Hospital Infection Therapeutics Market Size 2025-2029

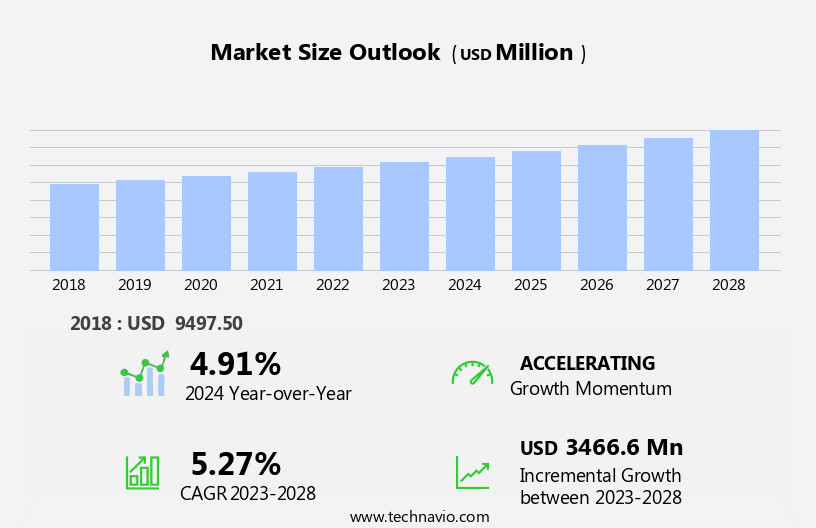

The hospital infection therapeutics market size is forecast to increase by USD 3.79 billion, at a CAGR of 5.5% between 2024 and 2029.

- The market is witnessing significant growth due to the increasing incidence and prevalence of respiratory disorders, leading to an increase in hospital visits. Moreover, stringent regulations imposed by regulatory authorities on the production and distribution of hospital infection therapeutics further fuel the market's growth. These regulations ensure the safety and efficacy of the therapeutics, instilling confidence in healthcare providers and patients. These agents inhibit or eliminate bacteria, addressing the escalating global burden of infectious diseases.

- However, challenges such as high production costs and complex regulatory approval processes pose significant obstacles for market players. To capitalize on the market opportunities and navigate these challenges effectively, companies must focus on cost reduction strategies and streamlining regulatory compliance processes. Microbial identification plays a pivotal role in antibiotic selection, ensuring appropriate treatment and mitigating antibiotic resistance. By doing so, they can ensure the production of high-quality, cost-effective hospital infection therapeutics, meeting the growing demand and regulatory requirements.

What will be the Size of the Hospital Infection Therapeutics Market during the forecast period?

- The market is witnessing significant advancements, driven by the emergence of antibiotic-resistant bacteria such as Vancomycin-resistant Enterococci (VRE) and Carbapenem-resistant Enterobacteriaceae (CRE), including strains like Acinetobacter baumannii and Pseudomonas aeruginosa. Point-of-care testing and molecular diagnostics play a crucial role in identifying these infections swiftly, enabling effective treatment. Data analytics and surveillance systems facilitate the tracking of infection trends and outbreaks, while AI and machine learning enhance the accuracy of diagnoses and improve healthcare outcomes. Infection control audits and patient education are essential components of quality improvement initiatives, ensuring adherence to standards and promoting patient satisfaction.

- Clostridium difficile infections continue to pose a threat, necessitating the development of new therapeutics and prevention strategies. Healthcare workers education and antimicrobial stewardship programs are vital in ensuring the appropriate use of antibiotics and minimizing the risk of resistance. Rapid diagnostics and whole genome sequencing offer valuable insights into the genetic makeup of bacteria, paving the way for precision medicine and more effective treatment approaches. Antimicrobial coatings and surfaces, biofilm disruptors, and personalized medicine are innovative solutions addressing the challenge of antibiotic resistance.

How is this Hospital Infection Therapeutics Industry segmented?

The hospital infection therapeutics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Drug Class

- Antibiotics drugs

- Antifungal drugs

- Antiviral drugs

- Type

- Respiratory tract infections

- Surgical site infections

- Bloodstream infections

- Gastrointestinal infections

- Urinary tract infections

- End-user

- Hospitals

- Ambulatory surgical centers

- Specialty clinics

- Long-term care facilities

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Drug Class Insights

The antibiotics drugs segment is estimated to witness significant growth during the forecast period. The market encompasses antibiotics, used to combat bacterial infections, as a significant component. Broad-spectrum antibiotics, effective against various microorganisms, are crucial in instances where narrow-spectrum drugs fail or when dealing with severe infections caused by unidentified or multiple bacteria. Healthcare infrastructure, policy, and infection control practices significantly impact market dynamics. Regulatory compliance, antimicrobial susceptibility testing, and clinical trials facilitate drug development, particularly for anti-fungal drugs and immunomodulatory therapy.

Outbreak investigation and infection control training are essential components of the healthcare infrastructure. Surgical site infections and hospital-acquired infections necessitate ongoing efforts in infection control practices and environmental cleaning. The market is influenced by various factors, including drug resistance, patient safety, and regulatory compliance. Infection prevention remains a priority, with ongoing research and development in antimicrobial agents and biotechnology.

The Antibiotics drugs segment was valued at USD 5.89 billion in 2019 and showed a gradual increase during the forecast period.

Healthcare technology, including digital health and biotechnology, advances infection prevention and patient safety. Surface disinfection, hand hygiene, and environmental cleaning are essential infection control practices. The economic impact of healthcare-associated infections necessitates continuous improvement in infection prevention strategies. Antibiotic resistance, multidrug resistance, and nosocomial infections pose significant challenges, necessitating the exploration of alternative therapeutic approaches, such as bacteriophage therapy, antimicrobial peptides, and antiviral drugs. Market forecasts indicate continued growth, driven by the evolving healthcare system, healthcare policy, and industry regulations. Antibiotic stewardship, infection prevention, and personal protective equipment are crucial in maintaining a competent healthcare workforce. Patient outcomes, culture and sensitivity testing, and cost-effectiveness analysis are vital considerations in market trends.

Regional Analysis

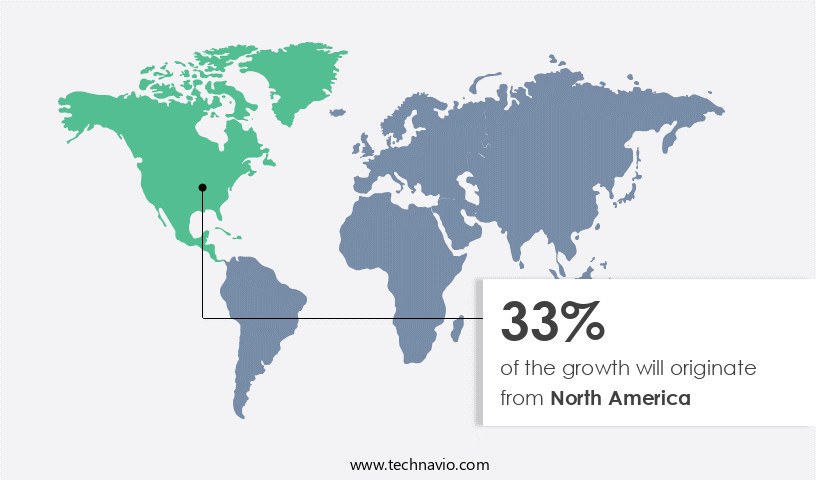

North America is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing incidence and prevalence of chronic diseases, growing healthcare expenditure, and the focus on therapeutics over surgical procedures. Chronic conditions such as cancer, pneumonia, and urinary tract infections necessitate timely treatment to prevent complications. Pharmaceutical and biotechnology companies are investing heavily in research and development to create innovative drugs for hospital infection diseases. The geriatric population's expansion also contributes to market growth, as older adults are more susceptible to infections. Regulatory compliance, infection control practices, and healthcare infrastructure improvements are essential factors driving market progress.

Antibiotic resistance, multidrug resistance, and nosocomial infections pose significant challenges, necessitating the development of new antimicrobial agents, antimicrobial peptides, and bacteriophage therapy. The healthcare workforce's training in infection control and patient safety is crucial for the effective implementation of these interventions. The biotechnology industry's advancements in immunomodulatory therapy and digital health technologies are also impacting the market. The economic impact of hospital infections necessitates cost-effective analysis and continuous improvement in patient outcomes. Microbiological testing, culture and sensitivity, and antimicrobial susceptibility testing are essential for infection control and regulatory compliance. The healthcare system's emphasis on infection prevention, personal protective equipment, and isolation precautions is also influencing market dynamics.

The market forecast indicates continued growth, driven by the ongoing need for effective infection therapeutics in the face of evolving microbial threats and healthcare policy changes.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Hospital Infection Therapeutics market drivers leading to the rise in the adoption of Industry?

- The rising number of respiratory disorders is a major driver fueling the market growth. Hospital-acquired infections, particularly those affecting the respiratory system, pose a significant challenge to healthcare systems worldwide. Chronic obstructive pulmonary disease (COPD) and asthma are two leading respiratory conditions that contribute substantially to global morbidity and mortality. COPD impacts over 200 million people globally, while asthma affects approximately 262 million, with rising incidence in both developed and developing nations. In developing countries, respiratory diseases are responsible for over four million annual deaths, with pneumonia accounting for nearly 18% of childhood deaths. In the US, chronic respiratory diseases caused over 534,000 deaths, with mortality rates equal between men and women.

- Isolation precautions and industry regulations play a crucial role in infection prevention. Antibiotic stewardship and addressing multidrug resistance are essential components of effective infection control practices. Innovative approaches, such as bacteriophage therapy and antimicrobial peptides, offer promising alternatives to traditional antimicrobial agents. The healthcare workforce relies on personal protective equipment to minimize infection transmission risks. The economic impact of hospital infections is substantial, with costs related to treatment, lost productivity, and increased length of stay. Surgical site infections, for instance, result in an estimated USD3 billion to USD10 billion in additional healthcare costs annually. Adherence to strict infection control practices remains essential to mitigate the burden of hospital-acquired respiratory infections.

What are the Hospital Infection Therapeutics market trends shaping the Industry?

- Rise in hospital-acquired infections (HAI) is an emerging trend shaping the market. Central venous catheters are a leading cause of HAIs, with their usage projected to increase by 8% in hospitals by 2025. Intensive care units, which are prone to multiple invasive procedures, are particularly susceptible to these infections. Sepsis, a common complication of HAIs, can lead to increased morbidity and mortality. The biotechnology industry is responding to this issue with innovative solutions. Antibacterial drugs, environmental cleaning, and infection control training are some of the traditional methods used to combat HAIs. However, the emergence of drug resistance has necessitated the exploration of alternative therapies such as immunomodulatory therapy.

- Digital health technologies, including digital diagnostics and telemedicine, are also being employed to improve infection control. Antiviral drugs and advanced diagnostic tools like gram staining are essential in identifying and treating various types of infections. The healthcare industry's focus on patient safety and reducing healthcare-associated infections is driving market growth. Despite these efforts, HAIs continue to pose a significant challenge, necessitating ongoing research and innovation.

How does Hospital Infection Therapeutics market face challenges during its growth?

- The strict regulatory environment poses a significant challenge to the expansion of the industry. In the realm of public health and healthcare safety, the market is a significant area of focus. Microbial identification and antimicrobial resistance are key challenges driving the demand for advanced solutions in infection control. Regulatory compliance is paramount, with regulatory authorities such as the US FDA and EMA enforcing stringent regulations. Companies must adhere to these regulations to obtain marketing approval for new drugs, requiring submission of extensive information, including preclinical study results, pharmacodynamic and pharmacokinetic properties, and safety profiles from clinical studies.

- Infection control measures, such as hand hygiene, surface disinfection, and ventilator-associated pneumonia prevention, are essential to mitigate the risk of healthcare-associated infections. Healthcare infrastructure and policy, infection control practices, and antimicrobial susceptibility testing are crucial market dynamics. Healthcare technology, including automated microbial identification systems and real-time monitoring systems, is playing a pivotal role in enhancing infection control and patient safety.

Exclusive Customer Landscape

The hospital infection therapeutics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the hospital infection therapeutics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, hospital infection therapeutics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company specializes in the development and commercialization of hospital infection therapeutics.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- AbbVie Inc.

- AstraZeneca Plc

- Basilea Pharmaceutica Ltd.

- Bayer AG

- Bristol Myers Squibb Co.

- Cipla Inc.

- F. Hoffmann La Roche Ltd.

- Gilead Sciences Inc.

- GlaxoSmithKline Plc

- Johnson and Johnson Services Inc

- Merck and Co. Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

- Spero Therapeutics Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Hospital Infection Therapeutics Market

- In February 2023, Pfizer Inc. announced the launch of its new antimicrobial solution, Zavicefta, in partnership with AstraZeneca. This combination therapy, which contains ceftazidime-avibactam, is designed to address multidrug-resistant bacteria infections in hospitals (Pfizer Press Release, 2023).

- In June 2024, Merck & Co. and The Medicines Company entered into a strategic collaboration to develop and commercialize a novel antimicrobial peptide, Becaplermin, for the prevention and treatment of hospital-acquired infections. This partnership combines Merck's expertise in commercialization with The Medicines Company's innovative research (Merck & Co. Press Release, 2024).

- In October 2024, Becton, Dickinson and Company (BD) acquired CareFusion, a leading provider of medical devices and infection prevention solutions. This acquisition expanded BD's portfolio in infection prevention and allowed for the integration of CareFusion's technologies, including its automated dispensing systems and real-time location solutions (BD Press Release, 2024).

- In March 2025, the U.S. Food and Drug Administration (FDA) granted approval for Sperava, a novel antimicrobial coating developed by SurfaceLogix, to reduce the risk of contamination in surgical instruments. This approval marks a significant step forward in the development of advanced infection control technologies (SurfaceLogix Press Release, 2025).

Research Analyst Overview

The market is a dynamic and evolving landscape, shaped by the ongoing challenges posed by hospital-acquired infections (HAIs) and the continuous emergence of antibiotic resistance. This market encompasses various sectors, including antibacterial drugs, environmental cleaning, infection control training, patient safety, biotechnology industry, immunomodulatory therapy, and healthcare associated infections. Antibacterial drugs remain a crucial component of HAI treatment, with ongoing research and development efforts focused on overcoming antibiotic resistance. Environmental cleaning plays a vital role in infection prevention, with advancements in surface disinfection technologies and hand hygiene practices. Infection control training is essential for healthcare workers to ensure regulatory compliance and effective implementation of infection prevention measures.

Biotechnology industry innovations, such as immunomodulatory therapy, offer new approaches to HAI treatment and prevention. Drug resistance continues to be a significant challenge, with multidrug resistance and gram-negative bacteria posing particular concerns. Healthcare associated infections, including ventilator-associated pneumonia and surgical site infections, require ongoing attention and intervention. Digital health technologies, such as electronic health records and telemedicine, offer opportunities for improved infection control practices and cost-effective analysis. Healthcare costs remain a significant factor, with ongoing efforts to balance quality of care and economic impact. Antiviral drugs and microbiological testing are also crucial components of the market, with culture and sensitivity testing essential for effective diagnosis and treatment.

The healthcare infrastructure, healthcare policy, and industry regulations continue to shape the market, with ongoing efforts to improve infection control practices and ensure patient safety. Personal protective equipment and antimicrobial agents are essential components of infection prevention efforts. The economic impact of HAIs underscores the importance of ongoing research and innovation in this field. The market forecast for hospital infection therapeutics remains robust, with ongoing developments in infection prevention, treatment, and diagnostics.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Hospital Infection Therapeutics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

231 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.5% |

|

Market growth 2025-2029 |

USD 3.79 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.1 |

|

Key countries |

US, Germany, Canada, China, France, UK, Japan, India, Italy, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Hospital Infection Therapeutics Market Research and Growth Report?

- CAGR of the Hospital Infection Therapeutics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the hospital infection therapeutics market growth of industry companies

We can help! Our analysts can customize this hospital infection therapeutics market research report to meet your requirements.