Heart Transplantation Therapeutics Market Size 2025-2029

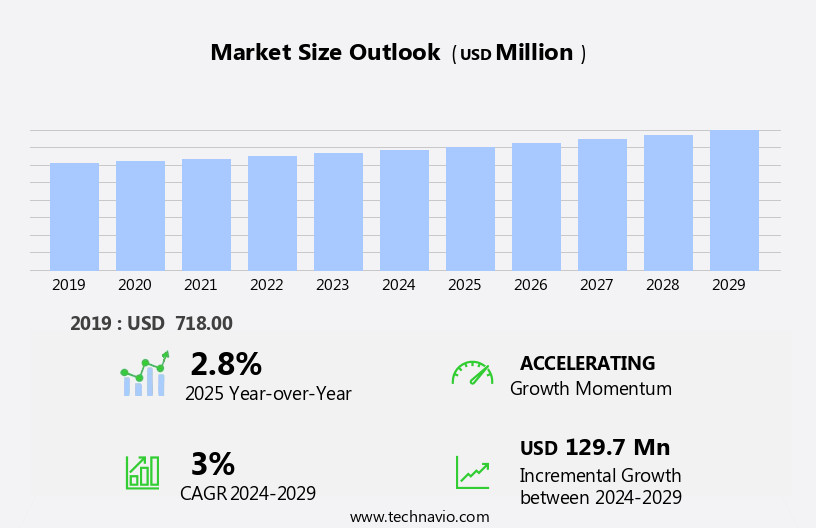

The heart transplantation therapeutics market size is forecast to increase by USD 129.7 million, at a CAGR of 3% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of ventricular assist devices and cardiovascular diseases, as well as heart failures. The need for organ preservation techniques during transplantation procedures is also driving market expansion. Moreover, the advancement of precision medicine and regenerative medicine is expected to revolutionize the heart transplantation landscape. However, the use of immunosuppressants for preventing organ rejection poses challenges due to their adverse effects, including increased risk of infections and cancer. The market is further influenced by international collaborations for heart transplantation research and development. Blood compatibility issues and ethical concerns are other factors shaping the market dynamics.

What will be the Size of the Heart Transplantation Therapeutics Market During the Forecast Period?

- The market is specifically focused on heart transplantation therapeutics, is experiencing significant growth due to the increasing prevalence of cardiovascular disease and the ageing population. According to recent statistics, cardiovascular disease is the leading cause of mortality worldwide, with an estimated 17.9 million heart surgeries performed annually. The geriatric population, in particular, is a key driver of this market, as they are more susceptible to heart-related conditions. Heart transplantation remains a viable option for end-stage cardiac patients, with both orthotopic and heterotopic transplantation techniques being utilized. Heart transplant devices, such as heart-lung machines and implantable cardioverter-defibrillators, are essential components of these procedures.

- Post-transplant care involves the use of immunosuppressants, anti-infectives, and analgesics to manage complications and ensure graft survival. Organ preservation techniques and advances in immunosuppressive therapies have improved transplant outcomes, leading to a growing number of successful procedures. Additionally, regenerative medicine approaches, including arrhythmia treatment and aneurysm repair, are emerging as potential alternatives to transplantation. The market for heart transplant therapeutics includes sales through hospitals, cardiac centers, hospital pharmacies, retail pharmacies, and online pharmacies.

How is this Heart Transplantation Therapeutics Industry segmented and which is the largest segment?

The heart transplantation therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Drug Class

- Immunosuppressants

- Anti-infectives

- Analgesics

- Others

- Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

- Type

- Left ventricular assist device (LVAD)

- Heart transplantation

- Implantable cardiac defibrillator (ICD)

- Extracorporeal membrane oxygenation (ECMO)

- Indication

- Ischemic heart disease (IHD)

- Dilated cardiomyopathy (DCM)

- Valvular heart disease (VHD)

- Hypertrophic cardiomyopathy (HCM)

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- France

- Italy

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Drug Class Insights

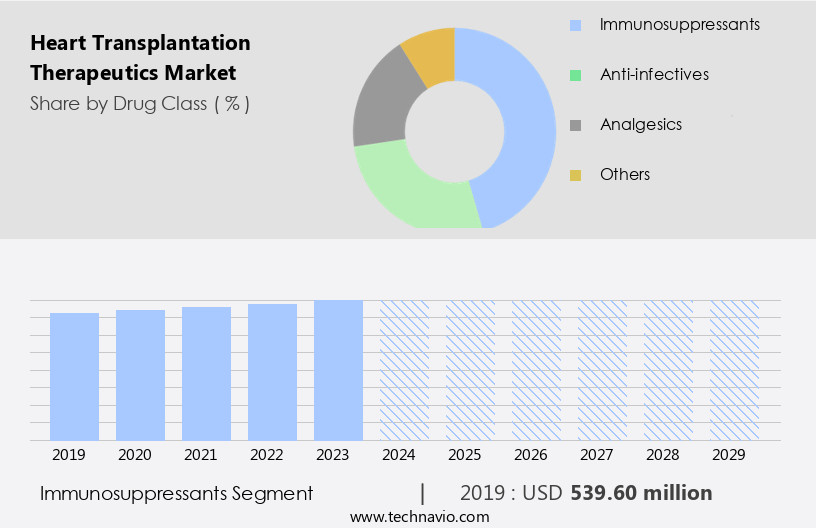

- The immunosuppressants segment is estimated to witness significant growth during the forecast period.

Immunosuppressants play a crucial role in organ transplantation procedures, particularly for non-identical donor-recipient matches. These drugs, including immunosuppressive medications and environmental toxins, prevent the recipient's immune system from rejecting the transplanted organ. Upon transplantation, the new organ is perceived as a foreign agent by the body's defense system, triggering an immune response aimed at damaging or destroying it. Immunosuppressants mitigate this response, enabling the new organ to integrate successfully. The geriatric population, afflicted by cardiovascular diseases such as heart failure, arrhythmias, aneurysms, and cardiomyopathy, often undergo heart transplantation procedures.

Hospitals, cardiac centers, and transplant institutes employ immunosuppressants, immunosuppressive therapies, regenerative medicine approaches, and organ preservation techniques to improve graft survival and enhance the quality of life for transplant recipients. Immunosuppressive drug regimens, antimicrobials, analgesics, and hospital and retail pharmacies are essential components of post-transplant care. Infectious complications, graft vasculopathy, and immunological challenges are ongoing concerns for transplant recipients, necessitating continuous research and innovation In the field.

Get a glance at the Heart Transplantation Therapeutics Industry report of share of various segments Request Free Sample

The immunosuppressants segment was valued at USD 539.60 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

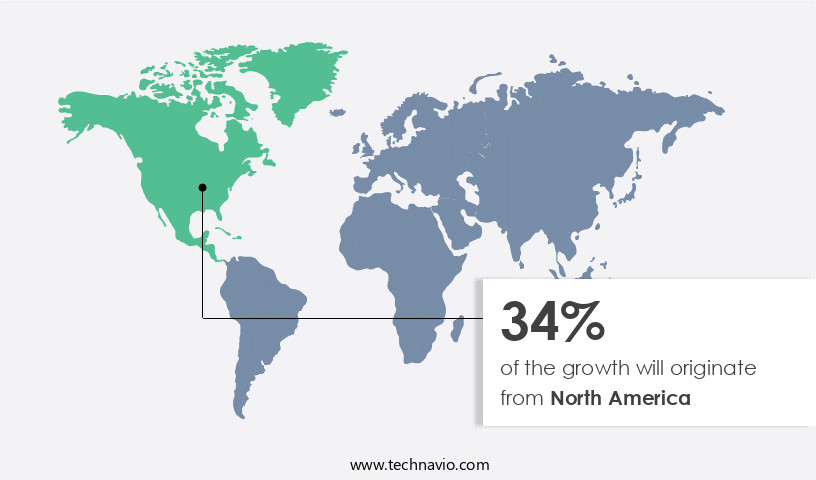

- North America is estimated to contribute 34% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is significantly driven by the increasing geriatric population and the rising prevalence of cardiovascular diseases, leading to an increase in heart transplant surgeries in North America. The US, with its advanced healthcare infrastructure and a high number of heart transplant procedures, dominates the market in this region. Immunosuppressants are the primary therapeutics in demand for heart transplant patients to prevent organ rejection. Cardiovascular diseases, such as arrhythmia, aneurysm, cardiomyopathy, and congenital cardiac abnormalities, contribute to the need for heart transplantation. Heart failure, poor exercise tolerance, coughing, shortness of breath, exhaustion, fluid retention, and cardiac instability are common symptoms leading to heart transplantation.

In addition, the market encompasses various devices, including artificial hearts, ventricular assist devices, and organ preservation techniques, as well as immunosuppressive therapies, regenerative medicine approaches, and precision medicine strategies. Immunosuppressive drug regimens and infectious complications are significant challenges in heart transplantation. Transplant surgeons, immunologists, and biomedical engineers play crucial roles In the transplantation process. Key players in the market include leading cardiac centers, hospitals, and pharmacies, including retail and online channels.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Heart Transplantation Therapeutics Industry?

The rising prevalence of cardiovascular diseases and heart failures is the key driver of the market.

- Cardiovascular diseases, which include various conditions affecting the heart and blood vessels, are a significant global health concern. The prevalence of these diseases has been on the rise due to several factors, including poor dietary habits leading to increased cholesterol and obesity, family history, use of chemotherapy drugs and radiation therapy for cancer, and physical inactivity. According to the World Health Organization, cardiovascular diseases are the leading cause of death worldwide, accounting for approximately 17.9 million deaths each year. The increasing prevalence of cardiovascular diseases has led to an increase In the number of heart transplant surgeries. Cardiothoracic organ transplantation, specifically orthotopic and heterotopic heart transplantation, is a viable treatment option for cardiovascular disease patients, particularly those suffering from heart failure, arrhythmia, aneurysm, or congenital cardiac abnormalities.

- Donor live hearts, artificial hearts, and ventricular assist devices are some of the heart transplant devices used in these procedures. Hospitals and cardiac centers are the primary providers of heart transplant surgeries. Immunosuppressants, anti-infectives, and analgesics are essential medications used during and after the surgery to prevent graft rejection and manage complications such as coughing, shortness of breath, exhaustion, and fluid retention. Organ preservation techniques and immunosuppressive therapies are critical in ensuring graft survival and minimizing transplant recipients' risk of infectious complications. Advancements in regenerative medicine approaches, including cell-based therapies and tissue engineering strategies, are promising alternatives to traditional heart transplantation.

What are the market trends shaping the Heart Transplantation Therapeutics Industry?

Growing international collaborations for heart transplantation is the upcoming market trend.

- The market is driven by the increasing number of cardiovascular disease patients, particularly In the geriatric population. According to the American Heart Association, over 650,000 Americans aged 65 and older live with heart failure, a common indication for heart transplantation. The market includes various procedures such as orthotopic and heterotopic heart transplantation, use of donor live hearts, artificial hearts, and ventricular assist devices. Cardiovascular diseases like arrhythmia, aneurysm, cardiomyopathy, congenital cardiac abnormalities, and coronary artery disease lead to poor exercise tolerance, coughing, shortness of breath, exhaustion, fluid retention, and other symptoms. Heart transplantation is a life-saving solution for these patients.

- However, the process involves complex surgeries in cardiothoracic organ transplantation centers and hospitals. Immunosuppressants, anti-infectives, analgesics, and other medications are essential for managing complications and ensuring graft survival. Hospital pharmacies, retail pharmacies, and online pharmacies play a crucial role in providing these medications to transplant recipients. Organ preservation techniques and immunosuppressive therapies are essential to maintain the health of the transplanted heart and prevent graft vasculopathy. Advancements in regenerative medicine approaches, including cell-based therapies and tissue engineering strategies, offer promising solutions for the future. Precision medicine approaches and genetic compatibility testing, such as immune profiling, are essential for successful transplantation.

What challenges does the Heart Transplantation Therapeutics Industry face during its growth?

Adverse effects of immunosuppressants is a key challenge affecting the industry growth.

- The market encompasses various immunosuppressants utilized for the prevention and management of symptoms related to heart transplantation. Immunosuppressants are essential drugs that suppress the immune system's response to reject a transplanted organ. These drugs significantly reduce the risk of organ rejection; however, they come with side effects that can impact patient compliance. The side effects, although often mild, persist for an extended period. Immunosuppressants can also cause muscle damage, leading to reduced muscle function. Cardiovascular disease patients, particularly seniors, undergo heart surgeries such as orthotopic and heterotopic heart transplantation, aneurysm repair, arrhythmia treatment, and ventricular assist device implantation.

- Hospitals and cardiac centers perform these procedures, utilizing heart transplant devices, organ preservation techniques, and immunosuppressive therapies. Transplant recipients require immunosuppressive drug regimens to prevent graft rejection and manage complications like graft vasculopathy, infectious complications, and cell-based therapies. Hospital pharmacies, retail pharmacies, and online pharmacies distribute these medications. Biomedical engineers, immunologists, and transplant surgeons play crucial roles in the heart transplantation process. Immunosuppressive therapies include immunosuppressants, antivirals, and anti-infectives. Regenerative medicine approaches, such as tissue engineering strategies and precision medicine approaches, are emerging trends in heart transplantation therapeutics. Genetic compatibility and immune profiling are essential considerations in heart transplantation.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AbbVie Inc. - The company offers heart transplantation therapeutics such as Gengraf, which is used to help prevent organ rejection in people who have received heart transplants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Astellas Pharma Inc.

- Biocon Ltd.

- Dr Reddys Laboratories Ltd.

- Endo International Plc

- F. Hoffmann La Roche Ltd.

- GlaxoSmithKline Plc

- Glenmark Pharmaceuticals Ltd.

- Intas Pharmaceuticals Ltd.

- Jubilant Pharmova Ltd.

- LEO Pharma AS

- Lupin Ltd.

- McKesson Corp.

- Novartis AG

- Panacea Biotec Ltd.

- Pfizer Inc.

- RPG Enterprises

- Strides Pharma Science Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of therapeutic interventions aimed at addressing the complexities of heart-related conditions. This market caters to an expansive patient pool, particularly those afflicted by cardiovascular diseases that lead to heart failure. The geriatric population represents a significant segment of this patient pool, with ageing being a primary risk factor for cardiovascular diseases. It is a life-saving procedure for individuals with end-stage heart failure, offering a second chance at life. Two primary types of procedures exist: orthotopic and heterotopic. Orthotopic transplantation involves replacing the failing heart with a donor heart In the same position, while heterotopic transplantation involves placing the donor heart alongside the recipient's heart.

Further, donor hearts are obtained from deceased individuals, with stringent screening processes in place to ensure the highest possible graft quality. In cases where a suitable donor heart is unavailable, alternative solutions such as artificial hearts and ventricular assist devices are employed to maintain patient survival until a donor heart becomes available. Cardiovascular diseases manifest in various forms, including arrhythmias, aneurysms, and cardiomyopathy. These conditions can lead to poor exercise tolerance, coughing, shortness of breath, exhaustion, and fluid retention. Immunosuppressants, anti-infectives, and analgesics are essential components of therapeutics, ensuring the successful integration of the transplanted organ and mitigating potential complications.

In addition, hospitals and cardiac centers serve as the primary providers of services. These institutions employ transplant surgeons, immunologists, and biomedical engineers to ensure the highest standards of care for patients undergoing transplantation. Immunosuppressive drug regimens are crucial for managing the risk of graft rejection, while organ preservation techniques are employed to maintain donor heart viability during transportation and transplantation procedures. Regenerative medicine approaches, including cell-based therapies and tissue engineering strategies, are emerging as promising alternatives to traditional transplantation. Precision medicine approaches and genetic compatibility assessments are also gaining traction In the field, enabling more personalized and effective treatments.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

252 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3% |

|

Market Growth 2025-2029 |

USD 129.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.8 |

|

Key countries |

US, Germany, Canada, France, Japan, UK, India, China, South Korea, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Heart Transplantation Therapeutics industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.