Hookah Charcoal Market Size 2025-2029

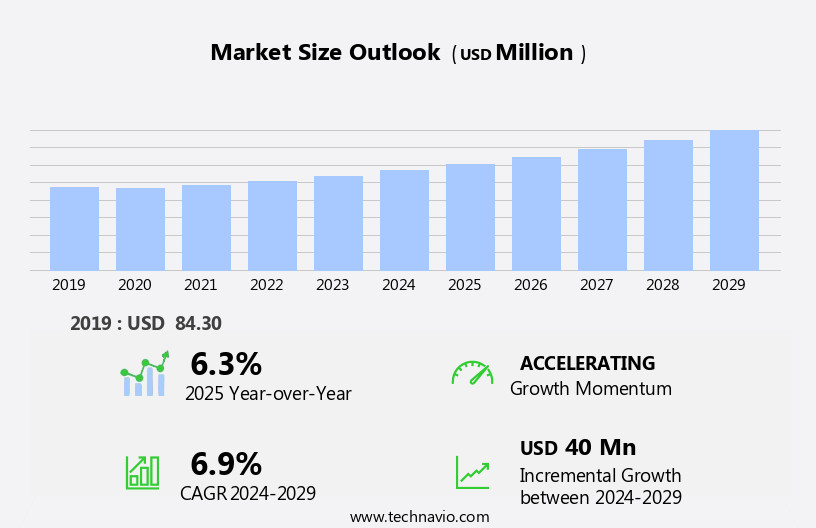

The hookah charcoal market size is forecast to increase by USD 40 million at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven by the expanding number of bars and nightclubs that offer hookah as an entertainment option. This trend is further fueled by the increasing demand for natural charcoal, which is perceived as healthier and more authentic compared to traditional coal. However, the market faces challenges that could hinder its growth potential. Regulatory hurdles impact adoption in certain regions due to concerns over the health effects of hookah consumption. Additionally, inconsistencies in the supply chain can lead to price fluctuations and quality concerns.

- Companies seeking to capitalize on market opportunities must navigate these challenges effectively. Strategies such as investing in research and development of healthier alternatives, establishing robust supply chains, and complying with regulatory requirements can help businesses thrive in this dynamic market.

What will be the Size of the Hookah Charcoal Market during the forecast period?

- The market is characterized by continuous innovation trends, with industry players focusing on enhancing flavor profiles and improving ignition time through charcoal blending and density manipulation. Charcoal sustainability practices, such as porosity optimization and ethical sourcing, are gaining importance to cater to eco-conscious consumers. Odor control and combustion efficiency are also critical factors driving market competition. Charcoal brands strive for recognition through superior product reviews, customer loyalty programs, and online communities. Heat intensity and smoke production remain essential considerations for hookah enthusiasts, influencing purchasing decisions.

- Market segmentation based on pricing strategies, niche markets, and charcoal patents further complicates the competitive landscape. Charcoal industry standards ensure consistent quality and safety, shaping consumer trust and preferences. Overall, the market is dynamic, with ongoing trends shaping consumer behavior and brand differentiation.

How is this Hookah Charcoal Industry segmented?

The hookah charcoal industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Online

- Offline

- Type

- Natural

- Non-natural

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- Middle East and Africa

- Egypt

- Turkey

- APAC

- China

- India

- South America

- Brazil

- Rest of World (ROW)

- North America

By Distribution Channel Insights

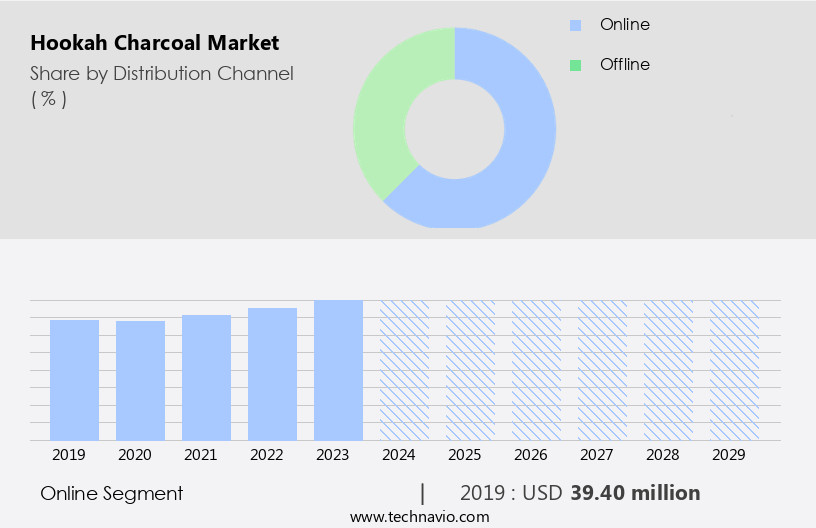

The online segment is estimated to witness significant growth during the forecast period.

The market encompasses various aspects, including charcoal certification, residue, social smoking, hoses, warnings, addiction, alternatives, blocks, odorless and bamboo charcoal, processing, heat consistency and output, bases, ash content, traditional and modern hookah, ash disposal, sustainability, labeling, smokeless charcoal, tobacco, heat management systems, electric heating elements, quick-lighting charcoal, portable hookah, health risks, innovation, home use, enthusiasts, manufacturing, lounges, natural charcoal, accessories, events, charcoal powder, combustion, culture, retail, cubes, emissions, burn time, environmental impact, packaging, safety, smoking risks, distribution, quality control, briquettes, coconut shell charcoal, and flavorless charcoal. The market is witnessing a shift towards certification and sustainability, with consumers expressing concerns over charcoal residue and health risks.

Social hookah smoking and the rise of hookah lounges are driving the demand for charcoal. Heat management systems and electric heating elements are gaining popularity for their consistency and convenience. Charcoal alternatives, such as smokeless and flavorless charcoal, are also emerging. Players are focusing on improving heat output and reducing ash content to cater to the evolving consumer preferences. Charcoal retailers are adopting new strategies, such as better pricing and wider assortments, to sustain in the competitive market. Charcoal manufacturing is undergoing innovation, with the introduction of charcoal powders and modern hookah designs. Despite these trends, the market faces challenges, including charcoal emissions and environmental impact, which are prompting regulatory scrutiny and calls for sustainable practices.

The Online segment was valued at USD 39.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

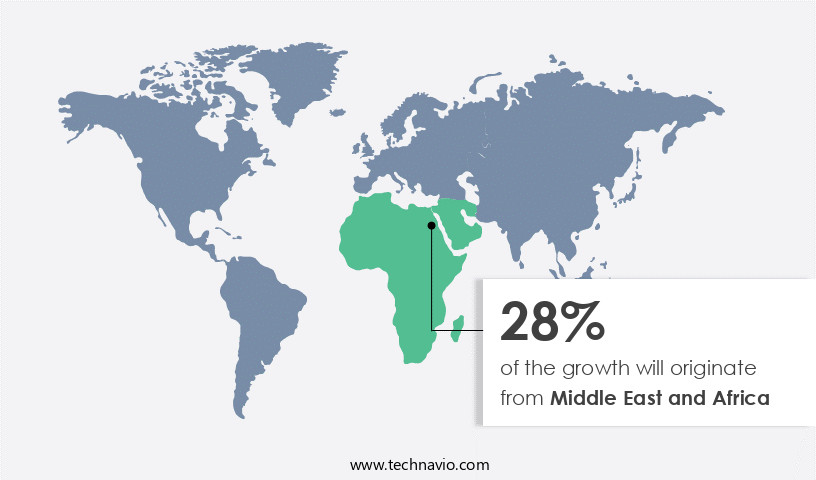

Middle East and Africa is estimated to contribute 28% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in MEA is experiencing significant growth due to various factors. The region's robust economic expansion, urbanization, and the presence of affluent consumers have led to the proliferation of bars and restaurants. The burgeoning tourism industry in the UAE, with over 3.7 million international tourists between June 2022 and May 2023, has further fueled this demand. The increased spending on hotels, bars, and restaurants has resulted in a higher need for hookah charcoal. Charcoal certification ensures the quality and safety of the product, while charcoal residue and warnings highlight the importance of proper use.

Social hookah smoking and hookah hoses have led to innovations in heat management systems, including electric heating elements and quick-lighting charcoal. Charcoal alternatives, such as smokeless charcoal and bamboo charcoal, offer sustainability and reduced ash content. Traditional hookah use continues, but modern hookahs and hookah culture have gained popularity. Charcoal manufacturing processes prioritize heat consistency and output, while natural charcoal and coconut shell charcoal offer eco-friendly options. Charcoal regulations ensure safety and quality control, and charcoal retailers offer various packaging options. Hookah enthusiasts enjoy events and accessories, while charcoal combustion and charcoal emissions are subjects of ongoing research.

Charcoal health risks and charcoal smoking risks are important considerations, and charcoal distribution networks ensure availability. The market's evolution reflects the dynamic interplay of consumer preferences, technological innovation, and regulatory requirements.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Hookah Charcoal market drivers leading to the rise in the adoption of Industry?

- The proliferation of bars and nightclubs represents the primary growth factor in this market.

- Hookah charcoal demand has surged globally due to the growing number of bars, pubs, lounges, and nightclubs. Factors such as an active and socially aware younger population, competitive pricing, and rising demand for tobacco products have fueled this trend. Developing countries, including India and China, have experienced significant growth in hookah charcoal consumption. Consumers' hectic lifestyles and increasing preference for socializing have led to frequent visits to these establishments. Furthermore, the opening of exotic bars at major tourist locations attracts a large youth demographic. Quality control and safety are crucial considerations in the market. Charcoal briquettes, such as coconut shell charcoal and flavorless charcoal, are popular choices due to their long burn time and minimal impact on the taste of hookah tobacco.

- Charcoal packaging plays a significant role in ensuring safety, as it must be airtight to prevent oxygen from reaching the charcoal and causing premature combustion. Charcoal regulations vary by region, with some countries implementing strict guidelines to minimize environmental impact. Electric hookahs have gained popularity as an alternative to traditional hookahs, reducing the need for charcoal and addressing safety concerns. Despite these advancements, charcoal smoking risks, such as carbon monoxide exposure, remain a concern. Charcoal distribution channels include both offline and online retailers, ensuring accessibility for consumers. Ensuring charcoal quality and safety remains a priority for manufacturers and retailers to maintain customer trust and loyalty.

What are the Hookah Charcoal market trends shaping the Industry?

- The professional and knowledgeable response to your inquiry is as follows: 1. The market trend indicates a growing demand for natural charcoal, reflecting a shift towards more sustainable and eco-friendly alternatives. 2. This trend is significant, as natural charcoal offers numerous benefits, including reduced environmental impact and improved product quality, making it an attractive option for consumers and businesses alike.

- The global market for hookah charcoal is witnessing significant growth, driven by the increasing preference for natural charcoal over quick-light charcoal. Natural charcoal, derived from coconut shells, is eco-friendly and produces minimal ash residue. The production process involves carbonizing coconut shells in a special charcoal kiln. In contrast, the demand for quick-light charcoal, made from compressed coal dust and chemicals, is declining due to health concerns and inconsistent heat output. Natural charcoal offers several advantages, including longer burn time due to the absence of chemicals, and odorless smoking experience. Additionally, natural charcoals like bamboo charcoal are gaining popularity for their health benefits.

- However, the production process of natural charcoal requires specialized equipment and expertise, which may increase the cost. Charcoal certification and warnings regarding charcoal addiction are becoming increasingly important in the market. As a result, manufacturers are focusing on producing high-quality, consistent charcoal blocks with optimal heat output. Alternatives to charcoal, such as electric hookahs and herbal smoking blends, are also gaining traction due to their convenience and health benefits. Overall, the market for hookah charcoal is expected to continue its growth trajectory, driven by consumer preferences for natural and eco-friendly products.

How does Hookah Charcoal market faces challenges face during its growth?

- The harmful impacts of hookah consumption pose a significant challenge to the growth of the hookah industry. With increasing awareness of the health risks associated with this form of smoking, consumer preferences are shifting towards healthier alternatives, potentially hindering industry expansion.

- Hookah charcoal plays a crucial role in the preparation and consumption of hookah, a traditional smoking method that has gained popularity worldwide. However, the health risks associated with hookah use are a growing concern. When charcoal is used to heat hookah tobacco, it releases harmful substances, including carbon monoxide, metals, and carcinogens, such as polyaromatic hydrocarbons. These toxic compounds are inhaled by the smoker, leading to health issues like lung cancer, stomach cancer, and esophageal cancer. To mitigate these risks, several innovations have emerged in the market. For instance, smokeless charcoal and quick-lighting charcoal have gained popularity due to their reduced ash content and easier disposal.

- Charcoal sustainability is also a concern, with some manufacturers focusing on eco-friendly and biodegradable alternatives. Moreover, heat management systems, electric heating elements, and ash disposal mechanisms are being integrated into hookah designs to improve user experience and reduce health risks. Charcoal labeling is also becoming mandatory to ensure transparency and consumer safety. Despite these advancements, it is essential to be aware of the potential health risks associated with hookah use and take necessary precautions, such as limiting usage duration and avoiding inhaling deeply or sharing hookah pipes.

Exclusive Customer Landscape

The hookah charcoal market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hookah charcoal market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hookah charcoal market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

COCO NARA - The company specializes in providing high-quality hookah charcoal products, including CocoNara, which comes in various quantities such as 3kg and 10kg options.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- COCO NARA

- Cocoyaya

- Firdauz Charcoal

- Fumari

- Haze Tobacco LLC

- HookahJohn

- Kaloud

- LeOrange Smoke

- Narine

- Nu Tobacco

- Red Cube International

- Rene Schonefeld BV

- Sagar Charcoal and Firewood Depot

- Starbuzz Tobacco Inc.

- Starlight Charcoal

- Swaraj Coal Corp.

- The Hookah Lab LLC

- TOM Cococha GmbH and Co. KG

- UrthTree

- Zomo America

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hookah Charcoal Market

- In February 2023, CocoBolo LLC, a leading hookah charcoal manufacturer, announced the launch of their new eco-friendly coconut shell charcoal product line, "Green Coco," at the International Tobacco & Nicotine Forum. This new product line aims to cater to the growing demand for sustainable and environmentally friendly alternatives in the hookah market (CocoBolo LLC, 2023).

- In March 2024, Starbuzz Tobacco, a prominent player in the hookah industry, entered into a strategic partnership with a leading Middle Eastern distributor, Al Fakher Trading Co. This collaboration was aimed at expanding Starbuzz's reach in the Middle East and North African markets, which account for a significant portion of the global hookah charcoal demand (Starbuzz Tobacco, 2024).

- In August 2024, Sabroso Charcoal, a US-based hookah charcoal manufacturer, raised USD5 million in a Series A funding round led by SOSV, a global venture capital firm specializing in food and agriculture technology. The funds will be used to scale up production and expand distribution networks to cater to the increasing demand for premium hookah charcoal (Sabroso Charcoal, 2024).

- In December 2025, the European Union passed a new regulation banning the use of certain additives in hookah charcoal, including heavy metals and polycyclic aromatic hydrocarbons (PAHs). This regulation aims to improve the health and safety standards for hookah users in the EU, creating an opportunity for manufacturers to innovate and introduce compliant products (European Commission, 2025).

Research Analyst Overview

The market continues to evolve, driven by shifting consumer preferences and regulatory requirements. Charcoal certification and labeling are increasingly important, ensuring compliance with safety and sustainability standards. Social hookah smoking and the rise of hookah hoses have led to new applications, while charcoal warnings and addiction concerns fuel the search for alternatives. Charcoal processing techniques, such as those using bamboo or odorless charcoal, offer improved heat consistency and output. Heat management systems, including electric heating elements and quick-lighting charcoal, are gaining popularity for their convenience and efficiency. The market's dynamism extends to traditional and modern hookah designs, with home use and hookah lounges driving demand.

Charcoal emissions and environmental impact are becoming key concerns, leading to innovations in smokeless charcoal and charcoal manufacturing. Charcoal ash disposal and safety remain critical issues, with regulations on charcoal health risks and smoking risks shaping the market. Heat duration and durability are also important considerations for charcoal blocks, cubes, and briquettes. The market's continuous unfolding is further shaped by charcoal's role in hookah culture and retail, as well as its impact on hookah tobacco and accessories. Charcoal's versatility and evolving patterns make it a dynamic and exciting sector to watch.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hookah Charcoal Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

191 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 40 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, Egypt, India, Germany, Turkey, UK, Brazil, China, Saudi Arabia, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hookah Charcoal Market Research and Growth Report?

- CAGR of the Hookah Charcoal industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Middle East and Africa, Europe, APAC, North America, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hookah charcoal market growth of industry companies

We can help! Our analysts can customize this hookah charcoal market research report to meet your requirements.