Industrial Gas Phase Filtration System Market Size 2025-2029

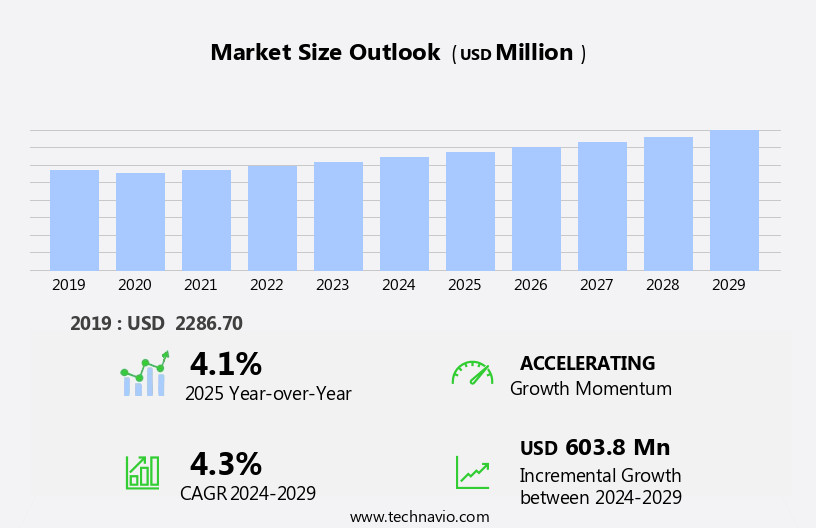

The industrial gas phase filtration system market size is forecast to increase by USD 603.8 million at a CAGR of 4.3% between 2024 and 2029.

- The market experiences significant growth due to increasing demand for air pollution control in various industries, particularly in power generation and industrial gases. The market is also driven by stringent quality-related norms in the food and beverage sector and the emerging demand for highly efficient filter media. The food and beverage industry's increasing focus on ensuring product purity and safety has led to a in demand for advanced filtration systems. Furthermore, these systems' ability to enhance product quality and yield, as well as reduce waste and energy consumption, makes them indispensable. However, the market is not without challenges. Uncertainties associated with volatile oil prices pose a significant threat to the market's growth. The production of industrial gas phase filtration systems relies heavily on petrochemicals, making the industry susceptible to price fluctuations.

- Additionally, the market's competitive landscape is intensifying, with key players investing heavily in research and development to differentiate their offerings and meet evolving customer demands. Companies seeking to capitalize on market opportunities and navigate challenges effectively must focus on innovation, cost competitiveness, and strategic partnerships.

What will be the Size of the Industrial Gas Phase Filtration System Market during the forecast period?

- In the industrial gas phase filtration market, optimization, maintenance, installation, troubleshooting, and operation are key areas of focus. Filtration system optimization involves enhancing system performance and efficiency through various methods, such as process control and automation. Regular maintenance is crucial to ensure the longevity and effectiveness of these systems, including cleaning, inspections, and replacement of worn-out components. Filtration system installation is a critical process that requires careful planning and execution to minimize downtime and ensure optimal performance. Troubleshooting is an essential aspect of filtration system management, addressing any issues that may arise and preventing potential system failures. The operation of filtration systems is a continuous process that requires a deep of the specific application and system design.

- Effective filtration system management can lead to increased productivity, reduced energy consumption, and improved product quality. Several market research firms provide valuable insights into the evolving trends and dynamics of the industrial gas phase filtration market. These reports highlight the importance of system optimization, maintenance, installation, and troubleshooting in ensuring the efficient and effective operation of filtration systems. Incorporating these practices into industrial gas phase filtration systems can lead to significant cost savings and operational improvements for businesses in various industries. By staying informed about the latest market developments and best practices, organizations can make informed decisions and maximize the value of their filtration investments.

How is this Industrial Gas Phase Filtration System Industry segmented?

The industrial gas phase filtration system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- W and WW

- Pharmaceutical

- Chemical

- Oil and gas

- Others

- Type

- Packed bed

- Combination

- Geography

- North America

- US

- Canada

- APAC

- China

- India

- Japan

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By End-user Insights

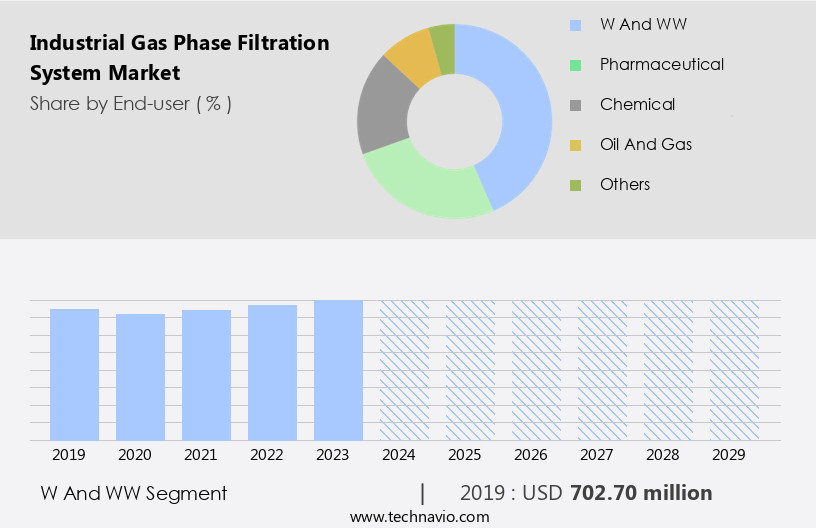

The W and WW segment is estimated to witness significant growth during the forecast period.

In the realm of industrial manufacturing, the importance of effective filtration systems is paramount across various sectors. Filtration technologies, including ULPA filtration, HEPA filtration, and gas filtration, play a crucial role in ensuring compliance with environmental regulations and maintaining occupational safety. Industrial gas filtration is a significant application of these technologies, particularly in industries such as oil & gas, chemical processing, and power generation. Food & beverage manufacturing relies on filtration for process gas and air filtration to ensure product quality and safety. Pharmaceutical manufacturing requires filtration for solution preparation, particle removal, and emission control.

In the semiconductor industry, membrane filtration is employed for the production of ultra-pure water. Filtration optimization, digital filtration, and filtration automation are emerging trends that enhance filtration efficiency, energy efficiency, and cost optimization. Filtration media, such as cartridge filters and bag filters, are customized to meet specific application requirements. Filtration systems are integrated with other technologies like electrostatic precipitators, cleanroom technology, and air scrubbers to ensure optimal performance. Gas cleaning, vent gas, and exhaust gas treatment are essential aspects of filtration systems in industries where gas phase filtration is required. Filtration monitoring and performance evaluation are essential for maintaining filtration capacity and ensuring consistent filtration efficiency.

Filtration technology continues to evolve, with advancements in filtration media, filtration automation, and filtration monitoring. In , filtration systems are integral to various industries, ensuring compliance with regulations, maintaining occupational safety, and enhancing product quality. The demand for advanced filtration technologies continues to grow, driven by the need for energy efficiency, cost optimization, and improved filtration performance.

Get a glance at the market report of share of various segments Request Free Sample

The W and WW segment was valued at USD 702.70 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

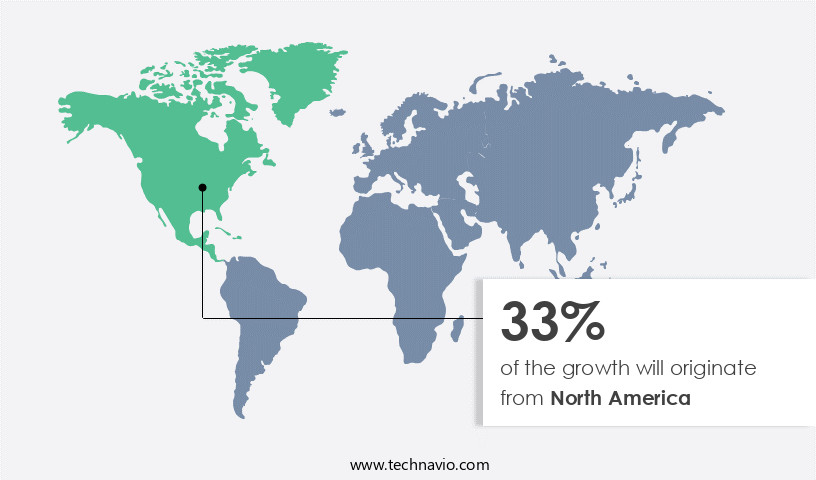

North America is estimated to contribute 33% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

Gas phase filtration is a critical process in industrial applications, particularly in the chemical industry, where it is used to purify the air surrounding the filter. Activated carbon and sodium permanganates are commonly used filter media in these systems, which are effective in removing impurities and pollutants. The increasing demand for industrial gas phase filtration systems in the treatment of wastewater in the chemical industry is driving market growth. These filtration systems play a pivotal role in the manufacturing process of various sectors, including agriculture, rubber, plastic, textiles, pulp and paper, and petroleum, by providing intermediate products.

Filtration efficiency is a significant consideration in industrial gas phase filtration systems, with ULPA filtration offering the highest level of efficiency. Filtration optimization and automation are also essential to ensure consistent performance and cost optimization. Filtration technology is continually evolving, with digital filtration and smart filtration systems offering advanced solutions for real-time monitoring and control. Environmental compliance is a crucial factor in the adoption of industrial gas phase filtration systems, with emission control and compliance standards playing a significant role in market growth. Filtration capacity, flow rate, and pressure drop are essential factors in the design and implementation of these systems.

Solution providers offer customized solutions, application expertise, and system integration to meet the unique needs of various industries. Gas filtration is also essential in power generation, pharmaceutical manufacturing, food and beverage, and oil and gas industries, among others. Membrane filtration, catalytic oxidation, and electrostatic precipitators are some of the advanced filtration technologies used in these applications. Gas cleaning, air filtration, and vent gas filtration are other essential filtration processes used to ensure occupational safety, energy efficiency, and industrial hygiene. Filtration media, including cartridge filters, bag filters, and gas scrubbers, are essential components of industrial gas phase filtration systems.

Filtration life, filtration monitoring, and filtration media replacement are crucial aspects of system maintenance and performance evaluation. Overall, the industrial gas phase filtration market is expected to continue growing due to the increasing demand for cleaner production processes and stricter environmental regulations.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Industrial Gas Phase Filtration System Industry?

- Stringent quality-related norms in food and beverage sector is the key driver of the market.

- In the realm of maintaining stringent cleanliness in food and beverage production facilities, industrial gas phase filtration systems assume significant importance. These industries necessitate precise airflow management through air handling units to prevent product contamination and equipment degradation. In a cleanroom environment, highly efficient filtration systems play a pivotal role in eliminating minute gaus particles. Gaus contaminants, such as sulfur and nitrogen compounds, pose a potential threat to the electronic and electrical components of control rooms.

- By integrating gas-phase filtration systems, these issues can be mitigated, ensuring the longevity and functionality of control units. The food and beverage sector's reliance on these systems underscores their significance in safeguarding critical processes and ensuring product safety.

What are the market trends shaping the Industrial Gas Phase Filtration System Industry?

- Emerging demand for highly efficient filter media is the upcoming market trend.

- Gas phase filtration systems utilize filter media to remove contaminants from gases. However, these media require replacement after a certain period due to the accumulation of contaminants, which can affect system performance. To address this issue, companies are innovating advanced filter media to enhance filtration efficiency and reduce maintenance requirements. Some offer filter media with stainless steel or aluminum mesh, while others provide silica-free options suitable for high-temperature chemical processes without compromising output.

- These advancements aim to minimize the need for frequent media replacements and improve overall system reliability.

What challenges does the Industrial Gas Phase Filtration System Industry face during its growth?

- Uncertainties associated with volatile oil prices is a key challenge affecting the industry growth.

- The market is subject to volatility due to fluctuating oil prices, which impact both production costs and demand. These systems are essential for removing gaus contaminants from air streams in industries such as petrochemicals, refineries, and chemical processing, where oil and gas are key raw materials. The unpredictability of oil prices creates cost pressures that ripple through the entire supply chain.

- When prices rise, industries heavily reliant on petroleum-based products face increased operational costs, leading to budget constraints and postponed capital investments in filtration systems. Conversely, when prices decline, reduced revenues in the oil and gas sector can result in cutbacks on infrastructure upgrades and maintenance, diminishing demand for filtration equipment.

Exclusive Customer Landscape

The industrial gas phase filtration system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the industrial gas phase filtration system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, industrial gas phase filtration system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Camfil AB (Sweden) - The company specializes in industrial gas phase filtration systems, catering to logistics, healthcare, food and beverage, and life science industries. These systems ensure optimal air quality and purity, enhancing operational efficiency and product safety.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAF International (United States)

- Alfa Laval AB (Sweden)

- Bry-Air (Asia) Pvt. Ltd. (India)

- Camfil AB (Sweden)

- Circul-Aire Inc. (Canada)

- Clarcor Industrial Air (United States)

- Daikin Industries Ltd. (Japan)

- D-Mark Inc. (United States)

- Donaldson Co. Inc. (United States)

- Freudenberg and Co. KG (Germany)

- HS Luftfilterbau GmbH (Germany)

- Kimberly-Clark Corp. (United States)

- Koch Filter Corp. (United States)

- MANN HUMMEL International GmbH (Germany)

- MayAir Group (Malaysia)

- Pall Corp. (United States)

- Parker-Hannifin Corp. (United States)

- Purafil Inc. (United States)

- PureAir Filtration LLC (United States)

- Troy Filters Ltd. (Canada)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Industrial gas phase filtration systems play a crucial role in various industries, particularly in chemical processing, power generation, and manufacturing sectors, where the production processes involve the handling and emission of gases. These systems are designed to ensure environmental compliance, improve occupational safety, and optimize energy efficiency. Fume removal is a critical application of gas phase filtration systems. These systems effectively capture and filter out harmful particles, VOCs (Volatile Organic Compounds), and other pollutants from exhaust gases. The filtration efficiency of these systems is a significant factor in their effectiveness, with Ultra Low Penetration Air Filters (ULPA) being the most efficient option, capable of removing particles as small as 0.1 microns.

The evolution of filtration technology has led to the development of smart filtration systems, which offer advanced features such as filtration optimization, digital filtration, and filtration monitoring. These systems use sensors and data analytics to optimize filtration performance, reduce energy consumption, and extend filter life. Cartridge filters and bag filters are common types of gas phase filtration systems. Cartridge filters offer high filtration capacity and are easily replaceable, while bag filters offer high filtration efficiency and are suitable for applications with large volumes of gas flow. The food and beverage industry relies on gas phase filtration systems for dust collection and gas cleaning.

These systems help maintain clean production environments, ensuring product quality and safety. In the pharmaceutical manufacturing sector, gas phase filtration systems are used for gas purification and emission control, ensuring compliance with stringent regulatory standards. The oil and gas industry uses gas phase filtration systems for various applications, including catalytic oxidation, membrane filtration, and emission control. These systems help reduce emissions, improve process gas quality, and ensure compliance with environmental regulations. Energy efficiency is a significant consideration in the design and implementation of gas phase filtration systems. Solutions providers offer customized solutions tailored to specific industry requirements, with application expertise and cost optimization being key factors.

Filtration automation and system integration are becoming increasingly important in the industrial gas phase filtration market. These technologies enable real-time monitoring and control of filtration systems, ensuring optimal performance and reducing downtime. Activated carbon is a common filtration media used in gas phase filtration systems for VOC removal and emission control. The performance evaluation of filtration systems is crucial to ensure they meet the required filtration capacity, efficiency, and flow rate. Gas filtration systems are essential for maintaining environmental compliance and ensuring occupational safety. They play a vital role in the reduction of particulate matter emissions and the removal of harmful VOCs from industrial processes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

206 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.3% |

|

Market growth 2025-2029 |

USD 603.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Industrial Gas Phase Filtration System Market Research and Growth Report?

- CAGR of the Industrial Gas Phase Filtration System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the industrial gas phase filtration system market growth of industry companies

We can help! Our analysts can customize this industrial gas phase filtration system market research report to meet your requirements.