Herbal Cosmetics Market Size 2025-2029

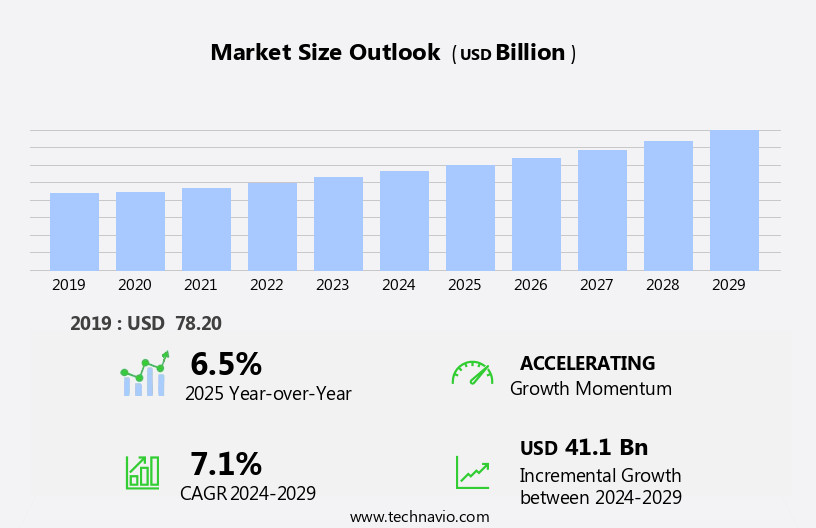

The herbal cosmetics market size is forecast to increase by USD 41.1 billion at a CAGR of 7.1% between 2024 and 2029.

- The market is experiencing significant growth, driven by increasing consumer awareness regarding the harmful effects of synthetic chemicals in traditional cosmetic products. This shift in consumer preferences towards natural and organic alternatives has opened up new opportunities for herbal cosmetic brands. Additionally, the convenience of online shopping has further fueled market expansion, as consumers can easily access a wide range of herbal cosmetic products from anywhere. However, regulatory hurdles impact adoption, as stringent regulations governing the production and labeling of herbal cosmetics can pose challenges for market entrants. As a result, herbal moisturizers, cleansers, and serums have gained popularity in skincare routines, offering simplicity and cultural heritage appeal to a multicultural population

- Furthermore, the high cost of herbal cosmetic products, often due to the use of premium, natural ingredients, can limit their affordability for some consumers. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on developing cost-effective production methods, adhering to regulatory requirements, and effectively marketing the health benefits of their herbal cosmetic offerings to consumers.

What will be the Size of the Herbal Cosmetics Market during the forecast period?

- The market in the US is experiencing significant growth, driven by the increasing demand for personalized skincare solutions and luxury wellness offerings. Consumers are increasingly seeking out herbal remedies infused with bioactive compounds, such as those derived from biodynamic farming practices, for oily skin, acne treatment, and skin brightening. Conscious consumerism is also a key trend, with a focus on ethical sourcing, fair trade, and ingredient transparency. Recyclable materials and packaging sustainability are also important considerations, as consumers look for upcycled and biodegradable options. The natural cosmetics sector, which includes vegan and organic offerings, is experiencing in popularity.

- Essential oils and herbal fragrances are also in demand, as are smart beauty devices and face masks. The natural beauty movement is gaining momentum, with clinical trials and traditional medicine inspiring innovation in the sector. Skin analysis and mapping technologies are being integrated into AI-powered skincare offerings, providing consumers with customized product recommendations. The market for premium cosmetics, including herbal extracts for dry skin, hair growth, and hair loss prevention, is expected to continue growing. Social media marketing and consumer awareness campaigns are playing a crucial role in driving sales, as consumers turn to digital channels for product discovery and information.

-

The e-commerce industry and online platforms are major retail channels for herbal beauty products, with social media and beauty blogs playing a crucial role in driving sales through influencer marketing and celebrity endorsements. Furthermore, the demand for herbal cosmetics is driven by consumers' concerns over animal cruelty and synthetic chemicals in beauty products. Ayurvedic practices and other traditional herbal remedies are also gaining traction in the market. The sustainable beauty sector, which encompasses clean beauty and wellness tourism, is also expected to see significant growth. Overall, the market is poised for continued expansion, driven by consumer preferences for natural, sustainable, and personalized offerings.

How is this Herbal Cosmetics Industry segmented?

The herbal cosmetics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Product

- Skin care

- Hair care

- Body care

- End-user

- Men

- Women

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Distribution Channel Insights

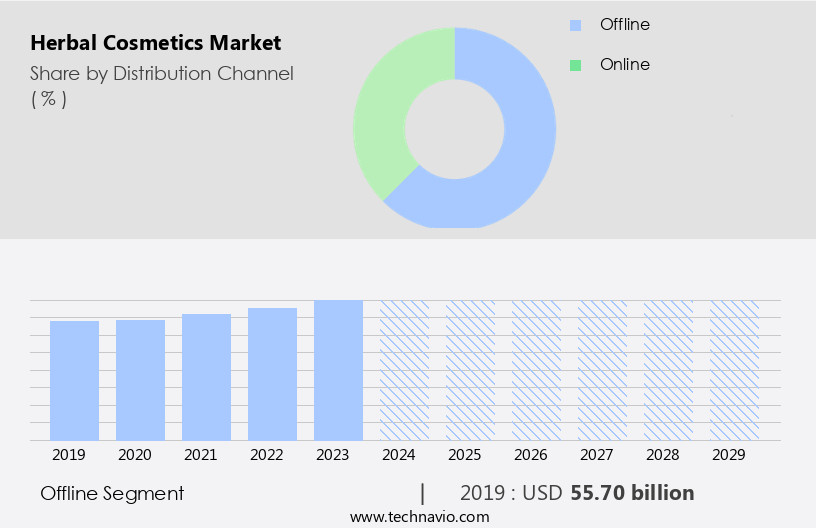

The offline segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments catering to diverse consumer preferences. Sensitive skin individuals seek products infused with herbal extracts for gentle care. Hair growth and prevention of hair loss are key concerns addressed through herbal cosmetics. Sustainability is a significant trend, with consumers favoring organic farming, bioactive compounds, and ethical sourcing. Premium cosmetics incorporating herbal ingredients offer superior performance. Transparency in ingredient sourcing and dermatological testing are essential. Acne treatment and skin brightening are popular applications. Essential oils, vegan cosmetics, and herbal fragrances add allure. AI-powered skincare and skin mapping provide personalized solutions. Biodynamic farming and packaging sustainability reflect the industry's commitment to the environment.

Furthermore, brands in specialty stores, supermarkets/hypermarkets, drugstores/pharmacies, and health and wellness stores specialize in offering a wide range of herbal cosmetics. Herbal cosmetics span various categories, including face masks, sun protection, and body care. Subscription boxes offer convenience. Smart beauty devices and Ayurvedic cosmetics cater to niche markets. Social media marketing influences consumer decisions. Clean beauty and fair trade practices ensure product integrity. Clinical trials and clinical studies validate efficacy. Distribution channels include specialty stores, supermarkets/hypermarkets, department stores, drugstores/pharmacies, and health and wellness stores. These channels cater to diverse consumer demographics and shopping habits.

The Offline segment was valued at USD 55.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

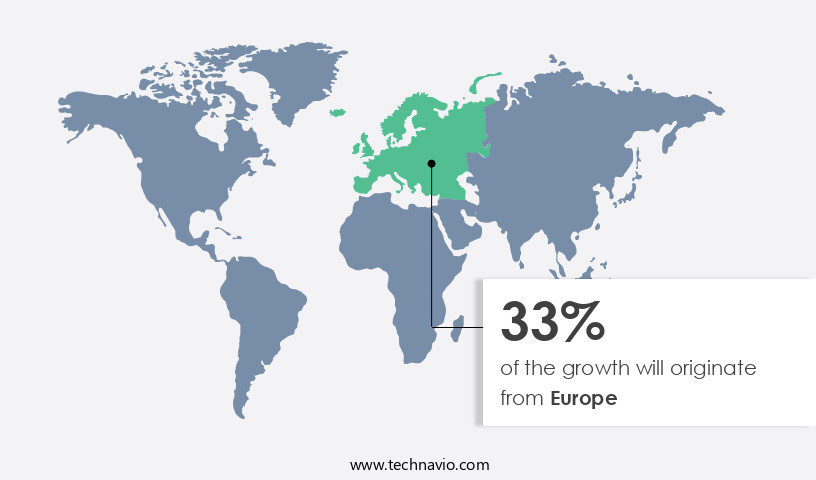

Europe is estimated to contribute 33% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the Asia-Pacific (APAC) is experiencing significant growth due to increasing consumer preference for natural and organic beauty products. This market encompasses a range of offerings, including skincare, haircare, and makeup, which utilize plant-based ingredients and eschew synthetic chemicals. Key drivers fueling this expansion include mounting awareness of the health risks associated with synthetic cosmetics, the trend toward sustainable and holistic wellness, and the expanding purchasing power of consumers in emerging economies, such as India, China, and Indonesia. Notable contributors to the market in APAC include China, India, and Japan. The sector incorporates various elements, such as sensitive skin solutions, hair growth treatments, sustainable beauty practices, premium cosmetics, bioactive compounds, organic farming, ingredient transparency, acne treatment, essential oils, vegan cosmetics, AI-powered skincare, skin mapping, skin brightening, biodynamic farming, packaging sustainability, herbal extracts, luxury cosmetics, skin analysis, ethical sourcing, dermatological testing, subscription boxes, smart beauty devices, Ayurvedic cosmetics, natural perfumes, social media marketing, hair loss prevention, face masks, sun protection, influencer marketing, oily skin treatments, personalized skincare, botanical ingredients, green beauty, body care, clinical trials, clean beauty, dry skin remedies, and fair trade.

These elements reflect the market's commitment to catering to diverse consumer needs and preferences while upholding environmentally-friendly and ethical production standards.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Herbal Cosmetics market drivers leading to the rise in the adoption of Industry?

- The significant consumer awareness regarding the detrimental impacts of synthetic chemicals serves as the primary market catalyst. The market is experiencing significant growth due to the increasing awareness and concern regarding the health risks associated with synthetic cosmetic ingredients. Consumers are increasingly seeking herbal alternatives, as these products offer numerous benefits for sensitive skin, hair growth, and acne treatment. Sustainable beauty is a key trend in the industry, with a focus on bioactive compounds derived from organic farming. These compounds are often rich in essential oils and are vegan-friendly. The use of herbal ingredients in cosmetics is a response to the potential health hazards posed by synthetic chemicals, many of which are derived from petroleum products.

- These chemicals, including benzene derivatives, aldehydes, toluene, and others, have been linked to various health issues, such as cancer, congenital abnormalities, central nervous system disorders, and allergic reactions. The acetaldehyde found in synthetic cosmetics can negatively impact the kidneys, nervous, and respiratory systems in humans. As a result, consumers are demanding greater transparency in cosmetic labeling, seeking out products with natural, herbal ingredients, and supporting companies that prioritize sustainable and organic farming practices. The premium cosmetics market is responding to these demands, offering a wide range of herbal cosmetics that cater to various skin types and concerns. This shift towards herbal cosmetics is expected to continue driving market growth during the forecast period.

What are the Herbal Cosmetics market trends shaping the Industry?

- The growing preference for online shopping represents a significant market trend. This trend is driven by the convenience, accessibility, and time savings that e-commerce platforms offer. The market experiences steady growth due to several factors. Consumers' increasing interest in holistic wellness and natural ingredients propels the demand for herbal skincare products. AI-Powered Skin Mapping and Skin Analysis technologies enable personalized skincare solutions, catering to unique skin types and concerns. Herbal extracts derived from Biodynamic Farming practices add authenticity and efficacy to these products. Packaging sustainability is another significant trend, as consumers prefer eco-friendly and recyclable packaging. Herbal fragrances add an allure to herbal cosmetics, appealing to both luxury and budget-conscious consumers. Skin Brightening is a key benefit that attracts a large consumer base, particularly in regions with high sun exposure.

- Online distribution channels, including pure-play e-retailers, company portals, and other online retailers, offer a vast selection of herbal cosmetics. These platforms enable consumers to compare products, read reviews, and make informed purchasing decisions. The proliferation of smartphones and the convenience of online shopping contribute to the increasing popularity of herbal cosmetics in the digital marketplace.

How does Herbal Cosmetics market faces challenges face during its growth?

- The escalating costs of producing herbal cosmetic products pose a significant challenge and hinder the growth of the industry. Herbal cosmetics, characterized by their natural ingredients derived from plants and essential oils, have gained popularity in the global market for their ethical sourcing and dermatological benefits. However, the production costs are higher due to the need for premium raw materials and labor-intensive processes. Regulations mandating stringent production standards further increase expenses. To cater to a wider audience, subscription boxes and smart beauty devices offer affordable access to these products. Social media marketing plays a significant role in promoting herbal cosmetics, with influencer collaborations driving engagement.

- Key product categories include Ayurvedic cosmetics, natural perfumes, face masks, hair loss prevention, and sun protection. Manufacturers focus on delivering high-quality, effective products to meet consumer expectations. Innovations in technology, such as smart beauty devices, are enhancing the user experience and driving growth in the market. The market dynamics remain influenced by consumer preferences for natural, chemical-free alternatives and the increasing awareness of ethical sourcing.

Exclusive Customer Landscape

The herbal cosmetics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the herbal cosmetics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, herbal cosmetics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alna Vedic - The company offers herbal cosmetics such as gold serum, Alan pure Syp blood purifier, charcoal serum.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alna Vedic

- APCOS NATURALS PVT. Ltd.

- Emami Ltd.

- HCP Wellness

- Herbline

- Himalaya Global Holdings Ltd.

- Jovees Herbal Care India Ltd.

- Khadi Natural

- LOreal SA

- Lotus Herbals Pvt. Ltd.

- MyChelle Dermaceuticals LLC

- Patanjali Ayurved Ltd.

- RDM Care India Pvt. Ltd.

- The Hain Celestial Group Inc.

- The Procter and Gamble Co.

- Vaadi Herbals Pvt. Ltd.

- WALA Stiftung

- Weleda

- Yves Rocher Amerique du Nord Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Herbal Cosmetics Market

- In February 2024, L'Oréal, the world's leading cosmetics company, introduced an innovative herbal skincare line, Seed Phytonutrients, reinforcing its commitment to the market (L'Oréal Press Release, 2024). This new range, enriched with natural botanical extracts, aims to cater to the growing consumer demand for eco-friendly and herbal cosmetics.

- In May 2025, The Body Shop, a renowned British cosmetics brand, announced a strategic partnership with a leading herbal tea company, Tazo, to develop a line of tea-infused cosmetics (The Body Shop Press Release, 2025). This collaboration represents a significant step towards innovation in the market, combining the benefits of herbal teas and skincare.

- In July 2024, Kao Corporation, a leading Japanese cosmetics manufacturer, acquired a majority stake in Biotherm, a French luxury skincare brand specializing in herbal and marine-derived products (Reuters, 2024). This strategic acquisition not only expanded Kao's global presence but also strengthened its position in the market.

- In September 2025, the European Union approved the use of cannabidiol (CBD) in cosmetics, marking a significant regulatory milestone for the herbal cosmetics industry (European Commission, 2025). This decision opened the door for numerous companies to introduce CBD-infused cosmetics, catering to the increasing consumer interest in this trendy ingredient.

Research Analyst Overview

The market continues to evolve, driven by consumer demand for natural, sustainable, and premium beauty solutions. Sensitive skin consumers seek out herbal cosmetics for their gentle and calming properties, while those focused on hair growth turn to these products for their bioactive compounds derived from plants. Sustainable beauty is a key trend in the market, with organic farming practices and ingredient transparency becoming increasingly important. Premium cosmetics infused with herbal extracts offer a luxurious experience, as consumers prioritize holistic wellness and ethical sourcing. Bioactive compounds derived from essential oils and herbal fragrances are at the forefront of innovation in the market.

These natural ingredients offer skin brightening, acne treatment, and anti-aging benefits, appealing to consumers seeking effective, plant-based alternatives. The rise of vegan cosmetics and ethical sourcing practices has led to an increased focus on sustainable packaging and production methods. AI-powered skincare and skin mapping technology enable personalized skincare solutions, catering to individual needs and preferences. Herbal cosmetics encompass a wide range of products, from face masks and sun protection to body care and hair loss prevention. Brands are leveraging smart beauty devices, subscription boxes, and influencer marketing to reach consumers and build brand loyalty. Botanical ingredients, such as ayurvedic cosmetics and natural perfumes, are gaining popularity in the market.

Brands are investing in clinical trials and dermatological testing to validate the efficacy of these natural ingredients and ensure they meet consumer expectations. The market is also embracing the concept of clean beauty, with a focus on minimally processed, non-toxic ingredients. Dry skin and oily skin consumers alike benefit from these gentle, herbal formulations. As the market continues to grow, it is essential for brands to prioritize ingredient transparency, sustainable production methods, and ethical sourcing practices. Consumers are increasingly knowledgeable about the ingredients in their beauty products and demand transparency and authenticity. The market is a dynamic and evolving space, driven by consumer demand for natural, sustainable, and effective beauty solutions.

Brands that prioritize transparency, ethical sourcing, and innovation will thrive in this competitive market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Herbal Cosmetics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

210 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.1% |

|

Market growth 2025-2029 |

USD 41.1 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.5 |

|

Key countries |

US, China, Japan, India, Canada, South Korea, Germany, UK, Italy, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Herbal Cosmetics Market Research and Growth Report?

- CAGR of the Herbal Cosmetics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the herbal cosmetics market growth and forecasting

We can help! Our analysts can customize this herbal cosmetics market research report to meet your requirements.