Video-On-Demand Market Size 2024-2028

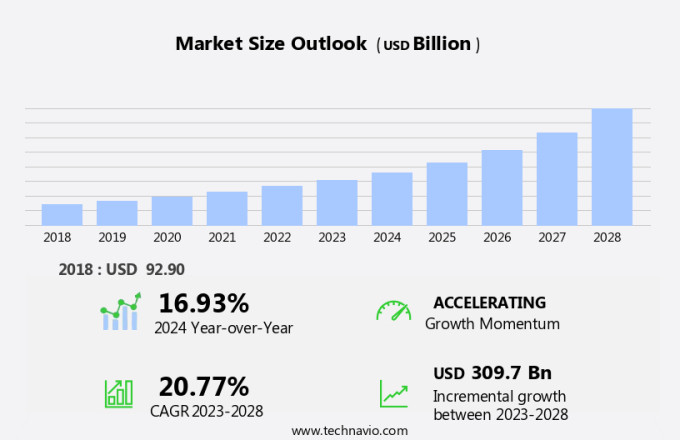

The video-on-demand market size is forecast to increase by USD 309.7 billion at a CAGR of 20.77% between 2023 and 2028.

- The video-on-demand (VOD) market is experiencing significant growth, driven by the increasing preference for cloud streaming services. This trend is fueled by the convenience and flexibility offered by VOD platforms, allowing consumers to access content at their own pace and on-demand. Another growth factor is the strategies adopted by companies to enhance user experience through personalized recommendations and high-quality streaming. However, the availability of pirated video content on online platforms poses a major challenge for market players, threatening revenue growth and intellectual property rights. To mitigate this issue, companies are investing in advanced technologies such as digital rights management and content protection solutions.

- Overall, the VOD market is expected to continue its growth trajectory, driven by consumer demand and technological advancements.

What will be the Size of the Video-On-Demand Market During the Forecast Period?

- The video-on-demand (VOD) market In the United States continues to experience robust growth, driven by audience engagement and monetization opportunities In the entertainment sector. Movies and TV shows streamed on VOD platforms cater to diverse viewer preferences and behaviors, providing content creators with new revenue streams. However, challenges persist, including video content piracy, security, and confidentiality concerns. Educational institutions and corporate environments are increasingly adopting VOD for online education and e-learning, enhancing the learning experience. High costs associated with video content creation, talent acquisition, equipment, and post-production processes necessitate strategic planning and innovative solutions from VOD providers. Technological advancements in VOD software and delivery/deployment methods are crucial for staying competitive in this dynamic market.

- Compliance with privacy laws, such as GDPR, is essential to maintain viewer trust and adhere to regulatory requirements.

How is this Video-On-Demand Industry segmented and which is the largest segment?

The video-on-demand industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2017-2022 for the following segments.

- Platform

- Smartphone and laptops

- Smart TV

- Type

- Subscription video-on-demand

- Advertising video-on-demand

- Transaction video-on-demand

- Geography

- North America

- US

- Europe

- UK

- France

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Platform Insights

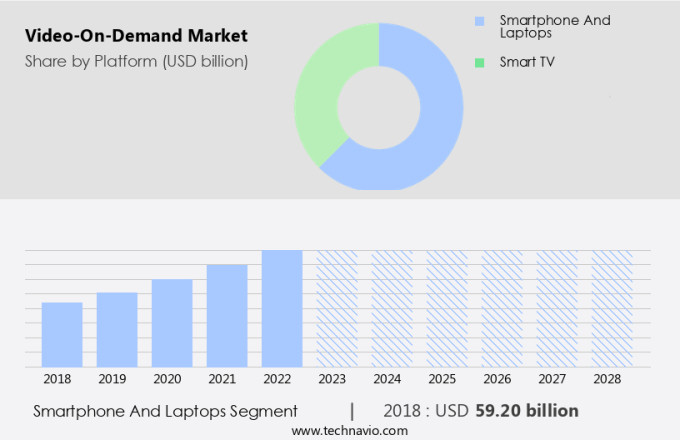

- The smartphone and laptops segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to increasing investment in IT infrastructure and the integration of new technologies in various industries, particularly in IT, BFSI, and telecommunication, where Bring Your Own Device (BYOD) policies are becoming increasingly popular. This shift towards digitalization is enabling companies to cater to the evolving consumer preferences and meet the growing demand for low-cost video-on-demand services. The primary focus of mobile video-on-demand is to enhance audience engagement and video consumption. With the rise of Internet-based video-on-demand services, consumer behavior is expected to undergo a significant transformation. Amidst this digital transformation, ensuring video content security, confidentiality, and adherence to privacy laws such as GDPR becomes crucial.

Companies like Technavio anticipate a continued growth trajectory for the market during the forecast period.

Get a glance at the Video-On-Demand Industry report of share of various segments Request Free Sample

The Smartphone and laptops segment was valued at USD 0.00 billion in 2017 and showed a gradual increase during the forecast period.

Regional Analysis

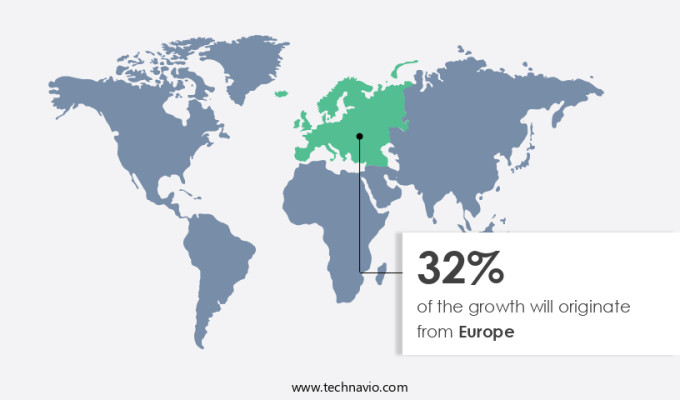

- Europe is estimated to contribute 32% to the growth of the global market during the forecast period.

Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market In the US and Canada is experiencing significant growth, driven by the expanding presence of key companies and increasing revenues. Strategies adopted by regional players, such as partnerships and content expansion, will positively impact the market. The region's mature and technologically advanced entertainment sector produces popular web series, movies, and animated content, easily accessible through streaming services like Netflix and YouTube. US consumers, known for their early adoption of technology, have fueled the growth of video storage and streaming services. The industry's flexibility, ease of use, and seamless customer experiences further contribute to its success.

Market Dynamics

Our video-on-demand market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Video-On-Demand Industry?

Growing preference for cloud streaming services is the key driver of the market.

- The Video-On-Demand (VoD) market In the US is experiencing significant growth due to technological advancements and changing viewer preferences. Monetization strategies, such as the freemium business model, are engaging audiences In the entertainment sector by offering both free and paid subscription options. VoD platforms, including Netflix, Hulu, and Disney Hotstar, are utilizing AI-based platforms for customized content suggestions and high-quality entertainment. Audience engagement is a key focus for VoD providers, with next-day TV programming and 3D titles becoming increasingly popular. However, challenges such as video content piracy, security, confidentiality, GDPR, and privacy laws require strategic planning and innovative solutions from streaming service providers.

- Educational institutions and corporate environments are also adopting VoD for online education and e-learning, offering flexible and seamless customer experiences. The complex regulatory framework, licensing requirements, and government regulations add to the market's complexity. Content creators, production houses, distributors, and streaming platforms are collaborating to ensure compliance and provide secure delivery and deployment processes. Cisco Systems, Inc, ComScore, VdoCipher Media Solutions, and other streaming service providers are investing in AI and machine learning algorithms to enhance the learning experience and meet the interests of audiences. The VoD market growth rate is expected to continue at a steady pace, with the increasing popularity of OTT platforms and the availability of high-quality entertainment at an affordable cost.

- The market's success is also driven by the flexibility and ease of use offered by VoD services, making them a preferred choice for consumers in various verticals, including media and entertainment, education, and other industries. Despite these opportunities, challenges such as content piracy, digital storage, and unlawful downloading remain significant concerns for content owners and broadcasters. Ensuring security and confidentiality while complying with complex regulatory frameworks and licensing requirements is essential for the sustainable growth of the VoD market.

What are the market trends shaping the Video-On-Demand Industry?

Strategies by vendors is the upcoming market trend.

- In the entertainment sector, the Video-On-Demand (VoD) market has experienced significant growth due to monetization opportunities and audience engagement. VoD platforms, including streaming services and OTT platforms, have gained popularity for providing movies, TV shows, and educational content to viewers with flexible subscription options and ease of use. Content creators, educational institutions, and corporate environments are increasingly utilizing VoD for delivering high-quality video content. However, challenges such as video content piracy, security, confidentiality, and compliance with GDPR and privacy laws remain. companies are addressing these concerns through innovative solutions like AI-based platforms, which offer customized content suggestions based on viewer preferences and behavior.

- Technological advancements have enabled the delivery and deployment of VoD content seamlessly, allowing production houses, distributors, and streaming platforms to reach wider audiences. The VoD market growth rate is expected to continue as the interests of audiences shift towards personalized and high-quality entertainment experiences. Streaming service providers are investing in strategic planning and partnerships with technology providers to offer innovative solutions and meet the demands of various verticals, including media and entertainment, education, and other industries. The complex regulatory framework, licensing requirements, and government regulations add to the challenges, but companies are adapting to these changes through contractual responsibilities and adaptive business models.

- Security, confidentiality, and data protection are crucial considerations for VoD providers, as unlawful downloading and digital storage pose significant risks. Service providers are implementing robust security measures and encryption technologies to protect their content library and maintain customer trust. Additionally, the emergence of live streaming and 3D titles, such as those on Oculus Go and Quest, is expanding the market and offering new opportunities for content creators and viewers alike. In conclusion, the VoD market is a dynamic and evolving industry that requires strategic planning, innovative solutions, and a deep understanding of viewer preferences and behavior. companies must address challenges like content piracy, security, and regulatory requirements while delivering seamless customer experiences and high-quality entertainment.

- With continued investments in technology and partnerships, the VoD market is poised for continued growth and success.

What challenges does the Video-On-Demand Industry face during its growth?

Availability of pirated video content on online platforms is a key challenge affecting the industry growth.

- The Video-On-Demand (VoD) market In the US entertainment sector continues to evolve, with monetization and audience engagement being key focus areas for VoD platforms. Movies and TV shows remain popular content choices, with viewer preferences influencing behavior in both educational institutions and corporate environments. However, the market faces challenges, including video content piracy and the need for robust security and confidentiality measures to comply with regulations such as GDPR and privacy laws. VoD providers are investing in innovative solutions to enhance the learning experience in online education and e-learning, while high production costs necessitate strategic planning and the use of AI-based platforms for content creation, talent acquisition, and post-production processes.

- Technological advancements in VoD software, delivery, and deployment processes are driving market growth, with streaming service providers offering contractual responsibilities, flexible subscription options, and seamless customer experiences. Despite these advancements, the VoD market faces complex regulatory frameworks, licensing requirements, and government regulations, making it essential for content creators, distributors, and streaming platforms to prioritize security and confidentiality. The rise of local players and movie studios In the online streaming services landscape, along with the increasing popularity of live streaming, AI-based content suggestions, and high-quality entertainment, are further shaping the market dynamics. The VoD market growth rate is influenced by the interests of audiences, who seek customized content suggestions and high-quality entertainment experiences.

- OTT platforms, such as Cisco Systems, Inc, ComScore, VdoCipher Media Solutions, and streaming service providers, are leveraging AI and machine learning algorithms to deliver personalized content and seamless streaming experiences. The market is expected to continue growing, with educational institutions, media and entertainment, and other verticals adopting VoD solutions to meet the evolving needs of their audiences. However, the market faces significant challenges, including the threat of video content piracy and unlawful downloading. Content owners and broadcasters are working to address these issues through digital storage solutions and AI-based piracy detection systems. The use of AI and machine learning algorithms is also helping to improve the overall user experience, with customized content suggestions and high-quality streaming becoming increasingly important to audiences.

- In conclusion, the VoD market In the US is experiencing significant growth, driven by technological advancements, changing viewer preferences, and the increasing adoption of streaming services in various industries. However, the market faces challenges related to video content piracy, regulatory compliance, and the high cost of video content creation and distribution. VoD providers must prioritize security, confidentiality, and innovation to meet the evolving needs of their audiences and remain competitive In the market.

Exclusive Customer Landscape

The video-on-demand market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the video-on-demand market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, video-on-demand market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Akamai Technologies Inc. - Our company provides Video-on-Demand solutions through Live Video Streaming and Video Delivery Services for both live events and linear TV. With Adaptive Media Delivery, users can instantly access video content on any device without interruptions. This technology ensures unparalleled convenience and flexibility for consumers In the US market. By combining advanced streaming and delivery technologies, we offer a seamless viewing experience for an extensive range of video content. Our Video-on-Demand offerings cater to various industries, including entertainment, education, and corporate communications, making us a versatile partner for businesses and individuals alike.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Alphabet Inc.

- Amazon.com Inc.

- Amdocs Ltd.

- Apple Inc.

- AT and T

- Cisco Systems Inc.

- Comcast Corp.

- Edgio Inc.

- Fujitsu Ltd.

- Huawei Technologies Co. Ltd.

- KWIKmotion

- Lumen Technologies Inc.

- Muvi LLC

- Netflix Inc.

- Roku Inc.

- The Walt Disney Co.

- Verizon

- Walmart Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Monetizing Video-on-Demand: A Deep Dive into Audience Engagement and Market Dynamics The video-on-demand (VOD) market has emerged as a significant player In the entertainment sector, offering movies, TV shows, and educational content to viewers on their terms. This dynamic industry is driven by the preferences and behaviors of audiences in various verticals, including educational institutions and corporate environments. VOD platforms have revolutionized the way content is consumed, providing viewers with unparalleled flexibility and ease of use. The entertainment sector has embraced this shift, with production houses and distributors partnering with streaming platforms to deliver high-quality content to consumers.

Viewer preferences and behavior play a crucial role In the monetization of VOD. Content creators invest in video content creation, talent, and post-production processes to cater to diverse interests. Technological advancements and innovative solutions have enabled VOD providers to offer seamless customer experiences, localized content, and personalized recommendations. Security and confidentiality are essential considerations In the VOD market. With the increasing popularity of online education and e-learning, privacy laws such as GDPR and privacy concerns have become increasingly important. VOD software and delivery processes are designed to ensure the protection of sensitive information and adhere to complex regulatory frameworks.

The high cost of video content creation and licensing requirements pose challenges for content owners and broadcasters. Government regulations and content piracy are ongoing concerns, with unlawful downloading and streaming posing a significant threat to the industry. Educational institutions and corporate environments are significant contributors to the VOD market. Online education and e-learning platforms have become essential tools for remote learning and professional development. VOD solutions cater to the unique needs of these verticals, offering customized content suggestions and interactive learning experiences. The market for VOD is experiencing robust growth, fueled by the interests of audiences and the strategic planning of providers.

AI-based platforms and machine learning algorithms enable personalized content recommendations and high-quality entertainment experiences. Live streaming and 3D titles are also gaining popularity, offering viewers immersive experiences. Cisco Systems Inc. And Comscore are among the companies that have made significant strides In the VOD market. Streaming service providers and VDocipher Media Solutions have emerged as key players, offering contractual responsibilities, subscription options, and flexible delivery processes. The VOD market is a complex ecosystem, with various stakeholders and interests at play. From content creators and production houses to distributors and streaming platforms, the industry requires strategic planning and innovative solutions to meet the evolving needs of audiences and verticals.

In conclusion, the VOD market is a dynamic and evolving industry, driven by the preferences and behaviors of audiences in various verticals. The monetization of VOD relies on the delivery of high-quality content, personalized experiences, and robust security measures. The future of VOD is bright, with technological advancements and strategic partnerships set to shape the industry landscape.

|

Video-On-Demand Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

183 |

|

Base year |

2023 |

|

Historic period |

2017-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.77% |

|

Market growth 2024-2028 |

USD 309.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.93 |

|

Key countries |

US, China, India, UK, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Video-On-Demand Market Research and Growth Report?

- CAGR of the Video-On-Demand industry during the forecast period

- Detailed information on factors that will drive the Video-On-Demand growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the video-on-demand market growth of industry companies

We can help! Our analysts can customize this video-on-demand market research report to meet your requirements.