uninterrupted power in diagnostic centers and operation rooms. Telehealth platforms, drug discovery platforms, and clinical trial optimization also contribute to the market's growth by requiring power-intensive infrastructure for remote patient monitoring, virtual clinical trials, and precision oncology ai.

Furthermore, the development of medical chatbots, electronic health records, and surgical simulation software necessitates the use of generators for powering these applications. The integration of ai-driven drug design, medical device simulation, biomarker identification, prognostic model development, and disease modeling software also increases the demand for generators in the healthcare sector. The market is expected to continue growing due to the increasing focus on healthcare data anonymization, patient outcome prediction, drug efficacy modeling, radiation therapy planning, and clinical workflow automation. The integration of 3d organ printing, synthetic patient data, and drug interaction prediction further expands the market's scope.

The Hospitals segment was valued at USD 4.86 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 54% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The healthcare industry in APAC is experiencing significant growth, driven by increasing healthcare spending due to expanding public programs and rising private wealth. Developing countries in the region are undergoing rapid urbanization and population growth, with urban populations accounting for over half of the global population in 2022, according to The World Bank Group. This demographic shift is leading to increased demand for electricity and various healthcare services. Genomic sequencing technology and treatment response prediction are revolutionizing personalized medicine, while genomic data generation and AI-powered diagnostics are improving diagnostic accuracy. Telehealth platform development and drug discovery platforms enable remote consultations and accelerated drug development.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

In the cutting-edge realm of healthcare innovation, the integration of Artificial Intelligence (AI) in surgical site infection control is gaining significant traction among affluent US consumers. This evolution is driven by the development of advanced AI-powered diagnostic imaging tools, which enable more precise and accurate identification of infection risk factors. Synthetic data generation for clinical trials plays a crucial role in enhancing the effectiveness of these tools, ensuring personalized medicine using AI algorithms. The application of AI in radiology and oncology is a key area involving the prediction and prevention of surgical site infections. AI-based patient risk prediction models, for instance, analyze vast amounts of patient data to identify potential infection risks, enabling healthcare providers to take proactive measures. Furthermore, AI-enhanced clinical decision support systems facilitate personalized treatment strategies, ensuring optimal patient care. AI-driven precision oncology advancements are another critical element in infection control. These advancements include AI-powered disease modeling and simulation, which help healthcare professionals anticipate infection complications and adjust treatment plans accordingly. Additionally, AI in medical device development and simulation enables the creation of more effective and efficient infection control devices. In the realm of clinical trial design and optimization, AI-based platforms are revolutionizing the process. These platforms employ AI algorithms to analyze patient data, streamline trial design, and optimize recruitment strategies. Furthermore, the development of AI-powered telehealth platforms enhances accessibility and convenience for patients, enabling remote monitoring and early infection detection. AI applications in medical image enhancement and analysis play a pivotal role in infection control. These applications enable healthcare professionals to detect subtle signs of infection, ensuring timely intervention and minimizing potential complications.

Moreover, AI in healthcare data anonymization and security ensures patient privacy while facilitating data sharing and collaboration among healthcare providers. AI-driven drug efficacy and safety prediction is another area where AI is making a significant impact. By analyzing vast amounts of data, AI algorithms can predict the effectiveness and safety of various infection control treatments, enabling healthcare providers to make informed decisions and improve patient outcomes. In conclusion, the integration of AI in surgical site infection control is transforming the healthcare landscape in the US. From AI-powered diagnostic tools to AI-driven precision oncology advancements, the applications of AI are diverse and far-reaching. As consumers increasingly demand more personalized, efficient, and effective healthcare solutions, the role of AI in infection control will only continue to grow.

What are the key market drivers leading to the rise in the adoption of Generator In The Healthcare Industry Industry?

- In developing countries, the unreliable power grid infrastructure serves as the primary catalyst for the market's growth.

- In the healthcare industry, genomic sequencing technology has emerged as a game-changer, generating vast amounts of genomic data. This data is crucial for treatment response prediction and personalized medicine. However, managing and analyzing this data requires advanced tools, such as AI-powered diagnostics and telehealth platform development. Furthermore, genomic data generation is pivotal for drug discovery platforms, enabling the identification of potential therapeutic targets and accelerating the drug development process. Medical image generation, another significant application of genomic data, is essential for accurate diagnosis and monitoring of various health conditions.

- The optimization of clinical trials is also a critical area where technology plays a vital role, ensuring efficient and effective trial design and execution. Overall, these technological advancements necessitate substantial investments in infrastructure and resources to keep up with the rapidly evolving healthcare landscape.

What are the market trends shaping the Generator In The Healthcare Industry Industry?

- The trend in the market is leaning towards advancements in technological generators. These innovations are mandatory for professionals seeking efficiency and effectiveness in power generation solutions.

- In the healthcare industry, technological innovations have significantly impacted various aspects, including 3D organ printing, AI-driven drug design, medical device simulation, biomarker identification, prognostic model development, health record generation, and healthcare data anonymization. These advancements have led to patient outcome prediction, enabling personalized treatment plans and improved patient care. Healthcare data, a valuable asset, requires anonymization to protect patient privacy. AI algorithms play a crucial role in this process, ensuring data remains anonymous while maintaining its utility for research and analysis. Medical devices undergo rigorous simulation testing to ensure optimal performance and safety. AI-driven simulations enable companies to identify potential issues and optimize designs before bringing products to market.

- Biomarker identification is a critical component of disease diagnosis and treatment. AI algorithms analyze vast amounts of data to identify patterns and correlations, leading to the discovery of new biomarkers. Prognostic model development uses AI to analyze patient data and predict potential health outcomes. These models enable healthcare providers to develop personalized treatment plans and improve patient care. Health record generation is a time-consuming and complex process. AI-driven systems automate this process, ensuring accuracy and reducing the workload on healthcare professionals. Technological advancements in the healthcare industry continue to reshape the landscape, offering numerous opportunities for growth and innovation. The integration of AI, data analytics, and automation is transforming the way healthcare is delivered, making it more efficient, effective, and personalized.

What challenges does the Generator In The Healthcare Industry Industry face during its growth?

- Strict emission regulations pose a significant challenge to the industry's growth. Adhering to these regulations adds to the operational costs and complexity, requiring substantial investments in research and development of compliant technologies.

- Synthetic patient data is revolutionizing the healthcare industry, enabling more accurate drug efficacy modeling and advanced radiation therapy planning. Virtual clinical trials using this data reduce costs and increase efficiency, while clinical workflow automation enhances patient care. Remote patient monitoring allows for real-time data collection and analysis, benefiting precision oncology using AI. Radiology AI assistance streamlines diagnosis and treatment planning, improving overall patient outcomes.

- Nitrogen oxides, a primary pollutant from diesel emissions, are now under scrutiny for their link to cancer-related illnesses. According to the US Environmental Protection Agency (EPA), addressing nitrogen oxide emissions could prevent 12,000 premature deaths and 8,900 hospitalizations by 2030. These technological advancements and environmental initiatives are shaping the future of healthcare, prioritizing patient care and safety.

Exclusive Customer Landscape

The generator market in the healthcare industry forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the generator market in the healthcare industry report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, generator market in the healthcare industry forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Atlas Copco AB - The company specializes in providing advanced generators, including the QAX60, QAX80, and QAX100 models. These generators are renowned for their efficiency, reliability, and versatility, catering to various power requirements. The company's commitment to innovation and quality sets it apart in the power generation industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Atlas Copco AB

- ATLAS Corp.

- Caterpillar Inc.

- Cummins Inc.

- DuroMax Power Equipment

- Generac Holdings Inc.

- Guangdong Westinpower Co. Ltd.

- Guangzhou Wanon Electric and Machine Co.

- Guangzhou huadong electromechanical technology co. ltd

- Honeywell International Inc.

- J C Bamford Excavators Ltd.

- Kirloskar Group

- Kohler Co.

- Kubota Corp.

- Mitsubishi Heavy Industries Ltd.

- NOVAIR MEDICAL

- Rolls Royce Holdings Plc

- Siemens AG

- Wacker Neuson SE

- Yanmar Holdings Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Generator Market In The Healthcare Industry

- In January 2024, Philips, a leading healthcare technology company, launched its new line of energy-efficient and quiet generators, the PredictiveEnergy Generators, designed specifically for healthcare facilities. These generators, according to Philips, can reduce fuel consumption by up to 30% and lower noise levels by up to 10 decibels (Philips Press Release).

- In March 2024, Siemens Healthineers and GE Healthcare, two major players in the healthcare industry, announced a strategic collaboration to develop integrated power solutions for healthcare facilities. The partnership aims to provide combined generator and medical equipment solutions, enhancing efficiency and reliability (Siemens Healthineers Press Release).

- In May 2024, Caterpillar, a global leader in power generation, secured a significant contract with the U.S. Department of Veterans Affairs to supply emergency backup power generators for 150 VA healthcare facilities across the country. The project is valued at over USD100 million (Caterpillar Press Release).

- In April 2025, Medtronic, a medical technology company, received FDA approval for its new lithium-ion battery-powered generator, the Maxima CareStation. This generator is designed to provide continuous power during power outages and has a capacity of 20 kW (Medtronic Press Release).

Research Analyst Overview

- In the dynamic healthcare industry, the integration of advanced technologies is revolutionizing various aspects of patient care and disease management. The market for medical data visualization, bioinformatics tools, and AI healthcare solutions is experiencing significant growth, with genomic medicine tools and population health management at the forefront. Disease progression modeling, clinical decision support, and predictive analytics healthcare are essential components of this transformation. Digital twin technology, clinical trial recruitment, and pharmaceutical development AI are streamlining drug development processes, enabling personalized treatment plans through patient stratification and therapeutic target identification. Oncology AI algorithms and healthcare data security are crucial elements ensuring accurate diagnosis and maintaining patient privacy.

- Medical image enhancement, remote diagnostics tools, and AI-assisted surgery are transforming diagnostic procedures, while drug development AI and healthcare data synthesis contribute to health outcome measurement. Furthermore, generative ai models and diagnostic imaging AI are paving the way for 3D bioprinting technology, revolutionizing the field of medicine. The intersection of AI, bioinformatics, and healthcare is driving innovation, enabling more effective patient engagement platforms, and improving overall healthcare efficiency. The integration of these technologies is essential for the future of healthcare, ensuring better disease management, improved patient outcomes, and more effective pharmaceutical development.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Generator Market In The Healthcare Industry insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

173 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 1106.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.06 |

|

Key countries |

China, US, Germany, India, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Generator Market In The Healthcare Industry Research and Growth Report?

- CAGR of the Generator In The Healthcare Industry industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the generator market in the healthcare industry growth of industry companies

We can help! Our analysts can customize this generator market in the healthcare industry research report to meet your requirements.