Hand Sanitizer Market Size 2024-2028

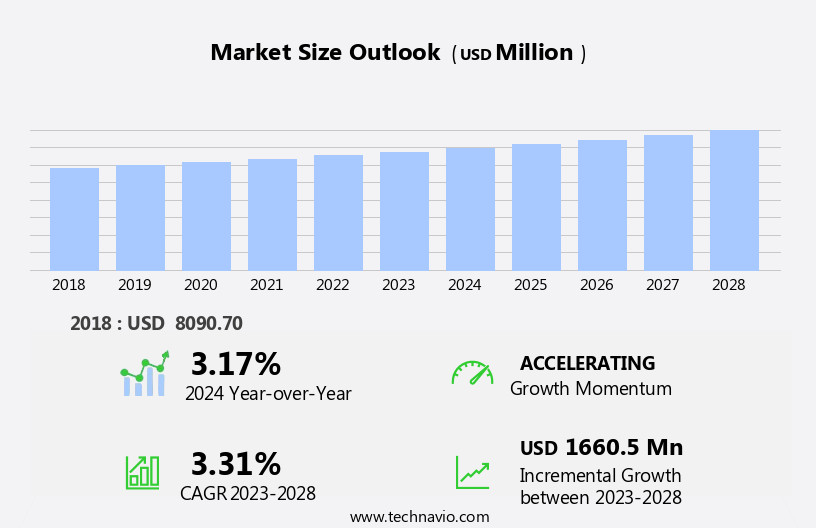

The hand sanitizer market size is forecast to increase by USD 1.66 billion at a CAGR of 3.31% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing awareness of hand hygiene in preventing the spread of infectious diseases. The demand for sanitizers has surged as ethyl alcohol and isopropyl alcohol have been identified as effective agents against various microorganisms. Fragrance ingredients are also gaining popularity in hand sanitizers to enhance consumer experience and make them more appealing.

- The cosmetic skin care, beauty, and personal care sectors are increasingly incorporating hand sanitizers into their product offerings. E-commerce platforms have facilitated the easy availability of these products, expanding their reach beyond traditional retail channels. However, the market faces challenges such as the presence of counterfeit products, which can negatively impact consumer trust and safety.

- Product innovation and portfolio extension are key trends driving market growth, with companies focusing on premiumization to cater to evolving consumer preferences.

What will be the Size of the Hand Sanitizer Market During the Forecast Period?

- The market encompasses a range of products designed to eliminate disease-causing germs, including viruses, on hands when soap and water are unavailable. This market includes various forms such as gels, foams, liquids, sprays, and foaming hand sanitizers, as well as those based on alcohol and non-alcohol solutions. Key ingredients like aloe vera, tea tree oil, glycerin, propylene glycol, ethyl alcohol, and others contribute to the market's diversity.

- Hand sanitizers are widely available through various channels, including hypermarkets and supermarkets, pharmacy stores, e-commerce platforms, and other retail outlets. Consumers increasingly prioritize hygiene and the prevention of bacteria and viruses, driving market growth.

- Alcohol-based hand sanitizers have historically dominated the market due to their proven effectiveness against a broad spectrum of microbes. However, non-alcohol-based options, which are often more gentle on skin, are gaining popularity, particularly among those with sensitive skin or allergies. Overall, the market is expected to continue expanding as consumers prioritize health and hygiene.

How is this Hand Sanitizer Industry segmented and which is the largest segment?

The hand sanitizer industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Gel

- Foam

- Spray

- Wipe

- End-user

- Commercial

- Residential

- Institutional

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Product Insights

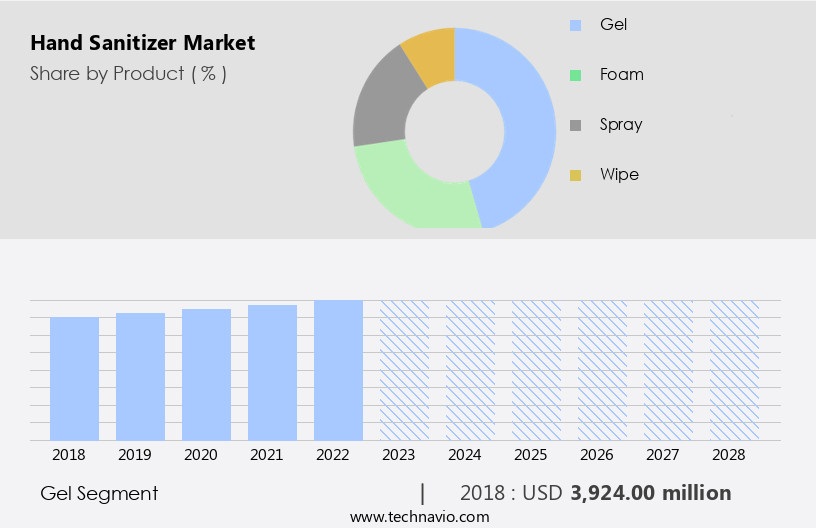

- The gel segment is estimated to witness significant growth during the forecast period.

Hand sanitizers have gained significant importance In the market due to the increasing awareness of disease-causing germs, viruses such as Norovirus, Influenza, and Meningitis, and the need for personal cleanliness and hygiene. Various types of hand sanitizers, including foam, gel, liquid, sprays, and foaming hand sanitizers, are available In the market. Companies offer a range of hand sanitizers, with ITC Ltd.'s Ecolab brand providing gel-based options like Express Gel Hand Sanitizer, Advanced Gel Hand Sanitizer, and Moisturizing Gel Hand Sanitizer. The market is witnessing new product launches to cater to the growing consumer demand.

A trend influencing the market's growth is the preference for hand sanitizers with beneficial ingredients like Aloe Vera, Tea Tree Oil, and Glycerin, as well as eco-friendly and biodegradable options. Hand sanitizers are widely available at hypermarkets/supermarkets and pharmacy stores, and e-commerce platforms are also significant sales channels. The market's growth is driven by factors such as the increasing internet penetration and the e-commerce industry's expansion. Ethyl alcohol and isopropyl alcohol are common disinfectant solutions used in hand sanitizers. Companies are focusing on sourcing raw materials and securing packaging materials sustainably, using renewable resources and organic personal care ingredients. Hand sanitizers serve various purposes, including personal care, household use, and in specialty stores, hospitals, hotels and restaurants, residential facilities, schools and colleges, military, and the corporate sector.

Get a glance at the Hand Sanitizer Industry report of share of various segments Request Free Sample

The Gel segment was valued at USD 3.92 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

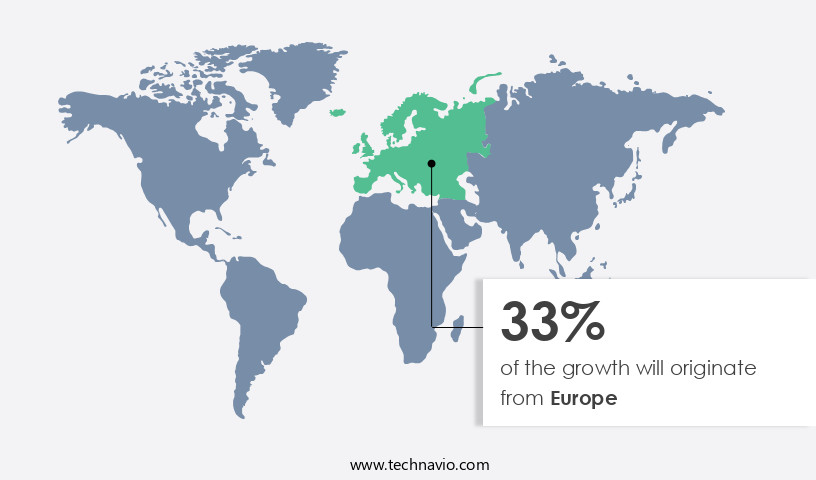

- Europe is estimated to contribute 33% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing significant growth due to increasing consumer awareness and the need for preventive measures against diseases, including influenza and Norovirus. The US is currently the largest revenue generator in this market. New companies are entering the industry, and existing companies are launching new hand sanitizer products in response to the surging demand. These new offerings come in various forms such as foams, gels, liquids, and sprays, including foaming and spray hand sanitizers. Key ingredients include alcohol-based options with ethyl alcohol or isopropyl alcohol, as well as non-alcohol-based alternatives with glycerin, propylene glycol, aloe vera, tea tree oil, and other beneficial ingredients.

Hand sanitizers are readily available at hypermarkets/supermarkets, pharmacy stores, and e-commerce platforms. The market's growth is driven by the importance of hygiene, cleanliness, and personal care, as well as the increasing penetration of the internet and e-commerce industry. The market is also focusing on sustainability, waste management, and the use of biodegradable ingredients and renewable resources. The market serves various sectors, including schools and colleges, hospitals, hotels and restaurants, residential facilities, specialty stores, and the military and corporate sector. Hand sanitizers are essential for personal cleanliness and hygiene, making them a crucial component in preventing the spread of non-communicable diseases, such as HIV/AIDS, and various viruses and bacteria.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hand Sanitizer Industry?

Product innovation and portfolio extension leading to product premiumization is the key driver of the market.

- Hand sanitizers have become essential skin care products in today's world, as disease-causing germs, viruses such as Norovirus, Influenza, and Meningitis continue to pose health risks. companies In the market are responding to these concerns by investing in research and development (R&D) to create innovative products that cater to various consumer preferences. These include foaming hand sanitizers and spray hand sanitizers, available in alcohol-based and non-alcohol based options. Customers seek hand sanitizers that offer multiple benefits, including effectiveness against germs, ease of use, and skin-friendly ingredients. companies are meeting these demands by incorporating beneficial ingredients such as Aloe Vera, Tea tree oil, and glycerin into their formulations.

- Additionally, they are focusing on sustainability by using biodegradable ingredients and renewable resources. Hand sanitizers are widely available at hypermarkets/supermarkets and pharmacy stores. With the increasing internet penetration and growth of the e-commerce industry, these products are also easily accessible on various e-commerce platforms. companies are leveraging television and internet marketing to reach a broader audience and promote their brands. The market is dynamic, with companies constantly innovating their product offerings to meet evolving consumer needs. Ethyl alcohol and isopropyl alcohol are commonly used as disinfectants, but companies are also exploring alternative disinfectant solutions for those with sensitive skin or allergies.

- Personal cleanliness and hygiene remain top priorities for individuals and organizations, particularly in sectors such as healthcare, education, hospitality, and corporate sector. Hand sanitizers are used not only for personal use but also for household purposes and in commercial settings such as shopping plazas, military bases, and schools and colleges. Hand sanitizers are available in various forms, including foams, gels, liquids, and sprays. companies are also offering scented beauty and personal care products, organic cosmetics, and cleansing accessories to cater to diverse consumer preferences. The market is expected to continue growing, driven by increasing awareness of the importance of personal hygiene.

What are the market trends shaping the Hand Sanitizer Industry?

Increased demand for customized product is the upcoming market trend.

- The market is witnessing an increasing demand for customized and personalized products, particularly among commercial and institutional end-users. In developed regions such as the Americas and Europe, this trend has gained significant traction over the last five years. Customers are seeking unique branding solutions, including engraving company logos and names on the products. Emerging economies like India and China are also exhibiting a high demand for customized office supplies, including hand sanitizers and dispensers. Leading companies In the market are catering to this trend by offering customized and personalized products to enhance their offerings' aesthetic appeal. These products come in various forms, such as foams, gels, liquids, and sprays, and may include beneficial ingredients like Aloe Vera, Tea tree oil, and glycerin.

- The market for hand sanitizers is driven by the growing awareness of disease-causing germs, viruses such as Norovirus, Influenza, and Meningitis, and the importance of personal cleanliness and hygiene. The market is also influenced by the e-commerce industry's growth and the increasing penetration of the internet. companies are sourcing raw materials and securing packaging materials sustainably, using biodegradable ingredients and renewable resources, and adhering to organic personal care standards. The market serves various sectors, including schools and colleges, hospitals, hotels and restaurants, residential facilities, specialty stores, and the corporate sector. It is also used in non-communicable diseases prevention and as disinfectants and cleansing accessories in various household and commercial purposes.

What challenges does the Hand Sanitizer Industry face during its growth?

Presence of counterfeit products is a key challenge affecting the industry growth.

- Hand Sanitizers have gained significant importance In the realm of skin care and hygiene, serving as essential disinfectant solutions against disease-causing germs, viruses such as Norovirus, Influenza, and Meningitis. The market for hand sanitizers encompasses various forms, including foaming hand sanitizers and spray hand sanitizers, available in alcohol based and non-alcohol based options. Manufacturers source raw materials and secure packaging materials sustainably, using biodegradable ingredients and renewable resources, aligning with organic personal care trends.

- Hypermarkets/supermarkets and Pharmacy stores remain primary sales channels, while e-commerce platforms are expanding their reach. However, the rise of counterfeit hand sanitizers poses a challenge. These products, often made of low-quality raw materials, can have detrimental effects. Government authorities worldwide seize counterfeit hand sanitizers regularly. The relatively low price of counterfeit products contributes to their demand. Ensuring personal cleanliness and hygiene, hand sanitizers are integral to various sectors, including schools and colleges, hospitals, hotels and restaurants, residential facilities, specialty stores, and the military and corporate sector. Hand sanitizers are not only used for personal care but also for household purposes and in shopping plazas.

- The market is a significant contributor to the e-commerce industry and the internet penetration, with television and internet marketing playing a crucial role in its growth.

Exclusive Customer Landscape

The hand sanitizer market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hand sanitizer market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hand sanitizer market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3M Co.

- Arbro Pharmaceuticals Pvt. Ltd.

- Arrow Solutions

- Dow Chemical Co.

- Earth Mama Angel Baby LLC

- EO Products

- Godrej Consumer Products Ltd.

- GOJO Industries Inc.

- ITC Ltd.

- Kiilto Family Group

- Neogen Corp.

- Petra Co.

- Reckitt Benckiser Group Plc

- S.C. Johnson and Son Inc.

- Skinvisible Pharmaceuticals Inc.

- The Clorox Co.

- The Procter and Gamble Co.

- TOUCHLAND LLC

- Unilever PLC

- Vi Jon LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hand sanitizers have become an essential component of daily life In the modern world, as the importance of maintaining personal hygiene and preventing the spread of disease-causing germs, viruses, and bacteria has come to the forefront of global health consciousness. These disinfectant solutions come in various forms, including foams, gels, and liquids, catering to diverse consumer preferences. The market encompasses a wide range of beneficial ingredients, such as aloe vera and tea tree oil, which not only ensure effective disinfection but also provide additional skin care benefits. These ingredients offer a gentler alternative to alcohol-based sanitizers, which can be harsh on the skin.

Hand sanitizers are available in various formats, including foaming and spray types. Alcohol-based hand sanitizers contain ethanol or isopropyl alcohol as the primary active ingredient, while non-alcohol based sanitizers rely on glycerin, propylene glycol, or water as their disinfectant agents. Both types of hand sanitizers are effective in eliminating norovirus, influenza, meningitis, and other common illnesses. The market is a dynamic and growing industry, with a diverse range of consumers and distribution channels. Hypermarkets and supermarkets, pharmacy stores, and e-commerce platforms are among the primary sales channels for hand sanitizers. Television and internet marketing have also played a significant role in increasing awareness and demand for these products.

Manufacturers of hand sanitizers source raw materials from various suppliers and secure packaging materials to ensure the highest quality and sustainability. Biodegradable ingredients and renewable resources are increasingly being used to cater to the growing demand for eco-friendly and organic personal care products. The market is influenced by several factors, including hygiene and cleanliness trends, health associations' recommendations, and infrastructural facilities in various sectors. Schools and colleges, hospitals, hotels and restaurants, residential facilities, specialty stores, and the military and corporate sector are among the primary consumers of hand sanitizers. Hand sanitizers are not limited to personal use but also have household and commercial applications. They are used in restaurants, shopping plazas, and other public places to maintain cleanliness and prevent the spread of illnesses. The market is expected to continue growing, driven by increasing awareness of personal hygiene, the e-commerce industry's growth, and the ongoing demand for sustainable and eco-friendly products. The market's future looks promising, with opportunities for innovation and growth in various sectors.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

190 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.31% |

|

Market growth 2024-2028 |

USD 1660.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.17 |

|

Key countries |

US, China, Germany, Japan, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hand Sanitizer Market Research and Growth Report?

- CAGR of the Hand Sanitizer industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hand sanitizer market growth of industry companies

We can help! Our analysts can customize this hand sanitizer market research report to meet your requirements.