High-Temperature Coating Market Size 2025-2029

The high-temperature coating market size is forecast to increase by USD 305.4 million at a CAGR of 4.2% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand for protective coatings in various industries. Ceramics, composite materials, and ceramic coatings are gaining popularity in sectors such as renewable energy, solar thermal, construction, satellite, cookware, lubricants, natural gas, and insulation. In the renewable energy sector, the expansion of solar thermal power plants and the production of solar panels require high-performance coatings to enhance their efficiency and durability. The aerospace industry also relies heavily on high-temperature coatings for satellite components and engine parts. In the manufacturing sector, the automotive industry is a major consumer of high-temperature coatings due to the increasing production of high-performance vehicles.

What will be the Size of the High-Temperature Coating Market During the Forecast Period?

- The high-temperature coatings market encompasses protective coatings designed for applications exposed to extreme temperatures and harsh environmental conditions. These coatings offer corrosion protection in various industries, including aerospace, industrial manufacturing, and equipment longevity. High-temperature coatings are essential in metal processing, as well as In the production of cookware and bakeware. In the building and construction sector, high-temperature coatings are used for fireproofing and thermal insulation.

- Underwriters Laboratories (UL) and other regulatory bodies set stringent standards for high-temperature coatings, ensuring their safety and effectiveness. Advanced materials, such as ceramics and polymers, serve as substrates for high-temperature coatings, providing resistance to degradation from oxidation, abrasion, and chemical exposure. The market for high-temperature coatings continues to grow, driven by increasing demand for improved performance and durability in various industries.

How is this High-Temperature Coating Industry segmented and which is the largest segment?

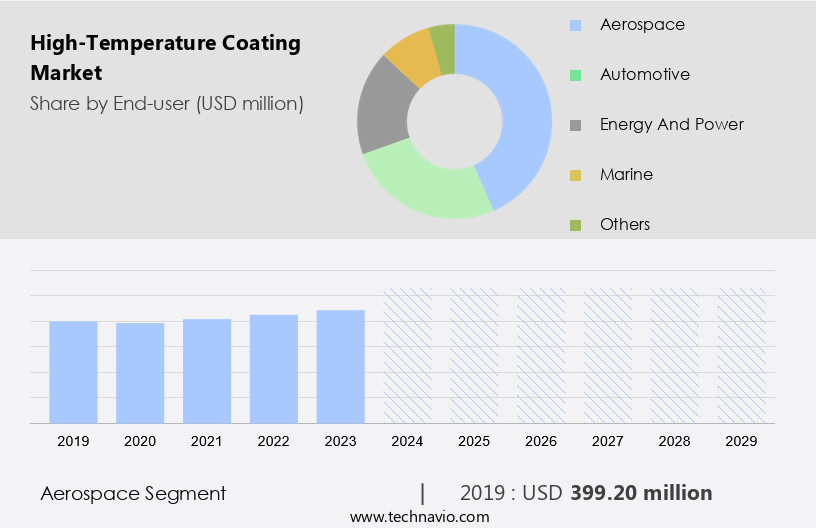

The high-temperature coating industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- Aerospace

- Automotive

- Energy and power

- Marine

- Others

- Type

- Water-based

- Solvent-based

- Powder-based

- Geography

- APAC

- China

- India

- Japan

- South Korea

- Europe

- Germany

- UK

- France

- Spain

- North America

- US

- Middle East and Africa

- South America

- Brazil

- APAC

By End-user Insights

- The aerospace segment is estimated to witness significant growth during the forecast period.

High-temperature coatings play a vital role In the aerospace industry, providing protection for components exposed to extreme heat and environmental conditions. These coatings enhance equipment durability, heat resistance, and performance. For instance, NASA's X-59 supersonic aircraft, developed in collaboration with Lockheed Martin Skunk Works, requires high-temperature coatings to withstand the intense heat generated during supersonic flight. The increasing demand for advanced aerospace technology drives the need for high-performance coatings. In industrial manufacturing, high-temperature coatings offer corrosion protection, thermal insulation, and improved chemical resistance. Energy and power sectors benefit from these coatings through increased equipment longevity and energy efficiency. Ceramic materials, nanotechnology, and hybrid materials are among the advanced technologies used in high-temperature coatings.

Get a glance at the market report of share of various segments Request Free Sample

The aerospace segment was valued at USD 399.20 million in 2019 and showed a gradual increase during the forecast period.

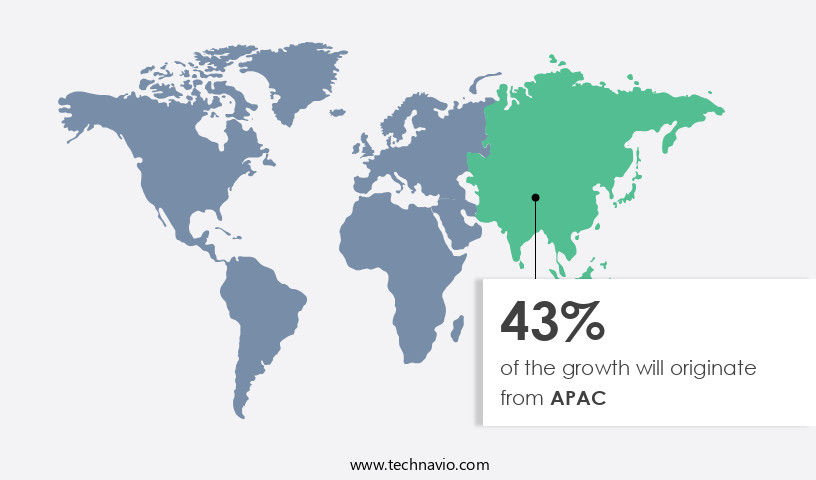

Regional Analysis

- APAC is estimated to contribute 43% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The high-temperature coatings market In the Asia Pacific region is witnessing notable expansion due to the rising adoption in extreme temperature and environmental condition applications, particularly In the energy and industrial sectors. The market growth is fueled by the increasing demand for corrosion protection in aerospace, industrial manufacturing, and equipment longevity. Advanced coating technologies, such as bisphenol-free coatings, nanotechnology, and ceramic materials, are gaining popularity for their performance enhancement and heat resistance properties. In the energy sector, high-temperature coatings are used in power generation, renewable energy, and hybrid materials for thermal insulation, corrosion resistance, and thermal barrier properties.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of High-Temperature Coating Industry?

Expansion of manufacturing and automotive sector is the key driver of the market.

- The global high-temp coatings market is witnessing notable expansion due to the growing demand from the aerospace and industrial manufacturing sectors. The increasing production of advanced equipment and vehicles necessitates the use of high-performance coatings for improved durability and efficiency. For instance, Aerospacelab, a leading satellite and space technology company, inaugurated a 35,000 sq ft satellite manufacturing facility In the US in October 2024. This expansion enhances their capabilities to produce and test satellite systems efficiently, contributing to advancements in space exploration and communication technologies. Likewise, Creation Technologies expanded its operations in January 2024 with a 150,000 sq ft manufacturing facility in Newark, Wayne County, US.

- This growth is driven by the need for high-temperature coatings that offer corrosion protection, thermal insulation, and enhanced performance in extreme temperatures and environmental conditions. The market encompasses various coating technologies, including acrylic, epoxy, water-based, and powder-based, as well as advanced materials such as nanotechnology, ceramic, hybrid, and composite. Applications span across energy and power generation, metal processing, emission standards, industrial processes, and construction. Key coating formulations include bisphenol-free, inorganic agents, silicone, phosphorus, and halogen-based products. The market's growth is further fueled by the increasing demand for heat-resistant coatings in industries like oil and gas, chemical processing, marine, and offshore exploration.

What are the market trends shaping the High-Temperature Coating Industry?

Product launches is the upcoming market trend.

- The high-temperature coatings market is experiencing innovation with new product launches focused on performance enhancement and sustainability. In June 2023, PPG Industries, Inc. Introduced the PPG ENVIRO-PRIME EPIC 200R coatings, which offer lower temperature curing capabilities for significant energy savings and reduced CO2 emissions. This alignment with eco-friendly solutions caters to the growing demand in various industries. Simultaneously, Sherwin-Williams launched Heat-Flex CUI-mitigation coatings, providing resistance to extreme temperatures and corrosion. These advancements contribute to equipment durability and longevity in energy, power generation, industrial manufacturing, and aerospace sectors. Additionally, there is a trend towards bisphenol-free coatings, nanotechnology, and the use of ceramic materials, composite materials, and hybrid materials.

- Coating technologies and formulations continue to evolve, offering thermal insulation, corrosion resistance, and advanced materials for substrates. These developments address challenges such as degradation, oxidation, abrasion, and chemical exposure in industries like oil and gas, industrial processing, and marine and offshore exploration. Energy and power generation sectors also benefit from heat resistance and emissions reduction through thermal barrier properties.

What challenges does the High-Temperature Coating Industry face during its growth?

High production cost is a key challenge affecting industry growth.

- High-temperature coatings play a crucial role in various industries, including aerospace, industrial manufacturing, and energy, by providing protection against extreme temperatures and environmental conditions. These coatings enhance equipment performance and longevity, offering corrosion protection and thermal insulation. Advanced materials such as nanotechnology, ceramic, and composite materials are used to create high-temperature coatings, ensuring high heat resistance, color stability, and chemical resistance. However, the market faces challenges due to the high production costs. The manufacturing process involves using advanced materials like ceramics, metal alloys, and complex composites, which are expensive to source and process. Furthermore, application techniques such as chemical vapor deposition (CVD), physical vapor deposition (PVD), and plasma spraying require sophisticated equipment and stringent quality control measures, leading to substantial capital investment and operational costs.

- High-temperature coatings are used extensively in various industries, including aerospace, industrial manufacturing, energy, and power generation, renewable energy, metal processing, and construction. Applications include engine components, exhaust systems, fuel efficiency, emissions reduction, thermal barrier properties, marine, offshore exploration, and fireproofing. Despite the high production costs, the benefits of high-temperature coatings, such as improved equipment durability and performance enhancement, make them a valuable investment for businesses In these industries. Water-based coatings, epoxy coatings, acrylic coatings, and powder-based coatings are some of the common types of high-temperature coatings used. Inorganic agents like silicone, phosphorus, and halogen-based products are often used In their formulations to enhance their thermal and chemical resistance properties.

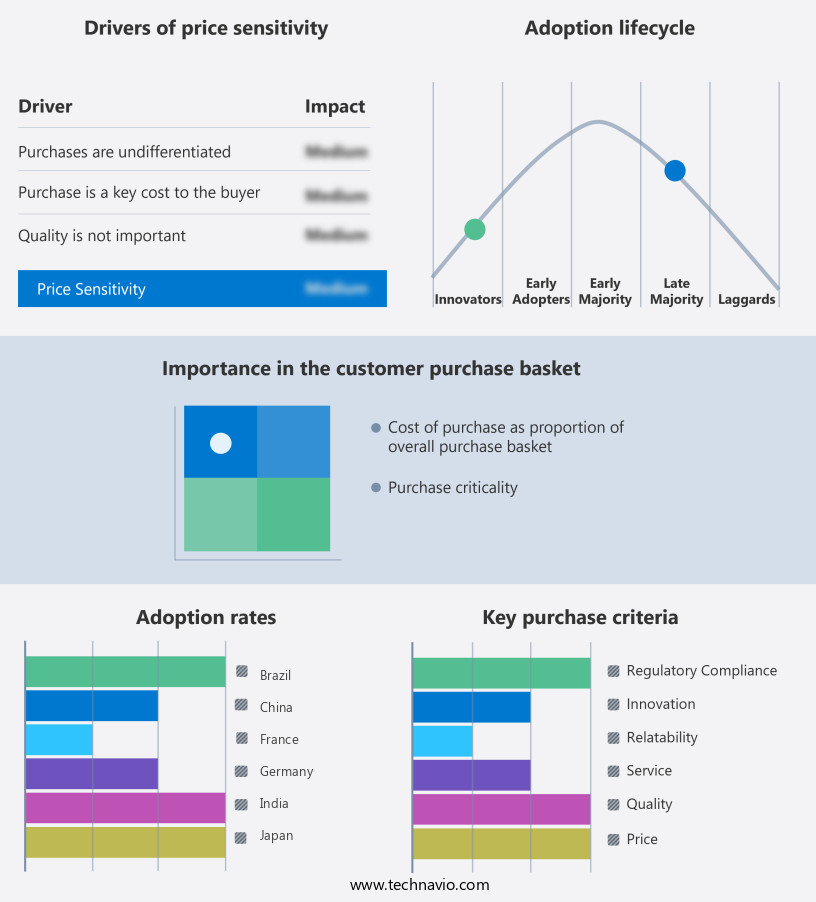

Exclusive Customer Landscape

The high-temperature coating market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high-temperature coating market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high-temperature coating market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akzo Nobel NV

- Albion Technology

- ARK India

- Asian Paints Ltd.

- Axalta Coating Systems Ltd.

- CRC Industries

- Heatman Products Pvt. Ltd.

- Jai AmbeyIndoChem Pvt. Ltd.

- Jotun AS

- Monarch Industrial Products India Pvt. Ltd.

- Mosil Lubricants Pvt.Ltd.

- PPG Industries Inc.

- Pyroflux India

- San Cera Coat Industries Pvt. Ltd.

- StarShield Technologies Pvt. Ltd.

- The Sherwin Williams Co.

- Twin Tech India Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

High-temperature coatings refer to protective layers applied to various substrates to enhance their performance and durability under extreme temperatures and environmental conditions. These coatings play a crucial role in various industries, including aerospace and industrial manufacturing, by ensuring equipment longevity and performance enhancement. The demand for high-temperature coatings continues to grow due to the increasing need for corrosion protection and thermal insulation in various applications. Inorganic agents, such as ceramic materials, silicone, phosphorus, and halogen-based products, are commonly used in formulating high-temperature coatings. Nanotechnology and hybrid materials, including composite and acrylic coatings, have gained significant attention due to their superior thermal resistance and chemical resistance properties.

In addition, bisphenol-free coatings have become increasingly popular due to environmental concerns. Water-based and powder-based coatings are common alternatives to traditional solvent-based coatings, offering lower volatile organic compound (VOC) content and improved application testing results. High-temperature coatings find extensive applications in energy and power generation industries, including metal processing and emission standards compliance. In the energy sector, these coatings are used to enhance the thermal insulation and corrosion resistance properties of equipment, leading to improved fuel efficiency and emissions reduction. The construction sector also benefits from high-temperature coatings, with applications in fireproofing and flame-retardant materials. The use of these coatings can significantly increase the durability and longevity of equipment and structures, making them a valuable investment for businesses.

Furthermore, high-temperature coatings are also essential in industrial processes, where equipment is subjected to harsh conditions, including high temperatures, abrasion, chemical exposure, and oxidation. These coatings help protect equipment from degradation, reducing downtime and maintenance costs. The oil and gas industry relies heavily on high-temperature coatings for engine components and exhaust systems. The thermal barrier properties of these coatings help improve fuel efficiency and reduce emissions, making them an essential component In the industry's efforts to meet emission standards. In the marine and offshore exploration industries, high-temperature coatings are used to protect equipment from harsh environmental conditions, including exposure to saltwater and extreme temperatures.

In addition, these coatings help ensure the longevity and durability of equipment, reducing maintenance costs and downtime. In summary, high-temperature coatings play a vital role in various industries by enhancing the performance and durability of equipment and structures under extreme temperatures and environmental conditions. The use of advanced materials, including ceramic coatings, nanotechnology, and hybrid materials, continues to drive innovation in this field, offering new opportunities for businesses to improve their operations and reduce costs.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

213 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.2% |

|

Market growth 2025-2029 |

USD 305.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.0 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, South Korea, India, and Brazil |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High-Temperature Coating Market Research and Growth Report?

- CAGR of the High-Temperature Coating industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high-temperature coating market growth of industry companies

We can help! Our analysts can customize this high-temperature coating market research report to meet your requirements.