Healthcare Business Collaboration Tools Market Size 2025-2029

The healthcare business collaboration tools market size is forecast to increase by USD 59.76 billion at a CAGR of 23.3% between 2024 and 2029.

- The digital health market is witnessing significant growth due to the integration of advanced technologies such as artificial intelligence (AI) and telemedicine into healthcare collaboration tools. Digital transformation is catalyzing the adoption of software solutions for aged care, predictive analytics, and remote patient monitoring. Cloud computing and blockchain are enabling secure data sharing and medical information access. The market is experiencing an increase in demand for healthcare analytics, team collaboration software, medical device connectivity, and video conferencing for healthcare services. Key drivers of the market include the increased investment in digital health and the integration of AI to enhance automation and education in healthcare.

What will be the Size of the Healthcare Business Collaboration Tools Market During the Forecast Period?

- The market is experiencing significant growth as the demand for patient-centered care technology and digital solutions continues to rise. Remote patient support, secure communication platforms, and cloud-based healthcare solutions are increasingly being adopted to enhance healthcare delivery and improve patient engagement. Artificial intelligence (AI) and healthcare data security are key focus areas, enabling healthcare innovation through advanced analytics, medical device cybersecurity, and healthcare interoperability solutions. Healthcare crisis communication and workflow automation are also crucial for effective virtual care coordination and remote care management. The market is witnessing a digital health transformation, with virtual healthcare collaboration and telehealth platforms becoming integral components of integrated healthcare systems.

- Virtual care delivery, healthcare regulatory compliance, medical data analytics, and medical device connectivity are other significant trends shaping the market. Overall, the healthcare collaboration tools market is poised for continued growth, driven by the need for efficient, secure, and patient-centric healthcare solutions.

How is this Healthcare Business Collaboration Tools Industry segmented and which is the largest segment?

The healthcare business collaboration tools industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Large facilities

- Small and medium facilities

- Type

- Communication and coordination software

- Conferencing software

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Spain

- APAC

- China

- Japan

- South Korea

- Middle East and Africa

- South America

- Brazil

- North America

By End-user Insights

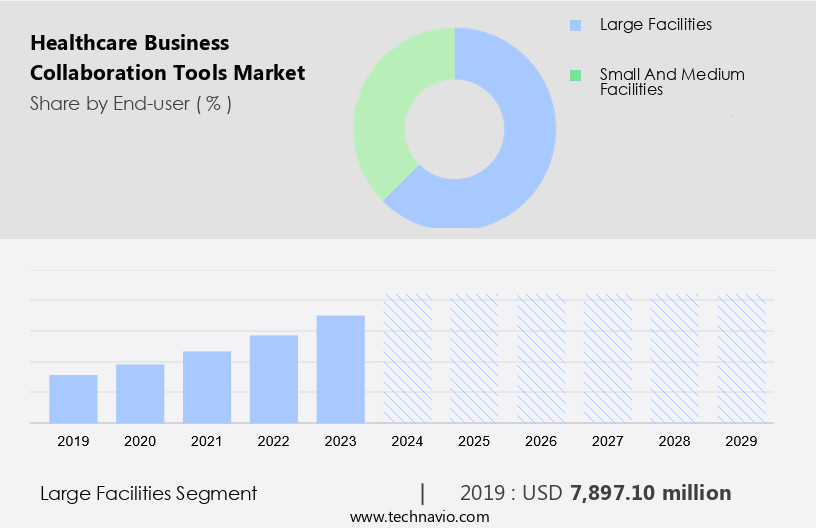

- The large facilities segment is estimated to witness significant growth during the forecast period.

The market is witnessing significant growth, particularly in large healthcare organizations such as hospitals and extensive healthcare networks. These entities are increasingly adopting advanced collaboration tools to enhance operational efficiency and improve patient care services. For instance, in October 2023, Teladoc Health and Sword Health formed a partnership to offer large healthcare facilities a comprehensive pain treatment platform. This platform integrates digital physical therapy and pelvic health care, providing a holistic approach to pain management. This collaboration signifies the growing trend of incorporating digital health solutions into large healthcare settings, enabling facilities to deliver specialized, accessible, and effective care. Team collaboration software, telemedicine services, real-time communication channels, and artificial intelligence are essential components of these advanced tools.

Get a glance at the market report of share of various segments Request Free Sample

The large facilities segment was valued at USD 7.9 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 35% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market is witnessing substantial expansion, with North America leading the growth. This trend is fueled by substantial investments in digital health and the adoption of advanced technologies in various healthcare sectors. For instance, in May 2024, the Digital Health Cooperative Research Centre (DHCRC), a US government entity, announced significant funding for digital health initiatives, including aged care, virtual health, medical research, and artificial intelligence (AI). The Federal Budget also unveiled several flagship initiatives to support these efforts, such as an additional USD1 billion investment in telehealth and remote patient care. Team collaboration software, telemedicine services, real-time communication channels, and AI are transforming routine care delivery, patient experiences, and intra-organizational communication.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Healthcare Business Collaboration Tools Industry?

Increased investment in digital health is the key driver of the market.

- The market is experiencing substantial growth due to increased investments in digital health initiatives by governments and organizations. These tools facilitate team collaboration among healthcare professionals, enabling efficient communication and information sharing during healthcare crisis management, routine care delivery, and remote patient care. Telemedicine services, real-time communication channels, and conferencing software are essential components of these digital collaboration solutions. Artificial intelligence, automation, and data-sharing capabilities are transforming value-based care models by improving patient experiences and outcomes. Remote medical consultations and virtual patient care are becoming increasingly popular, especially In the context of healthcare regulations and secure data sharing.

- Cloud-based collaboration tools and message translation services ensure seamless communication between healthcare systems, medical communications, biotech, pharma, and other stakeholders. The market is driven by the need for secure, HIPAA-compliant platforms that support intra-organizational communication, online patient visits, and medical device integration. Real-time communication platforms are crucial for effective collaboration and coordination among healthcare teams, ensuring optimal patient care. The digitization and automation of healthcare processes are enhancing the overall efficiency and effectiveness of healthcare services. In summary, the market is witnessing significant growth due to the increasing adoption of digital health technologies, the need for efficient communication and coordination among healthcare professionals, and the transformation of value-based care models.

What are the market trends shaping the Healthcare Business Collaboration Tools Industry?

Integration of AI in collaboration tools is the upcoming market trend.

- The market is witnessing significant growth due to the integration of artificial intelligence (AI) and advanced features that enhance productivity and efficiency for healthcare professionals. AI-driven tools offer real-time communication channels, data-sharing capabilities, and automation, enabling seamless collaboration for routine care delivery, telemedicine services, and remote patient care. Real-time communication platforms facilitate instant messaging, video conferencing, and conferencing software for virtual patient consultations and intra-organizational communication. AI capabilities include sentiment analysis, predictive analytics, and language translation, fostering effective communication and collaboration among diverse teams and departments. Moreover, AI-powered collaboration tools can analyze user behavior and provide personalized recommendations, streamlining workflows and improving overall efficiency.

- For instance, automated meeting scheduling can save time by coordinating calendars and setting up meetings without manual intervention. These tools also ensure secure data sharing and compliance with healthcare regulations, such as HIPAA, making them essential for organizations In the healthcare industry. In summary, the market is transforming the way healthcare professionals communicate and collaborate, enabling better patient experiences, improved care delivery, and increased operational efficiency. AI-driven collaboration tools offer advanced features, such as real-time communication channels, data-sharing capabilities, automation, and sentiment analysis, making them an essential investment for healthcare systems, pharma companies, biotech firms, and medical communications organizations.

What challenges does the Healthcare Business Collaboration Tools Industry face during its growth?

High initial cost is a key challenge affecting the industry growth.

- The market encompasses software solutions that facilitate real-time communication and data sharing among patients, healthcare professionals, and organizations. These tools are essential for crisis management, telemedicine services, and routine care delivery In the context of value-based care models. Team collaboration software, conferencing software, and cloud-based collaboration tools are popular choices. Artificial intelligence and automation enhance these platforms, enabling virtual patient care, remote medical consultations, and secure data-sharing capabilities. Compliance with healthcare regulations, such as HIPAA, is crucial. SaaS models offer flexibility and affordability, while on-premises solutions provide more control and security. The market dynamics are influenced by the digitization and automation of healthcare systems, medical communications, and the increasing demand for remote patient care.

- Pharma, biotech, and healthcare professionals rely on these tools for intra-organizational communication, online patient visits, and message translation. The market is continually evolving to meet the demands of the digital health landscape.

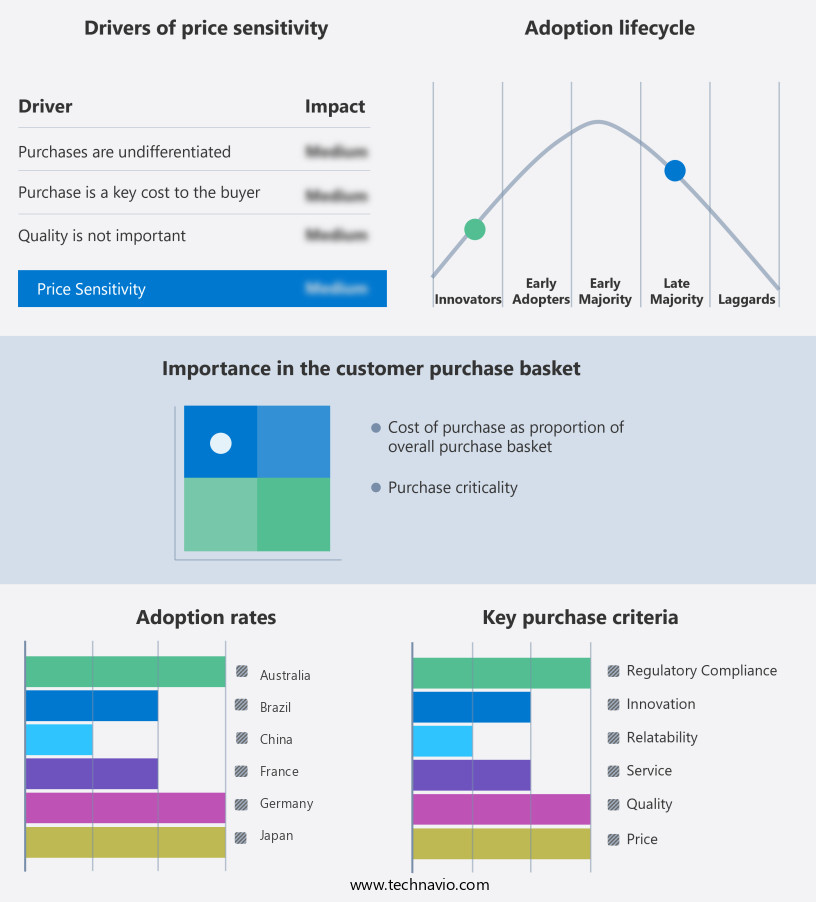

Exclusive Customer Landscape

The healthcare business collaboration tools market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the healthcare business collaboration tools market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, healthcare business collaboration tools market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alphabet Inc.

- American Well Corp.

- athenahealth Inc.

- Cisco Systems Inc.

- Doximity Inc

- eClinicalWorks LLC

- Epic Systems Corp.

- Health Catalyst Inc.

- Infor Inc.

- International Business Machines Corp.

- InterSystems Corp.

- MDLIVE Inc.

- Medical Information Technology Inc.

- Microsoft Corp

- NextGen Healthcare Inc.

- Oracle Corp

- Practice Fusion Inc.

- Teladoc Health Inc.

- Veeva Systems Inc.

- Zoom Video Communications Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The healthcare industry is undergoing a significant transformation as a result of the increasing demand for efficient and effective care delivery. One area of focus is the implementation of collaboration tools to enhance communication and coordination among healthcare professionals and between patients and providers. These tools have become increasingly important In the context of telemedicine services, remote patient care, and value-based care models. Team collaboration software plays a crucial role in facilitating real-time communication channels among healthcare organizations. These platforms enable seamless information sharing, enabling healthcare professionals to work together more effectively and efficiently. Telemedicine services, in particular, have benefited greatly from these solutions, allowing for remote medical consultations and online patient visits.

In addition, the integration of artificial intelligence (AI) into healthcare collaboration platforms is another trend that is gaining traction. AI-powered tools can help automate routine care delivery, freeing up healthcare professionals' time for more complex tasks. Additionally, AI can be used to enhance patient experiences by providing personalized care recommendations and message translation services. Healthcare regulations, such as HIPAA, have played a significant role in shaping the development of healthcare collaboration tools. These regulations require that all data be securely shared and protected, making it essential for collaboration platforms to have strong data-sharing capabilities and be HIPAA-compliant. Cloud-based collaboration tools have become increasingly popular due to their flexibility and scalability.

Furthermore, these solutions allow for easy access to information from anywhere, making them ideal for remote patient care and virtual patient consultations. Conferencing software is another essential component of healthcare collaboration platforms, enabling organizations to conduct virtual meetings and discussions. The digitization and automation of healthcare communications are also driving the adoption of digital collaboration solutions. These tools can help streamline processes, reduce administrative burdens, and improve overall patient care. Biotech and pharma companies are also leveraging these solutions to enhance medical communications and improve the development and delivery of new treatments. Intra-organizational communication is another area where collaboration tools have had a significant impact.

Moreover, these tools enable healthcare systems to improve internal communication and coordination, leading to better patient outcomes and increased operational efficiency. Remote medical consultations have become increasingly common, and collaboration tools have been instrumental in enabling these consultations to take place effectively. Virtual patient care is another area where these solutions have proven to be effective, allowing patients to receive care from the comfort of their own homes. These tools are enabling more efficient and effective care delivery, particularly In the context of telemedicine services, remote patient care, and value-based care models. The integration of AI, cloud-based solutions, and digital health technologies is driving innovation in this space, and regulations such as HIPAA continue to shape the development of these solutions.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 23.3% |

|

Market growth 2025-2029 |

USD 5.98 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

22.8 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, South Korea, Australia, and Brazil |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Healthcare Business Collaboration Tools Market Research and Growth Report?

- CAGR of the Healthcare Business Collaboration Tools industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the healthcare business collaboration tools market growth of industry companies

We can help! Our analysts can customize this healthcare business collaboration tools market research report to meet your requirements.