Geofencing Market Size 2025-2029

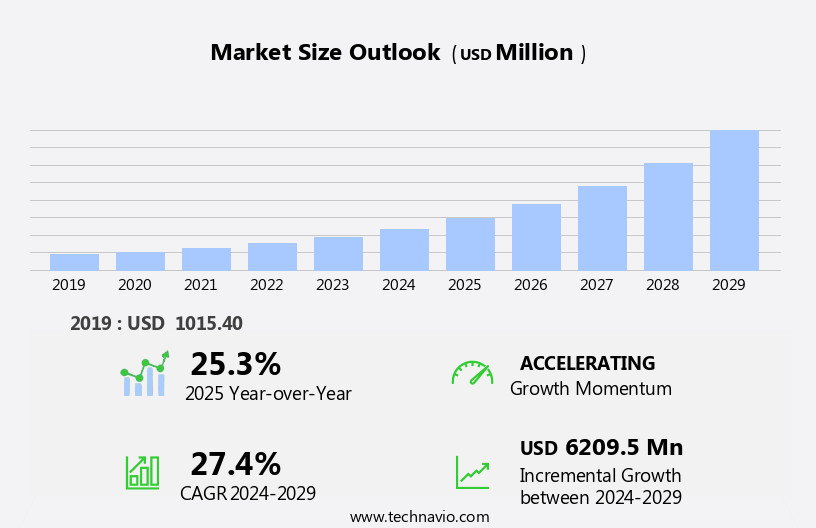

The geofencing market size is forecast to increase by USD 6.21 billion at a CAGR of 27.4% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing adoption of location-based marketing strategies. Businesses across various industries are recognizing the value of delivering targeted, contextually relevant promotions and offers to consumers based on their physical location. This trend is further fueled by the expanding applications of geofencing technology, which goes beyond marketing to include areas such as asset tracking, employee safety, and logistics optimization. However, the market also faces challenges that could hinder its growth. One of the most notable obstacles is the high initial setup costs and capital investments required for implementing geofencing solutions. This can be a significant barrier for small and medium-sized businesses, limiting their ability to enter the market and compete with larger players.

- Despite these challenges, companies seeking to capitalize on the opportunities presented by the market must navigate this landscape effectively to stay ahead of the competition and maximize their return on investment.

What will be the Size of the Geofencing Market during the forecast period?

- The market continues to evolve, with dynamic applications across various sectors. Geospatial analytics plays a pivotal role in this technology, enabling businesses to leverage location data for customer engagement and targeted marketing. Virtual fences, powered by RFID tags and GPS tracking, facilitate asset tracking and fleet management. Geofencing software and APIs enable real-time location services, enhancing contextual marketing and IoT applications. Privacy concerns persist, necessitating permission-based marketing and data security measures. Indoor positioning and spatial data analysis expand geofencing's reach, while location intelligence fuels smart city development.

- Mobile app development and mapping software further enhance geofencing capabilities, enabling hyperlocal marketing and proximity marketing. Geospatial databases and location services provide the foundation for these applications, ensuring accurate and timely data. Geofencing's continuous evolution underscores its potential in enhancing customer experience, optimizing operations, and driving growth across industries.

How is this Geofencing Industry segmented?

The geofencing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Fixed

- Mobile

- Component

- Services

- Solutions

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

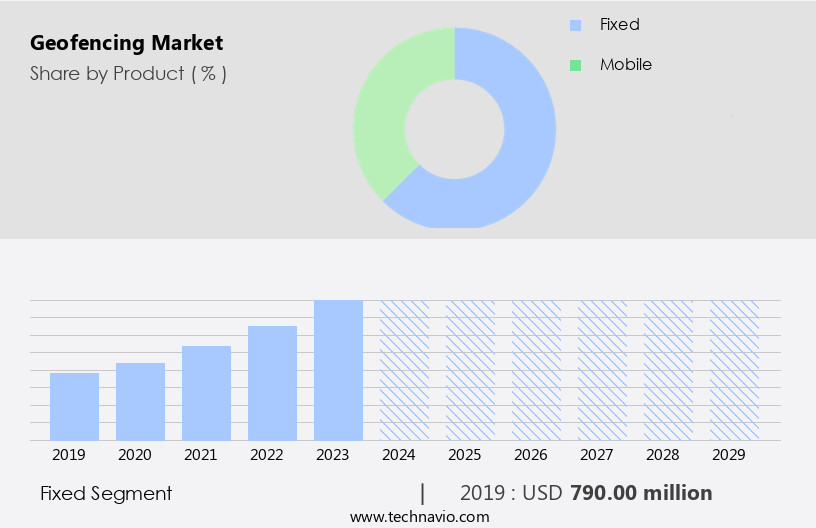

The fixed segment is estimated to witness significant growth during the forecast period.

Geofencing, a location-based technology, enables virtual fences around specific areas or fixed objects. When breached, this fence triggers alerts and reports on intruders' entry or exit, along with the time spent. Applications span across industries, including transportation and logistics, retail, healthcare, hospitality, and industrial manufacturing. Geospatial data, GIS mapping, and GPS tracking fuel geofencing, while wearable technology and RFID tags enhance indoor positioning. Geofencing software and APIs facilitate asset tracking and fleet management. Retail analytics and hyperlocal marketing leverage geofencing for contextual customer engagement. IoT applications, real-time location services, and spatial data fuel location intelligence. Mobile app development and mapping software integrate geofencing, while geospatial analytics ensure data security and privacy.

Proximity marketing and mobile payments further expand geofencing's reach. Geofencing platforms offer permission-based marketing and location-based advertising solutions. Smart cities and industrial manufacturing harness geofencing for infrastructure monitoring and optimization. Despite privacy concerns, the market continues to grow, driven by customer segmentation, geospatial analysis, and location awareness.

The Fixed segment was valued at USD 790.00 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

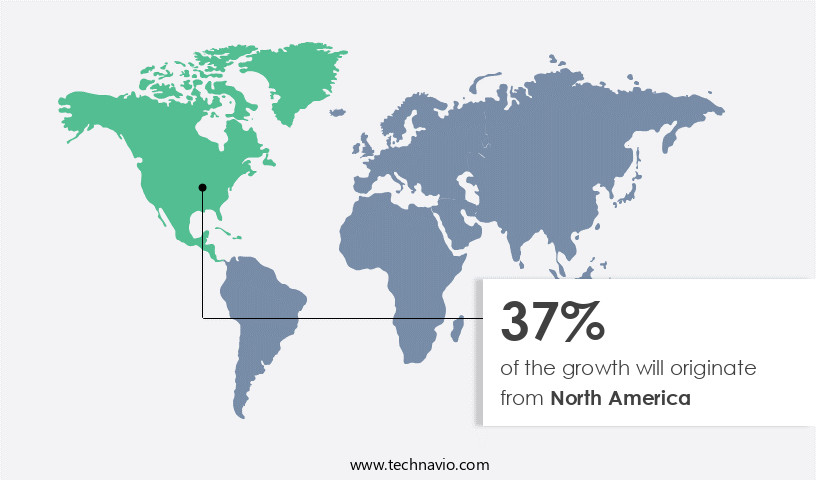

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

In the dynamic business landscape of 2024, the market experiences significant growth, with North America leading the charge. The US and Canada are primary contributors to this market's dominance. The transportation and logistics sector in the US plays a pivotal role in driving market expansion. The widespread use of smartphones and the escalating trend of social media networking and mobile-based advertising have significantly influenced this growth. With approximately 310 million smartphone users in the US, it ranks among the world's largest markets for this technology. Geofencing solutions and services have permeated various sectors, including defense, retail, media and entertainment, and transportation and logistics.

Wearable technology, geospatial data, and real-time location services have become integral components of these applications. Retail analytics, hyperlocal marketing, and proximity marketing are some of the key trends shaping the market. IoT applications, fleet management, and smart cities also contribute to the market's evolution. Location intelligence, geospatial databases, and mapping software facilitate the effective use of geofencing technology. Asset tracking, indoor positioning, and permission-based marketing are other essential aspects of geofencing platforms. Privacy concerns and data security are critical issues that market participants address to ensure customer trust and engagement. Mobile app marketing, mobile payments, and radio frequency identification are additional geofencing applications that continue to gain traction.

Geospatial analytics and contextual marketing enable businesses to segment their target audience and deliver customized offerings. The integration of geofencing technology with various industries offers immense potential for innovation and growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Geofencing Industry?

- Location-based marketing's growth is the primary catalyst for the market's expansion. This trend signifies a significant shift in marketing strategies towards more targeted and personalized approaches, leveraging advanced technologies such as geolocation and proximity marketing to reach consumers in real-time and deliver relevant content and offers.

- The marketing solutions have gained significant traction among businesses for location-based advertising and customer engagement. Also recognized as proximity marketing, this strategy enables marketers to connect with consumers via their mobile devices' locations. By utilizing geospatial data, GIS mapping, and GPS tracking, businesses can send targeted push notifications and personalized messages based on factors such as consumers' prior purchases, preferences, geographic locations, and time of day.

- This approach enhances customer loyalty and improves overall retail analytics, benefiting various sectors including retail, hospitality, entertainment, and public places like airports. Geofencing software and APIs facilitate asset tracking and hyperlocal marketing, providing immersive and harmonious consumer experiences. With geofencing platforms, businesses can emphasize timely and relevant offers, ultimately fostering stronger customer relationships.

What are the market trends shaping the Geofencing Industry?

- Geofencing technology is gaining increasing popularity in various industries, marking a significant market trend. This location-based technology enables targeted and contextually relevant engagement with consumers.

- Geofencing, an IoT-driven technology, is gaining significant traction across various industries, including logistics, retail, defense, healthcare, manufacturing, and media and entertainment. This location-based service utilizes real-time location data and spatial intelligence to create virtual perimeters around specific geographic areas. In logistics, geofencing is employed for asset monitoring, speed limiting, fleet and freight management, and commercial transportation management. For instance, governments and organizations use geofencing to monitor and manage vehicle speeds, ensuring compliance and safety. Retailers leverage geofencing for workforce management, customer satisfaction, user location alerts, competitor tracking, logistics management, asset management, and marketing and advertising. By delivering contextual offers and promotions, businesses can enhance customer engagement and loyalty.

- Defense systems employ geofencing for securing national borders and sensitive areas, receiving real-time updates on potential intrusions. With the integration of geospatial databases and mapping software, geofencing offers a powerful solution for enhancing operational efficiency, security, and customer experience. Mobile app development and location services further expand the potential applications of this innovative technology.

What challenges does the Geofencing Industry face during its growth?

- The high initial setup costs and substantial capital investments represent a significant challenge that impedes industry growth.

- Geofencing, a location-based technology utilizing geospatial analytics, is gaining traction in various industries due to its potential for enhancing customer engagement through virtual fences. However, the implementation of this technology comes with significant costs, making it a capital-intensive market. The infrastructure requirements, including RFID tags, indoor positioning systems, and permission-based marketing, contribute to the high investment needed. Moreover, privacy concerns surrounding the use of location data have emerged as a challenge. Despite these hurdles, the market continues to evolve, with applications ranging from fleet management and location-based advertising to smart city initiatives. The complexity of deployment and integration with existing IT infrastructure necessitates extensive planning and resources, posing challenges for small enterprises.

- Companies must address these concerns to ensure the successful implementation and adoption of geofencing solutions. The market, driven by its ability to offer targeted and immersive customer experiences, is an evolving and valuable technology. However, the high costs associated with its implementation, privacy concerns, and complex deployment processes necessitate careful planning and significant investments. Companies must focus on addressing these challenges to drive market growth and adoption.

Exclusive Customer Landscape

The geofencing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the geofencing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, geofencing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The company provides advanced geofencing capabilities on iOS and macOS devices.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Bluedot Industries Pty Ltd.

- Embitel Technologies Pvt. Ltd.

- Esri Global Inc.

- Floating Market B.V.

- Foursquare Labs Inc.

- GeoMoby Pty. Ltd.

- GPSWOX LTD.

- infsoft GmbH

- Juniper Networks Inc.

- Locance Inc.

- MessageBird BV

- Pulsate Mobile Ltd.

- Radar Labs Inc.

- Raveon Technologies Corp.

- Salesforce Inc.

- Simplifi Holdings Inc.

- Theoblong Global Ltd

- Thumbvista

- Upland Software Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Geofencing Market

- In February 2024, Apple announced the expansion of its iBeacon technology, enabling geofencing capabilities for businesses using its retail apps. This development allowed retailers to send targeted promotions and offers to customers when they entered specific locations, enhancing the shopping experience (Apple, 2024).

- In May 2025, Google and Samsung formed a strategic partnership to integrate Google's Location Services with Samsung's Galaxy devices. This collaboration aimed to improve geofencing accuracy and efficiency, providing better targeting opportunities for advertisers and enhancing user experience (Reuters, 2025).

- In August 2024, Proxima Centauri, a leading geofencing solutions provider, secured a USD20 million funding round from Sequoia Capital and other investors. The funds were allocated towards expanding its global presence, enhancing its technology, and accelerating product development (Bloomberg, 2024).

Research Analyst Overview

The market is experiencing significant advancements, driven by the integration of various technologies such as NFC tags, Bluetooth Low Energy (BLE) beacons, and Near-Field Communication (NFC). Big data analytics plays a crucial role in processing and deriving insights from the vast amounts of location-based data generated. Geospatial visualization and predictive analytics, fueled by artificial intelligence and machine learning, enhance decision-making capabilities. Geographic Information Systems (GIS), cloud computing, and edge computing facilitate efficient data management and real-time processing. Cross-platform development and mobile web development enable seamless user experiences across various devices. Location-based games, augmented reality, and social media integration add a layer of engagement and interactivity.

Geospatial engineering, spatial data infrastructure, and spatial analysis contribute to the development of accurate and reliable geospatial solutions. Aerial photography, satellite imagery, remote sensing, and real-time data processing offer valuable insights into geographic information. Virtual reality and data management solutions further expand the potential applications of geofencing technology. BLE beacons and NFC tags enable precise location tracking, while predictive analytics and machine learning algorithms offer personalized recommendations. Data integration and data management solutions ensure seamless data flow between various systems, enhancing overall efficiency and productivity.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Geofencing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 27.4% |

|

Market growth 2025-2029 |

USD 6209.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

25.3 |

|

Key countries |

US, China, Canada, Germany, UK, Mexico, India, Brazil, France, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Geofencing Market Research and Growth Report?

- CAGR of the Geofencing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the geofencing market growth of industry companies

We can help! Our analysts can customize this geofencing market research report to meet your requirements.