Hexamethylenediamine Market Size 2024-2028

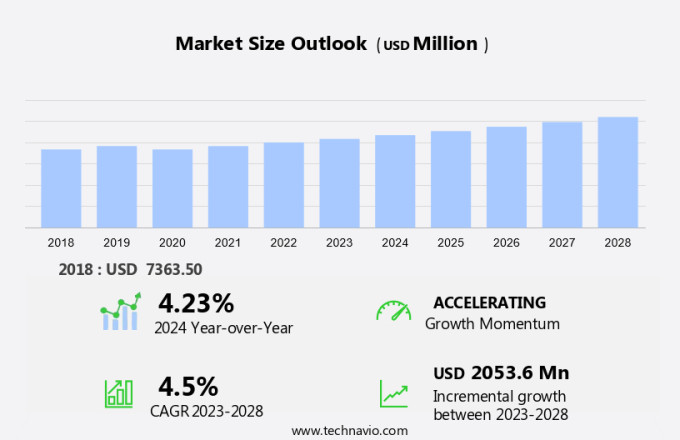

The hexamethylenediamine market size is forecast to increase by USD 2.05 billion, at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth due to several key trends and factors. One of the primary drivers is the increasing demand for recycled plastics, as HMD is a crucial ingredient in the production of polyurethane foam used in recycled plastic applications. Additionally, the growing demand for bio-based chemicals is propelling market growth, as HMD is used as a building block in the production of bio-based polymers. However, the market also faces challenges, including stringent regulations and policies related to the production and use of HMD and its derivatives. Hexamethylenediamine (HMDA) is a versatile organic compound that functions as an essential crosslinking agent and curing agents in various industries. Compliance with these regulations adds to the production costs, potentially impacting market competitiveness. Despite these challenges, the market is expected to continue growing due to its wide range of applications in various industries, including coatings, adhesives, and polymers.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

Hexamethylenediamine (HMD) is a versatile organic compound with the chemical formula (CH2)6(NH2)2. It is an essential intermediate used in various industries, including textiles and water treatment. In the textile industry, HMD is primarily used in the production of Nylon 6-6, a type of polyamide widely used in the manufacturing of high-performance fibers for apparel and industrial applications. The petrochemical sector plays a significant role in the Hexamethylenediamine market, as it is produced from Adiponitrile through a specific production process. HMD is also used in the production of Nylon 66 resins, which are key raw materials in the manufacturing of 3D printing materials and lubricants. Moreover, HMD finds extensive applications in water treatment as a corrosion inhibitor. The European Commission and the World Trade Organization have set regulations for the production and trade of HMD and its derivatives. The market for Hexamethylenediamine is expected to grow significantly due to the increasing demand for Nylon 6-6 and its applications in various industries. Castor oil is also used as a raw material for producing bio-based hexamethylenediamine products, adding to the market's diversity. The market volume for HMD is projected to increase in tons in the coming years.

Key Market Driver

Increasing demand for recycled plastics is notably driving market growth. Hexamethylenediamine applications extend to lubricants, paints and coatings, and petrochemicals. In the packaging sector, the adoption of eco-friendly practices has fueled the demand for HMDA and bio-based HMDA products. Recycled plastics are increasingly being used in the packaging industry due to growing consumer awareness and environmental regulations as compared to biodegradable plastics.

Further, HMDA plays a crucial role in the production of FDA-approved food packaging materials from recycled plastics. It is also used in the manufacturing of plastic containers, bottles, closures, jars, engineered pumps, sprayers, and caps. The shift towards sustainable solutions is expected to continue driving the growth of the HMDA market. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Growing demand for bio-based chemicals is the key trend in the market. Bio-based hexamethylenediamine (HMD) products have gained significant attention in various industries due to their eco-friendly nature. As an organic crosslinking agent, HMD is extensively used in curing agents for lubricants, paints, and coatings. Traditional lubricants, derived from petrochemicals, have been a major contributor to volatile organic compound (VOC) emissions and toxic gas releases. In response, there has been a growing demand for bio-based lubricants, which are produced using renewable feedstocks such as plant-based oil and sugar. These green lubricants undergo processes like fermentation, ultrafiltration, and crystallization to reduce their environmental impact.

Moreover, North America is a leading consumer of bio-lubes by volume, with countries like the US, Canada, and Mexico prioritizing the development of sustainable energy-saving resin systems. This region's focus on environmentally friendly solutions is expected to drive the demand for bio-based HMD products in the coming years. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Stringent regulations and policies is the major challenge that affects the growth of the market. The market is primarily driven by its applications as an organic crosslinking agent in various industries, including curing agents for paints and coatings, lubricants, and petrochemicals. However, stringent regulations on the volatile organic compound (VOC) content of commodity chemicals, such as those used in adhesives, sealants, and paints and coatings, pose significant challenges to market growth. For instance, the US Environmental Protection Agency (EPA) and the European Union's Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH) have imposed strict guidelines on VOC content to reduce emissions.

However, in August 2013, the Massachusetts Department of Environmental Protection (MassDEP) imposed a VOC limit for adhesives, including commodity chemicals used for industrial and commercial applications. Similarly, California has set VOC limits for various products, including adhesives and sealants. These regulations necessitate the development and adoption of bio-based hexamethylenediamine products to meet the evolving regulatory requirements and sustainability demands. Hence, the above factors will impede the growth of the market during the forecast period

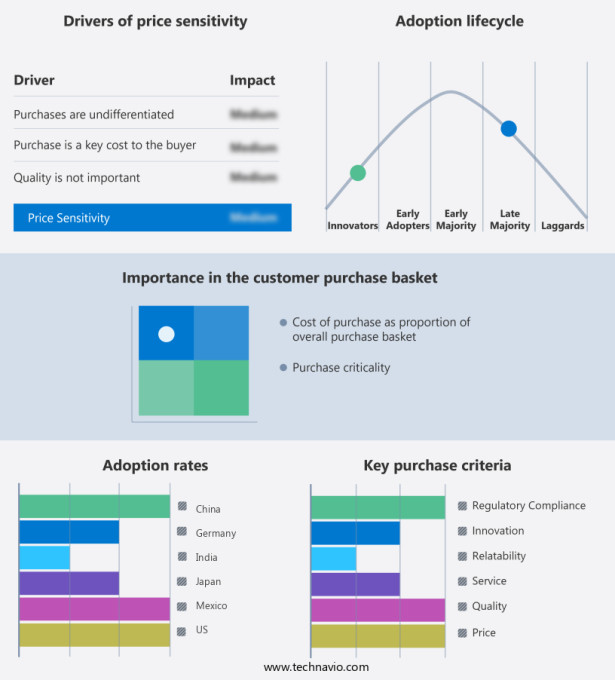

Exculsive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Asahi Kasei Corp.: The company offers bio hexamethylenediamine for Leona polyamide 66.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Enterprises

- Ascend Performance Materials

- Ashland Inc.

- BASF SE

- Covestro AG

- Daejungche Chemicals and Metals Co. Ltd

- DuPont de Nemours Inc.

- Evonik Industries AG

- Invista

- Junsei Chemical Co. Ltd.

- Lanxess AG

- Merck KGaA

- Radici Partecipazioni Spa

- Solvay SA

- Thermo Fisher Scientific Inc.

- Toray Industries Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

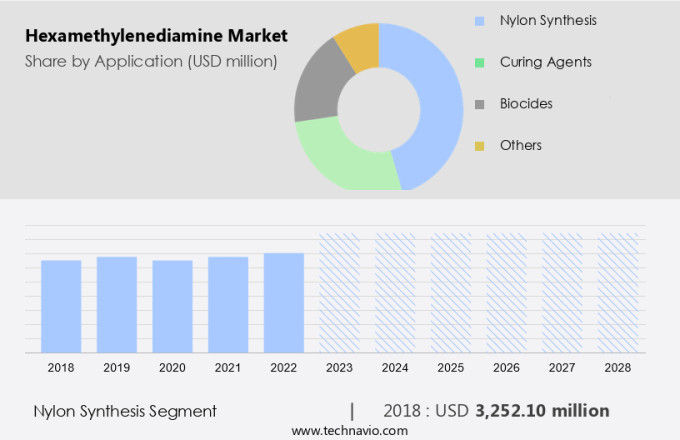

By Application

The nylon Synthesis segment is estimated to witness significant growth during the forecast period. Hexamethylenediamine (HMDA), an organic compound, plays a significant role in various industries such as textile, water treatment, and petrochemicals. In textiles, HMDA is used as a curing agent for fibers and resins in the production of Nylon 66 resins. It is also employed in the synthesis of Nylon and bio-based products derived from castor oil. In the water treatment sector, HMDA serves as an intermediate for coatings and biocides. The petrochemical sector utilizes HMDA in the production of Adipic acid, a key component in Nylon synthesis.

Get a glance at the market share of various regions Download the PDF Sample

The nylon Synthesis segment accounted for USD 3.25 billion in 2018. Furthermore, HMDA is used in the automotive industry for producing corrosion inhibitors and coatings. In the plastics industry, HMDA is used as a curing agent in the production of urea-formaldehyde resin. Moreover, HMDA finds applications in the production of Adiponitrile, a precursor to Nylon, and in the synthesis of 3D printing materials used for clothing. Covestro and Genomatica are some of the leading companies in the Global Hexamethylenediamine Market. The environmental impact of HMDA production is a concern due to solid waste disposal and recycling. However, efforts are being made to minimize waste and reduce the environmental footprint through sustainable production processes. In the automotive segment, MG Motor India is exploring the use of HMDA in lubricant production. In the apparel resources sector, HMDA is used in the production of textiles and fibers. Overall, the Hexamethylenediamine Market is expected to grow due to its wide range of applications in various industries.

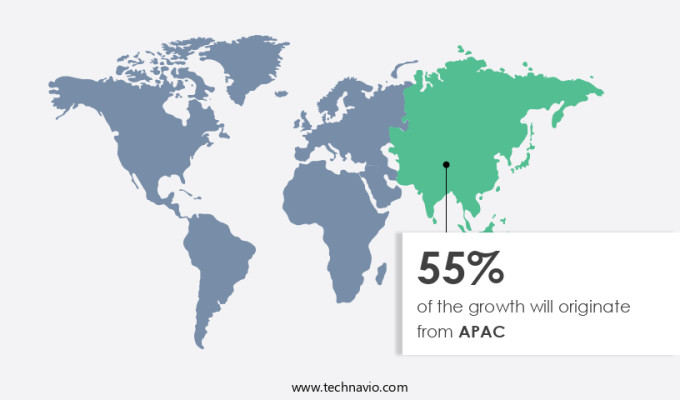

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 55% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Hexamethylenediamine (HMDA), an organic compound, is a crucial intermediate in various industries, including textile, water treatment, and the petrochemical sector. In textiles, HMDA is used for the production of fibers and resins, contributing significantly to the manufacturing of Nylon 66 resins. In water treatment, it serves as a curing agent and coating intermediates for the synthesis of urea-formaldehyde resins and biocides. The petrochemical industry utilizes HMDA in the production of Adipic acid, a primary component in Nylon synthesis. Moreover, HMDA finds applications in the automotive segment for producing corrosion inhibitors and in the lubricant industry for enhancing lubricant performance. In recent years, there has been a growing interest in bio-based HMDA derived from renewable resources such as castor oil, reducing the environmental impact of solid waste disposal and recycling. Major players in the Global Hexamethylenediamine Market include Covestro and Genomatica. The market is segmented into the automotive, textile, and lubricants sectors. The textile segment is expected to dominate the market due to the extensive use of HMDA in Nylon production.

Further, the automotive segment is also anticipated to witness significant growth due to the increasing demand for lightweight and durable materials in automotive manufacturing. Additionally, the 3D printing industry is a potential market for HMDA, as it is used as an intermediate for coatings and adhesives in this sector. In summary, Hexamethylenediamine is a versatile organic compound with extensive applications in various industries, including textile, water treatment, petrochemicals, automotive, and plastics. Its role as an intermediate for Nylon production, Adipic acid synthesis, and the manufacturing of fibers and resins, along with its use in corrosion inhibitors, lubricants, and coatings, makes it a vital component in numerous industrial processes. The growing demand for sustainable and bio-based products is also driving the development of HMDA derived from renewable resources, making it a promising area for future research and innovation.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application Outlook

- Nylon Synthesis

- Curing Agents

- Biocides

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

Market Analyst Overview

Hexamethylenediamine, an organic compound with the formula (CH2)6(NH2)2, plays a significant role in various industries, including textiles, water treatment, and the production of fibre and resins. In the textile industry, Hexamethylenediamine is used as a component in the synthesis of Nylon 66 resins and polyamides. In water treatment, it serves as a curing agent for water treatment chemicals. The production process of Hexamethylenediamine involves the reaction of ethylene diamine with formaldehyde. The market for Hexamethylenediamine is diverse, with applications in bio-based products, Adipic acid production, coating intermediates, corrosion inhibitors, and even in the automotive segment for the production of Nylon 66 resins and 3D printing. The global Hexamethylenediamine market is driven by the petrochemical sector's growth, with major players including Covestro and Genomatica. The automotive segment and textile segment are key end-users, while the lubricants segment also utilizes Hexamethylenediamine in the production of lubricant additives. The environmental impact of Hexamethylenediamine production is a concern, with solid waste disposal and recycling being important areas of focus.

Moreover, the use of renewable resources, such as castor oil, in the production of bio-based Hexamethylenediamine is a potential solution to reduce the environmental footprint. In the plastics industry, Hexamethylenediamine is used as an intermediate for coatings and biocides. Hexamethylenediamine is also used in the synthesis of Adiponitrile, which is a crucial raw material in the production of Nylon 6. Apparel Resources and MG Motor India are some of the notable companies utilizing Hexamethylenediamine in their respective industries. The global Hexamethylenediamine market is expected to grow significantly in the coming years due to its wide range of applications and the increasing demand for sustainable production methods.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

155 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 2.05 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, APAC, Europe, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 55% |

|

Key countries |

US, China, Japan, India, Germany, and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

AB Enterprises, Asahi Kasei Corp., Ascend Performance Materials, Ashland Inc., BASF SE, Covestro AG, Daejungche Chemicals and Metals Co. Ltd, DuPont de Nemours Inc., Evonik Industries AG, Invista, Junsei Chemical Co. Ltd., Lanxess AG, Merck KGaA, Radici Partecipazioni Spa, Solvay SA, Thermo Fisher Scientific Inc., and Toray Industries Inc. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies