Digital Publishing Market Size 2025-2029

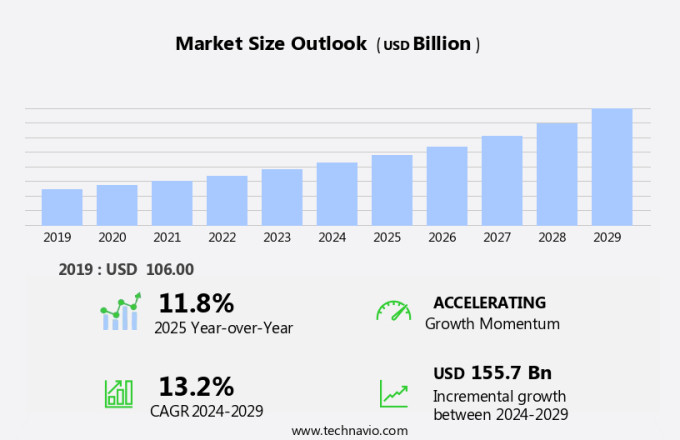

The digital publishing market size is forecast to increase by USD 155.7 billion at a CAGR of 13.2% between 2024 and 2029.

- The market is experiencing significant growth due to several key trends. The first trend is the digitization of paperback books, which has led to an increase in the adoption of e-books and audiobooks. Another trend is the proliferation of mobile applications, allowing readers to access digital content on-the-go. However, high subscription costs can be a challenge for some consumers, limiting their access to digital content. Despite this, the benefits of digital publishing, such as convenience, affordability, and a wider selection of titles, continue to drive market growth. Publishers are also investing in advanced technologies, such as artificial intelligence and virtual reality, to enhance the reader experience and differentiate themselves from competitors.

What will be the Size of the Market During the Forecast Period?

- Digital publishing, also known as e-publishing or online publishing, has revolutionized the way information is disseminated and consumed in the modern world. This form of publishing encompasses various formats, including text, audio, and video, delivered through websites, social media platforms, search engines, and other online technology. Financial magazines, medical journals, newsletters, and educational materials are just a few examples of the vast array of information content now accessible digitally. The shift from traditional print media to digital publishing has been driven by the widespread use of electronic devices such as tablets, smartphones, e-readers, and smart electronic devices. Advertising plays a significant role in digital publishing, providing revenue streams for publishers and enhancing the user experience.

- Search engines and social media platforms serve as crucial distribution channels, expanding reach and increasing visibility. Application platforms and digital publishing services offer consulting and solutions for businesses and individuals looking to enter the market. The market dynamics of digital publishing are constantly evolving, with new technologies and trends shaping the industry. Online technology continues to advance, enabling publishers to deliver high-quality, multimedia content to a global audience. Digital publishing platforms and services provide the tools and expertise necessary to produce and distribute content effectively and efficiently. In conclusion, digital publishing offers numerous benefits, from increased accessibility and convenience to cost savings and environmental sustainability.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Text content

- Video content

- Audio content

- Application

- Smartphones

- Laptops

- PCs

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Middle East and Africa

- South America

- APAC

By Product Insights

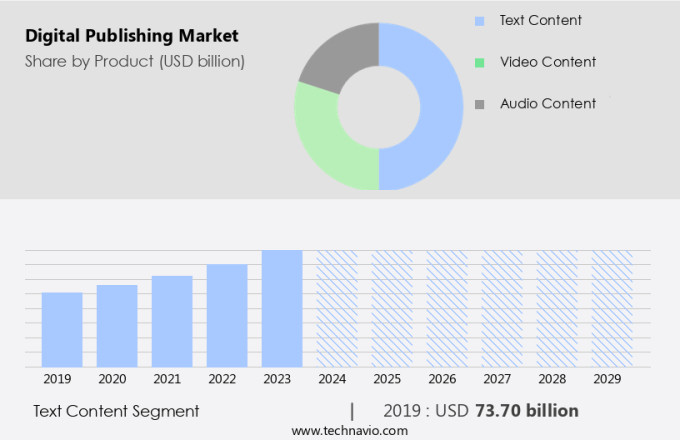

- The text content segment is estimated to witness significant growth during the forecast period.

The market is experiencing continuous growth as organizations and consumers shift towards digital platforms for accessing reading materials. This market can be segmented into business information and legal, e-books, digital newspapers and magazines, and STM (scientific, technical, and medical) publications. Businesses are increasingly investing in digital tools for news, information, and analytics to maintain a competitive edge. The demand for financial news, governance and compliance information, and legal and tax accounting data is driving the growth of the business information and legal segment. The market is expected to expand steadily during the forecast period, with a particular focus on the business information and legal segment. E-books, digital newspapers, magazines, and STM publications also contribute significantly to the market's growth.

Get a glance at the market report of share of various segments Request Free Sample

The text content segment was valued at USD 73.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

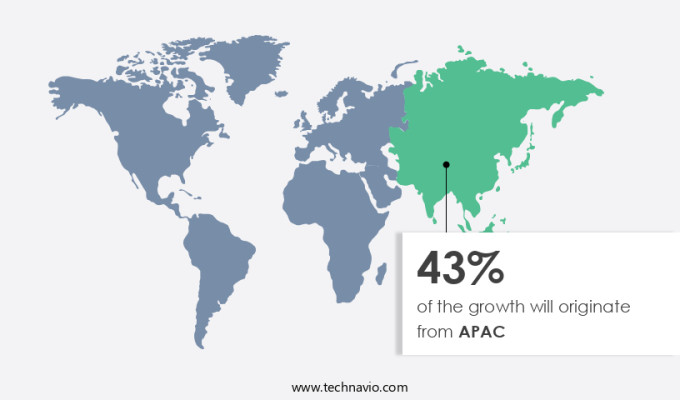

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

Digital publishing, also known as e-publishing or online publishing, is experiencing significant growth in the Asia Pacific (APAC) region, which is projected to be the fastest-growing market due to the increasing adoption of digital media. Pay TV and subscription TV in APAC are anticipated to expand between 2025 and 2029, with China leading the market and India making notable strides. companies such as 21st Century Fox, Sony, and Viacom dominate the pay-TV sector. In addition, the over-the-top (OTT) market in APAC is poised for growth during the forecast period. Search engines, social media platforms, and websites play a crucial role in digital publishing, providing access to text, audio, and multimedia content.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Digital Publishing Market?

Digitization of paperback books is the key driver of the market.

- Digital publishing, also known as e-publishing or online publishing, has significantly transformed the way information is consumed and distributed. Websites, social media platforms, and search engines have become the primary channels for accessing text, audio, and video content. Financial magazines, medical journals, newsletters, and various other types of information content are increasingly being published digitally. Advertising has also shifted to digital platforms, with tablets, smartphones, and e-readers becoming popular devices for consuming digital content. The rise of digital publishing has led to the growth of digital publishing platforms and services, offering consulting, support and maintenance, design and implementation, and managed services.

- The Internet and electronic devices have enabled the electronic substitution of paper-based documents, leading commercial printers to face challenges. E-books, open educational resources, and alternate textbook sources have emerged as free and subscription-based alternatives. The mobile industry has witnessed significant growth, with mobile applications becoming an integral part of our daily lives. News, music, entertainment, sports apps, and social media apps have seen immense popularity. The adoption of smart electronic devices has further fueled the growth of digital publishing. STM (scientific, technical, and medical) publications, legal and business publications, and educational materials are some of the key sectors that have embraced digital publishing.

What are the market trends shaping the Digital Publishing Market?

The proliferation of mobile applications is the upcoming trend in the market.

- The market encompasses various forms of online content distribution, including e-books, websites, social media platforms, and search engines. Text, audio, and video content are the primary types of information disseminated through digital publishing platforms. Financial magazines, medical journals, newsletters, and educational materials are among the popular content categories. Advertising is a significant revenue generator in the digital publishing industry, with tablets, smartphones, and e-readers serving as popular electronic devices for consumption. The Internet and smart electronic devices have facilitated the electronic substitution of paper-based documents, leading to the growth of digital publishing services. Digital publishing platforms offer consulting, support and maintenance, design and implementation, and managed services to cater to the diverse needs of publishers.

- The market for digital publishing is expanding, with the growth of application platforms and video content driving demand. The STM (scientific, technical, and medical), legal and business, and education sectors are major contributors to the market. The mobile industry's growth and the proliferation of mobile applications have significantly impacted digital publishing. Mobile applications offer a more engaging user experience and align with consumers' preferences for on-the-go access to information.

What challenges does Digital Publishing Market face during its growth?

High subscription costs is a key challenge affecting the market growth.

- The market has experienced significant growth due to the increasing use of electronic devices and the Internet. With the widespread availability of smartphones, tablets, laptops, and PCs, consumers now have access to vast amounts of information content in various formats, including text, audio, and video. Digital publishing platforms and services have emerged as key players in this market, offering solutions for financial magazines, medical journals, newsletters, and educational materials. Advertising opportunities have also expanded, with digital platforms providing targeted and measurable campaigns. Social media platforms and search engines have become essential tools for discovering and accessing digital content. The mobile industry has seen rapid growth, with mobile applications becoming increasingly popular for news, music, entertainment, sports, and social media.

- E-books and open educational resources have emerged as alternate textbook sources, offering free or subscription-based access to students. STM (scientific, technical, and medical) publications, legal and business journals, and other information-intensive content have also transitioned to digital formats. Digital publishing services provide consulting, support, maintenance, design and implementation, and managed services to help businesses and organizations effectively engage their audiences and enhance their brand image. E-reading devices, such as iPads and Kindles, have further facilitated the electronic substitution of paper-based documents. As technology continues to evolve, digital publishing is expected to remain a dynamic and innovative industry.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Adobe Inc. - The company offers digital publishing that includes folios, a set of tools and hosted services that lets publishers create and distribute publications on tablet devices.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adobe Inc.

- Advance

- Alphabet Inc.

- Amazon.com Inc.

- Apple Inc.

- Bloomberg LP

- Comcast Corp.

- Georg von Holtzbrinck GmbH and Co. KG

- Graham Holdings Co.

- Guardian Media Group plc

- Madison Avenue Publishers LLC

- Netflix Inc.

- News Corp.

- Nine Entertainment Co. Holdings Ltd.

- RELX Plc

- The New York Times Co.

- The Washington Post

- Thomson Reuters Corp.

- White Falcon Publishing Solutions LLP

- Xerox Holdings Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Digital publishing, a revolutionary concept that has transformed the way we consume and distribute information, has been a significant disruptor in various industries. This dynamic market encompasses a wide array of formats, including text, audio, video, and multimedia content. In this article, we delve into the intricacies of the digital publishing landscape, exploring the market trends, dynamics, and growth drivers. Market Expansion: the market has experienced exponential growth in recent years, fueled by the widespread adoption of electronic devices such as tablets, smartphones, laptops, and PCs. These devices have enabled users to access a vast array of information, from financial magazines and medical journals to newsletters and educational materials, at their fingertips.

Moreover, the market is further driven by the increasing popularity of e-books, open educational resources, and alternate textbook sources. Format Diversification: the market is characterized by its diverse range of formats. Text-based content remains a staple, with digital versions of newspapers, magazines, and books leading the charge. However, the market is witnessing a rise in demand for multimedia content, including audio, video, and interactive formats. Digital publishing platforms and application platforms are at the forefront of this trend, offering users great experiences and enhanced engagement. Services and Solutions: The digital publishing landscape is not limited to content distribution. It also encompasses a range of services and solutions, including consulting, support and maintenance, design and implementation, and managed services.

Furthermore, these offerings cater to the varying needs of publishers and content creators, enabling them to effectively navigate the digital publishing ecosystem. Market Dynamics: the market is driven by several key factors. The shift towards electronic substitution of paper-based documents is a significant trend, with more and more organizations recognizing the cost savings and environmental benefits of digital content. Additionally, the growing popularity of smart electronic devices and the increasing availability of free resources and subscription requirements have fueled the market's growth. Industry Insights: the market is diverse, with various industries adopting digital publishing solutions at different rates. The mobile industry, with its rapid app growth, has been a major contributor to the market's expansion.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

208 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.2% |

|

Market Growth 2025-2029 |

USD 155.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

11.8 |

|

Key countries |

US, China, Canada, Japan, UK, India, South Korea, Germany, Australia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch