Ethyl Alcohol Market Size 2024-2028

The ethyl alcohol market size is forecast to increase by USD 16.94 billion, at a CAGR of 5.28% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. One of the primary drivers is the high availability of feedstock, which includes grains such as corn, wheat, and sugarcane. This abundant supply enables the production of ethyl alcohol on a large scale. Another trend influencing the market is the reduction in arable land, leading to an increase In the efficiency of alcohol production processes. Additionally, the rising demand for electric vehicles is boosting the market, as ethyl alcohol is used as a key component In their production. These factors, among others, are shaping the growth trajectory of the market.

What will be the Size of the Ethyl Alcohol Market During the Forecast Period?

- The market encompasses various applications, including alcoholic beverages and industrial uses. In the alcoholic beverages sector, beer production and alcohol-based hand sanitizers are significant contributors. The grain-based and denatured alcohol segments dominate the market, with the former primarily used in beverage production and the latter in various industrial applications. The aviation industry is a major consumer of ethyl alcohol as a fuel additive, reducing carbon emissions. The coronavirus disease outbreak has surged demand for alcohol-based hand sanitizers, leading to market growth.

- Ethyl alcohol is also used as a biofuel, such as bioethanol, and an industrial solvent in chemicals and transportation sectors. The shift from fossil fuels like crude oil and natural gas to renewable fuels, including ethyl alcohol and methyl t-butyl ether, is a notable trend. The Renewable Fuels Association reports that bio-ethanol production from corn grain and distiller grains has increased significantly. Ethyl alcohol's versatility as a biobased fuel and industrial solvent continues to drive market growth.

How is this Ethyl Alcohol Industry segmented and which is the largest segment?

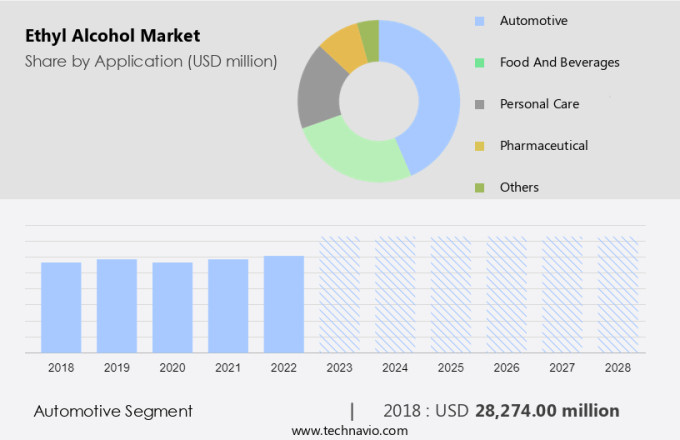

The ethyl alcohol industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Automotive

- Food and beverages

- Personal care

- Pharmaceutical

- Others

- Geography

- North America

- Canada

- US

- South America

- Brazil

- Europe

- Germany

- APAC

- China

- Middle East and Africa

- North America

By Application Insights

- The automotive segment is estimated to witness significant growth during the forecast period.

Ethyl alcohol, a type of alcohol, holds significant importance in various industries, primarily In the automotive sector. In 2023, this segment accounted for a substantial share of the market. Ethyl alcohol is utilized as a fuel additive in gasoline engines due to its high-octane number. Its use in vehicles contributes to reduced carbon emissions and enhanced fuel efficiency. The automotive industry's growth, driven by increasing vehicle production in countries like India, China, Germany, South Korea, and Japan, will fuel ethyl alcohol demand. Additionally, ethyl alcohol finds applications in industrial solvents, biofuels, beverages, personal care, disinfectants, and aviation industries. Ethyl alcohol's versatility and environmental benefits make it a preferred choice in numerous sectors.

Get a glance at the Ethyl Alcohol Industry report of share of various segments Request Free Sample

The automotive segment was valued at USD 28.27 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 44% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Ethyl alcohol, a type of grain-based or sugar-derived alcohol, holds a significant market share in various industries, including food and beverages, pharmaceuticals, industrial solvents, and biofuels. In the North American market, ethyl alcohol is extensively used as a fuel additive In the automotive sector, a solvent in industrial applications, and a key ingredient in beverage production. The food and beverage industry utilizes ethyl alcohol as a food additive to distribute coloring evenly and enhance food extract flavors. In the pharmaceutical sector, ethyl alcohol is employed in medical wipes as a disinfectant, denaturing proteins and dissolving lipids to kill bacteria, viruses, and fungi.

The aviation industry also relies on ethyl alcohol as a fuel component, reducing carbon emissions and contributing to the reduction of fossil fuel usage. Ethyl alcohol is also a crucial raw material In the production of biofuels, such as bioethanol, and is used as a solvent in various industrial processes and chemicals. The increasing demand for ethyl alcohol In these sectors, particularly In the context of the Coronavirus disease pandemic and the subsequent rise in demand for alcohol-based hand sanitizers, is expected to drive market growth.

Market Dynamics

Our ethyl alcohol market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of the Ethyl Alcohol Industry?

High availability of feedstock is the key driver of the market.

- Ethyl alcohol, a type of alcohol, is gaining prominence in various industries due to the increasing focus on reducing carbon emissions and the depletion of fossil fuel reserves. The market is driven by its applications in sectors such as automotive, food and beverages, pharmaceuticals, and personal care. In the automotive industry, ethyl alcohol is used as a biofuel, particularly in ethanol-blended fuels. In the food and beverages sector, it is used In the production of alcoholic beverages, such as beer and distilled spirits, as well as in food processing. Ethyl alcohol is also used as a disinfectant in personal care products, including hand sanitizers, due to its ability to kill bacteria, viruses, and fungi.

- The grain-based segment dominates the market due to the large availability of feedstock, particularly corn. However, the denatured alcohol segment is also gaining popularity due to its use as a solvent and industrial chemical. The aviation industry is another significant consumer of ethyl alcohol, as it is used as a fuel and as a denaturant in aviation fuel. The Coronavirus disease (COVID-19) pandemic has led to an increased demand for ethyl alcohol In the production of hand sanitizers. The renewable fuels industry, particularly bioethanol, is also a significant consumer of ethyl alcohol. Ethyl alcohol is produced through the fermentation of raw materials such as grains, sugar and molasses, and is used as a solvent, fuel, and industrial chemical.

- The market is subject to stringent regulations due to its use as a fuel and as a component of food and pharmaceutical products. Companies focusing on Renewable Energy are major producers of ethyl alcohol from grain-based sources. The Midwest region of the US is a significant producer of ethyl alcohol due to its large corn production capacity. Ethyl alcohol is used as a solvent in various industries, including automotive, paints and coatings, and chemicals.

What are the market trends shaping the Ethyl Alcohol Industry?

Reduction in arable land is the upcoming market trend.

- Ethyl alcohol, a type of alcohol, plays a significant role in various industries, including alcoholic beverages and industrial applications. In the alcoholic beverages sector, ethanol is used for producing beer, wines, and distilled spirits. Meanwhile, In the industrial sector, ethyl alcohol serves as a primary raw material for producing alcohol-based hand sanitizers, solvents, and biofuels. The grain-based segment dominates the market due to the abundant availability of raw materials like corn, sugar, and molasses. However, the denatured alcohol segment is expected to witness substantial growth due to its application as a solvent and industrial fuel. The aviation industry is a significant consumer of ethyl alcohol as a fuel, but its carbon emissions contribute to environmental concerns.

- The coronavirus disease has led to a rise in demand for ethyl alcohol In the production of hand sanitizers, disinfectants, and personal care products. Bacteria, viruses, and fungi are common contaminants that ethyl alcohol effectively eliminates, making it an essential ingredient in various applications. The market is subject to stringent regulations due to its widespread use in food processing, automotive sectors, and biofuels. Major ethyl alcohol producers include Braskem and Aventine Renewable Energy, which rely on grain-based and sugar and molasses-based sources to produce denatured and undenatured ethanol. The Renewable Fuels Association reports that ethanol production capacity In the Midwest, primarily from corn, is expected to increase, with companies like Poet Biorefining leading the way.

What challenges does the Ethyl Alcohol Industry face during its growth?

Increasing demand for electric vehicles is a key challenge affecting the industry growth.

- Ethyl alcohol, also known as ethanol, is a grain-based or sugar and molasses-based alcohol used primarily In the production of alcoholic beverages, biofuels, industrial solvents, and disinfectants. The alcoholic beverages segment includes beer production and distilled spirits such as wine and whiskey. In response to the Coronavirus disease pandemic, the demand for ethanol-based hand sanitizers has surged, leading to increased production In the denatured alcohol segment. The aviation industry is another significant consumer of ethyl alcohol as a fuel additive and as a solvent in aircraft de-icing fluids. However, the shift towards renewable fuels, such as bioethanol, and the increasing focus on reducing carbon emissions are expected to impact the demand for ethyl alcohol derived from fossil fuels like crude oil and natural gas.

- The grain-based segment dominates the market due to its widespread use In the production of alcoholic beverages and biofuels. The denatured ethanol segment is expected to grow at a significant rate due to its increasing use as a solvent in industrial applications and as a disinfectant in personal care products. Stringent regulations regarding the production and use of ethyl alcohol, particularly In the food processing industry, ensure a high level of quality and safety. Ethyl alcohol is also used as a fuel in ethanol-blended fuels and as a biofuel In the transportation sector. It is also used In the production of chemicals, paints and coatings, and other industrial applications.

Exclusive Customer Landscape

The ethyl alcohol market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the ethyl alcohol market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, ethyl alcohol market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ALTO INGREDIENTS Inc.

- Archer Daniels Midland Co.

- BP Plc

- Cargill Inc.

- CropEnergies AG

- GranBio Investimentos SA

- INEOS AG

- JEPSON COMMODITIES

- Jubilant Ingrevia Ltd.

- Kanoria Chemicals and Industries Ltd.

- LyondellBasell Industries N.V.

- Merck KGaA

- Mitsubishi Chemical Group Corp.

- POET LLC

- Sasol Ltd.

- The Andersons Inc.

- Thermo Fisher Scientific Inc.

- Valero Energy Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Ethyl alcohol, also known as ethanol, is a vital component of various industries, including alcoholic beverages and industrial applications. This colorless, volatile, flammable liquid is primarily produced from fermented sugars or synthesized from other sources. The alcoholic beverages sector is a significant consumer of ethyl alcohol. In this context, ethanol serves as the primary alcohol used In the production of beer, wine, and distilled spirits. The beverage industry's demand for ethyl alcohol is driven by consumer preferences and cultural traditions. Beyond beverages, ethyl alcohol finds extensive use in industrial applications. In the aviation industry, it is employed as a fuel additive to increase octane and reduce carbon emissions.

Also, ethyl alcohol functions as a solvent and a disinfectant in various industries, including food processing and personal care. The denatured alcohol segment of the market is gaining traction due to its application in industrial processes. Denatured alcohol is ethanol that has been denatured or made unfit for human consumption by the addition of denaturants. This segment's growth can be attributed to the increasing demand for denatured alcohol In the automotive sectors and as a raw material for producing biofuels. Grain-based ethyl alcohol is another essential segment of the market. This category includes ethanol produced from grains such as corn, wheat, and sugarcane.

Further, the grain-based segment's growth is driven by the availability of abundant raw materials and the increasing demand for biofuels. The market is influenced by several factors, including stringent regulations, the availability of raw materials, and market dynamics.

|

Ethyl Alcohol Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

171 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.28% |

|

Market Growth 2024-2028 |

USD 16.94 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.92 |

|

Key countries |

US, Brazil, Germany, Canada, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ethyl Alcohol Market Research and Growth Report?

- CAGR of the Ethyl Alcohol industry during the forecast period

- Detailed information on factors that will drive the Ethyl Alcohol Market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, South America, Europe, APAC, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ethyl alcohol market growth of industry companies

We can help! Our analysts can customize this ethyl alcohol market research report to meet your requirements.