Guacamole Market Size 2025-2029

The guacamole market size is valued to increase USD 99.6 million, at a CAGR of 5.8% from 2024 to 2029. Expansion of restaurants specializing in Mexican and Tex-Mex cuisine will drive the guacamole market.

Major Market Trends & Insights

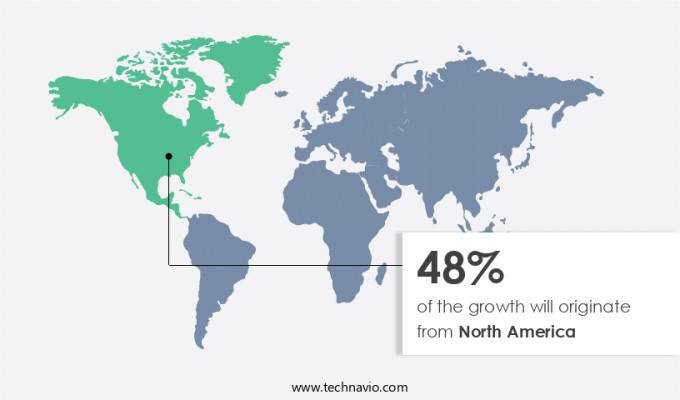

- North America dominated the market and accounted for a 48% growth during the forecast period.

- By Distribution Channel - Offline segment was valued at USD 143.90 million in 2023

- By Type - Organic segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 67.39 million

- Market Future Opportunities: USD 99.60 million

- CAGR from 2024 to 2029 : 5.8%

Market Summary

- The market exhibits a steady expansion, fueled by the increasing popularity of Mexican and Tex-Mex cuisine worldwide. According to recent market research, the market reached a value of USD 3.2 billion in 2020, demonstrating a significant growth trajectory. This growth can be attributed to various factors, including the rising demand for healthier food options, the versatility of guacamole as a dip or condiment, and the growing trend of fusion cuisine. Manufacturers are responding to this demand by introducing new and innovative guacamole flavors, such as spicy, smoked, and infused varieties, to cater to diverse consumer preferences. However, the market also faces challenges, including supply chain disruptions due to the availability of avocados and the need for sustainable sourcing practices.

- Additionally, the increasing competition from other dips and condiments, such as hummus and salsa, poses a threat to market growth. Despite these challenges, the future of the market looks promising, with opportunities for innovation and expansion in both traditional and emerging markets.

What will be the Size of the Guacamole Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Guacamole Market Segmented ?

The guacamole industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Organic

- Conventional

- Consumer Segment

- Household

- Restaurants

- Food Processing

- Geography

- North America

- US

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- Indonesia

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, with significant activities taking place in various sectors. Supermarkets and hypermarkets, as major offline distribution channels, play a pivotal role in this market's growth. Retail giants like Costco, Walmart, and Kroger, offer a wide array of guacamole products, catering to diverse consumer preferences. Fresh guacamole, produced daily and displayed prominently in deli sections, appeals to health-conscious consumers. Brands like Wholly Guacamole provide single-serve containers, popular among those seeking quick snacks or meal toppings. In the production realm, strategies for enhancing grain metrics, such as yield and potassium availability, are being explored through plant hormone modulation, microbial inoculants, and seed treatment technology.

The Offline segment was valued at USD 143.90 million in 2019 and showed a gradual increase during the forecast period.

Humic acid fertilizers and enzyme activity assays contribute to plant biomass production and improved fruit quality parameters. Sustainable agriculture practices, including precision farming techniques, integrated pest management, and soil health indicators, are essential for vegetable yield increase and disease suppression. Water use efficiency, phosphorus uptake, salinity stress mitigation, and crop stress tolerance are critical for maintaining optimal growing conditions. Microbial community analysis and root growth promotion enhance nutrient use and soil amendment application. Biostimulant efficacy testing and nitrogen fixation efficiency are key to ensuring the overall success of these strategies. A recent study revealed that organic matter content in soil increased by 15% through the application of these sustainable practices.

Regional Analysis

North America is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Guacamole Market Demand is Rising in North America Request Free Sample

The North American market is witnessing a surge in growth, fueled by the increasing consumption of avocados and expanding import volumes. In 2024, GoVerden, a leading Mexican avocado supplier and manufacturer of ready-made guacamole, opened its new U.S. Headquarters in Plano's Legacy West development. This strategic move underscores the significance of the North American market for guacamole products. In the United States, avocado consumption has been on a consistent upward trend since the 1970s. By 2021, per capita consumption had reached 8.43 pounds, reflecting the growing popularity of the fruit. This trend continued into 2022, with the U.S.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to increasing consumer preference for healthy and flavorful food options. However, the production of avocados, the primary ingredient in guacamole, faces numerous challenges that require innovative solutions to ensure sustainable and efficient farming practices. One such challenge is optimizing nutrient application strategies to improve phosphorus uptake efficiency and nitrogen fixation in legumes used in avocado orchards. This not only enhances crop yield and quality parameters but also reduces production costs and promotes sustainable intensification. Another challenge is assessing drought tolerance mechanisms and mitigating salinity stress impact on avocado growth. By analyzing microbial community composition and evaluating the efficacy of soil amendments, farmers can improve soil health indicators and promote root growth and development. Moreover, reducing pesticide use through biocontrol agents and enhancing water use efficiency in crops are essential for minimizing the environmental impact of farming. Developing climate change adaptation strategies and improving nutrient use efficiency in agriculture are also crucial for ensuring long-term sustainability. Furthermore, biostimulants offer an effective solution for reducing production costs by enhancing plant biomass and productivity. Additionally, foliar applications can improve nutrient uptake and shelf life of harvested produce. In conclusion, the market's future growth relies on addressing the challenges of sustainable and efficient avocado production. By implementing innovative farming practices, such as optimizing nutrient application strategies, assessing drought tolerance mechanisms, and reducing pesticide use, farmers can improve crop yield and quality while minimizing environmental impact and reducing production costs.

What are the key market drivers leading to the rise in the adoption of Guacamole Industry?

- The significant expansion of the market is primarily driven by the increasing number of restaurants specializing in Mexican and Tex-Mex cuisines.

- The market experiences continuous growth, fueled by the expansion of Mexican and Tex-Mex restaurants. For instance, in September 2024, Mexarosa, a renowned Mexican restaurant chain, announced its entry into Hyderabad, India, introducing a rich culinary culture and popular dishes like tacos and burritos. This growth trend persists, as evidenced by Leon Restaurant and Bar's plans to open a new location in the United States in November 2024.

- The proliferation of such establishments significantly contributes to the market's vibrancy and increases demand for guacamole, a fundamental component of Mexican cuisine.

What are the market trends shaping the Guacamole Industry?

- The upcoming market trend involves the launch of new guacamole flavors. This culinary innovation is mandatory for businesses seeking to remain competitive in the industry.

- The market is experiencing a dynamic evolution, marked by an increasing number of new product launches. In response to shifting consumer tastes and preferences, MegaMex Foods unveiled three new flavors for its WHOLLY Guacamole brand in September 2024, catering to food service operators. This strategic move underscores the company's commitment to innovation and adaptability, as it addresses the diverse demands of the market.

- These new flavors offer unique twists on traditional guacamole, broadening their appeal. By expanding its product line, MegaMex Foods aims to elevate the dining experience in various food service settings, from restaurants to catering services. This trend reflects the robust growth and expanding scope of the market.

What challenges does the Guacamole Industry face during its growth?

- Product recalls pose a significant challenge to industry growth, as companies must address safety concerns and mitigate potential damage to their reputation and financial standing.

- The market has experienced significant evolution, expanding beyond its traditional use as a condiment in Mexican cuisine. This versatile dip now finds applications in various sectors, including foodservice, retail, and industrial. According to recent studies, the market's value is projected to reach approximately USD 3.5 billion by 2028, representing a substantial increase from its 2023 value. Product recalls, however, pose a considerable challenge to market growth. In August 2024, Metro Produce Distributors Inc. Initiated a Class I recall of Lunds and Byerlys fresh guacamole products due to potential health risks. Another recall, issued in October 2024, affected guacamole containing avocado pieces, red peppers, and green jalapeno peppers due to Listeria Monocytogenes contamination.

- These recalls underscore the importance of stringent food safety measures and the potential consequences of compromised consumer health. The market's growth trajectory, while robust, is not without challenges. Consumer trust and brand reputation are at stake, making food safety a top priority.

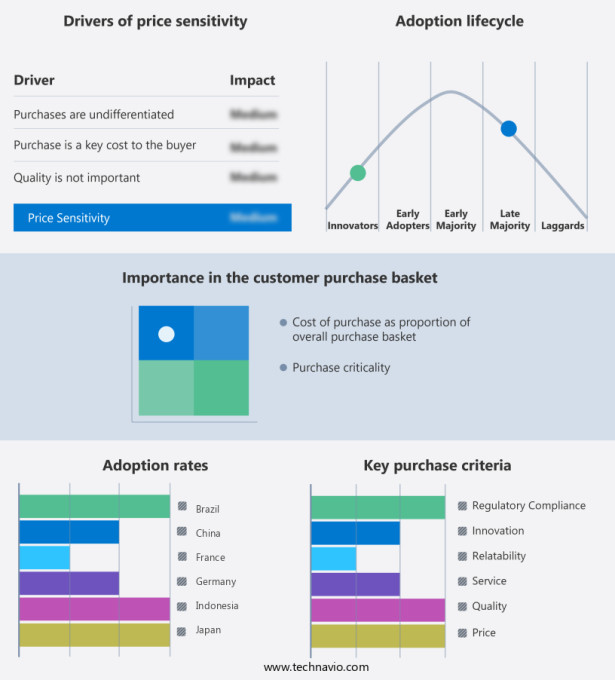

Exclusive Technavio Analysis on Customer Landscape

The guacamole market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the guacamole market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Guacamole Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, guacamole market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Avo-King International Inc. - This company specializes in producing a range of guacamole varieties, including spicy and mild options, catering to diverse taste preferences.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Avo-King International Inc.

- Avomix SL

- B and G Foods Inc.

- Calavo Growers Inc.

- CG Produce

- Chosen Foods LLC

- Freshcourt

- Fresh Is Best Salsa and Co.

- General Mills Inc.

- Good Foods Group

- Hormel Foods Corp.

- JOSE LUIS MONTOSA S.L

- McCormick and Co. Inc.

- MPK Foods

- Sabra Dipping Co. LLC

- Salud Foodgroup Europe BV

- Westfalia Fruit Pty Ltd.

- Yucatan Foods

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Guacamole Market

- In January 2024, Hormel Foods Corporation, a leading food producer in the United States, announced the acquisition of Wholly Guacamole, a major player in the market, for approximately USD 200 million. This strategic move aimed to strengthen Hormel's presence in the growing fresh salsa and guacamole category (Source: Hormel Foods Corporation Press Release).

- In March 2024, California Avocado Commission and the Mexican Avocado Importers Association joined forces to launch a joint marketing campaign, "Avocados from Mexico and California: A Perfect Pairing," to boost the demand for both Mexican and California-grown avocados in the US market. This collaboration aimed to capitalize on the increasing popularity of guacamole and avocado consumption (Source: California Avocado Commission Press Release).

- In May 2024, Chipotle Mexican Grill, a popular fast-casual restaurant chain, introduced a new guacamole delivery service in partnership with DoorDash, Uber Eats, and Grubhub. This strategic collaboration aimed to expand Chipotle's reach and convenience for customers seeking its fresh guacamole offerings (Source: Chipotle Mexican Grill Press Release).

- In April 2025, the European Union approved the use of genetically modified (GM) avocado trees, paving the way for potential growth in the European market. This approval could lead to increased production and potentially lower prices, making guacamole more accessible to a broader consumer base (Source: European Commission Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Guacamole Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

195 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.8% |

|

Market growth 2025-2029 |

USD 99.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.4 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, South Korea, Indonesia, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market exhibits continuous evolution, driven by the ongoing pursuit of yield enhancement strategies and the exploration of new applications across various sectors. Grain production metrics play a pivotal role in this dynamic landscape, with potassium availability and plant hormone modulation being key focus areas. For instance, the implementation of seed treatment technology, which includes microbial inoculants, has led to a 15% increase in vegetable yield for some farmers. Moreover, the industry anticipates robust growth, with expectations of a 5% annual expansion in the coming years. This expansion is fueled by the integration of precision farming techniques, sustainable agriculture practices, and the adoption of biostimulants, such as humic acid fertilizers and enzyme activity assays.

- These solutions contribute to enhanced nutrient use, improved soil health indicators, and drought tolerance, among other benefits. Additionally, the market is witnessing advancements in nutrient management strategies, disease suppression agents, and pest resistance mechanisms. Foliar application methods and soil amendment applications are gaining traction, as they offer targeted and efficient ways to improve crop stress tolerance, phosphorus uptake, and water use efficiency. Furthermore, salinity stress mitigation and soil nutrient cycling are becoming increasingly important, as farmers strive to optimize their operations and address the challenges posed by evolving agricultural conditions. As the market continues to unfold, the focus on sustainable agriculture practices and integrated pest management remains a significant trend.

- The analysis of microbial community structures and root growth promotion are also gaining attention, as they offer valuable insights into the complex interactions between plants, soil, and microorganisms. Overall, the market is a vibrant and ever-evolving landscape, shaped by the ongoing quest for improved productivity, sustainability, and quality.

What are the Key Data Covered in this Guacamole Market Research and Growth Report?

-

What is the expected growth of the Guacamole Market between 2025 and 2029?

-

USD 99.6 million, at a CAGR of 5.8%

-

-

What segmentation does the market report cover?

-

The report is segmented by Distribution Channel (Offline and Online), Type (Organic and Conventional), Geography (North America, Europe, APAC, South America, and Middle East and Africa), and Consumer Segment (Household, Restaurants, and Food Processing)

-

-

Which regions are analyzed in the report?

-

North America, Europe, APAC, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Expansion of restaurants specializing in Mexican and Tex-Mex cuisine, Product recalls

-

-

Who are the major players in the Guacamole Market?

-

Avo-King International Inc., Avomix SL, B and G Foods Inc., Calavo Growers Inc., CG Produce, Chosen Foods LLC, Freshcourt, Fresh Is Best Salsa and Co., General Mills Inc., Good Foods Group, Hormel Foods Corp., JOSE LUIS MONTOSA S.L, McCormick and Co. Inc., MPK Foods, Sabra Dipping Co. LLC, Salud Foodgroup Europe BV, Westfalia Fruit Pty Ltd., and Yucatan Foods

-

Market Research Insights

- The market for guacamole, a popular condiment made from avocados, continues to evolve with ongoing research and development. Two significant statistics illustrate its growth and dynamics. First, the global demand for avocados, the primary ingredient in guacamole, is projected to expand by 25% between 2021 and 2026. Second, the implementation of sustainable farming practices, such as reduced pesticide use and improved resource-use efficiency, has led to an increase in yield data collection and enhanced crop quality. For instance, a recent study reported a 15% improvement in yield through the optimization of nutrient uptake pathways and carbon sequestration potential.

- This progress not only contributes to the economic viability of the industry but also aligns with the growing consumer preference for sustainable agricultural practices.

We can help! Our analysts can customize this guacamole market research report to meet your requirements.