High-Temperature Filters Market Size 2024-2028

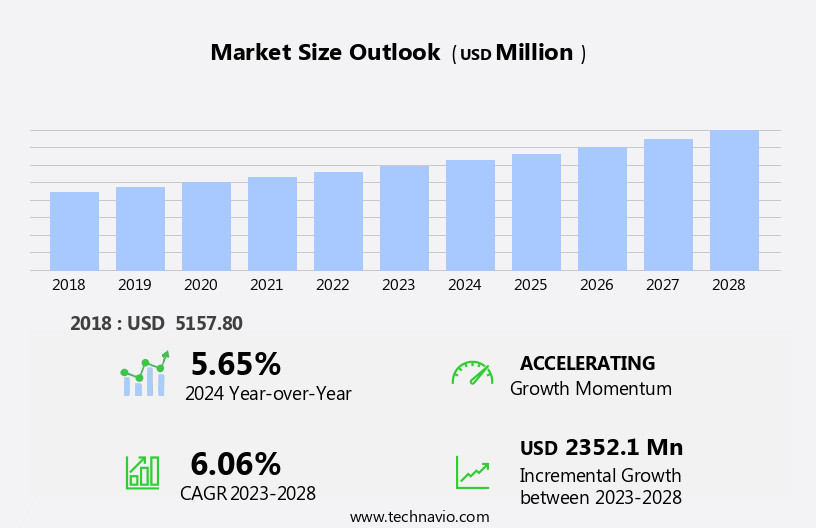

The high-temperature filters market size is forecast to increase by USD 2.35 billion at a CAGR of 6.06% between 2023 and 2028.

- The market is experiencing significant growth, driven by the industrial expansion in emerging economies. This trend is particularly noticeable in sectors such as power generation, oil and gas, and chemical processing, where high-temperature filtration systems are essential for efficient and reliable operations. However, market growth is not without challenges. One major obstacle is the increasing market consolidation, as leading players seek to expand their market share through acquisitions and strategic partnerships. Another challenge comes from the proliferation of counterfeit filters, which not only undermine the reputation of legitimate manufacturers but also pose safety risks. To capitalize on market opportunities and navigate these challenges effectively, companies must focus on innovation, quality, and customer service.

- By investing in research and development to create advanced filtration technologies and providing exceptional after-sales support, they can differentiate themselves from competitors and build long-term customer loyalty. Additionally, collaborating with industry associations and regulatory bodies to combat counterfeit products and promote industry standards can help protect the market's integrity and ensure sustainable growth.

What will be the Size of the High-Temperature Filters Market during the forecast period?

- The market encompasses various aspects, including filter performance analysis, industry landscape, cost reduction, and environmental compliance. Product quality improvement is a significant trend, with applications in hot gas filtration and air quality control. Material science plays a crucial role, with the use of ceramic materials, metal alloys, and advanced filtration materials. High-temperature gases necessitate filtration engineering services for energy efficiency and safety improvements. Heat-resistant filters, fire-resistant filters, and dust explosion prevention are essential considerations. The market dynamics are influenced by filtration optimization software, filter design software, and filter media innovation. Emerging filtration technologies, such as extreme temperature filtration and remote monitoring, offer competitive advantages.

- Sustainable filtration and filter life extension are essential for process optimization and emissions reduction. The future of filtration includes thermal shock resistance, filter automation, and particulate matter control. In the realm of material science, ceramic materials and metal alloys are key players. Filter media innovation and filter efficiency optimization are crucial for addressing the needs of high-temperature applications. The market's evolution is shaped by various factors, including filtration simulation, dust explosion prevention, and emissions reduction. The filter industry landscape is diverse, with various players offering custom filtration solutions and filtration engineering services. The market's future holds promise with advanced filtration materials and emerging filtration technologies.

How is this High-Temperature Filters Industry segmented?

The high-temperature filters industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Liquid and gas filters

- Air filters

- Technology

- Electrostatic Precipitators

- Baghouse Filters

- Cartridge Filters

- End-use

- Power Generation

- Industrial Manufacturing

- Automotive

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

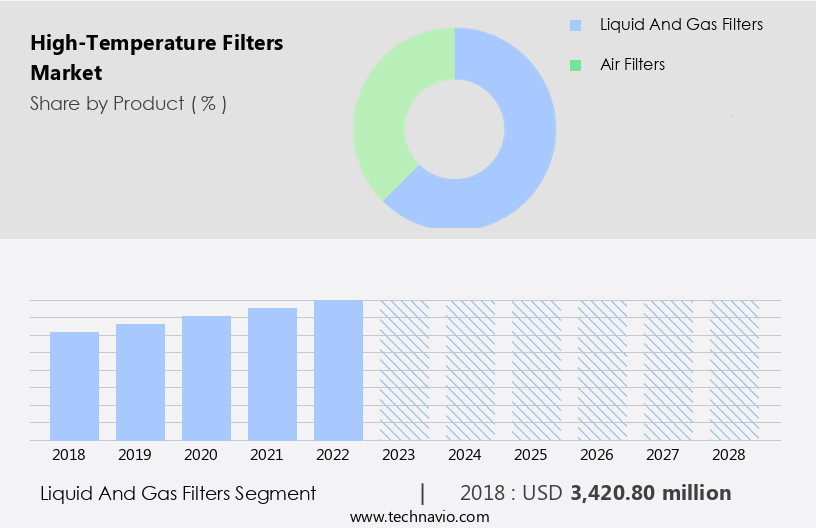

The liquid and gas filters segment is estimated to witness significant growth during the forecast period.

In the realm of industrial manufacturing, filtration technology assumes a pivotal role in ensuring the purity and safety of liquids, gases, and air. The market for filtration systems encompasses a diverse range of applications, from HVAC and industrial processes to power generation and pharmaceutical manufacturing. Among these, liquid and gas filters are anticipated to witness substantial growth during the forecast period. These filters, which include membrane filters, sintered filters, and high-temperature filters, are more intricate and costlier than air filter units due to their complex design. However, their extensive applications across various industries, such as refineries, chemical and petrochemical complexes, water and wastewater treatment, food and beverage processing, oil and gas pipelines, and power generation, contribute significantly to their larger market share.

High-temperature liquid and gas filters are specifically designed to remove solid contaminants and microfine particulates from liquids and gases at elevated temperatures. Their robustness and efficiency make them indispensable in industries where process fluids and gases require stringent filtration, such as refineries and chemical processing plants. Furthermore, the demand for filtration systems is fueled by the increasing focus on regulatory compliance, emissions control, and clean air technology. Filters are essential in ensuring regulatory compliance with standards such as OSHA, EPA, and FDA, as well as in reducing emissions and improving air quality. In the context of filtration media, ceramic filters and sintered filters have gained popularity due to their high chemical resistance and filtration efficiency.

These filters are extensively used in applications where corrosion resistance and high-temperature filtration are crucial, such as in ceramic production and power generation. Moreover, the trend towards high-efficiency filtration and advanced filtration technologies, such as HEPA and ULPA filters, is expected to drive market growth. These filters offer superior filtration performance, with HEPA filters capable of removing 99.97% of particles larger than 0.3 microns and ULPA filters removing 99.9995% of particles larger than 0.1 microns. In conclusion, the filtration market is characterized by its diverse range of applications, from air filtration in HVAC systems to high-temperature filtration in power generation and chemical processing.

The increasing focus on regulatory compliance, emissions control, and clean air technology, coupled with the development of advanced filtration technologies, is expected to drive market growth in the coming years.

Get a glance at the market report of share of various segments Request Free Sample

The Liquid and gas filters segment was valued at USD 3.42 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

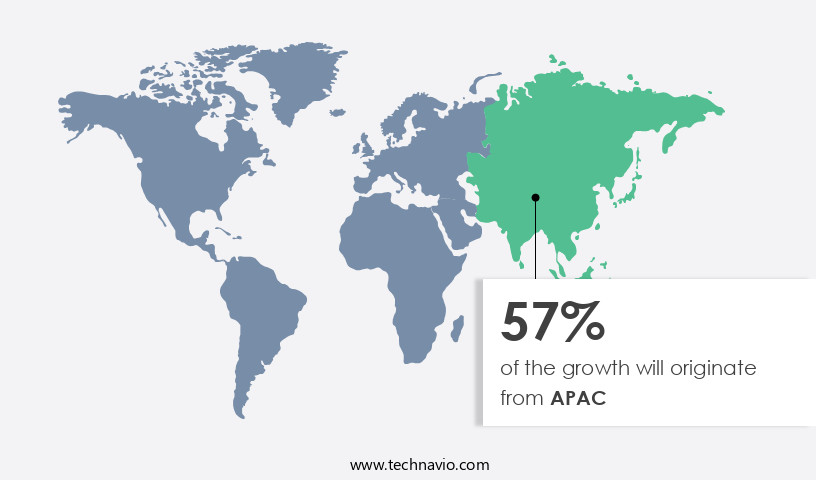

APAC is estimated to contribute 57% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in Asia Pacific is experiencing notable growth, driven by the expanding industrial sector in countries such as China, Japan, India, Vietnam, South Korea, Malaysia, and Australia. These nations are significant markets for high-temperature filters, with end-users in the oil and gas, power, and electronics industries being the primary revenue contributors. The increasing industrialization in the region is a major catalyst for market expansion, as developing countries like India, Indonesia, and Malaysia focus on enhancing their domestic manufacturing sectors. High-temperature filters are essential in various applications, including HVAC filtration, power generation, and industrial processes, where corrosion resistance, temperature resistance, and filtration efficiency are crucial.

Additionally, the demand for high-performance filters in industries such as ceramic production, chemical processing, and pharmaceutical manufacturing is increasing due to stringent regulatory compliance and emissions control requirements. The market trends also include the development of advanced filtration technologies, such as thermal filtration, membrane filtration, and sintered filters, to meet the evolving needs of various industries. Filter optimization, filter replacement, and filter maintenance are also critical aspects of the market, ensuring the longevity and efficiency of the filtration systems.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of High-Temperature Filters Industry?

- Industrial growth in emerging nations is the key driver of the market.

- The market is witnessing significant growth due to the increasing industrialization in developing economies, particularly in Asia and South America. Governments in these regions are investing in local industries to meet the rising demand for manufactured goods and reduce dependence on imports. This trend is expected to drive the market for high-temperature filters over the next five years. The manufacturing industry is the largest consumer of high-temperature filters worldwide. As a result, the growth in manufacturing activities directly impacts the demand for these filters.

- The market's expansion is influenced by various factors, including the increasing focus on energy efficiency, stringent emission regulations, and the growing adoption of automation in industries. Overall, the market is poised for steady growth in the coming years.

What are the market trends shaping the High-Temperature Filters Industry?

- Growing market consolidation is the upcoming market trend.

- The global high-temparature filters market is marked by intense competition, with numerous regional and international players vying for market share. Regional manufacturers in areas such as APAC and Europe offer equipment and components at lower prices, posing a challenge for international players. This pricing pressure impacts the sales of premium high-temperature filters, affecting the pricing strategy, research and development investments, and brand image of established international companies.

- To counteract this competition, major players in the market are focusing on mergers and acquisitions. The high-competition landscape necessitates a strategic approach from market participants to maintain their market position and grow in this dynamic market.

What challenges does the High-Temperature Filters Industry face during its growth?

- Threat from counterfeit products is a key challenge affecting the industry growth.

- The global high-temparature filters market faces a significant challenge from counterfeit products. Counterfeiting is not unique to this market, but the risks associated with counterfeit high-temperature filters are considerable. These filters are essential for processing fluids under harsh conditions, including high temperatures, pressure, flowrate, chemicals, and potential gas leaks. Genuine filters, certified by the industry and manufactured to exacting standards, offer superior safety in such environments. In contrast, counterfeit filters may not provide the necessary insulation features, potentially leading to catastrophic consequences for businesses.

- The consequences of using a counterfeit filter can range from production downtime and increased maintenance costs to more severe issues like equipment damage, personal injury, or even environmental hazards. Ensuring the authenticity of high-temperature filters is crucial for maintaining safety, efficiency, and profitability in various industries.

Exclusive Customer Landscape

The high-temperature filters market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the high-temperature filters market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, high-temperature filters market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAF Flanders

- AAF International

- APC Technologies

- Babcock & Wilcox

- Camfil

- Clarcor Industrial Air

- Donaldson Company

- Filtration Group

- Freudenberg Filtration Technologies

- Gore & Associates

- MANN+HUMMEL

- Midwesco Filter Resources

- Nederman Holding

- Parker Hannifin

- Porous Metal Filters

- Porvair Filtration Group

- Purex International

- Sefar AG

- Testori Group

- Thermax Limited

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The high-temperature filtration market encompasses a range of processes and applications that require the effective separation of particles, gases, and liquids at elevated temperatures. This market is driven by the increasing demand for filtration solutions in various industries, including power generation, HVAC systems, industrial processes, and chemical production. Filter design plays a crucial role in high-temperature filtration, as materials and configurations must be able to withstand extreme temperatures without compromising filtration performance. Membrane filters, ceramic filters, sintered filters, and metal filters are among the filtration technologies commonly used in high-temperature applications. Filtration applications in high-temperature environments are diverse, ranging from dust collection in ceramic production to fume extraction in chemical processing.

Corrosion resistance is a key consideration in the design of filter systems for these applications, as the harsh conditions can lead to degradation of filter elements and housing over time. Regulatory compliance is another important factor driving the high-temperature filtration market. Safety standards for emissions control in industries such as power generation and pharmaceutical manufacturing necessitate the use of advanced filtration technologies, such as HEPA filters and ULPA filters, to ensure air quality and prevent the release of harmful particles and gases. Filter testing and optimization are essential to maintaining filtration performance and ensuring filter life. Pressure drop and filtration capacity are critical metrics in evaluating filter efficiency, while filter replacement schedules must be optimized to minimize downtime and maintenance costs.

Temperature resistance is a key factor in the selection of filtration media for high-temperature applications. Ceramic filters, for example, offer excellent thermal stability and chemical resistance, making them well-suited for use in applications such as heat treatment and sintering processes. Filtration technology continues to evolve, with new developments in materials science and engineering leading to advances in high-temperature filtration. For instance, cartridge filters with high-efficiency media can provide effective particle removal in high-temperature environments, while clean air technology is increasingly being used to improve air quality in industrial settings. In the food processing industry, high-temperature filtration is used to ensure product quality and safety.

Filtration media with absolute filtration capabilities can remove even the smallest particles, ensuring that food products meet stringent regulatory requirements for purity and contaminant levels. Environmental protection is another area where high-temperature filtration plays a critical role. Aerosol filtration systems, for example, can be used to remove pollutants from industrial emissions, helping to reduce the environmental impact of industrial processes. In conclusion, the high-temperature filtration market is a dynamic and evolving field, driven by the need for effective filtration solutions in a range of industries and applications. From power generation and HVAC systems to chemical processing and food production, high-temperature filtration technology is essential for ensuring product quality, safety, and regulatory compliance.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

149 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.06% |

|

Market growth 2024-2028 |

USD 2352.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

5.65 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this High-Temperature Filters Market Research and Growth Report?

- CAGR of the High-Temperature Filters industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the high-temperature filters market growth of industry companies

We can help! Our analysts can customize this high-temperature filters market research report to meet your requirements.