What is the Size of the Ship And Yacht Repair Market in Greece?

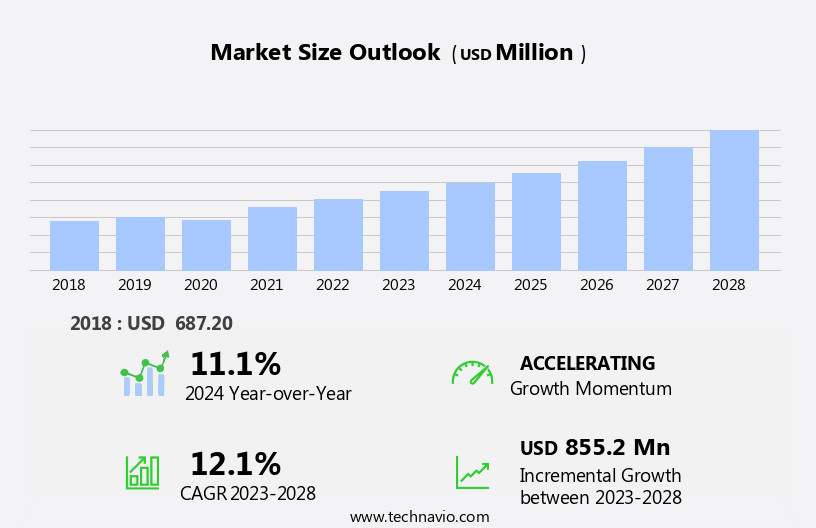

The market size is estimated to increase by USD 855.2 million, at a CAGR of 12.1% between 2024 and 2028. The ship and yacht repair market is driven by several factors, including the need to address malfunctions and ensure operational efficiency. Downtime due to repairs can lead to significant fuel wastage and increased operational costs. As such, reliability is a top priority for ship and yacht owners. Compliance with regulations, fines, and penalties also play a crucial role in the market. Insurance requirements and maintenance logs are essential tools for ensuring regulatory compliance and mitigating risks. Propulsion systems, in particular, require regular maintenance to maintain optimal performance and prevent costly repairs. companies are collaborating to offer comprehensive repair solutions, reducing downtime and improving operational efficiency. However, the high costs associated with yacht and ship repair remain a challenge for market growth.

Request Free Ship And Yacht Repair Market in Greece Sample

Market Segment

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018 - 2022 for the following segments.

- Type

- Ship

- Yacht

- Service Type

- Engine repair

- Electrical and instrumentation repair

- Metal fabrication repair

- Others

- End-user

- Commercial shipping companies

- Private yacht owners

- Cruise line operators

- Others

- Geography

- Greece

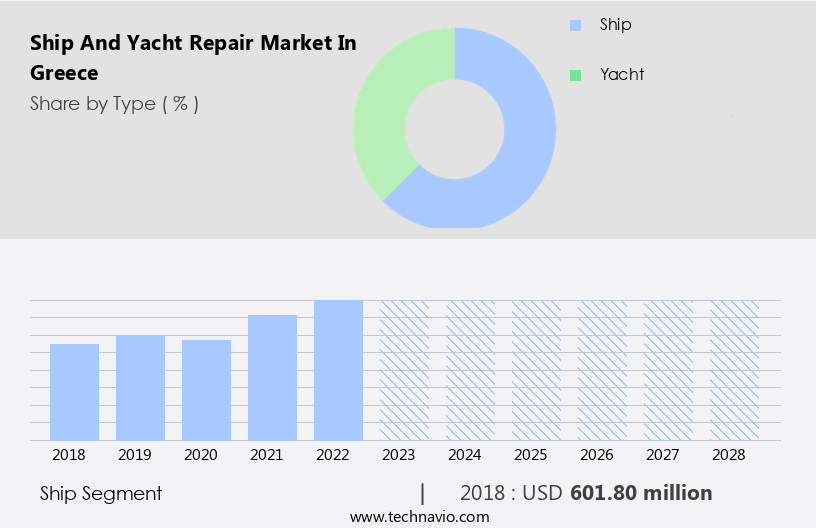

Which is the Largest Segment Driving Market Growth?

The ship segment StartFragment is estimated to witness significant growth during the forecast period. In the maritime industry of Greece, shipyards offer comprehensive repair and maintenance services for a range of vessels, including cargo ships, tankers, and bulk carriers. These commercial vessels play a pivotal role in Greece's economy and international trade, necessitating frequent upkeep to ensure operational efficiency and adherence to safety and environmental regulations. Greek shipyards are equipped with advanced technology and specialized skills to address complex repair needs, such as plumbing system overhauls and machinery upgrades. Moreover, the offshore energy sector relies on Greece's shipyards for the maintenance and repair of offshore support vessels. These vessels are essential for maritime operations and the energy sector, making it crucial to maintain their optimal performance. The construction and repair of these vessels require labor-intensive efforts and specialized skills, which Greek shipyards possess in abundance. Technology and automation are integral to the ship repair market in Greece, ensuring that vessels are repaired and maintained to the highest industry standards. Greek shipyards remain at the forefront of innovation, incorporating the latest technology to streamline processes and enhance the quality of their services. With a focus on efficiency, safety, and compliance, Greek shipyards continue to cater to the diverse needs of the maritime industry.

Get a glance at the market share of various regions Download the PDF Sample

How do Technavio's company ranking index and market positioning come to your aid?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

A1 GROUP - The company offers ship and yacht repair services such as blasting, shrink wrapping, scaffolding, and others.

Technavio provides the ranking index for the top 20 companies along with insights on the market positioning of:

- A1 GROUP

- Alpha Marine Group Inc.

- CHALKIS SHIPYARDS S.A

- Dionisopoulos Co.

- Elefsis Shipyards

- Fincantieri Spa

- Hellespont Ship and Yacht Repairs and Maintenance

- HPS

- JGP Hellas Ltd.

- Kappa Services SA

- Marine Plus

- NAFS Hellas S.A.

- ONEX NEORION SHIPYARDS S.A

- Okean One

- Piraeus Port Authority S.A.

- Salamis Shipyards

- Seatrium Ltd

- Skaramangas Shipyards

- Spanopoulos Group

- Vliho Yacht Club

Explore our company rankings and market positioning Request Free Sample

How can Technavio Assist you in Making Critical Decisions?

What is the Market Structure and Year-over-Year growth of the Ship And Yacht Repair Market in Greece?

|

Market structure |

Fragmented |

|

YoY growth 2023-2024 |

11.1 |

Market Dynamic

The global ship and yacht repair market plays a crucial role in the international trade sector, ensuring the seaworthiness and profitability of vessels. Regular maintenance is essential to mitigate operational costs associated with on-board accidents, unexpected breakdowns, and malfunctions. Crew morale and safety are paramount in the maritime industry. A well-maintained vessel not only ensures the safety of the crew but also reduces the risk of accidents. Regular inspections and timely repairs of hull, lifeboats, electrical systems, navigation equipment, fire suppression systems, and emergency power systems are vital to maintaining a seaworthy vessel. Operational costs can be significantly reduced by addressing potential issues before they escalate into major problems. Delayed repairs can lead to prolonged downtime, fuel wastage, and potential fines and penalties for non-compliance with regulations. Legislation and inspections are integral parts of the ship and yacht repair market.

Moreover, compliance with regulations is not only necessary for the safety of the crew and passengers but also to avoid costly fines and penalties. Regular inspections help identify potential issues and allow for timely repairs. Machinery inspections are a critical component of ship and yacht repair. These inspections help identify any malfunctions and ensure the reliability of the vessel's machinery. Addressing these issues promptly can prevent unexpected breakdowns and the associated costs and downtime. The lifespan of a vessel is directly related to the quality and frequency of maintenance. Proper maintenance can extend the lifespan of a vessel, reducing the need for costly replacements. Additionally, a well-maintained vessel is more likely to be profitable, as it can operate more efficiently and effectively. In conclusion, the ship and yacht repair market plays a vital role in the international trade sector by ensuring the seaworthiness and profitability of vessels. Regular maintenance, inspections, and timely repairs are essential to reducing operational costs, maintaining crew safety, and complying with regulations. Investing in proper maintenance can lead to a more reliable vessel, reduced downtime, and a longer lifespan.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Primary Factors Driving the Market Growth?

The increasing sales of new yachts and ships in Greece is notably driving market growth. The international ship and yacht repair market is experiencing notable growth due to the increasing sales of new vessels, particularly in Greece. This trend is linked to the recovery of the tourism sector post-pandemic. As travelers prioritize exclusive and safe vacation experiences, there has been a significant increase in demand for luxury sea vacations. This has resulted in a heightened interest in purchasing new yachts for leisure and recreational purposes, making Greece a preferred destination for yachting. In 2023, Greek ship owners placed orders for approximately 165 new ships, surpassing the 123 ships ordered in the previous year.

Furthermore, the majority of these orders were for tankers and dry bulk carriers, with 93 orders in the Aframax/LR2 sector and 51 in the Kamsarmax and Ultramax sectors. Ship maintenance and repair play a crucial role in ensuring the operational efficiency and safety of vessels. Crew morale and safety are essential considerations in this regard. On-board accidents can lead to significant operational costs and potential reputational damage. Therefore, adherence to legislation and inspections is imperative. Compliance with safety regulations and regular inspections are essential to maintain the safety of the crew and passengers. The ship and yacht repair market is expected to continue its growth trajectory, driven by these factors and the increasing demand for new vessels. Thus, such factors are driving the growth of the market during the forecast period.

What are the Significant Trends being Witnessed in the Market?

The increase in collaboration among companies is the key trend in the market. The ship and yacht repair market in Greece is experiencing a notable evolution, marked by an increase in collaborative efforts among industry players. This trend is linked to the broader revitalization of the ship repair and shipbuilding sector in the country. Notable collaborations include the partnership between Naval Group and Hellenic Shipyards SA in May 2023, and Fincantieri Spa's alliance with ONEX Shipyards and Technologies Group, part of Neorion Syros Shipyards. These strategic alliances are significant, attracting substantial investments and boosting growth within the Greek ship repair industry.

Moreover, malfunctions and downtime in ships and yachts can result in significant fuel wastage and decreased operational efficiency. With increasing compliance requirements and potential fines and penalties, maintaining the reliability of these vessels is crucial. Proper maintenance logs are essential for ensuring regulatory compliance and reducing insurance risks. Propulsion systems, in particular, require regular attention to ensure optimal performance. These factors underscore the importance of a strong ship repair market to address the needs of the industry. By fostering collaboration and investment, the Greek ship repair sector is well-positioned to meet these demands and enhance operational efficiency. Thus, such trends will shape the growth of the market during the forecast period.

What are the Major Market Challenges?

The high operation costs associated with yacht and ship repair is the major challenge that affects the growth of the market. The ship and yacht repair industry in Greece encounters substantial challenges due to elevated operational expenses. One of the major cost drivers is the high price tag of skilled labor and crew. Expert technicians, engineers, and specialized workers are indispensable for executing complex repairs, installing sophisticated systems, and adhering to stringent safety regulations. The high demand for proficient personnel and the unique expertise required for various repair tasks lead to increased labor costs in the maritime repair sector.

Moreover, the cost of materials, machinery, and replacement parts significantly impacts the operational expenditures of yacht and ship repair in Greece. Ensuring a seaworthy vessel necessitates continuous investment in lifeboats, electrical systems, navigation equipment, fire suppression systems, and emergency power systems. Unexpected breakdowns can lead to extensive repair bills, further increasing the financial burden on repair businesses. To maintain profitability and extend the vessel lifespan, it is essential to prioritize regular machinery inspections and proactive maintenance strategies. Hence, the above factors will impede the growth of the market during the forecast period.

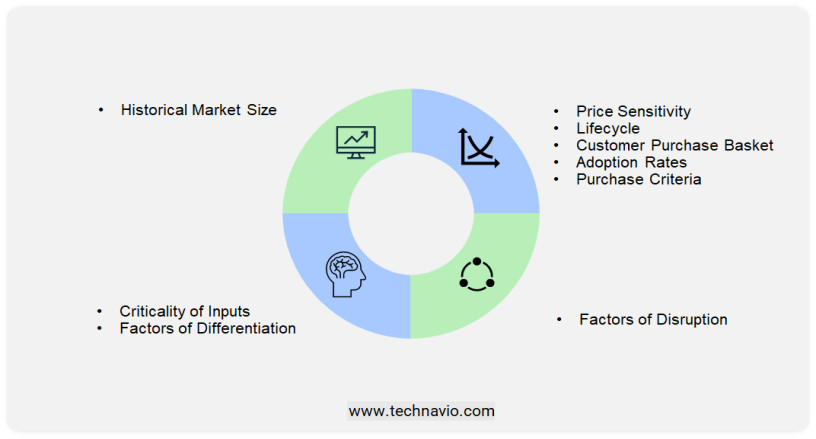

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Market Analyst Overview

The global ship repair market is a significant sector within international trade, focusing on maintaining and repairing various types of vessels to ensure their seaworthiness and operational efficiency. Ship repair encompasses various aspects, including hull, machinery, electrical systems, navigation equipment, fire suppression systems, and emergency power systems. Crew morale and safety are paramount in this industry, with legislation and inspections mandating strict adherence to safety protocols. On-board accidents can lead to unexpected downtime, increased operational costs, and potential fines and penalties. Vessel lifespan and profitability depend on reliable machinery inspections, timely repairs, and compliance with regulations. Hull repair, including keel, automation, and technology, plays a crucial role in maintaining a vessel's structural integrity. Specialized skills and labor-intensive processes, such as fabrication, welding, and coatings application, require extensive training and adherence to quality control measures. Natural environment considerations include environmental issues, air emissions, water discharge, and waste management, with a focus on minimizing hazards and ensuring compliance. Unexpected breakdowns and malfunctions can lead to significant fuel wastage and increased operational costs. Preventive maintenance, including machinery inspections and maintenance logs, is essential to mitigate these risks and ensure the vessel's reliability. Safety concerns include hazards related to scaffolding, welding, steel plate fabrication, and the handling of solvents, epoxy, insulation, and paint. Proper safety measures, such as the use of respirators, noise reduction, ergonomics, and electrical hazard precautions, are essential to protect crew health and wellbeing. In conclusion, the ship repair market is a critical component of international trade, requiring a focus on safety, efficiency, and regulatory compliance. With the increasing complexity of vessels and the need for specialized skills, the industry continues to evolve, incorporating advanced technologies and automation to improve processes and reduce downtime.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

172 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 12.1% |

|

Market growth 2024-2028 |

USD 855.2 million |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

A1 GROUP, Alpha Marine Group Inc., CHALKIS SHIPYARDS S.A, Dionisopoulos Co., Elefsis Shipyards, Fincantieri Spa, Hellespont Ship and Yacht Repairs and Maintenance, HPS, JGP Hellas Ltd., Kappa Services SA, Marine Plus, NAFS Hellas S.A., ONEX NEORION SHIPYARDS S.A, Okean One, Piraeus Port Authority S.A., Salamis Shipyards, Seatrium Ltd, Skaramangas Shipyards, Spanopoulos Group, and Vliho Yacht Club |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, fast-growing and slow-growing segment analysis, AI impact on market trends, COVID-19 impact and recovery analysis and future consumer dynamics, market research and growth, market condition analysis for the market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across Greece

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies