Hospital Logistics Robots Market Size 2024-2028

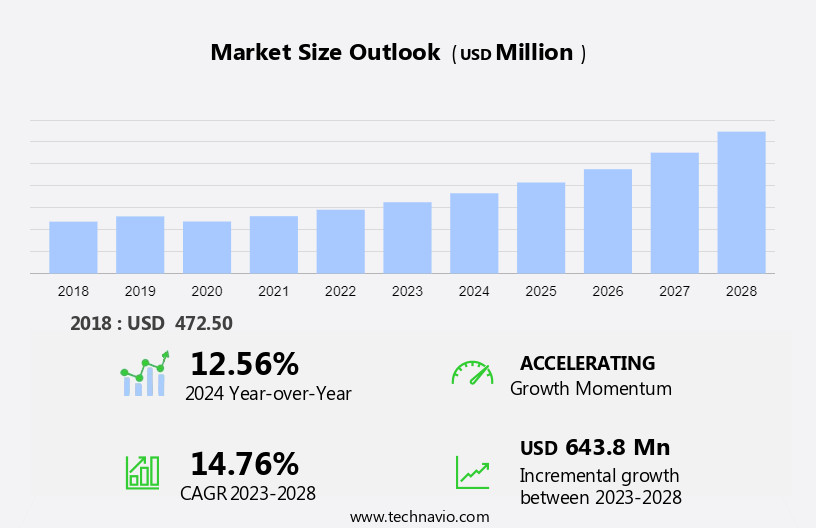

The hospital logistics robots market size is forecast to increase by USD 643.8 million at a CAGR of 14.76% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. First, advances in technology continue to drive innovation in this field, leading to more efficient and effective robotic systems for managing hospital logistics. Second, the importance of improving customer support services in healthcare settings is increasingly recognized, and robots can help streamline processes and reduce wait times for patients. Automated guided vehicles (AGVs) and mobile robots facilitate material transport, delivery, sterilization, disinfection, inventory management, and waste management, making them essential components of modern hospital logistics operations. However, the high cost remains a challenge for some healthcare providers, limiting widespread adoption. Despite this, the benefits of automation and improved efficiency are expected to outweigh the costs In the long run. Overall, the market is poised for continued growth as technology advances and healthcare providers seek to enhance patient care and operational efficiency.

What will be the Size of the Market During the Forecast Period?

- The market is experiencing significant growth due to the increasing adoption of automation and robotics in healthcare facilities. Artificial intelligence (AI), machine learning, computer vision, and autonomous navigation systems are key technologies driving this trend. These advanced technologies enable hospital logistics operations to efficiently manage medical equipment, supplies, medications, and food, reducing the need for manual handling and increasing hospital staff productivity.

- The coronavirus disease pandemic has further accelerated this trend, as hospitals seek to minimize personnel interactions and maintain social distancing. Autonomous robots, equipped with sensors, cameras, and robotic arms, are increasingly being used to transport medical supplies and medications, freeing up hospital staff for patient care. The integration of these technologies is expected to continue, leading to cost savings and improved hospital operations.

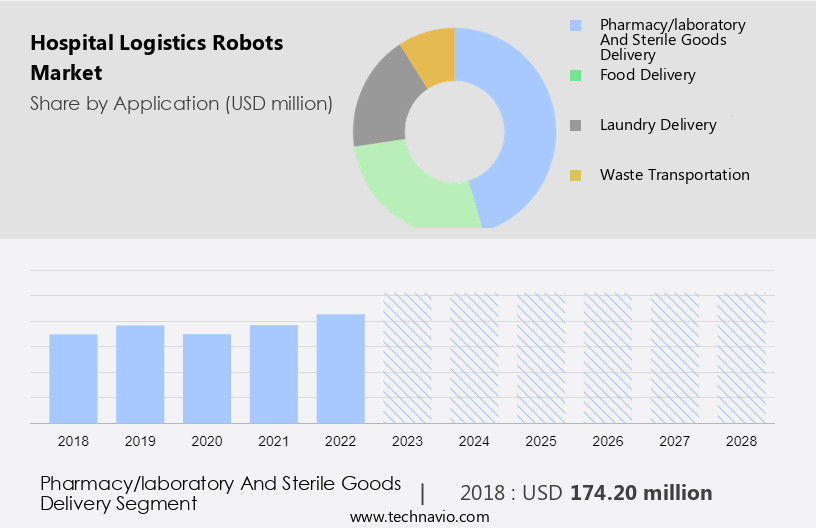

How is this Industry segmented and which is the largest segment?

The industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pharmacy/laboratory and sterile goods delivery

- Food delivery

- Laundry delivery

- Waste transportation

- Geography

- North America

- US

- APAC

- China

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Application Insights

- The pharmacy/laboratory and sterile goods delivery segment is estimated to witness significant growth during the forecast period. These robots are set to revolutionize healthcare facility operations by enhancing efficiency and patient care. Leveraging advanced technologies such as artificial intelligence (AI), machine learning, computer vision, and autonomous navigation systems, these robots optimize the transportation of medical equipment, supplies, medications, and other essentials. In the context of the ongoing Coronavirus disease pandemic, the importance of contactless and automated processes has become increasingly apparent. These robots address this need by delivering critical items without human intervention, reducing the risk of infection and human errors. These robots cater to various hospital departments, including pharmacy, laboratory, sterile goods, surgical supplies, food delivery, laundry delivery, waste transportation, and more.

Get a glance at the market report of share of various segments Request Free Sample

The Pharmacy/laboratory and sterile goods delivery segment was valued at USD 174.20 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 49% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The US, with its significant healthcare expenditures and predominantly privately and publicly owned hospitals, represents a substantial market. The government's focus on enhancing healthcare facilities and infrastructure will drive market expansion. Advanced technologies, including artificial intelligence (AI), machine learning, computer vision, and autonomous navigation systems, are increasingly adopted by hospital logistics robot manufacturers in North America. Strategies such as product line extension and innovation will strengthen their market positions, propelling the growth of the market In the Americas. These robots streamline the delivery of medical equipment, supplies, medications, and even food, improving operational efficiency, patient care, and safety.

For more insights on the market size of various regions, Request Free Sample

Key technologies include robotic arms, mobile platforms, sensors, and cameras. The market offers cost savings, improved patient experience, and safety benefits, making it an attractive investment for hospitals, despite capital investment and maintenance requirements. Challenges include programming algorithms, security measures, and the integration of obstacle detection systems. Automated guided vehicles (AGVs) and mobile robots facilitate material transport, delivery, sterilization, disinfection, inventory management, and waste management, making them essential components of modern hospital logistics operations.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Hospital Logistics Robots Industry?

- Increasing advances in technology is the key driver of the market. The market is experiencing significant growth due to technological advancements that enable mobile robotic platforms with intelligent capabilities. These capabilities include artificial intelligence (AI), machine learning (ML), computer vision, and autonomous navigation systems. These are increasingly being utilized for the transportation of medical equipment, supplies, medications, and other essential items within healthcare facilities. The focus on automation and robotics in hospital operations is aimed at improving efficiency, patient care, and reducing human errors. Hospital logistics robots are equipped with sensors, cameras, and autonomous robots that can detect and avoid obstacles, enabling route mapping and automatic transportation of pallets and packages.

- AI and ML algorithms are used to optimize inventory management, waste management, sterilization, and disinfection. These robots can also be programmed to deliver food, laundry, and waste, as well as transport sterile goods and surgical supplies. The COVID-19 pandemic has accelerated the adoption of hospital logistics robots, as they help minimize contact between hospital staff and patients, ensuring patient safety and reducing the risk of infection. The market for hospital logistics robots is expected to continue growing slowly over the next few years due to the need for cost savings, improved patient experience, and increased operational efficiency. Capital investment in hospital logistics robots requires maintenance and programming, but the long-term benefits outweigh the initial costs.

What are the market trends shaping the Hospital Logistics Robots Industry?

- Improving customer support services is the upcoming market trend. Hospital logistics robots have become an integral part of modern healthcare facilities in enhancing efficiency and patient care. Artificial intelligence (AI), machine learning, computer vision, and autonomous navigation systems are the driving technologies behind these robots. They are utilized for delivering medical equipment, supplies, medications, and even food to various departments such as pharmacy, laboratory, sterile goods, surgical supplies, and more. The coronavirus disease has further accelerated the adoption of hospital logistics robots for contactless delivery and improved patient safety. companies offering hospital logistics robots provide services including engineering, programming, system integration, installation, commissioning, maintenance, repair, upgrades, retrofits, and refurbishment.

- To ensure a smooth transition, they offer training sessions and workflow adjustment assistance for hospital staff. Autonomous guided vehicles (AGVs) and mobile robots are popular choices for material transport and delivery, while robotic arms offer precision and automation in tasks such as sterilization, disinfection, and inventory management. Hospitals benefit from cost savings, improved operational efficiency, and a competitive edge by implementing hospital logistics robots. These robots minimize human errors, increase resource utilization, and enhance patient safety. companies like DF Automation and Robotics Sdn Bhd are leading the market, offering advanced solutions in this domain. The global population's increasing need for chronic disease management and healthcare services further fuels the demand for hospital logistics robots.

What challenges does the Hospital Logistics Robots Industry face during its growth?

- High cost of hospital logistics robots is a key challenge affecting the industry growth. Hospital logistics robots, which integrate artificial intelligence (AI), machine learning, computer vision, and autonomous navigation systems, have become increasingly essential in healthcare facilities to enhance efficiency and patient care. These robots are employed for the delivery of medical equipment, supplies, medications, and even food, while ensuring patient safety and reducing human errors. The Coronavirus disease has further accentuated the need for automation and robotics in hospital operations. The implementation of hospital logistics robots involves the use of sensors, cameras, and advanced technologies, leading to substantial investments. Equipment costs are significant, and additional expenses on accessories, add-ons, and maintenance add to the overall expenditure.

- Customization, operational requirements, and training for specialists and operators further increase costs. Infrastructure and facility modifications are also necessary, adding to the investment. Despite the high costs, hospital logistics robots offer numerous benefits, including improved operational efficiency, a competitive edge, and a better patient experience. They can transport materials such as sterile goods, surgical supplies, and medications, ensuring timely delivery and reducing the workload on hospital staff. Mobile robots can also deliver food, laundry, and waste, freeing up staff for critical tasks. Autonomous robots and robotic arms, along with automated storage and retrieval systems and mobile robots, offer cost savings through increased productivity and reduced labor costs.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Corvus Robotics Inc.

- DF Automation and Robotics Sdn Bhd

- Diligent Robotics Inc.

- IAM Robotics

- John Bean Technologies Corp.

- Kollmorgen Corp.

- MIDEA Group Co. Ltd.

- Mobile Industrial Robots AS

- OMRON Corp.

- PAL Robotics

- Panasonic Holdings Corp.

- Pudu Technology Inc.

- Ramboll Group AS

- Relay Robotics Inc.

- ROFA INDUSTRIAL AUTOMATION AG

- Singapore Technologies Engineering Ltd.

- Sir Steward

- Zapi Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Hospital logistics refers to the efficient management and movement of medical equipment, supplies, medications, and other essential resources within healthcare facilities. The integration of artificial intelligence (AI), machine learning (ML), computer vision, and autonomous navigation systems in hospital logistics has revolutionized the way hospital operations are conducted. The implementation of these advanced technologies has significantly improved hospital logistics by increasing operational efficiency, enhancing patient care, and reducing human errors. With the global population continuing to grow and the prevalence of chronic diseases, the demand for efficient and effective healthcare services is increasing. Hospital logistics robots, including robotic arms and mobile platforms, are being utilized in various areas of hospital operations.

In addition, these robots are equipped with sensors, cameras, and other advanced technologies that enable them to navigate hospital environments autonomously and perform tasks such as medication delivery, food delivery, laundry delivery, waste transportation, and sterile goods and surgical supplies delivery. The use of autonomous robots in hospital logistics has resulted in numerous benefits. These include cost savings through increased resource utilization, improved patient experience due to faster and more reliable delivery of essential supplies, and enhanced safety by reducing the risk of human errors. However, the adoption of hospital logistics robots also presents certain challenges. Capital investment In these technologies can be significant, and ongoing maintenance and programming requirements can be costly.

Additionally, the implementation of security measures to ensure patient safety and data privacy is essential. Despite these challenges, hospital logistics robots offer a competitive edge for healthcare facilities looking to streamline their operations and provide high-quality patient care. The integration of AI, ML, AGVs, and other advanced technologies in hospital logistics is set to continue, with potential applications in areas such as automated storage and retrieval systems, inventory management, and waste management. The use of hospital logistics robots is not limited to large hospitals or healthcare systems. Small and medium-sized facilities can also benefit from these technologies, particularly in areas such as pharmacy and laboratory operations.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

147 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 14.76% |

|

Market growth 2024-2028 |

USD 643.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.56 |

|

Key countries |

US, China, Germany, UK, and Russia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Hospital Logistics Robots industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.