Ginger Beer Market Size 2024-2028

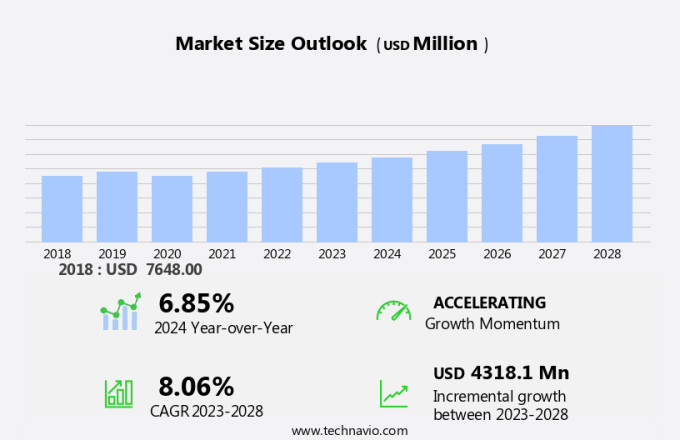

The ginger beer market size is forecast to increase by USD 4.32 billion, at a CAGR of 8.06% between 2023 and 2028. The market is experiencing significant growth due to several key factors. Consumers' preference for low-alcoholic beverages, flavored beverages is on the rise, making ginger beer an attractive option. Additionally, the health benefits associated with ginger, such as its anti-inflammatory and digestive properties, are driving demand. Furthermore, the increasing concern over obesity and related health issues is leading more people to opt for healthier drink alternatives. Brands are capitalizing on these trends by offering premium ginger beers.

What will be the Size of the Market During the Forecast Period?

The market is experiencing steady growth, fueled by the increasing demand for artisan drinks and healthier beverage options. Consumers are increasingly seeking out ginger beer for its unique taste and health benefits. Ginger, a key ingredient in ginger beer, is known for its anti-inflammatory and digestive properties, making it an attractive choice for health-conscious consumers. Flavoured ginger beers, such as those infused with kakadu plum or gubinge, have gained popularity in recent years. These beverages offer a unique taste profile and cater to consumers looking for new and exciting flavors. Digital publishing platforms and e-commerce channels are making it easier for consumers to access ginger beer from various brands, while infrastructure and retail transportation play a crucial role in ensuring timely and efficient distribution.

On-trade distribution channels, such as bars, restaurants, and clubs, have been a significant contributor to the growth of the market. The availability of ginger beer in these establishments has led to increased visibility and consumer awareness, driving demand for this beverage. The use of ginger beer in cocktails has also contributed to its growth. Cocktail packs, which include a pre-measured amount of beer and other ingredients, have gained popularity among consumers. These packs offer convenience and consistency, making it easy for consumers to create cocktails at home. E-commerce platforms have made it easier for consumers to purchase ginger beer online.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Distribution Channel

- Off-trade

- On-trade

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- APAC

- China

- South America

- Middle East and Africa

- North America

By Distribution Channel Insights

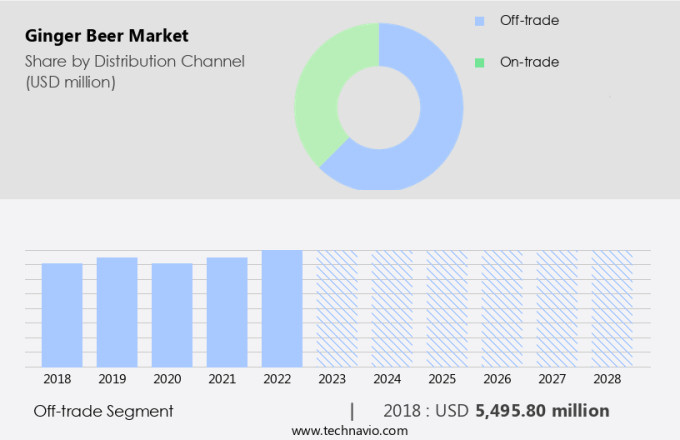

The off-trade segment is estimated to witness significant growth during the forecast period. The market has seen significant growth in the off-trade segment, with sales primarily coming from supermarkets, retail outlets, beer/specialty stores, and e-commerce platforms. E-commerce, in particular, has gained popularity due to its convenience and wide selection of brands. The COVID-19 pandemic led to a rise in online sales as consumers turned to e-commerce for essentials, thereby boosting the market's expansion through digital channels. The off-trade segment's revenue growth is attributed to the ease of access to a variety of products and the convenience of shopping from the comfort of one's home.

Get a glance at the market share of various segments Request Free Sample

The off-trade segment accounted for USD 5.50 billion in 2018 and showed a gradual increase during the forecast period.

Regional Insights

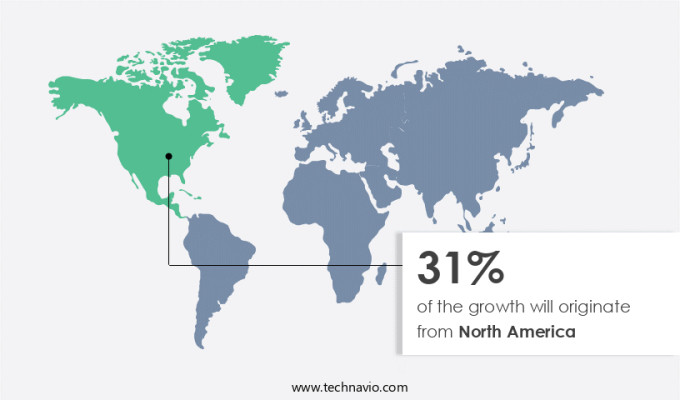

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

In North America, the market is experiencing significant growth due to increasing consumer preference for healthier food and beverage options. The region's market share is substantial, with the United States being a leading consumer of flavored ginger beverages. Key industry players are collaborating to innovate new ginger beer products and expand their market reach. This strategic partnership underscores the industry's commitment to catering to the evolving consumer palate and driving market expansion.

The market in North America is witnessing growth due to the rising trend of gluten-free and nutrition drinks. As consumers become more health-conscious, they are turning to ginger beer as a refreshing and tasty alternative to traditional sodas and alcoholic beverages. Furthermore, the e-commerce platform has made it easier for consumers to access these beverages, contributing to the market's growth. In conclusion, the North American market is poised for continued growth due to increasing consumer awareness and preference for healthier beverage options. Industry players are responding to this trend by introducing new and innovative ginger beer products, collaborating, and leveraging e-commerce platforms to expand their reach.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for low-alcoholic flavored beverages among consumers is the key driver of the market. The market specifically those in the original flavor category of ginger beer, is experiencing significant growth. According to recent industry reports, sales of these low-alcoholic and non-alcoholic beverages have seen a substantial increase, with online sales up by 315% in the past year compared to a 26% increase in sales for alcoholic beverage categories. Two primary distribution channels, on-trade and off-trade, cater to the demand for ginger beer. Brands like Fentimans and Rita have made a mark in the on-trade channel, supplying to bars, restaurants, and clubs. In contrast, off-trade distribution channels, such as supermarkets and convenience stores, offer consumers the convenience of purchasing ginger beer for home consumption.

Moreover, retail transportation and infrastructure play a crucial role in ensuring the timely delivery of these beverages to various distribution channels. As consumer preferences continue to shift towards healthier, low-alcoholic options, the market is expected to grow further. In conclusion, the market is witnessing a rise in demand, driven by consumers' preference for low-alcoholic and non-alcoholic beverages. Brands are catering to this trend by offering products with less sugar and fewer calories, while distribution channels, both on-trade and off-trade, ensure the timely delivery of these beverages to meet consumer needs.

Market Trends

Health benefits offered by ginger beer is the upcoming trend in the market. Ginger beer, brewed at Docker Brewery and Bakehouse, offers numerous health advantages, distinguishing it from typical carbonated beverages. The primary ingredient in ginger beer is ginger root, which has been utilized in culinary and medicinal applications since antiquity. Ginger root is rich in gingerol, an active compound that functions as a natural oil and a significant source of minerals such as magnesium, manganese, potassium, copper, and vitamin B6. The therapeutic properties of ginger are attributed to gingerol, which also imparts the root's distinctive aroma. Ginger beer provides several health benefits that set it apart from other refreshing beverages. It aids in alleviating nausea and enhancing digestion.

Furthermore, it decreases the risk of cancer due to its antioxidant properties. Ginger beer's anti-inflammatory benefits make it an effective remedy for inflammation, while its anti-bacterial properties help combat harmful bacteria. Additionally, it slows down the signs of aging and supports mental health. These advantages are expected to fuel the expansion of The market during the forecast period.

Market Challenge

Increasing obesity rates and related issues is a key challenge affecting the market growth. The expansion of the market is influenced by several factors. One significant challenge is the rising prevalence of overweight and obesity among consumers. According to the Centers for Disease Control and Prevention (CDC), approximately 42.4% of adults in the US were identified as obese in 2021. This trend is a cause for concern due to the associated health risks, such as high blood pressure, diabetes, and joint problems.

In response, consumers have become more conscious of their caloric intake and have started limiting their consumption of sugary and high-calorie beverages. As a result, there is a growing demand for non-alcoholic, low-calorie alternatives, such as those offered by brands. To cater to this trend, retailers are increasingly stocking these options to meet consumer preferences.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Barritts - The company offers a range of ginger beer offerings, including Bundaberg ginger beer, in the market. With a focus on quality and authenticity, these ginger beers cater to consumers seeking unique and refreshing beverage options.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Brooklyn Crafted

- Bruce Cost Ginger Beer

- BUNDABERG BREWED DRINKS PTY LTD

- Crabbies Alcoholic Ginger Beer

- Fentimans Ltd.

- Fevertree Drinks Plc

- Gosling Brothers Ltd.

- Gunsberg

- Maine Root

- Natrona Bottling Co.

- Old Jamaica Ginger Beer

- Pickett Brothers Beverage

- Q Tonic LLC

- RACHELS GINGER BEER

- Reeds

- Regatta Craft Mixers

- RITA Food and Drink Co. Ltd.

- Zevia LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ginger beer, a zesty and effervescent beverage, has been gaining popularity in the global market due to its unique taste and health and wellness advantages. This multidisciplinary drink, often used as a mixer in cocktails or enjoyed on its own, is seeing a rise in demand in various regions, including Seattle, Washington, and beyond. The market is witnessing significant growth in the non-alcoholic segment, with artisan breweries and bakehouses producing premium ginger beer in original, flavored, and low-alcoholic variants. Brands like Bundaberg are leading the charge with innovative packaging designs and on-trade distribution channels.

Ginger beer, a low-alcohol, zesty, and effervescent beverage, has been making waves in the beverage industry. This flavored, gluten-free drink, hailing from the alcoholic category, has gained a premium position in the market due to its unique taste and versatility. Packaging design plays a crucial role in ginger beer's success, with eye-catching labels and bottles showcasing its amber hue and distinctive ginger aroma. The on-trade distribution channel, including bars and restaurants, has embraced ginger beer, using it as a base for an array of cocktails, such as the Moscow Mule and Dark 'n' Stormy.

Off-trade distribution channels, like supermarkets and convenience stores, have also seen a surge in ginger beer sales, making it a popular choice for consumers seeking low-alcoholic drinks at home. Brands like AMPLYS and Rusty Yak have capitalized on this trend, offering a wide range of ginger beer flavors to cater to diverse tastes. As the ginger beer market continues to grow, it's not just quenching the thirst for a refreshing, low-alcohol beverage, but also offering a flavorful and versatile addition to the cocktail scene. So, raise a glass of ginger beer and savor the zest!

Further, craft beer enthusiasts are also exploring ginger beer as an alternative to their usual alcoholic beverages, with flavored ginger beer gaining traction in the cocktail scene. Gluten-free ginger beer is another niche market that is growing rapidly, catering to consumers with dietary restrictions. The use of natural and organic ingredients in these beverages further adds to their appeal. The growing trend towards gluten-free diets has led to an increase in demand for gluten-free ginger beers. These beverages cater to consumers with gluten intolerance or celiac disease, ensuring they can enjoy a refreshing and tasty beverage without compromising their health.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

131 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.06% |

|

Market Growth 2024-2028 |

USD 4.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.85 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 31% |

|

Key countries |

US, China, Germany, UK, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Barritts, Brooklyn Crafted, Bruce Cost Ginger Beer, BUNDABERG BREWED DRINKS PTY LTD, Crabbies Alcoholic Ginger Beer, Fentimans Ltd., Fevertree Drinks Plc, Gosling Brothers Ltd., Gunsberg, Maine Root, Natrona Bottling Co., Old Jamaica Ginger Beer, Pickett Brothers Beverage, Q Tonic LLC, RACHELS GINGER BEER, Reeds, Regatta Craft Mixers, RITA Food and Drink Co. Ltd., and Zevia LLC |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements.